Ghana, a west African country, is the second largest palm oil producing country within Sub-Saharan Africa. On an average, in the last 3 years, Ghana produced about 537,000 MT of palm oil every year. Last year, Ghana produced 560,000 MT of palm oil. With growing population over time, oils and fats consumption has been on the rise. Per capita oils and fats consumption in Ghana is at 20.7kg with over 30 million population in 2019. While consumption is higher than the production of palm oil in the country, Ghana imports palm oil from other countries to meet the local demand. While Malaysia holds the largest market, Ghana also imports palm oil from Indonesia and other neighboring countries like Cote D’Ivoire.

| JAN – AUG 2020 | JAN – AUG 2019 | Difference | % Difference | |

|---|---|---|---|---|

| KENYA | 243,610 | 76,150 | 167,460 | 219.91 |

| NIGERIA | 222,103 | 164,686 | 57,417 | 34.86 |

| MOZAMBIQUE | 197,341 | 119,650 | 77,691 | 64.93 |

| GHANA | 151,470 | 82,059 | 69,411 | 84.59 |

| SOUTH AFRICA | 142,713 | 148,803 | (6,090) | (4.09) |

| TOGO | 127,658 | 67,365 | 60,293 | 89.50 |

| TANZANIA | 119,542 | 114,385 | 5,157 | 4.51 |

| ANGOLA | 94,501 | 96,715 | (2,214) | (2.29) |

| MADAGASCAR | 82,966 | 27,357 | 55,609 | 203.27 |

| BENIN | 72,162 | 99,535 | (27,373) | (27.50) |

| MAURITANIA | 65,928 | 60,584 | 5,344 | 8.82 |

| COTE D’IVOIRE | 32,944 | 16,053 | 16,891 | 105.22 |

| SENEGAL | 29,857 | 20,764 | 9,093 | 43.79 |

| CONGO, DEM. REP. OF THE | 25,402 | 32,869 | (7,467) | (22.72) |

| GUINEA | 18,255 | 53,692 | (35,437) | (66.00) |

| CAMEROON | 17,953 | 5,974 | 11,979 | 200.52 |

| GAMBIA | 17,589 | 12,104 | 5,485 | 45.32 |

| NIGER | 16,496 | 15,900 | 596 | 3.75 |

| OTHERS | 17,022 | 23,715 | (6,693) | (28.22) |

| TOTAL | 1,695,512 | 1,238,360 | 457,152 | 36.92 |

Table 1: Export of Malaysian Palm Oil to Sub-Saharan Africa (Tonnes)

Source: MPOB

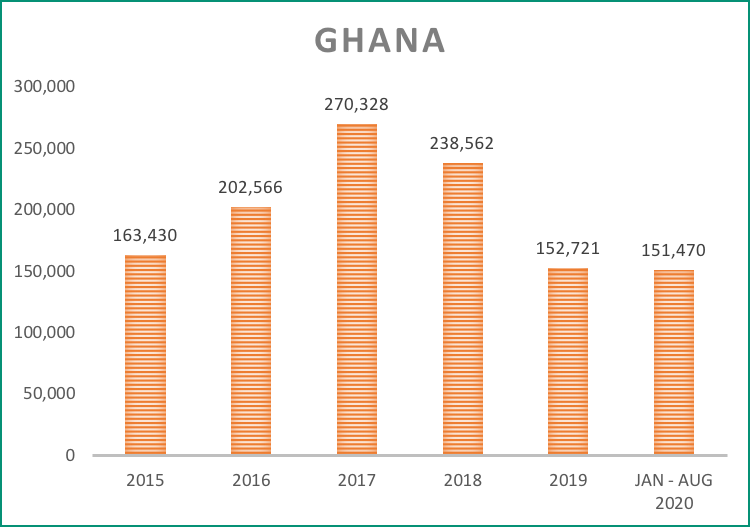

During the last 8 months Ghana has seen a big increase in Malaysian Palm Oil imports. Up until August 2020, Ghana imported a total of 151,470 MT of Malaysian palm oil, a staggering increase of 85% compared to the same time frame last year. In fact, Ghana has reached the total amount of 2019 Malaysian Palm Oil imports within the first 8 months of this year.

Source: MPOB

There are several factors for the way the market has been performing in this country. The pandemic has put the country in a situation where local production has been affected. The lockdown, limited manpower and work schedule have resulted in low palm oil output. To continue supplying palm oil for local consumption, palm oil producing companies and other importers increased the importation of palm oil in recent months. Another main reason for the increase in recent months, the price for imported palm oil has been lower than the locally produced oil. This has increased the interest to buy imported oils. Due to the low production, and higher production cost of local palm oil, increased MPO imports is seen up until recent months.

Ghana has been preparing for an election this year and recently the government announced that the election will be taking place on December 7, 2020. In preparation for that, the government has been quite lenient with the lockdown restrictions from the start to facilitate citizens to register in-person to vote back in July, while the number of COVID cases was still high. This situation brought in criticism from the citizens on government’s handling of health and safety of public during the pandemic.

As long as the pandemic situation continues and the local palm oil is still struggling with production volume and cost, the uptrend on Malaysian palm oil imports is expected to continue. Malaysian oil palm industry members should take this opportunity to continue to increase their market share in Ghana, and other palm oil-producing countries within Sub-Saharan Africa that are facing similar situation and trend like in Ghana.

Prepared by Karthigayen Selva Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.