The pandemic has caused major upheavals to the economy of India, as it has done globally. The country began a nationwide lockdown in late March, and the first phase which continued until May, forcing businesses to come to a halt. The food and HORECA sectors are among those greatly affected resulting in the decline of edible oils consumption most notably palm oil. The major setbacks for the decline in palm oil consumption were due to a combination of factors, but international prices and the shift in the demand pattern from HORECA to home consumption, where soft oils are the favoured cooking oils, have been the main factors driving down palm oil utilisation during this period.

Hence, the news on the surge in edible oils demand in India for the month of July 2020 definitely offer some pleasing news to the industry players. Palm oil import apparently registered the most significant increase as its shipments were 824,000 tonnes against 812,000 tonnes a year ago according to the Solvent Extractors Association of India (SEA). The surge in palm oil imports are attributed to the increased demand from hotels and restaurants as the country eased its restrictions.

Analysis on Oils and Fats Import in India – Jan to July 2020

With further gradual opening up of the economy, both demand and imports surged during July. Geo-political factors affecting Malaysian palm oil (MPO) imports seem to have taken the back seat. Jan-July 2020 saw total vegetable oils imports at 7.53 MMT, down 16% from the 8.94 MMT in the same period previous year. Total imports decreased by 16% but palm oil products (POP) imports decreased by 34 % to 3.80 MMT during this period, compared to 5.75 MMT in Jan-July 2019. The most significant drop was in RBD palm olein imports, which fell 91% to a mere 163,000 MT from 1.85 MMT in the previous corresponding period, a direct consequence of the removal of the 5% duty advantage for Malaysian RBD. For the first time in recent years, RBD palm olein imports in July 2020 were NIL. Crude palm oil (CPO) imports fell by a mere 1%, thanks to a significant volume of 0.82 MMT in July 2020, compared to 0.53 MMT in the previous year July.

Although POP imports picked up a fair bit, it was still outshone by imports of soft oils. Total POP imports in the import basket have decreased from 64% to 50% during this comparative period. Historically, POP have always enjoyed a share of more than 50%, in fact being close to 80% a few years ago. In the soft oils basket, sunflower oil (SFO) increased by 16% to 1.66 MMT and soybean oil (SBO) increased by 20% to 2.06 MMT. In fact, imports of SBO, at 0.48 MMT, set a record for monthly imports in July 2020.

The efforts by the Indian edible oils industry have paid off earlier in the year by the imposition of licensing requirements on RBD imports but the import duty differential between CPO and RBD has eroded to 7.5%. The industry continues to fight for an increase in this differential to 10 to 15%.

Key Policy Changes in India’s Edible Oils Market (2019-2020)

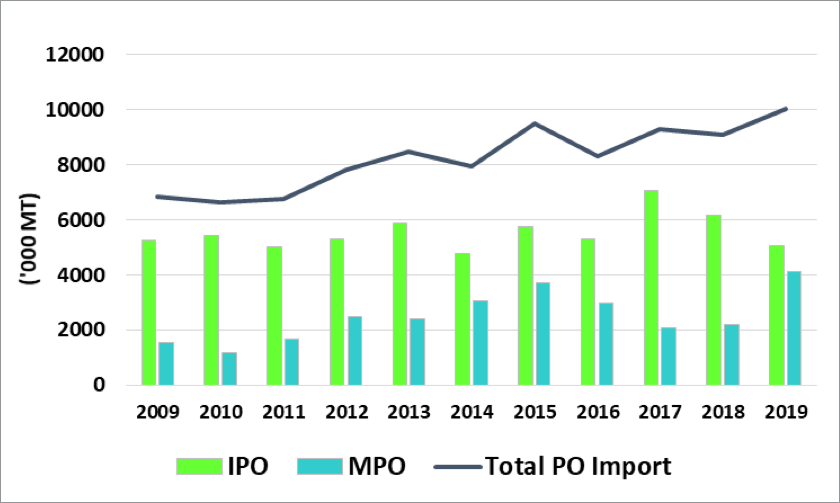

Prior to the outbreak of the worldwide coronavirus pandemic, India had always been the world’s leading importer of edible oils driven by its huge population and income growth. Besides these two main factors, key changes that take place in trade policy plays a crucial role in determining the import level of edible oils into the country. In 2018, of India’s palm oil imports, Malaysia accounted for only 28% while Indonesia catered to 72%. That scenario changed dramatically in 2019 when Malaysia enjoyed an import duty advantage under the Malaysia-India Comprehensive Economic Cooperation Agreement (MICECA). MPO exports to India surged to a record 4.5 MMT (46%), as illustrated in Figure 1.

In fact, if one were to look at the Jan-Aug 2019 imports, MPO accounted for 54% of total palm oil imports into India. Due to the duty advantage that Malaysian RBD had enjoyed for the first 9 months in 2019, total MPO exports to India registered a huge jump to 4.5 MMT in 2019 against 2.6 MMT in 2018. This saw the market share for Malaysia increasing to 46% and bringing down Indonesian market share to 54%.

Figure 1: Total Palm oil Imports to India

The Implementation of Safeguard Duty

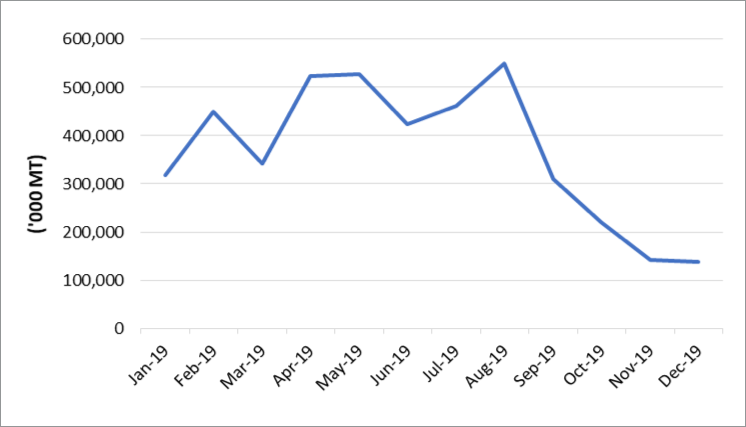

The MICECA Agreement resulted in an influx of RBD palm olein from Malaysia which saw a significant amount of RBD palm olein imported from Malaysia during Jan-Sept 2019 period. This adversely impacted the domestic industry which took up the matter resulting in the imposition of the safeguard duty. In response to the petition filed by the SEA of India, the Indian government imposed an additional 5% safeguard duty on RBD palm olein of Malaysian origin from 5th September 2019. This resulted in MPO exports going down from September to the end of 2019 as shown in Figure 2.

Figure 2: MPO Exports to India (2019)

Restrictions on Refined Palm Oil Imports

Even after the implementation of the safeguard duty, India continued to import RBD palm olein from Malaysia. At the same time, comments emanating from Malaysian government sources with regard to some internal policies of the Indian government started to pour in and they did not go down well, resulting in a diplomatic row between the two nations. On 8th January 2020, the Ministry of Commerce and Industry of India issued a notification declaring that the import of refined palm oil “is amended from ‘Free’ to ‘Restricted’’’. The decision to impose the restrictions on imports of palm oil and palm olein is widely believed and reported as retaliation against Malaysia for the Malaysian government’s views on certain issues which the Indian government construed was their internal policies. As a result, MPO exports to India suffered a blow since the start of 2020. Based on MPOB data, during Jan-June 2020 period, exports to India was a mere 0.4 MMT from 2.6 MMT, a staggering decline of 84.6% or 2.2 MMT as compared to the same period a year ago.

Recovery in MPO Imports into India

After a dismal performance in the first 5 months of 2020, exports of MPO saw positive recovery as India resumed their purchases from Malaysia. MPO exports recorded a total of 0.25 MMT in June 2020 as shown in Figure 3. The latest MPOB data shows that export figures to India in July 2020 alone was recorded at 0.46 MMT, the highest since January this year, an increase of 85% from last month and 871% from January 2020. Out of the total, 0.43 MMT was in the form of CPO. Total MPO exports to India registered a total of 0.85 MMT during Jan-Jul 2020 period as shown in Table 1.

Figure 3: MPO Exports to India (Jan-July 2020)

Table 1: MPO Exports to India by Type of Products (MT)

| TYPE OF PRODUCTS | Jan-Jul 2020 | Jan-Jul 2019 | Diff (Vol) | Diff (%) |

|---|---|---|---|---|

| RBD PL | 6,140 | 1,830,596 | (1,824,456) | (99.7) |

| CPO | 775,624 | 1,017,210 | (241,586) | (23.7) |

| CPS | 2,496 | 74,895 | (72,400) | (96.7) |

| PFAD | 54,325 | 55,807 | (1,482) | (2.7) |

| CPL | 3,997 | 30,368 | (26,370) | (86.8) |

| PAO | 7,073 | 24,912 | (17,839) | (71.6) |

| OTHERS | 2,795 | 13,324 | (10,528) | (79.0) |

| TOTAL | 852,450 | 3,047,112 | (2,194,662) | (72.0) |

Source: MPOB

The increase in the Malaysian palm oil import share could be attributed to the price advantage which saw MPO being cheaper in the month of May. In addition to this, during the month of May, Indian importers and traders were reported to have contracted for the month of June and July 2020 also. It has been reported that MPO was $15-20 cheaper compared to Indonesian palm oil during the period. Malaysian companies were also able to offer competitive prices taking advantage of the fully exemption from export duties that includes for CPO as announced by the Malaysian Government on 5 June 2020.

Soybean oil, though contracted, due to the time lag in delivery has resulted in Indian consumption leaning towards palm. With the HORECA sector reeling under the lockdown lack of demand, household consumption increased. Mustard demand and prices have risen significantly making the palm – mustard and palm – groundnut oil spread to be higher than normal of INR 15-20 per litre. Hence, palm coupled with the gradual relaxation of lockdown, became attractive. In short, price, demand as well as refiner margins became better post license suspension as soybean situation became tight.

Another driver for the increase in MPO intake by India could be attributed to lower edible oils stock levels in the country as widely reported. Total stocks at Indian ports reportedly stood at 0.87 MMT at the start of May 2020, a 26% drop month on month and 61% lower than a year earlier. The decline in the stock levels were due to the lower domestic demand as well as reduced imports. As the country’s lockdown restrictions ease, this has resulted in restocking of edible oils from June 2020 onwards.

Palm Oil Outlook – Post Pandemic

The surge in MPO exports to India was simply due to the price competitiveness that made MPO a better option as compared to Indonesian palm oil. However, the situation might not last long as MPO share is foreseen to fall as it no longer holds the $15-20 price advantage over Indonesian palm oil in the months to come. China has become active in the palm oil international market.

The palm oil industry can expect that the Indian edible oils import scenario is changing rapidly. July import surge was surely at the back of the unlock measures taken in India. HORECA sector gradually opened up and the Covid-19 crisis induced de-stocking due to price risk and the risk of demand destruction. Currently, according to the domestic players, August downstream sales is at least 10-15% lower than July 2020.

There is an over hang of the 15% increased kharif crops mainly in groundnut and soybean oil. Soybean crop is expected to be 10.5-11.0 MMT as against 8.5 MMT of last year. It is uncertain how much this factor will put pressure on the local soybean prices. On the other hand, a crucial factor to note is, the crushing pace of soybeans as well as meal exports are not in parity with South American meal in the export markets.

For the remainder of 2020, there is a likelihood of slowdown of imports in the forward months. The tempo is likely to be maintained in Sept-Oct due to the upcoming festival season, though a bit subdued this time but slowdown is expected in November and December. September and October are normally the peak import months traditionally but this time, the trade is expecting a low-key festivities and thereby subnormal festival induced oil demand. Taking into consideration all these factors as of now, it is estimated that, subject to changes again, the import demand can be as follows:

Table 2: Projection on Import Demand by India Aug-Dec 2020 (‘000 MT)

| Palm Oil | Soybean Oil | Sunflower Oil | |

|---|---|---|---|

| August | 725 – 740 | 370 – 400 | 150 – 170 |

| September | 700 | 300 – 325 | 150 – 180 |

| October | 650 | 280 – 300 | 120 – 150 |

| November | 600 | 250 – 270 | 200 |

| December | 650 | 250 – 270 | 200 |

Source: MPOC Intelligence

Malaysian companies could take advantage from the news that Indonesia may further increase palm oil export levies in future to support its ambitious biodiesel programme. Indonesia raised its levy on crude palm oil exports in June to $55 per tonne and the government has pledged 2.78 trillion rupiah financial assistance for the programme. Indonesia biodiesel programme is expected to limit its supply of palm oil for export purposes thus could result in a gap that is expected to be filled by Malaysia. Based on the assumptions above, if Malaysia were to maintain its market share at 35% until end of 2020, it is projected that Malaysia will export 1.21 MMT during Aug-Dec 2020 period. Total MPO exports by Dec 2020 could reach 2.02 MMT.

Prepared by Azriyah Azian and Bhavna Shah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.