Background

The African Continental Free Trade Area (AfCFTA) is a trade agreement encompassing the African continent. An initiative of the African Union (AU), the free trade agreement is set to be the largest in the world, with 54 out of 55 African countries had signed the agreement and as of July 2019, 28 countries have ratified the AfCFTA. Once the remaining countries have ratified, AfCFTA will cover more than 1.2 billion people and over $3 trillion in GDP. Negotiations on the tariff schedule is still ongoing and it has been indicated that implementation was at 1st of July 2020 but could be postponed to a later date as COVID-19 spreads in the continent.

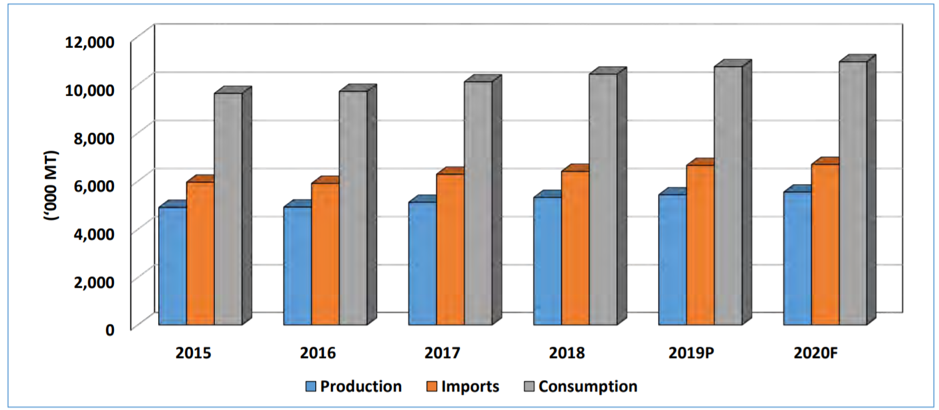

Oils and Fats scenario in Sub-Saharan Africa (SSA) Region

Source: Oilworld, MPOC Estimates

SSA region mainly produces palm oil in West Africa, soybean and sunflower in the southern and east Africa respectively. Major palm oil producing countries include Nigeria, Ghana, Cote d’Ivoire, and Cameroon. South Africa produces sunflower and soybean oil while Tanzania produces sunflower oil.

In terms of major consuming countries, Nigeria is the largest consumer in the SSA region, with 3 million MT annually, followed by South Africa at 1.4 million MT, Tanzania at 871,000 MT, and Ghana at 734,000 MT.

In 2019, SSA region imported approximately 6.5 million MT of oils and fats, in which 83% is palm oil. Major importing countries include Nigeria, Kenya, Tanzania, Angola, and South Africa. Malaysia exported 2 million MT of palm oil into SSA region in 2019.

Impact of AfCFTA to local oils & fats producing countries

Generally, the agreement may benefit and encourage trade intra-Africa. However, in terms of oils and fats, it is important to note that most oils and fats produced in SSA region are meant for local consumption. According to Oilworld, The biggest oils and fats producer in the region, Nigeria, only produces 1.1 million MT in 2019 while their consumption is 3 million MT. South Africa, consumes 1.4 million MT in 2019 and produced 700,000 MT of oils and fats in 2019. The same can be said in other countries in the SSA region. The supply shortfall are met with imports from other producing countries such as Malaysia, Indonesia, Brazil, and EU.

In lieu of this, the agreement could become a catalyst for future development of the agricultural industry in the region, with countries such as Nigeria, Cote D’Ivoire and Tanzania already laid groundworks to increase local production of palm oil for the two former and sunflower oil for the latter, and become a net exporter. However, to achieve this it may take many years as rising consumption and population will lead to increased reliance on oils and fats imports.

AfCFTA, a new opportunity for palm oil imports in SSA?

To be clear, the agreement will not benefit Malaysian palm oil directly as preferential trade would only benefit the signatories. However, it is expected that with the introduction of the agreement, palm oil consumption could increase as trade barriers intra-Africa are removed. Should the agreement be implemented, it could open up new market opportunities, especially export of palm oil into land locked countries. Countries such as South Africa, Cote d’Ivoire, Togo, Benin, Kenya, Senegal is expected to become major re-export destinations in their region due to low import tariffs and easy accessibility via land borders. A partnership or joint venture with the local oils and fats industry in these countries could be beneficial for Malaysian palm oil industry players.

| Port of Entry | Re-export region | Crude Palm Oil Tariff (%) | Refined Palm Oil Tariff (%) |

|---|---|---|---|

| South Africa | Southern Africa | 10.0 | 10.0 |

| Cote d’Ivoire | West Africa | 10.0 | 20.0 |

| Togo | West Africa | 10.0 | 20.0 |

| Benin | West Africa | 10.0 | 20.0 |

| Kenya | East Africa, Central Africa | 10.0 | 25.0 |

| Senegal | West Africa | 7.5 | 20.0 |

Source: MPOC Intelligence

In view of this, there are two ways Malaysian industry players could benefit from the agreement. In the proposed Annex 2 on the Rules of Origin for the agreement, Article 4 on “Origin Conferring Criteria” stipulates that:

“A Product shall be considered as originating from a State Party if it has:

- been wholly obtained in that State Party within the meaning of Article 5 of this Annex; or

- undergone substantial transformation in that State Party within the meaning of Article 6 of this Annex.”

Article 6 of the annex on “Sufficiently Worked or Processed Products” stipulates that:

“For purposes of Article 4(b) of this Annex, Products which are not wholly obtained are considered to be sufficiently worked or processed when they fulfil one of the following criteria:

- Value Added;

- non-originating Material content;

- change in tariff Heading; or

- specific processes.”

According to Article 6 of the annex, palm oil products could enjoy the preferential tariff should the tariff heading changes provided that the changes occur in a member state country. This would entail an opportunity for palm-based products especially in the Fast-Moving Consumer Goods (FMCG) sector. Thus, FMCG sector could have a booming demand vis-à-vis the agreement as trade barriers intra-Africa are removed. According to McKinsey, 100 cities in Africa is expected to have 1 million population by 2025 and the total population of the continent could double from the current 1 billion population by 2030. The surge in population as well as the introduction of the agreement will greatly boost the demand for FMCG products.

The second benefit that could be entailed for the Malaysian Industry players through the agreement is the establishment physical operations in Special Economic Zones (SEZs). Article 9.1 of the Annex 2 on “Goods produced under Special Economic Arrangements / Zones” stipulates that:

“Goods produced in Special Economic Arrangement / Zone shall be treated as originating Goods provided that they satisfy the rules in this Annex and in accordance with the provisions of Article 23.2 of the Protocol on Trade in Goods.”

Thus, goods produced under the umbrella of SEZs would be able to enjoy full benefit of the agreement provided that companies adhere to the local customs requirements and regulations. This presents a great opportunity for palm oil refining and re-exports to neighbouring countries. Examples of SEZs located in Sub-Saharan Africa are Dakar Integrated Special Economic Zone (Senegal), Coega Special Economic Zone (South Africa), and Kigoma Special Economic Zone (Tanzania), to name a few.

Conclusion

It is important to note that negotiations on tariff schedule for the AfCFTA agreement is still ongoing. With only 28 out of 54 countries have ratified the agreement, and the current COVID-19 pandemic, it is foreseeable that the implementation could be postponed to a later date. While not directly beneficial towards Malaysian palm oil industry, the agreement would present opportunities towards the palm oil industry. It is expected that with the introduction of the agreement, palm oil demand in the region will experience an increase in consumption especially in the FMCG sector. Finally, establishing a physical presence under the umbrella of SEZs in the continent would entail the full benefit of the agreement, presenting opportunities in refining and re-exports of palm oil products.

Further readings:

Agreement Establishing the African Continental Free Trade Area

Compiled Annexes on the Establishment of the Continental Free Trade Area

Prepared by Fazari Radzi and Karthigayen Selva Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.