Introduction:

Algeria is a predominantly liquid market and is a net importer of oils and fats, it produces only 9.2% of its requirements of around 915.4 thousand MT per annum. Requirements are largely met by imports of oils and fats mainly of soybean oil, followed by palm oil and sunflower oil.

Until 1998, the Algerian oils & fats market was dominated by only one producer, the state-owned operator ENCG. The economic liberalisation in the 1990s opened opportunities for private sector to get involved in the industry. Since then, a private company, Cevital has been the major oils and fats importer and is the single largest palm oil buyer. In 2006, the private sector took over the edible oil industry after ENCG units were sold to several private companies. The new companies are keen to develop more palm-based products, but logistics issues and landed price are part of challenges holding back higher consumption of palm oil in Algeria. Another constraint that is facing palm oil and its products was the high import duty for bulk processed palm oil products is 30% compared to crude edible oils at 5%. In the liquid oil market, palm olein is not widely used in frying due to clouding problem during winter. Some edible oil producers have tried to promote palm oil blend with soybean, but their trials were not successful due to solidification problem.

The demand and imports of oils and fats into this country faced another challenge with current Covid-19 issue worldwide. Algerian’s Ministry of Health announced the total infected cases have reached 7,019 and the number of deaths reached 548 as of 17th of May 2020. As part of measures to prevent the spread of coronavirus, Algeria’s President Abdelmadjid Tebboune has ordered all flights and all land borders to be closed, those carrying freight were not included in the order. He also banned mass gatherings, including the religious gatherings. However, mosques will only perform the call for prayers. The province of Blida is the only province that under total lockdown while the rest of the provinces are under partial lockdown, the hourly volume of partial lockdown is from 3 p.m. to 7 a.m. for other nine provinces. All means of public transportation are suspended. The cafés and restaurants are temporary closed in major cities.

All these decisions will slow down all the economic activities and will definitely slow down the demand on food and could affect the demand on palm oil. The HORECA sector is directly affected because of the closure of the cafes and restaurants, in addition to, many private and state-owned hotels are to host Algerian nationals that will be repatriated from abroad and quarantined.

On the other hand, the government took many measures to ensure that the food sector is not affected by Covid 19. Under these measures, the ministry of Finance will facilitate “the clearance of imported food products and speed up relevant banking procedures, to secure the needs of food sector. To ensure the country’s food security the President of the Republic have given the priority to the investment in farm products, notably cereal chains. Minister of Agriculture and Rural Development claimed that Algeria has adequate basic food stocks. He reassured that The State’s support to basic foodstuffs will continue despite the drop-in oil prices and the global economic crisis caused by the pandemic of coronavirus. Exceptional measures to ease the import of goods will be carried out by the Algerian General Directorate of Customs. To allow financial establishments and banks to increase their financing capacities the Bank of Algeria (BA) announced a series of exceptional and cyclical measures to reduce the impact of Covid 19 on the affected companies.

Aligned with the government reassurance of the sufficient food, Cevital, the leading player in edible oils market in Algeria has announced that they reassure all Algerians of the availability of sufficient quantities of their different products, mainly the oils and sugar, and without any increase in prices. Beside to the adequate stocks reserved for high demand cases, their factory in Bejaia continues to operate at full capacity. The production of this latter alone covers more than required by the Algerian market’s needs. This is beside the production of the three other operators to add on the requirement of the market’s needs. [ On the other hand, they have deployed all their logistic resources to deliver their products to all over Algeria.

Cevital continues to be the leading player in edible oils in 2019, due to its long history in Algeria which goes back to more than 30 years. Cevital uses roughly 7,000 MT in their monthly production as they are the biggest importer of palm oil in Algeria and have estimated 50% of the market share of palm oil in Algeria. They use palm oil mainly to produce Shortening, Margarine, and some for industrial frying. However, for the cooking oil production for household, only soybean oil is used in this segment. There is no blended cooking oil containing palm oil available in the market currently. Furthermore, the proper way to blend palm oil is to use super olein to maintain its liquid form and this will increase the cost of blended cooking oil and will not be able to compete with the soybean oil. Soybean oil prices relatively competitive in the market and sometime lower than Palm Olein especially during summer session[ , lower freight cost and oversupply of Soybean oil especially during summer brought this commodity more competitive in the market. Apart from that, more than 30% Soybean oil crushed locally to support domestic meal and oil requirements. The main suppliers of palm oil products to Cevital are Wilmar and AAA Oils & Fats Pte Ltd. Cevital prefers these companies because of their efficiency of products delivery at least for every two weeks and at competitive prices. Domestic players in addition to Afia International control edible oils in Algeria, thanks to their long-standing presence and affordable prices. Moreover, as the local supply covers almost all the demand for edible oils in Algeria, there is only a small gap for international players.

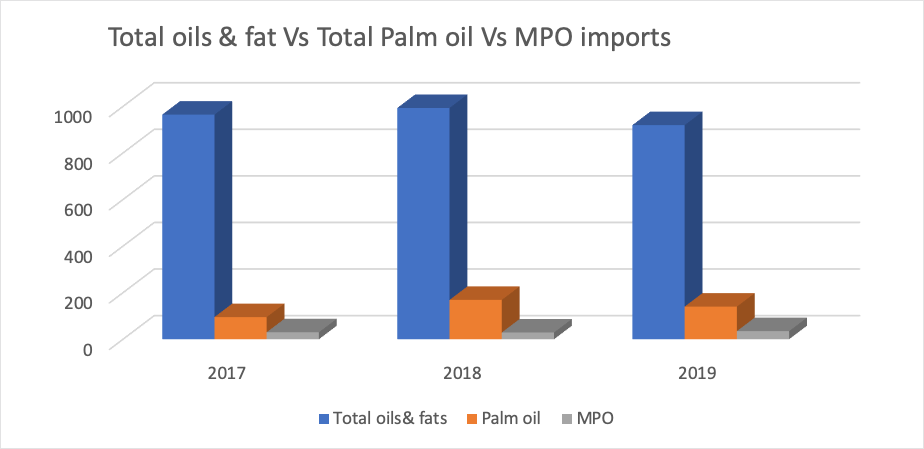

Algeria’s total oil & fats imports reached 993.2 thousand MT in 2018, while their consumption reached 915.4 thousand MT in the same year. Algeria is a net importer for oils & fats. They produced roughly 9.2% of their total consumption. Algeria only produces two types of oils, Olive oil & Sunflower oil. Sourced from Oil World statistics, the total production is 84.8 thousand-ton, olive oil represents roughly 95% of the total production while the sunflower oil is the rest. Soybean oil dominate the imports as it represents 74.4% of the total imports, followed by palm oil 16.9% then 5.1% sunflower oil, the rest of the oils & fats are only 3.4% of the total imports in 2018.

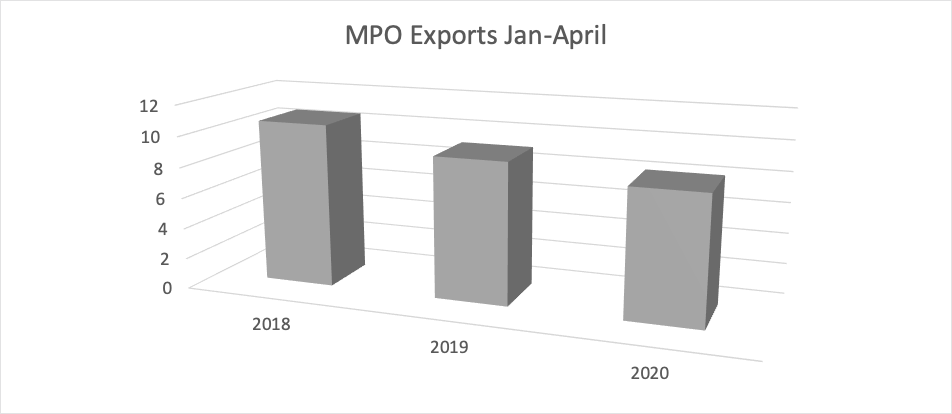

The imports of the Malaysian palm oil slightly decreased in Jan-April 2020 by 9.9% compared with 2019, Decreasing from 9,161 MT in 2019 ton to 8,249 in 2020. In the same period the RBD palm oil is still the top imported MPO product and it witnessed a slight decrease in Jan-April 2020 by less than1%, decreasing from 3,726 MT in Jan-April 2019 to 3,690 MT in Jan-April 2020. In the meanwhile, the shortening imports slumped by 76.9% decreasing from 2,788 MT to 643 MT. Also, the HRBD palm oil witnessed a drop by 37.9%, decreasing from 2,756 MT to 1,710 MT at the same period.

(source MPOB statistics)

Note: data of total oils & Fats and total palm oil in 2019 is forecast from the oil world.

(source oil world & MPOB Statistics)

(Source MPOB statistics)

Expectation for 2020

Challenges:

(Source Gain report)

2020 could be a more challenging year for palm oil as the slowdown in economy will probably be in the favour of the dominated edible oil which is Soybean specially with the new crushing plant that increased the imports of the Soybean significantly in the first two months of 2020 compared with the same period last year. As reported by the U.S. Global Agricultural Trade System, (GATS), “U.S. agricultural exports to Algeria during the January- February 2020 period were above figures for that same time period in 2019. Total agricultural exports in January-February 2019 are reported at 15.3 million, and 30.5 million for the same period in 2020. This increase is mainly attributed to increased exports of U.S. soybeans, ($22.5 million) as a new crushing plant became operational in the Western part of Algeria. These figures were not impacted by COVID-19, as the first recorded case of COVID-19 in Algeria was at the end of February. The Government of Algeria has for several years oriented itself toward a strategy to reduce imports and is starting to see the results of this strategy.”

The demand of oils and fats in local market would be at lower side during current Covid-19 crisis. According to the General Directorate of Algerian Customs (DGD). During Jan-Feb 2020 the food import bill in Algeria reached US$1.293 billion compared with US$1.340 billion dollars during Jan-Feb 2019, down by US$46.87 million (-3.50%). This shows that there is already decline in the food demand in Algeria. According to the estimates of the Complementary Finance Bill (LFC) 2020, Algeria’s foreign exchange reserves are expected to fall to $44.2 billion by the end of 2020. The shortage in the foreign exchange reserves will lead the government to maintain its strategy to reduce the imports of the oils & fats and expend the using of local crushers for the Soybean. The financial situation is expected to be difficult as to increase the national guaranteed minimum wage (SNMG) to DZD20,000 as of June 2020, the president of the Republic decided to reduce State’s operating budget from 30% to 50%.

The expected slowdown in the HORECA sector will lead to partial shift of food consumption from the restaurants and cafes to the household. With the absence of palm olein for household especially for cooking and frying oils, it is more difficult to penetrate the market as it need much more work to promote palm olein to the consumer than to promote to the industry.

Opportunities:

Regardless of the economic situation, the hydrogenated RBD palm oil imports from Malaysia dropped, while the RBD palm oil have increase in Jan-Mar 2020 compare with the same period last year. This could support the direction in Algeria to produce trans-fat free products and will be a good opportunity for palm oil to replace the hydrogenated soybean oil in the solid fats to product trans-fat free products.

Oleochemical sector with palm-based products is another opportunity that can be explored. Introduction of palm-based products to the local manufacturers through its techno-economic advantages would create another additional demand for palm oil products in the market.

Conclusion

Palm oil import is expected to decline in Algeria, mainly affected by current situation and the share of palm oil is also expected to decline while soybean’s share is expected to increase. Malaysian palm oil exports are also expected to slightly decline based on Jan-April export data. However, this slight decline would not affect MPO share in Algeria as the total palm oil is expected to decrease. The decline in palm oil imports is expected to be limited as palm oil is mainly used as solid fat.

Malaysian exporters should focus on the solid fats as replacement of the hydrogenated fats taking advantage of the increase of awareness of the problems caused by trans fats. Beside the palm based oleochemicals to take advantage of the increase of using detergents and other applications that can be explored. Meanwhile, efforts should be made to try to penetrate the soft oil sector with better logistic and availability of Malaysian palm oil products and become more competitive as the government and the private sector will try its best to cut down their costs to coup with the economic situation.

Prepared by Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.