Covid-19 has taken thousands of unfortunate lives and currently infecting millions of people globally, but other than lives, it affects everything from the economy to lifestyle. The situation is made worse for the Middle East region as global crude oil prices fell to its 20-years low from weak demands as most countries are major crude oil producers, leading to production cut agreement by OPEC+ starting April 2020. The IMF revised its GDP growth for the region from 1.2 percent to -2.8 percent in 2020, expecting a total economic fallout of countries in the region. This will affect the government’s income, higher inflation leading to lower consumer confidence which eventually results in lower spending and lesser imports as the whole supply chain is totally disrupted.

The region recorded a 33 percent growth during Jan – Apr 2020 as Malaysian palm oil imports reached 609,221 MT as compared to 458,220 MT during the same period last year. The growth in imports was mainly from the significant increase in imports from Oman, Yemen and Saudi Arabia at 20,770 MT, 172,154 MT and 36,831 MT respectively.

It is believed that the significant price difference between palm oil and other oils are the driving factor of the significant import figures, supported by cyclical up trends by major importing countries such as Saudi Arabia.

Updates on major markets

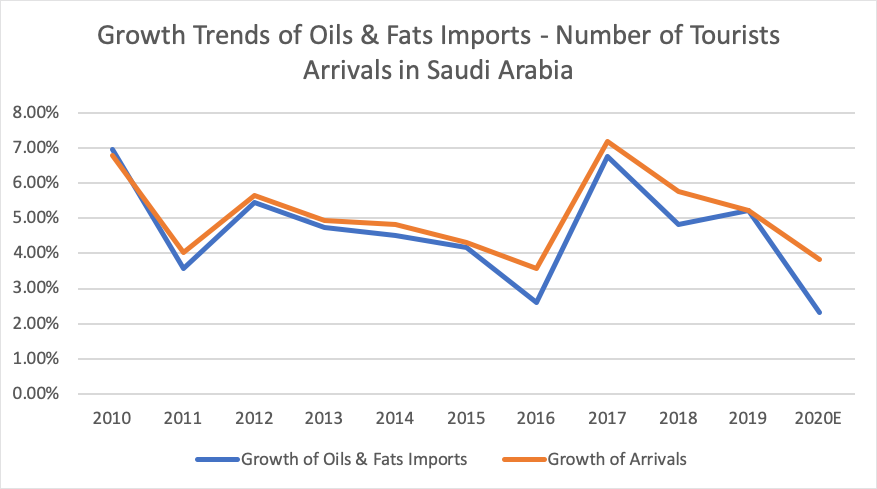

Saudi Arabia is back to its 2018 level for the Malaysian palm oil imports, as Jan – Apr 2020 figure reached 172,154 MT, similar to the 151,300 MT levels shown during the same period in 2018. The Saudi industry members indicated that this year, while overall palm oil demand could be stagnated at last year’s level, most of the palm oil supply going into the kingdom will be of Malaysian origin. This could be due to the same reasons as it was in Q1 where buyers are getting price advantages from Malaysian suppliers over other suppliers. By the end of the year, Saudi is expected to import around 500,000 MT as the cancellation of Hajj and Umrah was already confirmed, leading to an expected drop in the number of arrivals to Saudi Arabia, leading to less demand for food.

Iran is another major market for the Malaysian palm oil, as perceived quality as described by industry correspondence as to the main reason for the preference. As one of the countries that are highly affected by the coronavirus pandemic with the highest number of cases and deaths in the region, IMF predicted a GDP growth decline up to 7 percent, as the pandemic put added pressure on the economy on top of the imposed sanction. Malaysian palm oil imports declined by 12 percent, as Jan – Apr 20 period recorded a drop of 7,702 MT, which is 56,268 MT as compared to 63,970 MT during the same period last year. The overall outlook for palm oil imports in 2020 could be in the region of 505,000 MT.

Turkey kept its 2020 import outlook, based on the Jan – Apr imports figures with a drop of 10 percent, from 232,302 MT in 2019 to 172,154 MT this year. While manufacturing continues to show strong demand for palm oil, it is the horeca sector that showed weakness in demand as the tourism sector is heavily affected from the country’s lockdown in its effort to curb and control new infections of the Covid-19.

Other countries with import potentials

Turkey, Iran and Saudi Arabia have always commanded more than 75 percent of total imports in the region and will continue to record positive export growth as it is the main choice of oils and fats for the ever-growing food manufacturing and horeca industries.

However, dependencies on these countries could jeopardize imports of Malaysian palm oil in this region as industry members should look for alternative markets that would supplement the decline in these traditional markets. The approach will also have to change as there are no more big markets, and these new markets will unlikely yield a 50,000 or 100,000 MT of total imports. However, the strategy should focus on minimal growth, but enough to cover the deficits left by big markets, with the opportunity to grow in the future as the economy is back on its more predicted growth trends. Higher value-added products can also be focused to off-set the gap in volume exported.

QATAR is one of the promising new markets in the Middle East as they have the highest per capita income in the world, number one among the Gulf countries in human development index, on top of friendly foreign policies.

Qatar had been relying on their neighbours for oils & fats imports until the conflict in 2015 that forced them to source their oils & fats supply from other countries. Palm oil has been one of the leading supplies of oils & fats with a steady CAGR (2015 – 2018) of 49.8%. Malaysia has been the leading palm oil supplier to Qatar, with 99% market share of the total 25,800 MT of palm oil imported in 2018. The trend is set to continue in the near future as the country strives for self-sufficiency and have been planning for physical investments, especially in the food manufacturing industry.

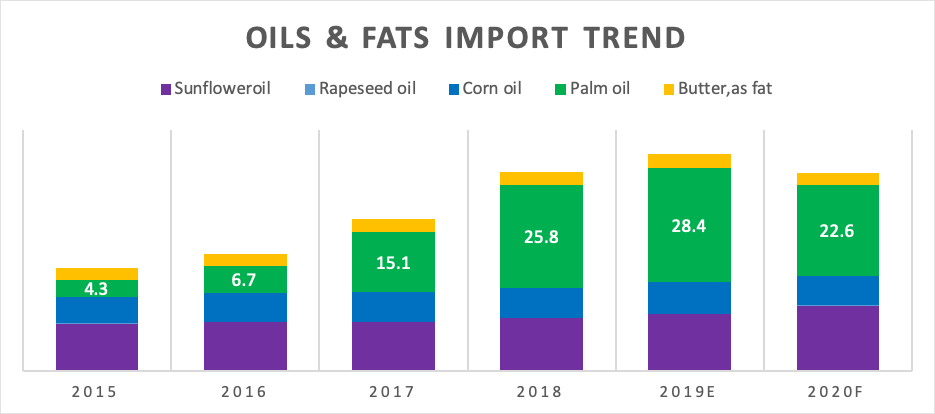

Qatar’s imports of oils & fats have been steady over the years. Since 2015, 5 year-CAGR for oils & fats imports are at 15.7 percent, reaching 54,100 MT in 2019. Palm oil and sunflower oil is the most imported oil with 28,400 MT and 14,100 MT, respectively. This year, however, total imports are expected to drop due to contraction in the hospitality sector and weakness in consumer demand as efforts to contain the pandemic could prolong until the end of the year.

While Qatar’s population is small, many expatriates are working in Qatar who are already familiar with palm oil and require an economical choice of fats. With oils & fats per capita at just 22.9 kg, there is still room for increased intake. However, the real opportunity in Qatar comes from the hospitality sector and the upcoming food manufacturing sector in the government’s effort to improve self-sufficiency.

Government initiatives such as ‘Own Your Factory in 72 Hours’ by the Ministry of Economy and Commerce and ‘Made In Qatar’ by the Ministry of Energy and Trade with Qatar National Bank, while not fully realised, expressed the government’s acknowledgement and eagerness in expediating a critical sector of the country. QR 2.5 billion has already been approved, and 22 projects are identified in the food sector, leading to opportunities for more demand for palm oil.

Other sectors that serve as an opportunity would be in the consumer food services of which by 2022 it is forecast that the industry will reach US$2.26 billion with cafes leading the market share with a forecast of US$1.25 billion followed by chain restaurants with a market size around US$745 million.

Despite the disruption of growth in 2020, another opportunity that will boost hospitality and food services in Qatar would be the upcoming World Cup 2022. While currently in preparation to build stadiums for the tournament, the country is also preparing for the anticipated influx of arrivals that will come for the tournament, needing enough accommodation and food outlets. As demonstrated by previous cities that have held the tournament, it sees tremendous economic growths, leading to potential imports of palm oil.

Considering these factors, Qatar could likely boost its imports of palm oil to a further 15,000 MT leading up to 2022 with imports reaching 40,000 MT. While 99 percent palm oil imports into Qatar is from Malaysia as reported by ITC Trademap, the industry members in Malaysia should take this opportunity to look for more opportunities in establishing new ventures with local companies. The focus should be on fresh, higher-value products such as pumpable stearine, that can be introduced in the country’s new and emerging food manufacturing sector. Qatar has its own edible oil refinery; Qatar Food Industries with storage capacity up to 9,000 MT and has an extensive distribution in the country, focusing on the B2C segment. QFI contributed to half of palm purchase in Qatar. There are also some edible oil blenders and packers which makes part of the supply distribution in the B2B especially horeca industry and food distributors.

MPOC Efforts in Qatar

MPOC has run a program in collaboration with Qatar Culinary Professionals (QPC) association that consists of members along the food supply chain in Qatar, in October 2020. Presentations on the technical and economic advantages of palm oil were made by representatives from Matrade, MPOC and food experts from the industry. A cooking demo was also done to show the type of food that can be prepared using palm oil and the comments received were overwhelming as participants were surprised on the versatility of palm oil. MPOC also received some inquiries on potential ventures with Malaysian partners and were taken up by Matrade.

As MPOC is also a professional member of QCP, another follow-up event was scheduled last March but it is currently postponed and expected to be resumed in November 2020. The QCP Professional Roadshow will be a 2-day event that will bring together users and suppliers of products in the horeca sector that will convene and exchange their thoughts on the direction of the industry. This serves as a platform for suppliers to introduce their products and be part of the growing food industry in Qatar.

IRAQ is another promising market in the Middle East region. Despite the turmoil, the requirement for food, including oils & fats, has always been constant. The 40 million population only consumes around 20 kg per person, which leaves much room for more intake of oils & fats as local confectionery and food types are similar to the higher consuming nations in the region.

Overall, Iraq requires around 450,000 MT of edible oil for the Ministry of Trade, which will be part of the national food rationing system while the same amount is also needed for retail. Overall, Iraq requires around 900,000 MT of oils & fats of which 650,000 MT is sunflower oil, 172,000 MT of palm oil, 90,000 MT soybean oil while the rest are shared between rapeseed oil, sesame oil, corn oil, coconut oil, butter and tallow & grease. However, reliance on palm oil is slowly growing as food manufacturing, and food services sector is slowly picking up pace as Iraq becomes more politically and economically stable. This is reflected in a steady 5 percent CAGR (2013 – 2018) in domestic disappearance for palm oil.

Etihad Food Industries is the dominant supplier for the Ministry of Trade food ration supply for sugar and oils & fats. EFI has its own edible oil refinery with a capacity of 2,000 MT a day production that started production in April 2017.

CONSUMPTION OF OILS & FATS IN IRAQ

| 2016 | 2017 | 2018 | 2019 | 2020F | |

|---|---|---|---|---|---|

| Sunflower | 464 | 527 | 555 | 607 | 648 |

| Palm | 171 | 155 | 169 | 171 | 172 |

| Soybean | 86 | 57 | 47 | 39 | 36 |

| Others | 46 | 50 | 47 | 47 | 48 |

| Overall | 768 | 789 | 817 | 864 | 904 |

Iraq imports most of its edible oil requirement from Turkey through traders (some are part of the UN World Food Program) that transports the oil to northern Iraq through Marsin and Iskenderun port. Cost for transport from Mersin is around US$450 per 20-foot containers while it costs US$350 to transport from Iskenderun port for a 7-day trip to Iraq.

Malaysia only managed to export directly around 40,700 MT of palm oil and palm products to Iraq last year 2019. However, most of the Malaysian palm oil into Iraq is believed to be delivered through Turkey. Turkey exported around 150,000 MT of oils & fats to Iraq, mainly sunflower and blended oil.

Malaysian palm oil companies, especially those that command a wholistic production chain and enough capital, should consider opening a physical plant as Iraq can still serve as a hub for surrounding regional market. This will give players opportunities in terms of costs benefits as it will avoid any import duties imposed, on top of initiatives provided the Iraqi government for new investments. Despite its political uncertainties, most of the problems are focused in specific areas in Iraq while it is business as usual for other regions like Erbil. The idea has already been considered by few companies around the region that think this move will bring in good return in the long run.

There is also news that Iraq is looking at Egypt to supply their needs for cooking oil for their monthly food ration program as they wanted to minimise their reliance on Turkey over political difference on issues in Idlib, Syria. This could again serve as an opportunity for Malaysian palm oil suppliers to seek opportunities to supply to companies with government contracts.

Conclusion

This global pandemic is expected to be one of the biggest disruptions in the global economy. While many countries will be affected, Middle East countries that mostly rely on crude oil production as their main source of income will also be severely affected. Governments will also have to dig deep in to their reserves, having to support the economy and the people through this challenging period.

The region’s palm oil imports are mainly supported by these three countries – Turkey, Iran and Saudi Arabia, where Iran is the epicentre of the infection in this region with the highest number of positive cases. Many predict Iran’s GDP would be severely affected with some reports indicating that it might contract up to 7 percent. Saudi Arabia will also be affected as non-oil sector’s GDP is already showing signs of weakness with PMI data showing a back to back contraction for March and April 2020. The disruption in these major markets could be supplemented through increase imports in these two potential countries – Qatar and Iraq as both offer opportunities through different areas.

Qatar’s crisis with its neighbours has forced them to be self-sufficient, hence forcing the government to make rapid policies in ensuring food security for the country. Other than that, they are also boosting their hospitality and food services sector in anticipation of the influx of global arrivals as they will host the 2022 World Cup tournament.

On the other hand, Iraq has always been a good market barring its political unrest. The Ministry of Trade is struggling to provide enough through the food rationing program while stabilising economy means more opportunities in many more businesses, usually accompanied by increased urbanisation and demand for food services.

It is believed that efforts to establish reliable partners should be made swiftly to grab these opportunities presented by both countries. The quantity could be small initially, but it could be a start to a bigger market if both continue the current growth trends.

Prepared by Mohammed Hafezh

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.