2021 in review

Since the COVID-19 pandemic shocked the global supply chain in the spring of 2020, Europe was one of the most affected regions in the world. The region took severe beatings as measures to curb the spread of the pandemic took its toll on its economies. A second wave hit the European Union in the winter of 2020-21, which as a result saw stricter measures implemented leading to lockdowns and economic closures, affecting one of the most important sectors in Europe; transport. The restriction on movements had adversely affected the use of public and commercial transport, and with it, impacted the demand for biofuels in the region, and inadvertently the palm oil biofuel feedstock demand.

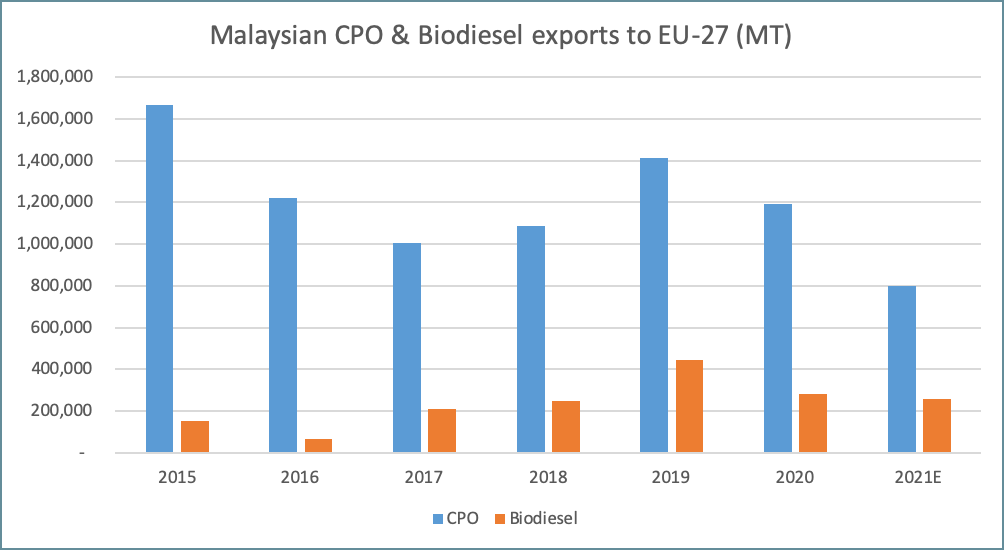

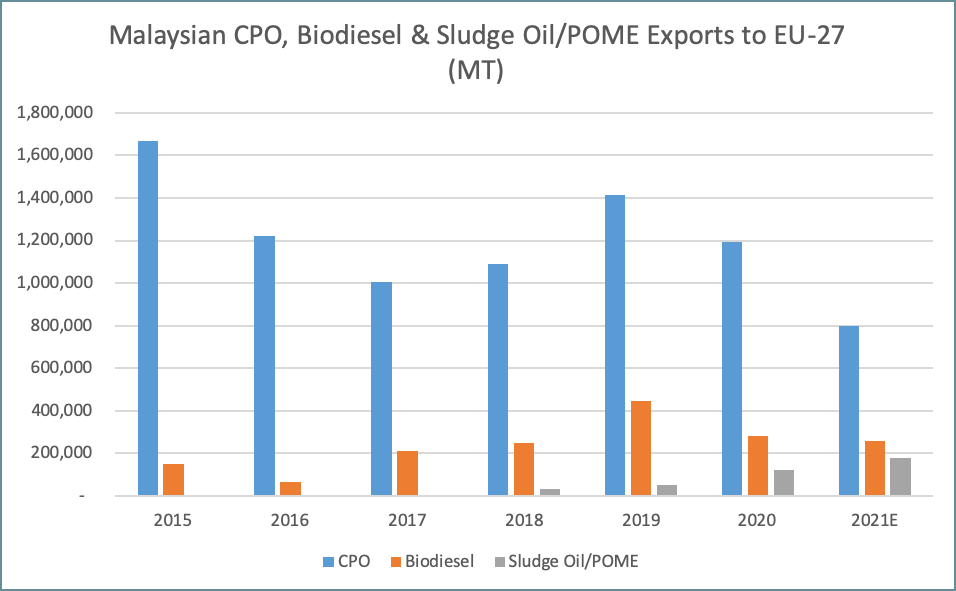

Rapeseed oil remains the dominant feedstock used in the EU-27 biodiesel sectors but its use has been slowly declining over the past 5 years. Nevertheless, the use of rapeseed oil as feedstock in biodiesel slightly recovered in 2021, in part due to the high price of palm oil and its tightening supply. This trend was apparent in January-November 2021 Malaysian CPO and biodiesel exports to the EU region. Data shows that CPO exports to the region recorded a total of 733,298 MT (Including RSPO and ISCC certified CPO), and biodiesel recording a total of 240,492 MT, a drop of 35% and 0.5% respectively. By the end of 2021, it is estimated that CPO and biodiesel exports to the EU-27 would amount to approximately 800,000 MT and 260,000 MT respectively.

Factors to keep in view in 2022

Early adoption of Renewable Energy Directive II by several member states

In the past decade, the EU has enacted several initiatives and regulations that have restricted palm oil trade in the region. One of the most compelling initiatives is the Renewable Energy Directive (RED) II which would phase out high indirect land-use change (ILUC) risk biofuels starting in 2023, in which palm oil is the only feedstock categorized as high-ILUC risk.

While RED II only foresees a gradual phase-out of high ILUC-risk biofuels from being counted towards the European Union’s renewable energy targets, several EU Member States have been forging ahead with the directive even earlier, taking measures that go beyond the RED II and exclude palm oil-based biofuel from relevant policies. They are also not providing for exceptions of low ILUC-risk feedstock, or even from being used as biofuel at all. It is disconcerting to see these measures as such, but also about their likely influence on other Member States of the EU and other countries globally.

Germany, one of the largest palm oil-consuming countries for biodiesel, is set to phase out palm oil to be used as biodiesel feedstock by 2023. It is foreseeable that the impact would be felt in 2022, as the industry is transitioning towards waste-based feedstocks. Even more concerning is the approach by Belgium, which will prohibit, from 1 January 2022, the placing on the market of biofuels and biogases based on palm oil or other products directly or indirectly derived from the oil palm, as well as based on soybean oil or other products directly or indirectly derived from the soybean plant. While Belgium extends the prohibition to soybean oil, it is an actual prohibition of placing on the market and not limited to the fact that such biofuels may not be counted towards the renewable energy targets. Other member states such as the Netherlands, Italy, Denmark, and Portugal are expected to follow suit as regulations pertaining to palm oil uses in biofuels are being drafted.

Malaysian supply situation

Malaysia has been facing enormous challenges with its CPO production since the start of COVID-19. It was projected that Malaysian CPO for 2021 would amount to 18 million MT, a drop of 6% or 1.1 million MT compared to 2020, the lowest figure since 2017. This situation contributed to the surge of palm oil prices to a record high. With the rising price of CPO, it is foreseeable that rapeseed oil used as biodiesel feedstock would be strengthened as long as palm oil prices remain high, at least until the second quarter of 2022, where palm oil supply is expected to recover.

The transition towards advanced biofuels

The RED II contains Annex IX which lists the feedstocks that receive special treatment for the RED II transport target. It has a specific sub-target starting at 0.2% in 2022, at least 1% in 2025, and increasing to at least 3.5% in 2030. According to Part A of Annex IX, palm oil mill effluent (POME) and empty fruit bunches are classified as waste materials that qualify for the production of biogas and advanced biofuels, in which the energy contribution is eligible for double-counting.

In this regard, rising imports of palm oil mill effluent (POME) from Malaysia was seen since 2018. From January to November 2021, the EU region imported a total of 165,769 MT of POME, a 58% increase in imports compared to the same period in 2020, at 104,625 MT due to rising demand for second-generation biofuels, especially in Italy. It is expected that this trend will continue well in the future, with many producers transitioning towards advanced biofuels production.

Conclusion

Since the inception of RED II, palm oil demand in the EU have been steadily declining. Although the process of phasing out high-ILUC risk feedstocks would only start in 2023, several member states has moved forward with the adoption earlier than expected. Some countries blatantly phase out palm oil notwithstanding whether it could contribute to the EU renewable energy targets. In lieu of this, demand for waste-based feedstocks such as POME and used cooking oil are on the rise, because of an attractive energy contribution scheme. As such, it is foreseeable that demand for palm oil as a biofuels feedstock would continue to drop in 2022, but the demand for POME to be used as biodiesel feedstock would likely see an increase.

Prepared by Fazari Radzi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.