The statistics published by industry analyst Oil World ISTA Mielke GmbH (headquartered in Germany) show palm oil imports into Germany to have dropped drastically over the past five years. That contrasts with overall exports of the commodity to the European Union (EU) and thus begs the question: what is going on? This article provides an answer.

Is Germany’s appetite for palm oil waning?

The answer to this question depends on who you ask. By all accounts, though, Germany, the EU’s largest economy, is a significant buyer of the golden tropical oil.

Based on palm oil imports recorded by Oil World (excluding intra-EU trade), Germany remains the fourth largest buyer in the Union.

Figure 1: Top 4 palm oil imports by country – without intra-EU trade (`000 MT)

However, Germany’s quantities are only a fraction of the amounts that go to the Netherlands, Spain, and Italy. And since 2016, German imports almost halved.

According to numbers compiled by the Malaysian Palm Oil Board (MPOB), the Malaysian share of the total was small in 2019 and fell by almost 40% in 2020.

Figure 2: Malaysian palm oil exports to Germany (MT)

The picture that emerges when considering intra-EU trade – which can be significant not least because of the Dutch Port of Rotterdam’s role of principal point of entry and redistribution hub – is similar: Germany’s share is surprisingly small.

Figure 3: Top 4 palm oil imports 2019 with intra-EU trade (`000 MT)

But how can an economic powerhouse like Germany import not even half the amount of Spain or Italy? Especially when Oil World lists the country as the largest biodiesel producer in the EU?

Thus, even when considering that Germany buys much more palm oil from European suppliers (primarily from the Netherlands) than its peers in the Top 4, the overall drop in imports compared to a few years ago needs an explanation.

As it turns out, the import slump disappears when using numbers the German government works with.

A quick background on that: The German Forum for Sustainable Palm Oil, known by its German acronym FONAP, was established in 2013 as a public-private alliance to promote the use of sustainably produced palm oil. Its steering committee comprises five elected members from industry, NGOs, and the federal government plus one non-elected, permanent representative from the German Ministry of Food and Agriculture (currently Dr. Eva Ursula Müller, Head of the Department of Forests, Sustainability, Renewable Resources).

Since 2013 the FONAP commissions every two years a comprehensive analysis of the palm oil sector in Germany. The environmental consultancy MEO Carbon Solutions prepares the study and the version covering the year 2019 was published on January 20th, 2021.

The data in the report are unique in that they go beyond available statistics that cover direct imports. For those, apart from Oil World, the main source is the German Federal Statistical Office (Destatis). For indirect imports, i.e., palm oil contained in products, the study relies on its own surveys among around 790 market players.

The following graph is decisive. It compares direct palm oil imports as reported by MEO Carbon with those of the industry reference Oil World.

Figure 4: German palm oil imports 2015 – 2019 (in MT)

For 2019 the delta between both data sources amounts to no less than almost 440 thousand MT.

The formula MEO Carbon uses to arrive at total palm oil imports is:

(Indirect imports + direct imports) – (indirect exports + direct exports)

That approach leads to vastly different results, and the drop in German palm oil imports, apparent in Oil World figures, turns out to be the opposite. The summary results of the FONAP/MEO Carbon report (abstract in English here) are as follows:

“In 2019, 821,500 MT of palm oil was imported directly to Germany and 334,000 MT was exported to other countries. In addition, more than 1 million MT of palm oil was imported into Germany as a component of final and intermediate products, and approximately 320,000 MT were exported.

Total palm oil consumption in 2019 was 1.26 million MT, an increase of over 100,000 MT compared to the 2017 study.

Of the 1.26 million MT consumed, over 1 million MT were sustainably certified (1.044 million MT), which means an overall share of sustainable palm oil in total consumption of 83%. Compared to 2017, this represents an increase of 5 percentage points.

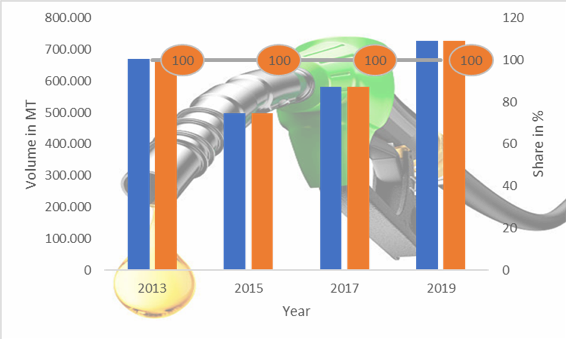

More than half of the palm oil consumed (726,397 MT) was consumed in the energy sector, with the transport sector being the most important segment with a total consumption of 646,000 MT of palm oil.

In the four non-energy sectors, a total of 534,989 MT of palm oil was consumed. Here, the food sector was the most important with 246,500 MT of palm oil, ahead of the animal feed sector (150,200 MT), chemicals and pharmaceuticals (106,517 MT), and detergents, cleaning agents and cosmetics (29,622 MT).

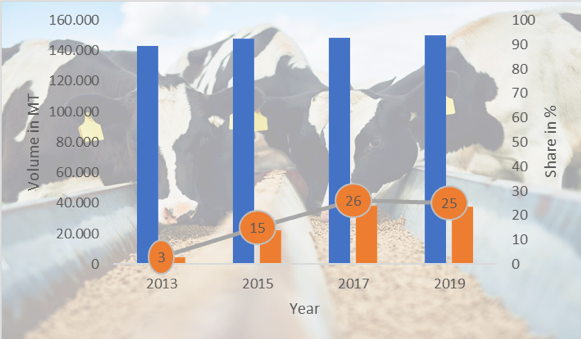

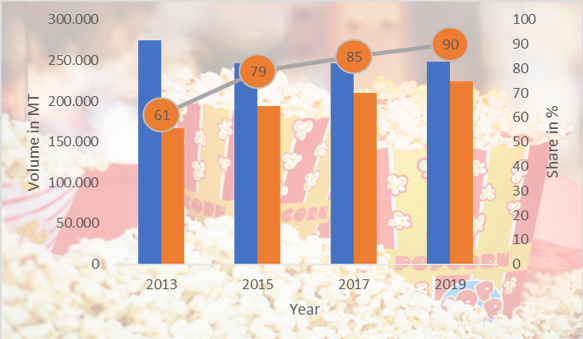

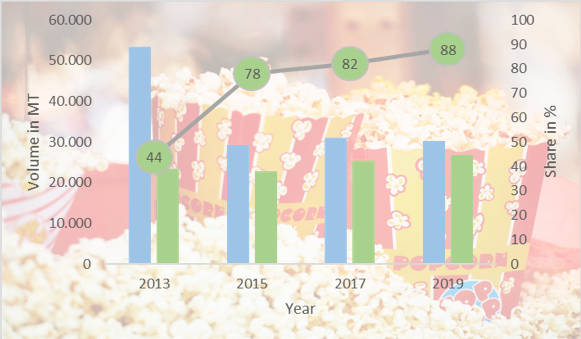

The share of sustainable palm oil increased in the food sector by 5 percentage points since 2017 to a total of 90%, in the detergents, cleaning agents and cosmetics sector (+ 1 percentage point to a total of 63%) and chemical and pharmaceutical sector (+ 9 percentage points to 36%), the sustainable share of palm oil was also increased, whereas a slight decrease was measured in the animal feed sector (– 1 percentage point to 25%).”

Background: Why is Germany (and Europe) so keen on sustainable palm oil? The age of (Green) politics

The cradle of European environmentalism stood in Germany. The very political term “green” harks back to the formation of the German Green Party in 1980. Today, the Greens are active the world over: from the Egyptian Green Party to the Partido Verde in Brazil, from the Australian Greens to the Papua New Guinea Greens Party. What they all have in common is a desire to build an ecologically sustainable society. In Germany, the Greens have triumphed in election after election in recent years. Although governing on the federal level has thus far proved elusive, a ruling coalition with the Christian Democrats under a Green chancellor is no longer a laughingstock. Already, green politicians sit in most local and in federal parliament, and they are part of the ruling coalitions in 11 of 16 German states. The State Premier of the economic powerhouse Baden Wurttemberg is “a Green”– a first in German politics and considered a blueprint for a federal government by many. Long story short, German politics these days cannot turn a blind eye to green topics. And palm oil features prominently among them. For example, in a formal inquiry of parliament to the executive (“interpellation”) in 2019, the Green Party requested answers from the government under the emblematic heading: “Rainforest in the Tank – Palm Oil Imports to Germany”. Similar attacks come from other political quarters, albeit with motivations that differ from those of the environmentalists. The party “The Left”, the remnant of the former communist party of the German Democratic Republic, in 2018 tabled an interpellation entitled “Palm oil imports and their use in the Federal Republic of Germany”. The far right “Alternative for Germany”, always keen to promote nationalistic projects, for its part inquired in 2020 about the “Health risks from palm oil in food”. They wanted to know why the federal government did not do more to promote the production of “national alternatives” to palm oil like rapeseed and sunflower. “

German palm oil consumption by industry sector

The following eight graphs show the domestic consumption in Germany of palm oil and palm kernel oil plus the respective shares of sustainable palm oil.

These sectors are covered:

- Animal feed

- Energie, which mostly means biofuels

- Food

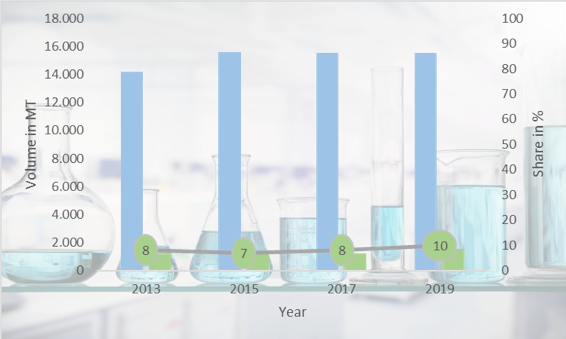

- Cleaning agents and cosmetics

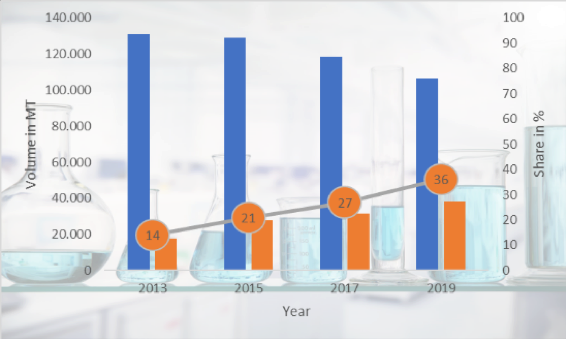

- Chemicals and pharmaceuticals

For all eight graphs, the data source is MEO Carbon Solutions 2021.

The following legend applies:

Three main conclusions can be drawn from the graphs:

- Overall consumption of palm products in Germany remained stable. A decrease was observed only in the cleaning/cosmetics and chemical/pharmaceutical sectors.

- In all sectors (except for energy, where the use of sustainable palm oil is mandated by law), there was a simultaneous continued growth in demand for sustainable palm products, although to a lesser extent in the feed sector. This growth clearly is driven by consumer preferences.

- Additional proof for the consumer’s crucial role lies in the fact that the further removed from the consumer a sector is (like feed and chemicals), the lower the percentage of sustainable palm (kernel) oil used. In the view of FONAP this is because most consumers are not even aware that those sectors consume palm oil. Further evidence of this “consumer proximity thesis” is that feed for pets sold in Germany is already 100% sustainable.

Consumption of (sustainable) palm oil and palm kernel oil in German industry sectors in metric tons (MT)

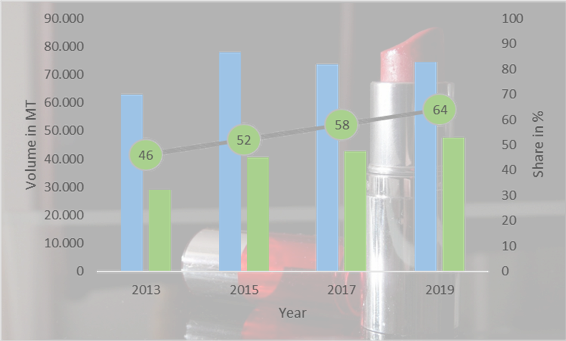

Figure 5: Palm oil - feed sector

Figure 6: Palm oil - energy sector

Figure 7: Palm oil - food sector

Figure 8: Palm kernel oil - food sector

Figure 9: Palm oil - cleaning agents and cosmetics sector

Figure 10: Palm kernel oil - cleaning agents and cosmetics sector

Figure 11: Palm oil - chemicals and pharmaceuticals sector

Figure 12: Palm kernel oil - chemicals and pharmaceuticals sector

The way forward: which opportunities exist?

The analysis presented in this article paints a drastically different picture compared to simply looking at Oil World figures: a stark drop in 2019 palm oil imports into Germany turns into considerable growth.

The sector-based analysis in the MEO Carbon report also unveils four areas for the Malaysian palm oil industry to focus on in the immediate to foreseeable future.

- Sustainable palm oil. In the four non-energetic sectors analyzed, consumption of palm and palm kernel oil between 2017 and 2019 was more or less stable. However, sustainably produced and certified palm oil experienced considerable growth.

In that context, the sectors place varying emphasis on the available trading options. There appears to be a move up the “value chain” from Book&Claim to Mass Balanced to Segregated and eventually to Identity Preserved.

Palm oil producers should take this into account and strive to provide the quantities desired by German buyers in the respective categories.

The market anticipates another increase for sustainable palm oil of 5% and for palm kernel oil of 3% between now and 2023. - Biodiesel: After a slump in 2015, palm-based biodiesel grew strongly after 2017 despite – or maybe because of – the EU’s Renewable Energy Directive (RED II), which mandates phasing out palm oil from 2023 onwards.

Two drivers for the rebound of palm consumed for biodiesel can be identified:

– First, RED regulations provide an incentive to keep the consumption level in 2019 high as it forms the benchmark for allowed imports until 2023.

– Secondly, it is simply hard to see how German or, for that matter, European drivers can replace palm biodiesel in the short term. Expect demand to remain robust for the next few years. On February 3rd, 2021, the German government will decide to incorporate RED II into national law. The current draft foresees a phase-out by 2026. That does, however, not apply to the classification of POME (palm oil mill effluent) as an advanced biofuel, which can therefore be used also after 2026, - Biogenic lubricants: In 2019, German consumption in this industry segment was:

– palm oil: 11.280 MT,

– palm kernel oil 9.760 MT.

In both cases, that is roughly double the volume in 2013.

The German market for lubricants is at around 1,000,000 metric tons per year. Biobased products this far only have a market share of about 3%. But given the environmental regulations in agriculture and other polluting parts of the economy, experts predict growth of around 4% per year in that segment. - Organic palm oil has experienced continued growth since 2013 as well but remains a niche product. From a total of 13.070 MT of organic palm oil consumed in Germany in 2019, 12.050 MT went to the food sector. The rest was used in organic cosmetics and certain “natural” cleaning agents. According to the report, to date, only Columbia, Brazil, Ecuador, Ghana, and Sierra Leone produce organic palm oil.

Thus, it might be worth looking into the organic food market segment. Red palm oil falls into this category. Although quantities necessarily would be comparatively low compared to industrial applications, producers and the Malaysian palm oil industry at large should bear in mind that promoting organic palm oil as a functional health food in the German and European markets will have a considerable positive impact on palm oil’s image overall.

Prepared by Uthaya Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.