The Philippines has been one of the most dynamic economies in the East Asia Pacific region. The average annual growth rose to 6.4% between 2010-2019, from an average of 4.5% between 2000-2009. Due to increasing urbanisation, a growing middle class, and a large and young population, the Philippines’ economic dynamism is rooted in a strong consumer demand that is supported by a vibrant labour market and robust remittances.

The Philippines is set to experience a rapid economic growth should the momentum of the current government continue, leading to better income for the people. The growth of the middle income group will increase discretionary spending, leading to growth in various sectors, especially the hotel, restaurant, and catering industries. As the population continues to grow, so do the low-income earners who need affordable food while also expecting to experience the convenience of food preparation. Food industries in the Philippines will need to seek quality and economical ingredients to ensure that the cost of production is kept low, to offer affordable food while still maintaining a healthy profit.

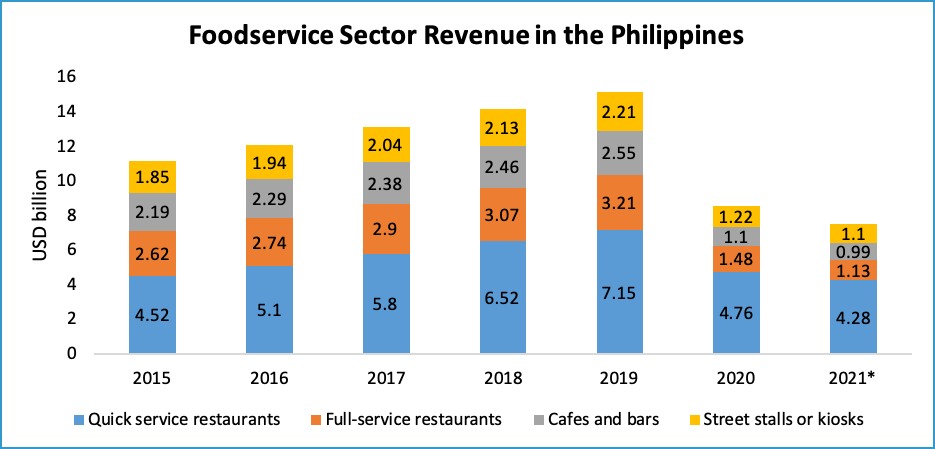

The foodservice sector in the Philippines recorded an upward trend from 2015 to 2019 with a strong CAGR of 7.84%. However, due to the COVID-19 outbreak, the sector was impacted severely in 2020 and 2021. The pandemic not only changed Filipinos’ dining habits, but also impacted the foodservice industry’s revenue. Due to prolonged lockdowns, the sales of the foodservice sector dropped by 43.4% to USD8.56 billion in 2020, and continued to drop to USD7.5 billion in 2021.

Although sales in the foodservice sector have shown a decline due to the pandemic and movement restrictions, consumers’ spending on food and beverage has significantly increased in 2020 and 2021. In 2021, the consumer expenditure for food and beverage in the Philippines was valued at over USD106.97 billion, which increased by 16.8% from USD91.58 billion in 2019. This shows that the demand for food and beverage will continue to increase year by year.

Palm Oil in the Philippines

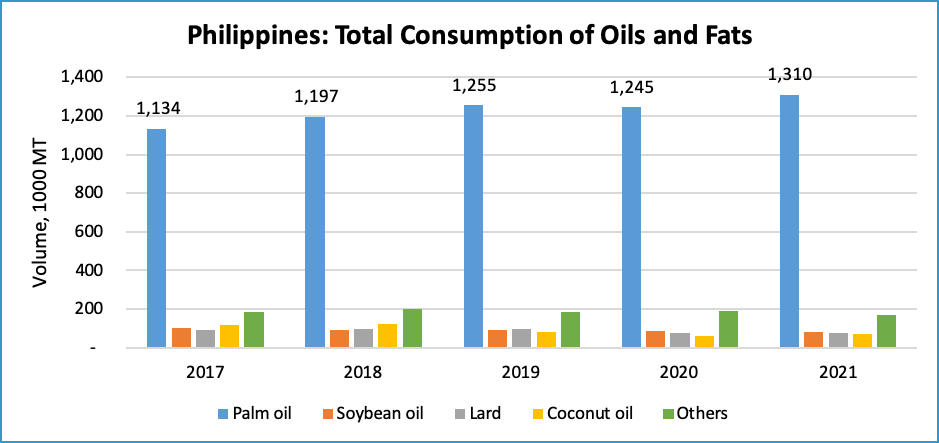

The Philippines is the second largest importer of Malaysian palm oil in the Asia Pacific region. With a total population of 115 million people, the consumption of oils and fats was at 1.7 million MT in 2021, an increase of 41,000 MT or 2.5% as compared to 2020. Palm oil is the main consumed oil in the Philippines, and accounted for approximately 76.7 % of total oils and fats consumed in the country in 2021.

The trend of palm oil consumption in the Philippines has grown at a compounded annual growth rate (CAGR) of 2.9% since 2017. The consumption of oils and fats is growing, driven by strong growth in the food and beverage sector. Palm oil is mainly used in the household, foodservice sector and food processing industries. The demand for palm oil in the Philippines is expected to show an upward trend in the future in food industries, especially the foodservice sector, as the sector is one of the major consumers of palm oil in the country

| MPO Export to the Philippines (by product) | 2021 | 2020 | Change (MT) | Change (%) |

|---|---|---|---|---|

| RBD Palm Olein | 543,176 | 635,859 | (92,683) | (14.58) |

| RBD Palm Oil | 19,828 | 30,499 | (10,670) | (34.99) |

| Cooking Oil | 8,994 | 13,737 | (4,744) | (34.53) |

| RBD Palm Stearin | 5,865 | 9,889 | (4,024) | (40.69) |

| Others | 1,943 | 3,456 | (1,513) | (43.78) |

| Total | 579,806 | 693,441 | (113,635) | (16.39) |

Source: MPOB

RBD palm olein is the main imported Malaysian palm oil product in the Philippines, with a share of 93.7% of the total Malaysian palm oil import into the Philippines. RBD palm olein is a popular frying oil that has a longer shelf life for finished goods, and good resistance to oxidation and the formation of breakdown products at frying temperatures. It is widely used as cooking oil in the Philippines in various sectors, particularly in the foodservice sector.

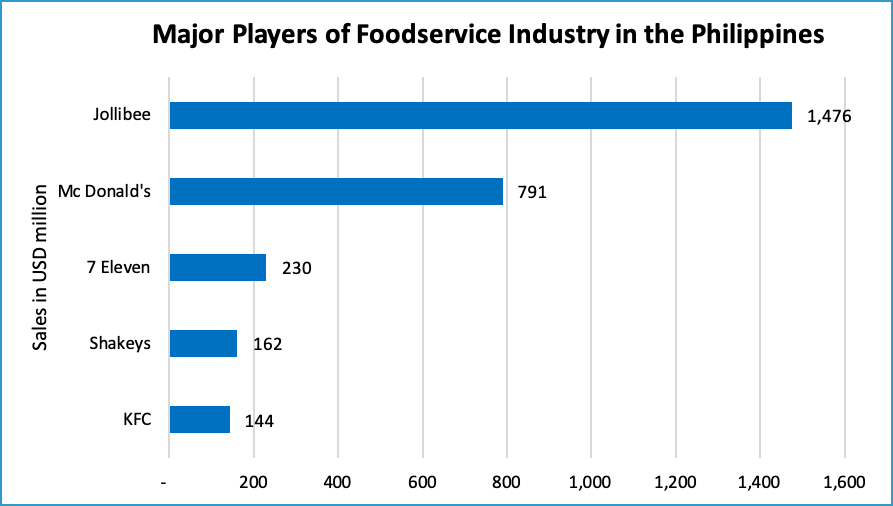

The top five foodservice players in the Philippines are from the fast-food restaurant segment. Jollibee is one of the leading fast-food restaurants in the Philippines, with around 1,400 chains nationwide. Palm oil is widely used in the fast-food restaurant segment. The rising popularity of fast-food restaurants and growing preference for takeaway food and beverages are the major drivers of growth in the foodservice industry. Filipinos’ eating habits have been influenced by the companies’ use of media marketing. The growth in the foodservice industry in the Philippines is also being helped by the growing number of millennials looking for inexpensive places to eat with friends. Also, the expansion of shopping malls and hypermarket chains is projected to help the growth of fast-food restaurants’ revenue, as well as that of the foodservice industry’s in the country. This growth will in turn spur the demand for palm oil in the country, as the Philippines will continue to depend on imported palm oil from Malaysia and Indonesia.

Referring to Philstar Global’s article, the GlobalData firm projected that the foodservice sector in the Philippines will reach 1.01 trillion pesos (~USD17.45) in 2026 with a CAGR of 17.5% from 451.1 billion pesos (~USD7.5 billion) in 2021. Meanwhile, palm oil consumption in the Philippines is expected to grow by 6% CAGR to 1.75 million MT in 2026.

Prepared by: Rina Mariati Gustam

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

Source:

- Statista

- MPOB

- GlobalData

- USDA, Foodservice – Hotel Restaurant Institutional