The rapid spread of COVID-19 and actions to contain the virus have understandably drawn parallels with previous outbreaks, in particular that of Ebola in West Africa in 2014. As of March 30, the African Union has reported there were just over 4,000 case of Covid-19 in Africa. In West Africa region, Burkina Faso, Senegal, Cameroon, Nigeria and Ghana are among the worst infected countries.

But as African countries prepare to battle the coronavirus on a much larger scale, they are ill prepared to combat the disease compared to other wealthy nations as they are lacking in testing equipment, much fewer health workers and do not have capability to offer financial aid and economic rescue plans.

Palm Oil Import and Demand

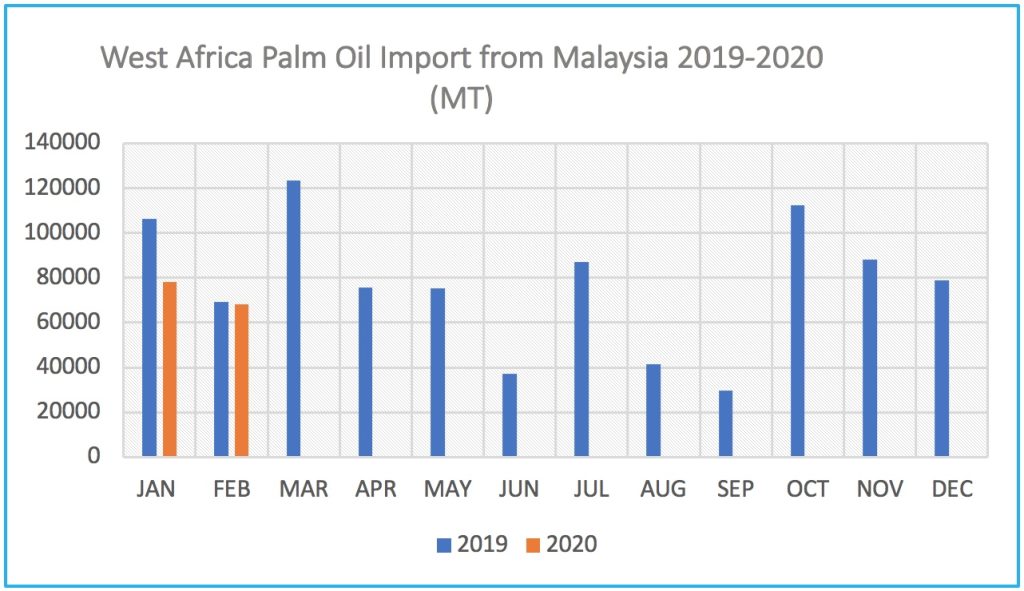

West African countries as a region imported 2.68 million MT of palm oil in 2019. In the last 5 years, total import of Malaysian palm oil to the West Africa region averaged about 1.11 million MT per annum. The region also produced about 2.70 million MT of palm oil last year with Nigeria, Ghana and Ivory Coast were the biggest producers.

With population of close to 400 million people, West Africa is a major consumers of palm oil, estimated at 3.90 million MT in 2019. Last year, Nigeria, the largest country in Sub-Saharan Africa consumed 2.31 million MT, Ghana utilized 680,000 MT, while Cameroon and Ivory Coast palm oil usage totaled about 350,000 MT each.

Impact of Covid-19 on Palm Oil

As the Covid-19 pandemic takes hold in West Africa, many governments have begun to tighten borders, restrict gatherings and close schools. The crisis has already significantly changed people’s lives not just with regards to public health but also on economy, trade and much more. Before Covid-19 hit, Sub-Saharan Africa economy was forecast by the IMF to grow by 3.5% in 2020. With the spread of the disease, that forecast is going to be readjusted.

Palm oil trade in West Africa is organized through three main market chains. First, through global trade where palm oil is imported from Malaysia and Indonesia. Secondly through cross-border regional trade between countries, e.g. from Benin or Togo to Nigeria or Niger, and thirdly through domestic trade involving small scale farmers and mostly family own businesses.

Based on MPOB data available until February 2020, palm oil export to West African countries have reduced by 16.6 % to 146,450 MT compared to 175,510 during Jan-Feb 2019 period.

Due to movement control order imposed by certain government, it is foreseen that cross regional trade and domestic trade will be affected, resulted in less availability of palm oil in the local market despite lower palm oil price in the global market. In Nigeria for example, annual inflation rose for the sixth straight month in February 2020 to a near two-year high as the impact of the country’s closed borders continued to be felt. According to the Nigerian National Bureau of Statistics, the rise in the food index was caused by increases in prices of bread and cereals, fish, meat, vegetables, and oils and fats. West Africa may be few weeks away from the peak of a coronavirus outbreak, but its impact is already wreaking havoc on the production and movement of goods and raw materials in, out and around the region.

While the short-term effects of Covid-19 on world economies are already being felt and put many countries in economic difficulties, their long-term ones are yet to be fully grasped. In West Africa, the impact will be felt strongest by the crude oil producing countries in the region like Nigeria, the largest importer and consumer of palm oil in the West Africa region. The pandemic is being combined with a historic crash in oil prices, putting pressure on Nigeria budgets and public spending. Nigeria had budgeted 2020 with crude oil price at $57 per barrel, and with forecast that crude oil price is going to stay below $30 dollar for the rest of the year, state budgets need to reviewed, and public spending need to be reduced downwards.

In the event of an extended period or a worsening of the virus outbreak, it is foreseen that the demand will be lower and palm oil import from the West Africa region will be reduced by 15-20 % compared to last year.

Prepared by Iskahar Nordin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.