To cater to the consumption demands of edible oil, India is constrained to import. Two thirds of the demand is met by imports. Palm oil accounts for around 60-65% of the total imports.

Though India’s edible oil imports fell and domestic availability increased during the financial year 2020-21, the import bill also went up due to price rise. At the same time, domestic edible oil production increased to fill in for the drop in imports in the last couple of years.

From the time of the Covid-19 pandemic disruptions, vegetable oil prices have started to firm up. Lockdowns, supply chain disruptions, migration of labour caused this spurt. The second wave of the pandemic coupled with unusually high demand led to soaring prices.

Initially, on a global level, Covid-19 restrictions, labour shortages in Malaysia, increased bio fuel mandates, dry weather in South America and high demand from China for stockpiling disrupted the supply chain for vegetable oil.

The ongoing Russia-Ukraine war has also dampened sentiments. India imported 17.44 LMT edible oil from Ukraine and 3.48 LMT from Russia in 20-21.

The India palm oil market is expected to grow at a CAGR of 9.8% during 2021-2026.

The government has been hard at work, to douse the spiraling inflation. Import duties have been revised multiple times. Import policy for refined palm oil has been tweaked from ‘restricted’ to ‘free’. Additional price control mechanisms like freezing the tariff value, imposing stockpile limits and suspending futures trading in edible oils and oilseeds has been adopted. All this did not result in the desired result of cooling prices. This forced the government to launch the National Mission on Edible oil – Oil Palm (NEMO-OP). Here, a whooping sum of USD 1.49 billion (Rs. 11,040 Crore) was allotted in a bid to reduce the import dependency and achieve self-sufficiency in edible oils

Table 1: Changes in Customs Duties of Veg Oil

| Oil | W.E.F | ||||||

|---|---|---|---|---|---|---|---|

| 14th Feb, 2022 |

20th Dec, 2021 | 14th Oct, 2021 |

11th Sept, 2021 | 20th Aug, 2021 |

02nd Feb, 2021 | 27th Nov, 2020 | |

| Crude Palm Oil | 5.50 | 8.25 | 8.25 | 24.75 | 30.25 | 35.75 | 30.25 |

| RBD Palmolein | 13.75 | 13.75 | 19.25 | 35.75 | 41.25 | 49.50 | 45.00 |

| RBD Palm Oil | 19.25 | 19.25 | 19.25 | 35.75 | 41.25 | 59.40 | 54.00 |

| Crude Soyabean & Sunflower Oil | 5.50 | 5.50 | 5.50 | 24.75 | 30.25 | 38.50 | 38.50 |

| Refined Soyabean & Sunflower Oil | 19.25 | 19.25 | 19.25 | 35.75 | 41.25 | 49.50 | 49.50 |

Source: Central Board of Indirect Taxes and Customs

In the aftermath of the pandemic, the world grappled with soaring food prices. In order to safe guard its domestic supplies, Indonesia mandated its palm oil producers set aside 20% of its exports for domestic consumption. This was subsequently raised to 30% and then removed altogether in the changes announced by the Indonesian government on 17 March 2022.

Russia and Ukraine are two of the largest producers and exporters of sunflower oil. The ongoing war between them has disrupted the global supply chain. This has caused the prices of other oils such as palm and soyabean to scale fresh peaks.

The consistently dropping soyabean crop estimates from South America has boosted Palm oil prices.

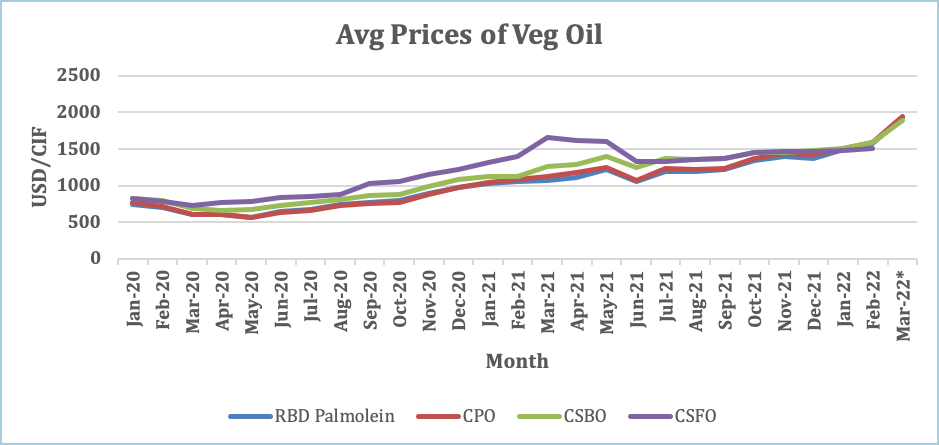

In March, 2022 escalating tensions in the Black Sea region made palm oil the costliest oil among the four major edible oils as buyers sought alternatives for sunflower oil, whose supply had been interrupted due to port closures owing to the Russian-Ukraine war.

Table 2: CNF INDIA PRICES

$/Per Ton

| Month | RBD Palm Olein | CPO | CSBO | CSFO |

|---|---|---|---|---|

| Jan-20 | 748 | 762 | 828 | 820 |

| Feb-20 | 703 | 708 | 795 | 785 |

| Mar-20 | 611 | 606 | 682 | 723 |

| Apr-20 | 605 | 599 | 664 | 766 |

| May-20 | 566 | 558 | 672 | 789 |

| Jun-20 | 639 | 629 | 730 | 838 |

| Jul-20 | 675 | 660 | 771 | 850 |

| Aug-20 | 739 | 723 | 806 | 882 |

| Sep-20 | 769 | 751 | 861 | 1028 |

| Oct-20 | 798 | 774 | 879 | 1050 |

| Nov-20 | 896 | 873 | 991 | 1148 |

| Dec-20 | 968 | 974 | 1081 | 1215 |

| Jan-21 | 1022 | 1047 | 1121 | 1319 |

| Feb-21 | 1057 | 1089 | 1126 | 1400 |

| Mar-21 | 1075 | 1126 | 1266 | 1657 |

| Apr-21 | 1115 | 1173 | 1290 | 1614 |

| May-21 | 1220 | 1250 | 1400 | 1609 |

| Jun-21 | 1051 | 1075 | 1254 | 1335 |

| Jul-21 | 1190 | 1230 | 1374 | 1330 |

| Aug-21 | 1196 | 1217 | 1362 | 1358 |

| Sep-21 | 1222 | 1240 | 1372 | 1369 |

| Oct-21 | 1349 | 1369 | 1453 | 1457 |

| Nov-21 | 1395 | 1432 | 1459 | 1471 |

| Dec-21 | 1375 | 1420 | 1480 | 1460 |

| Jan-22 | 1490 | 1510 | 1506 | 1475 |

| Feb-22 | 1581 | 1594 | 1595 | 1506 |

| Mar-22* | 1930 | 1945 | 1890 | – |

Price in USD/CIF, Indian Port/ton)

Source: SEA of India

* Weekly Comparative Rate as of 11th March 2022

Chart 1: Average Vegetable Oil Prices

The Russia Ukraine imbroglio has created a huge void in global vegetable oil supply. This void is going to be difficult to fill in the near future. This crisis has amplified the cost pressures and supply disruptions across the world. Palm oil prices have increased substantially as a direct response to a prospective sunflower oil supply disruption.

Palm oil prices has scaled new peaks, surpassing the prices of soft oils like soyabean oil as seen in Table No. 2. The current palm oil supply – demand gap is being fulfilled by Malaysia. The Malaysian Production is estimated at 18,900 million MT for 2022 from 18,200 million MT in previous year. However, it should be noted a 3-4% increase in Malaysian palm oil production will not be sufficient to narrow the gap in the world vegetable oil demand.

Vegetable oil caters to a variety of industries. It is used in food processing, bakery items, local snacks, cookies, cosmetics, and so on. The price rally is set to cascade down to companies, local retailers, and eventually to consumers in the form of higher costs.

The Indian agriculture sector is going to be impacted as around 35% of the fertilizers consumed are imported. The key component in fertilizers is potash whose main suppliers are Belarus and Russia. With Russia staging assaults on Ukraine using Belarus, prices of fertilizers are set to rise.

The massive hike in crude oil and energy prices will result in higher fuel costs including cooking gas. The cascading effect of this will impact other commodity prices with the impact posing more hurdles for growth-inflation dynamics.

The geo-political situation has an impact beyond the human food chain. Animal feed materials are also threatened. Wheat and corn prices have gained more than 50% and 25%, respectively. Add the rising soyabean costs, this will have a telling influence on the poultry business

A few weeks into the outbreak of the war, average Indian retail prices of vegetable oils such as palm oil, soyabean oil, and sunflower oil have risen by 12.5%, 8%, and 14.4%, respectively. Finance Minister Nirmala Sitharaman has said the government is looking at alternative sources to import sunflower oil because supplies have been affected due to the Russia-Ukraine war. She reiterated of the country’s plans to make India self-reliant in edible oil to avoid future supply disruptions. The other major vegetable oil exporters like Argentina, Canada and Ukraine have also seen supply cutbacks in the past few months, intensifying the tensions and uncertainty in the vegetable oil market.

The bumper domestic mustard crop harvest, could ease the spike in edible oil prices as this can be used as an alternate to sunflower oil. But rising fertilizer cost and international food prices could contribute to price spikes. Consumer angst in India will be exacerbated by the current war situation. They will have to brace for an unprecedented rise in prices of animal protein including poultry, dairy products and seafood.

The retail inflation which is measured by Consumer Price Inflation, touched 6.07% in February 2022 on the back of high food and beverage prices. This was the sixth consecutive monthly rise. The retail inflation has crossed the upper limit set by the Reserve Bank of India (RBI) for the second time since June 2021. The wholesale inflation measured by Wholesale Price Inflation has sighted double-digit growth for the eleventh consecutive month, posing a challenge for authorities battling the pressure of high prices against the backdrop of the current war. In a price-sensitive economy like India, rising edible oil prices may contribute to demand destruction.

Table 3: Inflation Level in India

| Month |

Wholesale Price Inflation (WPI) % |

Consumer Price Inflation (CPI) % |

|---|---|---|

| Jan-21 | 2.51 | 4.06 |

| Feb-21 | 4.17 | 5.03 |

| Mar-21 | 7.89 | 5.52 |

| Apr-21 | 10.74 | 4.23 |

| May-21 | 13.11 | 6.30 |

| Jun-21 | 12.07 | 6.26 |

| Jul-21 | 11.57 | 5.59 |

| Aug-21 | 11.64 | 5.30 |

| Sep-21 | 11.80 | 4.35 |

| Oct-21 | 13.83 | 4.48 |

| Nov-21 | 14.87 | 4.91 |

| Dec-21 | 13.56 | 5.66 |

| Jan-22 | 12.96 | 6.01 |

| Feb-22 | 13.11 | 6.07 |

Source: Ministry of Statistics and Programme Implementation

China and India, the world’s two largest purchasers of palm oil, have slowed imports as prices have sky-rocketed. The conflict between Russia and Ukraine may result in spiraling inflation. This will affect a range of sectors leading to consumption curtailment, which would impact imports.

The only silver lining in high prices is that the farmers are blessed with higher MSP prices. In the Indian oilseeds sector, this may lead to larger planted area in the next season.

World powers are jockeying for position in the background of the Russia-Ukraine war. In war there are no winners but many losers. The human tragedy on ground zero is heart wrenching. Sky-rocketing commodity prices, including for vegetable oils, affect not only the people directly involved but also the billions of people around the world. Global peace hopes rest on sanity prevailing and an early end to the conflict, which will lead to a cooling down of all commodity prices and relief for the common man.

Prepared by: Bhavna Shah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.