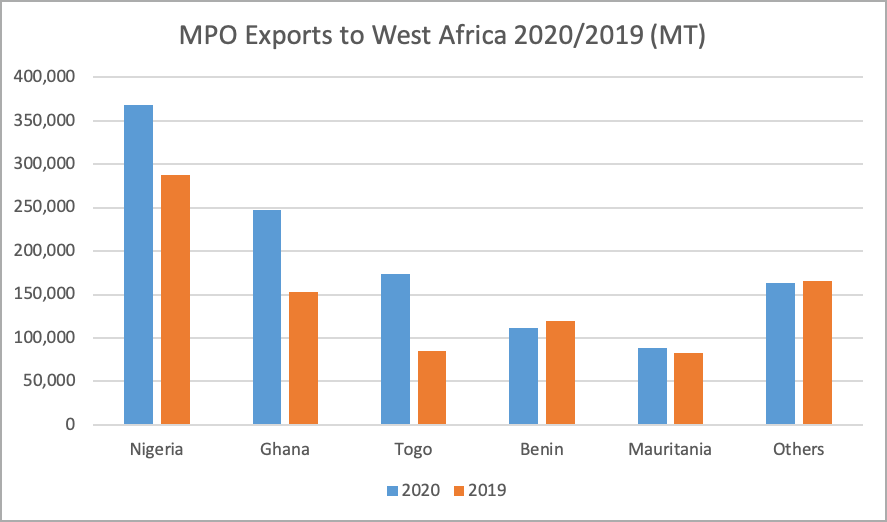

Summary of MPO Exports Performance to West Africa 2020

In 2020, it is estimated that West Africa imported a total of 2.65 million MT of palm oil, with Malaysia exported a total 1.15 million MT. MPO exports to the region increased by 29% compared to the previous year at 0.89 million MT. The increase is attributed by the CPO export duty exemption announced by the Malaysian Government in June 2020, in which Nigeria, Ghana, and Togo took advantage to increase their CPO imports exponentially. This also explained Benin, Mauritania, Cote d’Ivoire’s rather minimal increase and decrease, due to their market preference towards refined palm oil. Ghana recorded the largest increase in terms of volume, recording a 94,140 MT increase, while Guinea recorded the largest drop in imports of 37,987 MT due to the increase in price of imported palm oil throughout the second half of 2020. Although predominantly a palm oil market, demand is always met with imports, and is subject to many tariff and non-tariff barriers. As such, joint ventures and direct investments would be beneficial in order to expand the market penetration of MPO in West Africa.

Challenges of Joint Ventures in West Africa

Land Grab

While Africa seems to be a booming land and there is opportunity for growth and foreign investment, there are also challenges that come with it. Local residents are not very keen in welcoming foreign investment when it involves utilizing more land areas in the region. There are growing number of NGOs and activists who are fighting for the locals. Locals claim that their lands are being grabbed and that they are not given a fair and equal compensation in terms of place and livelihood.

Due to developments by foreign investment, small farmers are often affected and being displaced and cattle/ sheep farmers are losing their gazing lands. Locals from rural area lose essential properties like water. When the locals are moved from their land, they lose the place where they grow their food, which forces them to buy food market or from other village which is less convenient and more costly.

Moreover, once displaced, the cost of rebuilding is evident, especially in women. They are more likely to carry the brunt of land loss than men as their role is usually providing food for household. Men by contrast benefit from the deal with job offer at the plantations.

There are also reports that plantations oftentimes conduct poor labor practice and mistreat the residents in and around the concession. They are accused to be engaged in active land clearing, destruction of sacred and grave sites, and forceful displacement of people without adequate compensation and active planting and cultivation of palm oil without prior informed consent.

Due to all these unpleasant experiences, locals are becoming less favorable of foreign investors coming into the region.

Weak Governance

When looking at this from the investors’ perspective, there are also problems that the foreign companies face which leads to disagreeable circumstances. This is mainly due to the poor governance across many nations in Africa. Proper land ownership law, and land registry is very important to create a fair situation for both foreign investors and for the wealth of the nation.

Foreign companies come to Africa with bigger dream and aim. Once on site, they face challenging times to make a profit. Legal ambiguity and weak property rights in the matter of land tenure often cause much trouble and challenge for the foreign investors. Moreover, they also have challenges due to unclear administrative procedures, lack of access to funding and agricultural insurance, gaining access land and poor infrastructures.

Reports also suggest that companies have a hard time abiding to rules. “According to Senegalese law, land administered by rural councils cannot be sold or leased and must be allocated to residents of the community. Unfortunately, rural councils sometimes allocate land to foreigners in contravention to that law.” According to the researcher with IPAR, this is also due to the modern law and the traditional law that exist. Traditionally in Senegal for instance, land is to be owned by family, and not individual property that to be bought or sold. When government intervene with their new laws and moves, the challenges arise.

In Liberia on the other hand, the legal framework remains unclear. Reports suggest that in the past, under the Aborigines Law (1956) and the Public Land Law (1972-1973), Liberian government granted tribes legal deeds to their chiefdoms and clans. Later on, 47 deeds out of the total were located, which in combination cover a total of 6.8 million acres (2,751,922 ha) or 29% of Liberia’s total land area. Even then, the Liberian government has not stopped from granting mining and forestry concessions to foreign investors in these areas.

Due to challenges from doing business in Africa, many projects have been abandoned or scaled down. At the end of 2019, Sime Darby Plantation pulled out from Liberia from their plantation project that was started in 2009. Sime Darby, through its website, stated that though Sime Darby had 220,000 ha of land with over 60 years of concession deal in place, after 10 years, the company only managed to plant 10,300 ha of palm plantation due to many operational challenges. The company recently sold its business over to Mano Palm Oil Industries Limited (MPOI).

Besides that, political instability and macroeconomic instability are also factors for less interest in foreign investments or joint ventures coming into the region.

On the other hand, Malaysian industry players are known to be experts in the industry and African counterparts are often interested in Joint venture opportunities, especially in plantation and production sectors. Malaysian industry players however may be less interested in joint venture opportunity if the level of expertise and investments isn’t equally matched.

Opportunities for local joint ventures

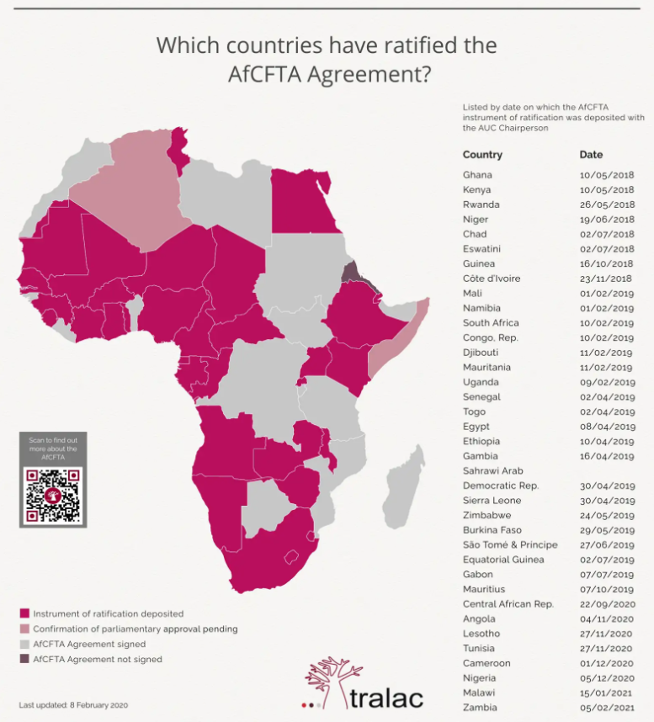

African Continental Free Trade Area (AfCFTA)

The AfCFTA is a continent encompassing trade agreement whereby 54 out of 55 African countries have signed the agreement. The agreement entered into force on 30 May 2019 and as of 5 February 2021, 36 countries have ratified the agreement

Source: https://www.tralac.org/resources/infographic/13795-status-of-afcfta-ratification.html

To be clear, the agreement will not benefit Malaysian palm oil directly as preferential trade would only benefit the signatories. However, it is expected that with the agreement, palm oil consumption could increase as trade barriers intra-Africa are removed. Should the agreement be implemented, it could open up new market opportunities, especially export of palm oil into land locked countries. Countries such as Cote d’Ivoire, Togo, Benin, and Senegal are expected to become major re-export destinations in their region due to low import tariffs (assuming a common external tariff is not adopted) and easy accessibility via land borders. A partnership or joint venture with the local oils and fats industry in these countries could be beneficial for Malaysian palm oil industry players.

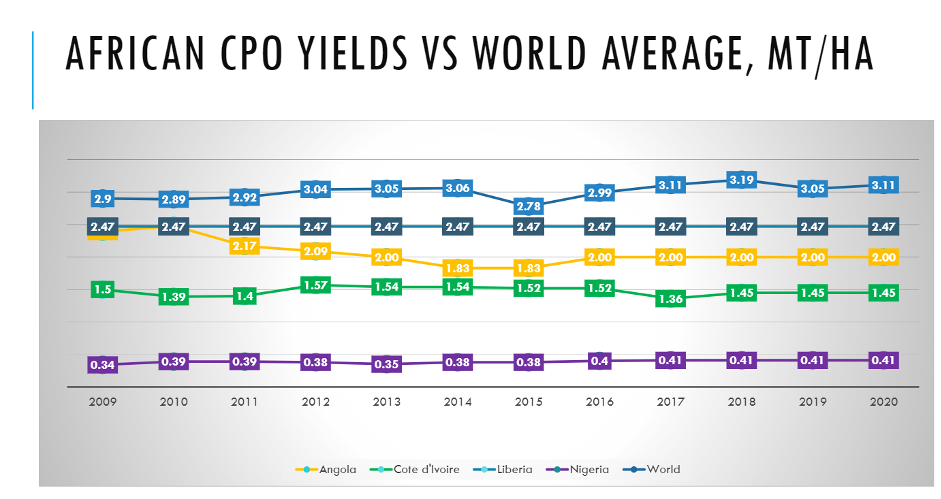

Land Availability

Meeting the demand for palm oil consumption has been a critical challenge for many West African countries. Mostly are net importers of palm oil, either importing from Malaysia or Indonesia. The largest producer of palm oil in West Africa, Nigeria, has a supply deficit of 1.3 million MT. There are several reasons for this wide gap in supply and demand. Most palm FFB in West Africa are cultivated from smallholders and even wild palm trees without proper estate management and agricultural practices. This is evident in the palm oil yield per hectare of West African countries. As such, there are opportunities in investments especially in estate management and plantations. Nigeria alone possess 2.5 million hectares of uncultivated lands in the southern region.

Infrastructure Investments

As mentioned earlier, it is foreseeable that several countries in West Africa such as Cote d’Ivoire, Togo, Benin, and Senegal has the potential to become re-export destinations, especially with the AfCFTA entering into force. Current infrastructure and palm oil supply chain may have to be improved to accommodate such logistical activity.

In view of the AfCFTA, there are two ways Malaysian industry players could benefit from the direct investments in West Africa through the agreement. In the proposed Annex 2 on the Rules of Origin for the agreement, Article 4 on “Origin Conferring Criteria” stipulates that:

“A Product shall be considered as originating from a State Party if it has:

- been wholly obtained in that State Party within the meaning of Article 5 of this Annex; or

- undergone substantial transformation in that State Party within the meaning of Article 6 of this Annex.”

Article 6 of the annex on “Sufficiently Worked or Processed Products” stipulates that:

“For purposes of Article 4(b) of this Annex, Products which are not wholly obtained are considered to be sufficiently worked or processed when they fulfil one of the following criteria:

- Value Added;

- non-originating Material content;

- change in tariff Heading; or

- specific processes.”

According to Article 6 of the annex, palm oil products could enjoy the preferential tariff should the tariff heading changes provided that the changes occur in a member state country. This would entail an opportunity for palm-based products especially in the Fast-Moving Consumer Goods (FMCG) sector. Thus, FMCG sector could have a booming demand vis-à-vis the agreement as trade barriers intra-Africa are removed. While not directly beneficial in terms of towards foreign investors, investments in bulking installations could prove beneficial to streamline the palm oil supply chain until the end product in West Africa.

The second benefit that could be entailed for the Malaysian Industry players through the agreement is the establishment physical operations in Special Economic Zones (SEZs). Article 9.1 of the Annex 2 on “Goods produced under Special Economic Arrangements / Zones” stipulates that:

“Goods produced in Special Economic Arrangement / Zone shall be treated as originating Goods provided that they satisfy the rules in this Annex and in accordance with the provisions of Article 23.2 of the Protocol on Trade in Goods.”

Thus, goods produced under the umbrella of SEZs would be able to enjoy full benefit of the agreement provided that companies adhere to the local customs requirements and regulations. This presents a great opportunity for palm oil refining and re-exports to neighbouring countries. One examples of SEZ located in West Africa is the Dakar Integrated Special Economic Zone (Senegal).

Conclusion

It is foreseeable that palm oil would be the preferred edible oil in West Africa in the long term. It is also foreseeable that the supply and demand gap would widen should status quo be maintained. As such, this provide great avenues and opportunities for investments in West Africa. It expected that with the introduction of AfCFTA, intra-Africa trade would be liberalized, and countries such as Togo and Benin whom are re-exporters would become major players in the region. Thus, physical investments or joint ventures with local companies in the region would prove beneficial in the long term.

Prepared by Fazari Radzi & Karthigayen Selva Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.