The Middle East region, with a population of more than 330 million and an upward trend in consumption, used 2.35 million tonnes of palm oil in 2021 and has been showing signs as a potential Malaysian palm oil (MPO) market and re-export point from which it could be sold to its neighbouring countries. Palm oil consumption recorded an increase of 4% in 2021 compared to a year before, while MPO products exported to this region grew by 8.4% from 1.697 to 1.854 million tonnes for the same period. With economic activities in the region showing improvements that are approaching pre-pandemic levels, we may see a significant demand for palm oil this year and in the years ahead. This is due to production requirements, its HORECA sector and household consumption, and supported by greater regional tourism activities. This is clearly shown by a better performance of MPO exports to the region, reaching 1.71 million tonnes for the period of Jan-Aug 2022, as compared to the same period last year, at 1.309 million tonnes as indicated in Table 1.

Table 1: PO Consumption & MPO Exports

‘000 Tonnes |

||||||

|

PO Consumption |

MPO Exports |

||||

Country |

2020 |

2021 |

Jan-Dec 2020 |

Jan-Dec 2021 |

Jan-Aug 2021 |

Jan-Aug 2022 |

BAHRAIN |

9.9 |

11.5 |

9.8 |

5.7 |

3.8 |

4.1 |

IRAN |

409.5 |

394.4 |

321.1 |

404.3 |

357.2 |

327.5 |

IRAQ |

180.3 |

231.3 |

25.9 |

9.9 |

8.5 |

31.4 |

JORDAN |

32.1 |

37.5 |

13.1 |

34.3 |

23.0 |

22.1 |

KUWAIT |

23.1 |

30.0 |

20.7 |

24.5 |

15.7 |

18.1 |

LEBANON |

22.6 |

25.3 |

7.7 |

5.0 |

4.3 |

4.0 |

OMAN |

67.6 |

81.7 |

99.9 |

61.1 |

56.2 |

62.9 |

SAUDI ARABIA |

546.5 |

561.6 |

349.5 |

316.9 |

192.1 |

351.8 |

SYRIA |

30.1 |

37.2 |

17.0 |

26.5 |

10.2 |

29.3 |

TURKIYE |

604.9 |

617.5 |

615.9 |

703.6 |

434.7 |

596.1 |

UAE |

121.5 |

145.2 |

102.2 |

134.8 |

104.7 |

224.9 |

YEMEN |

207.8 |

174.0 |

94.4 |

100.0 |

83.0 |

14.7 |

Total |

2,255.9 |

2,347.2 |

1,677.1 |

1,826.6 |

1,293.4 |

1,686.8 |

A new palm oil product segment which has seemed to gain momentum in the Middle East and needs better supply support from Malaysian exporters is certified sustainable palm oil (CSPO) products. Last year, we witnessed the increment demand for RSPO-certified MPO products in this region. Malaysia exported 45,000 tonnes of RSPO-certified palm oil products, a 37.8% increase as compared to the previous year. As revealed in the table below, Turkiye was the biggest importer of these products, at 40,460 tonnes, followed by UAE and Saudi Arabia, at 3,580 and 10,050 tonnes, respectively. According to recent data, exports of Malaysian CSPO into this region from Jan – Aug 2022 jumped to 48,400 tonnes, as compared to only 18,500 tonnes in 2020. It can be seen that Turkiye is the market with the biggest potential, bringing in 83.5% of the total Malaysian CSPO exports into the region. RBD Palm Olein and RBD Palm Stearin are two main CSPO products that received higher demand in this region.

Table 2: Malaysian CSPO Products Exported to the Middle East

Malaysian CSPO Products |

||||||

|

Jan – Aug |

Jan – Dec |

||||

COUNTRY |

PRODUCT |

2020 |

2021 |

2022 |

2020 |

2021 |

Lebanon |

NBDPL FOR RSPO MASS BALANCE |

|

|

|

63 |

– |

Total |

|

|

|

|

63 |

– |

Saudi Arabia |

CPO FOR RSPO FROM MASS BALANCE |

|

|

|

1,000 |

– |

|

RBDPL FOR RSPO MASS BALANCE |

1,301 |

1,050 |

2,650 |

1,581 |

1,050 |

|

RBDPO FOR RSPO MASS BALANCE |

|

– |

1,000 |

|

|

|

NBDPL FOR RSPO MASS BALANCE |

105 |

|

105 |

– |

|

Total |

1,406 |

1,050 |

3,650 |

2,686 |

1,050 |

|

UAE |

RBDPO FOR RSPO FROM SEGREGATED |

– |

1,024 |

1,615 |

– |

1,590 |

|

RBDPL FOR RSPO FROM SEGREGATED |

|

– |

229 |

|

|

|

RBDPS FOR RSPO FROM SEGREGATED |

– |

1,024 |

1,022 |

– |

1,986 |

|

RBDPS FOR RSPO MASS BALANCE |

1,051 |

|

|

1,051 |

– |

|

RBDPL FOR RSPO MASS BALANCE |

108 |

|

|

130 |

– |

|

RBDPO FOR RSPO MASS BALANCE |

|

– |

1,476 |

|

|

Total |

|

1,159 |

2,048 |

4,343 |

1,181 |

3,576 |

Serbia |

RBDPL FOR RSPO MASS BALANCE |

|

|

|

21 |

– |

Total |

|

|

|

|

21 |

– |

Turkiye |

RBDPO FOR RSPO FROM SEGREGATED |

198 |

139 |

120 |

198 |

179 |

|

RBDPL FOR RSPO FROM SEGREGATED |

4,301 |

4,821 |

4,943 |

6,581 |

6,813 |

|

RBDPS FOR RSPO FROM SEGREGATED |

46 |

46 |

848 |

240 |

291 |

|

NBDPL FOR RSPO FROM SEGREGATED |

286 |

1,293 |

2,574 |

347 |

1,900 |

|

NBDPS FOR RSPO FROM SEGREGATED |

69 |

115 |

115 |

184 |

253 |

|

PMF FOR RSPO FROM SEGREGATED |

437 |

677 |

839 |

836 |

1,355 |

|

RBDPS FOR RSPO MASS BALANCE |

6,991 |

6,302 |

7,351 |

13,527 |

10,405 |

|

RBDPL FOR RSPO MASS BALANCE |

3,547 |

10,196 |

15,924 |

6,769 |

14,070 |

|

RBDPO FOR RSPO MASS BALANCE |

99 |

2,499 |

7,697 |

99 |

5,198 |

Total |

|

15,975 |

26,089 |

40,412 |

28,782 |

40,465 |

Grand Total |

|

18,540 |

29,187 |

48,404 |

32,732 |

45,092 |

Source: MPOB

The key driver in these countries’ demand for CSPO products is the requirements placed on products that are exported to European countries, as both palm oil products or as an ingredient of finished products that are produced in the Middle East, for export to Europe. European countries are striving towards the goal of 100% sustainable palm oil content in their products, compelling the suppliers and manufacturers of finished products to source for CSPO supplies. From the consumers’ perspective, products containing CSPO will gain a competitive advantage over other products made with, and from, uncertified palm oil.

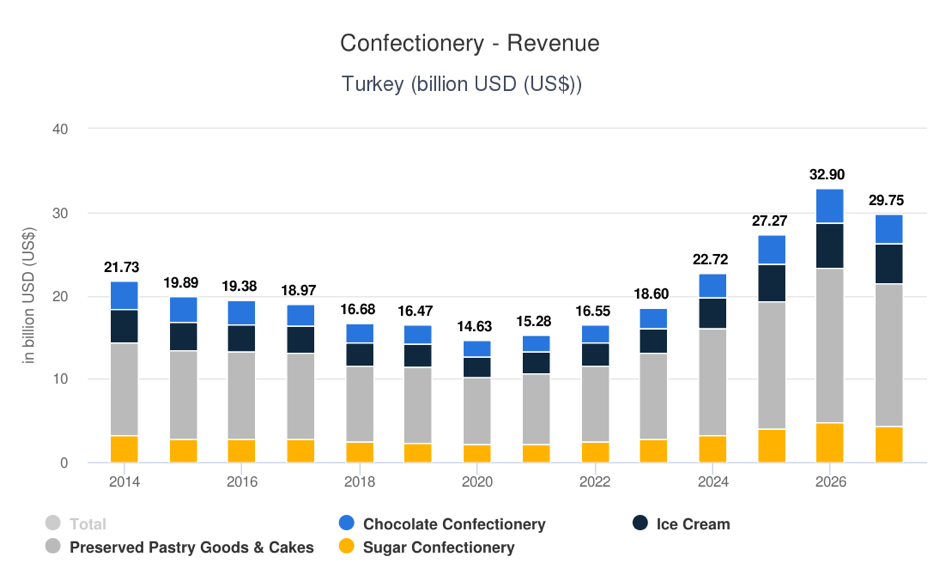

Turkiye is the biggest importer of Malaysian CSPO products in the region and has been a strong consumer of palm oil products. The CSPO product requirements have mainly been applied to the confectionery sector and exports to European countries. The confectionery sector is big in Turkiye with revenues amounting to USD16.55 billion in 2022. The sector is expected to grow by 12.44% (CAGR) annually for the period of 2022 to 2027, as shown in Chart 1. With positive growth in this sector, we may see a bigger demand for CSPO products by this sector in the years ahead.

Chart 1: Turkiye – Confectionery Revenue

For the other countries in the region such as Saudi Arabia and UAE, the demand for CSPO products is also gaining a favourable trend, as indicated in Table 2. More products entering the European market through these countries will definitely drive the need for CSPO products.

Looking at the current trend of CSPO requirements in the region, the potential of exporting Malaysian CSPO products is very high, not only in Turkiye but also in other exporting countries in the region, even the neighbouring region such as North Africa. Apart from supplying the products in order to comply with European market regulations, supplying CSPO products to the Middle East would provide Malaysian exporters with another competitive advantage, when the consumers in these regions are becoming more aware of the certified sustainable products. .

Prepared by: Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.