2020 is a challenging year for most of the industries in the world due to the outbreak of COVID-19 pandemic. This outbreak gives negative effects on the country’s economy from global supply and demand shocks and also domestic factors during the lockdown. Malaysian palm oil industry was also affected by the outbreak of the coronavirus. For example, slow demand from the palm oil importing countries as well as domestic consumption. Also, the movement control order has interrupted the normal upstream activities such as fertilizing, harvesting, collection of FFB and milling. This has resulted in a lack of manpower and logistic issues thus will hamper the palm oil production.

On March 24 Sabah government imposed a closure on oil palm estates and mills in six districts until April 14 after some of the workers have tested positive for COVID-19. With the appeals from MPIC, MPOA and plantation companies the closure was lifted on the 8 April. The brief shutdown of the estates and mills has affected nearly 75% of Sabah’s CPO production and about 100,000 workers. Sabah constitutes 25 per cent of Malaysian palm oil production. However, on 20 April, FGV Holdings has voluntarily ceased its operation within the Sahabat region in Lahad Datu, Sabah after 11 COVID-19 cases were detected. The closure involves 115,432 hectares of plantation, comprising 7 mills and 48 estates.

SUPPLY SCENARIO

Palm Oil Production

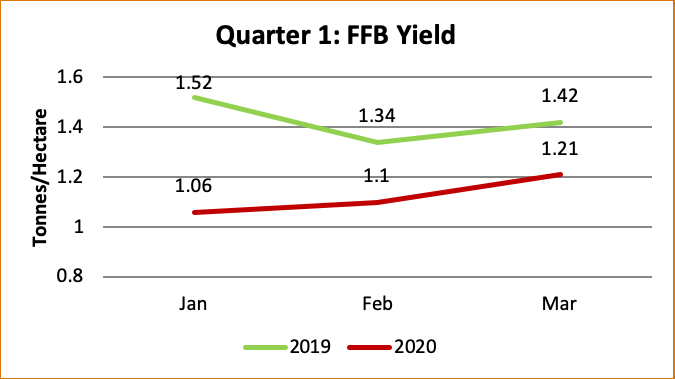

It is projected that Malaysian palm oil production will likely to have slow growth in 2020 compared to 2019. The is based on the impact of the low fertilizer application in 2019, dry weather in the middle of 2019 which resulting in diminished oil palm fruit yields and also brief suspension of Sabah oil palm estates and mills due to COVID-19 pandemic. The graph below shows the fresh fruit bunch (FFB) yield for the first quarter of 2020 is below than 2019 with an average gap at 0.3 tonnes per hectare.

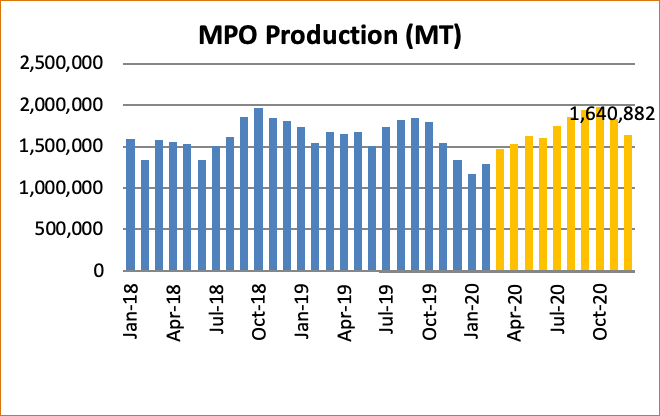

For 2020, it is estimated that CPO production will drop by 1% to 19.7 million tonnes compared to 19.9 million tonnes in 2019.

Palm Oil Stock

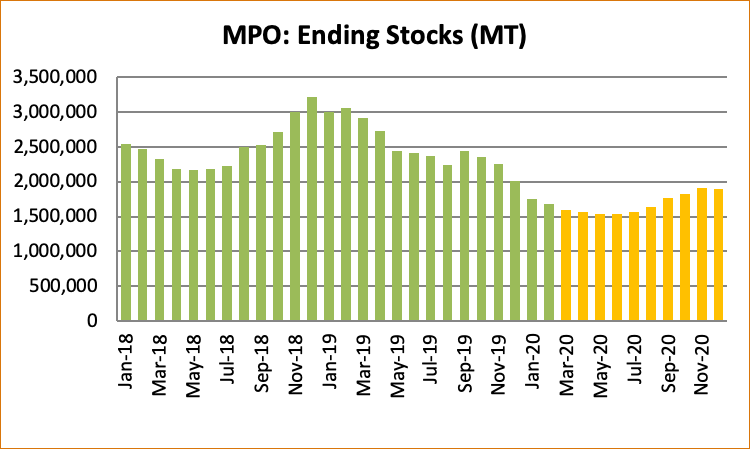

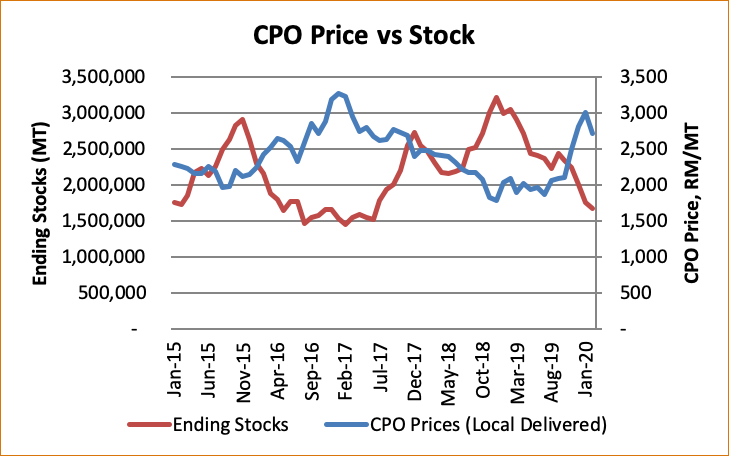

Palm oil ending stock is one of the important variables that influence the CPO price movement. Fundamentally, the low stock will result in a higher CPO price and vice versa. It is forecasted that Malaysian palm oil stock to be at 1.9 million tonnes by the end of 2020 compared to 2 million tonnes in 2019. This is might be because of slow demand from the importing countries due to COVID-19 outbreak and also postponement of B20 biodiesel mandate.

Below is the graph showing the negative correlation between stock and CPO price.

DEMAND SCENARIO

Malaysian Palm Oil Export

| Top 10 of Destinations for Malaysian Palm Oil Export | |||||

|---|---|---|---|---|---|

| No. | Country | Jan – Mar 2020 | Jan – Mar 2019 | Diff (MT) | Diff (%) |

| China | 481,652 | 571,253 | (89,601) | (15.68) | |

| Netherlands | 304,678 | 233,338 | 71,340 | 30.57 | |

| Pakistan | 284,776 | 288,412 | (3,636) | (1.26) | |

| Philippines | 184,982 | 158,629 | 26,353 | 16.61 | |

| USA | 162,348 | 146,143 | 16,205 | 11.09 | |

| Turkey | 152,735 | 183,026 | (30,291) | (16.55) | |

| Japan | 131,595 | 118,197 | 13,398 | 11.34 | |

| Saudi Arabia | 125,902 | 33,134 | 92,768 | 279.98 | |

| Italy | 100,237 | 126,613 | (26,376) | (20.83) | |

| South Korea | 100,043 | 92,217 | 7,826 | 8.49 | |

| Other Countries | 1,448,358 | 2,675,296 | (1,226,938) | (45.86) | |

| Total | 3,477,306 | 4,626,258 | (1,148,952) | (24.84) | |

Source: MPOB

For the period January to March Malaysian palm oil export record decline by 25% to 3.48 million MT compared to the same period in 2019. The decline was mainly contributed by low import from major importing countries such as India, China and EU. However, other important countries for MPO such as South Korea, USA, Philippines and Japan showed an increment in their imports. It shows that for the first quarter of 2020, the COVID-19 pandemic issue was yet affected the Malaysian palm oil export into the countries.

Palm Oil Stock in Major Importing Countries

| MPO Export & PO Stocks in 3 Major PO Importing Countries | |||||

|---|---|---|---|---|---|

| Country | Month/Year | 2020 | 2019 | ||

| MPO Export | PO Stocks | MPO Export | PO Stocks | ||

| China | Jan | 176,830 | 1,024,200 | 319,385 | 704,600 |

| Feb | 156,805 | 1,053,100 | 80,352 | 887,900 | |

| Mar | 148,017 | 878,800 | 171,515 | 862,300 | |

| India | Jan | 46,876 | 657,547 | 318,342 | 697,028 |

| Feb | 21,130 | 672,605 | 448,996 | 819,989 | |

| Mar | 10,806 | 533,094 | 341,540 | 747,858 | |

| Pakistan | Jan | 170,802 | 373,630 | 80,660 | 383,000 |

| Feb | 46,910 | 417,170 | 77,753 | 366,000 | |

| Mar | 67,064 | 380,270 | 129,999 | 359,750 | |

Source: MPOC Website

Based on the MPOC monthly stock report, palm oil stock in the importing countries like China, India and Pakistan recorded a decline for March 2020. As has been highlighted earlier, there was a decline in the Malaysian palm oil import by these three countries. The low import in the countries has resulted in the drop of their palm oil stocks due to the countries are relying on their stocks to cater to the local demand. Thus, it is anticipated that palm oil stock in the major palm oil importing countries will drop in the second quarter of 2020 because of these circumstances.

Prepared by Rina Mariati & Muhammad Kharibi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.