China is one of the biggest markets for palm oil in the world. In 2020, 3 main issues are affecting the palm oil trade in China. Firstly, there is a surge in soybean imports as the hog industry recovers from the African Swine Fever (ASF) outbreak. This recovery encourages more soybean crushing. The resultant increase in locally produced soybean oil reduces the spread between soybean and palm oil, making palm oil less competitive (Refer to Chart 1). Secondly, the diplomatic tension between China and the country’s main canola exporter, Canada, which escalated following the arrest of Huawei’s Chief Financial Officer has resulted in a reduction in rapeseed imports. This reduces the country’s rapeseed crushing and rapeseed oil production and favors palm oil imports. The third relates to the impact of the outbreak of COVID 19 on the overall oils and fats demand in the country, particularly in the catering sector.

Chart 1 : Rapeseed Oil, Soyabean Oil and Palm Oil Price Spread In China (RMB/MT)

China’s Palm Oil Imports From January-September 2020

In the first 3 months of 2020, China’s palm oil imports rose from 371,100 MT in January to 505,500 MT in February to 526,100 in March. Although China begins to impose lockdown starting with Wuhan on 23rd January 2020, palm oil imports did not fall in February and March. It is due to the preceding 3 months order that sustains its import growth. However, imports were cautious among the palm oil importers for fear of importing more than market needs. As a result, palm oil inventory did register a notable increase within this period. In February inventory maintains almost at January level before declining in March 2020. After the Chinese government gradually lifted the country’s movement control order and finally on Wuhan on the 8th April 2020, palm oil imports have started seeing improvement with imports rising from 328,400 MT in April 2020 to 587,600 MT in June 2020. This increase is attributed to the improving demand and also the fast declining PO stock level since April which also supported the price and encouraged importers to bring in more PO to capitalize on good import margin. Although there was a fluctuation in monthly palm oil import volume in the Jul-Sep period, overall import volume in 3Q remains highest among the 3 quarters in 2020 as of today, mainly due to the weather condition which encourages palm oil usage.

Chart 2 : China’s Monthly Palm Oil Imports & Stocks

Malaysia’s palm oil exports improved for January – September 2020

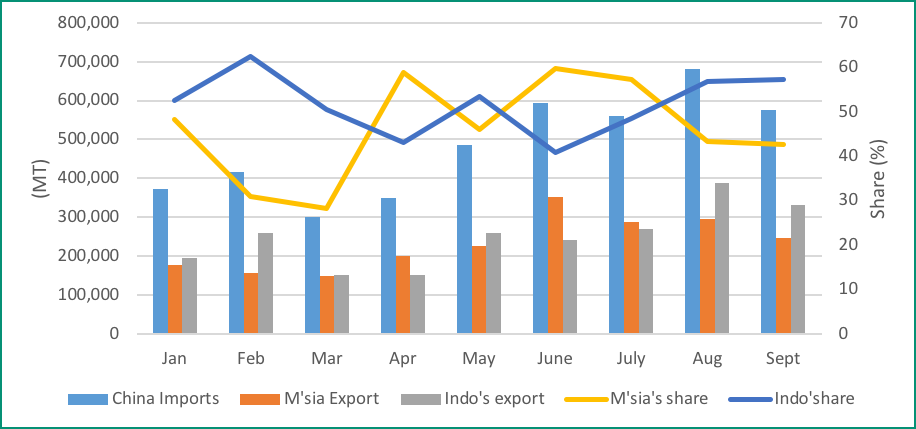

From a low market share of 28.1% in March 2020, Malaysia’s market share rose to close at 47.7% in September 2020 while Indonesia’s market share drop from 70.4% to 51.9% as the country’s palm oil exports to China drop. Indonesia’s palm oil exports fell as more palm oil was channeled to produce biodiesel to fulfill the country’s biodiesel mandate of B30 effective 1st January 2020. Based on the Indonesian government’s projection, implementation of the B30 mandate from B20 will absorb an additional 2.4 million MT of palm oil for the country’s domestic production of biodiesel for domestic use. On top of this, the decline in CPO production reduced further the availability of Indonesia’s palm oil for export. For 2020, Indonesia’s palm oil is forecasted by Oil World to reduce by 1.2 million MT to 43.0 million MT.

Chart 3 : China’s Import, Malaysia & Indonesia Exports and Market Share

In line with Malaysia’s rising exports, there was a 29.8% increase in RBD PL import by 307,070 MT to 1.34 million MT for the January-September period in China. There was also a 42.1% or 134,993 MT rise in RBD PS imports to 455,352 MT. Meanwhile, the total palm oil exports increase by 473,823 MT or 29.3%.

Table 1 : Malaysia’s RBD PL, RBD PS and other Palm Oil Products Exported to China

| Jan-Sep 2020 | Jan-Sep 2019 | Change (Vol.) | Change (%) | |

|---|---|---|---|---|

| RBD PL | 1,336,082 | 1,029,012 | 307,070 | 29.8% |

| RBD PS | 455,352 | 320,359 | 134,993 | 42.1% |

| Others | 300,605 | 268,845 | 31,760 | 11.8% |

| Total | 2,092,039 | 1,618,216 | 473,823 | 29.3% |

Source: MPOB

Malaysia’s Palm Oil Export Outlook for 4th Quarter Appears To Remain At Last Year’s Level

It is expected that in the 4th quarter, Malaysia’s palm oil exports to China will remain at last year’s level. Competition from Indonesia’s suppliers is expected to be keener as the country’s CPO production is anticipated to increase. With further higher CPO production in the 4th quarter, the availability of Indonesia’s palm oil exports to China increases. Analyst presenting at the POC virtual 2020 conference is of the view that Indonesia’s low output in the 2nd quarter will recover from the 3rd quarter onwards till the end of the year as the weather becomes moister. The improvement in Indonesia’s output has already been translated into higher export as it starts surpassing Malaysia’s export in the 3rd quarter by 214,000 MT (Refer to table 2)

Table 2 : Malaysia Vis-à-vis Indonesia’s Quarterly Palm Oil Export’s To China In 2020 (MT)

| Quarter | Malaysia | Indonesia | (-/+ ) |

|---|---|---|---|

| 1 | 481,652 | 606,200 | (124,548) |

| 2 | 776,829 | 651,900 | 124,929 |

| 3 | 774,100 | 988,100 | (214,000) |

(Source: Oilworld)

While the import of Malaysian palm oil in the 4th quarter is anticipated to remain at last year’s level, total China’s palm oil import is expected to trend lower. We anticipate China’s total palm oil import in the 4th quarter will not be strong compared to last year due to the recovery of soybean crushing activity. This is fuelled by rising hog demand as the number of ASF outbreak cases is subsiding. The development will encourage more soybean crushing and higher production of soybean oil.

MPOC’s forecast for Malaysian palm oil exports to China in 2020

For 2020, MPOC China Office projected that China’s palm oil import will decline between 1.2 million MT to 1.5 million MT from 2019 imports of 7.5 million MT. With the anticipated decline, China is expected to import between 6.0 million MT to 6.3 million MT of palm oil in 2020.

However, Malaysian palm oil exports in 2020 is expected to gain a notable market share between 450,000 MT to 600,000 MT due to a drop in Indonesia’s export. For January – September 2020, Malaysia’s palm oil exports already register an increase of 473,882 MT to 2,092,039 MT. However, we are not expecting further increase in Malaysia’s exports in the 4th quarter as Indonesian CPO production is anticipated to increase. Due to higher rainfall, analyst presenting in the recently concluded POC Virtual Conference expects Indonesia’s CPO production to be higher.

Prepared By: Lim Teck Chaii and Desmond Ng

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.