COVID-19 is spreading very quickly in Latin America. The situation in Mexico is no exception. The country declared a health emergency on Monday, March 30 and issued stricter rules aimed at containing the fast-spreading coronavirus after its number of cases surged past 1,000 and the death toll rose sharply, reported Reuters. Health officials warned that the country’s health system could be overwhelmed if the coronavirus is not contained. The country is taking measures of containment on multiple fronts which include a broad stay-at-home policy, closing schools and government offices and other social distancing measures.

Mexico is the third largest country in Latin America, after Brazil and Argentina. The Mexican economy is the 12th largest in the world by GDP and one of the chief economic and political forces in Latin America. The country, however, remains economically fragile despite the forging of stronger ties with the United States and Canada. According to Heritage Foundation, about 40% of Mexico’s total incoming foreign direct investment comes from the United States, and with the uncertainty of COVID-19 lingering over the U.S. economy, it is likely that American companies will reconsider making direct investments into foreign countries, which could have a negative impact on the Mexican economy.

In its recent opinion piece, Wells Fargo reported that for the past few years, the Mexican economy has struggled to gather any significant momentum. Since experiencing an annual growth rate of 2.6% in 2015, GDP growth has been slowly deteriorating, with the economy slowing every year since. Given the likely economic impact of COVID-19, the economy is expected to experience another annual contraction in 2020.

Aside from COVID-19, tensions between Saudi Arabia and Russia over oil production are also likely to have knock-on effects for Mexico. Mexico is a significant oil producer, and the current low oil prices will add another blow to the economy. Mexico’s oil production has been deteriorating for the past 15 years. As of February 2020, oil production was just 1.75 million barrels per day, down from close to three million barrels per day in 2004. The petroleum sector is crucial to the Mexican economy; while its oil production has fallen in recent years, oil revenues still generate over 10% of Mexico’s export earnings.

The recent announcement by the U.S. and Mexico to restrict the border crossings may also create an impact on Mexico given that over 80% of Mexico’s exports go to the U.S. and 45% of imports come from the United States. The U.S.-Mexico border is the busiest in the world, with estimated one million legal crossings per day. The restriction may further dampen the Mexican economy.

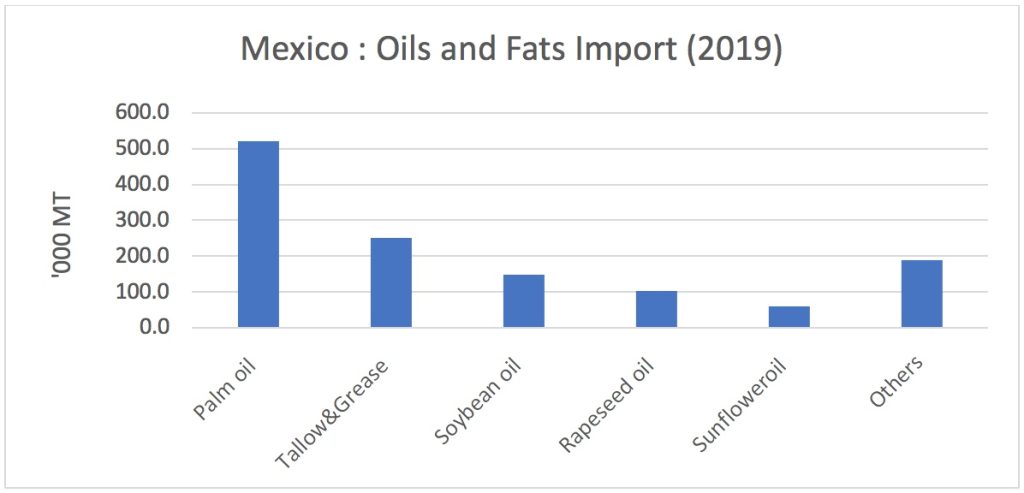

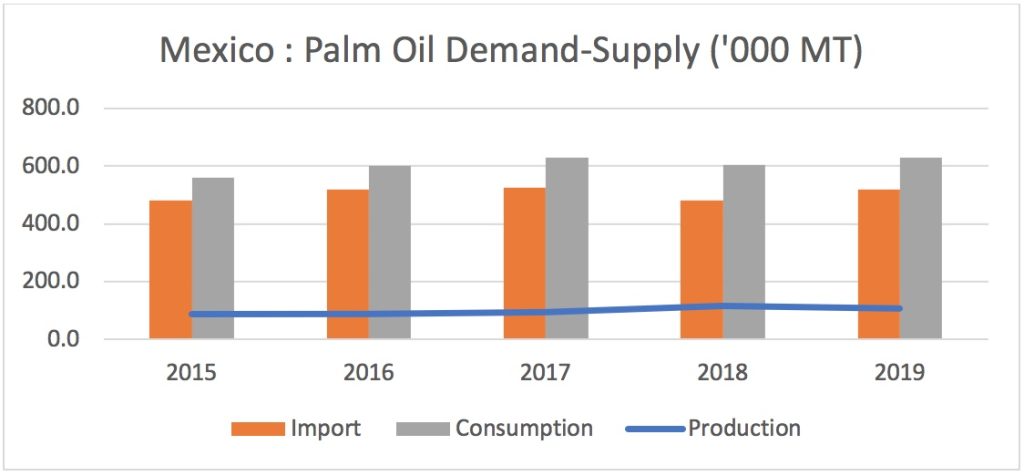

During the restriction on border crossing, Mexican oils and fats supply chain will be disrupted. Freight transport is already experiencing significant volatility where the flow of migrant workers is also at risk. Certain staple crops, such as corn, rice, and wheat, which are domestically produced and stored in industrial quantities are unlikely to experience significant disruptions but foreign goods and products can be affected, including imported palm oil. Annual consumption volume of palm oil in Mexico is at 630,000 MT in 2019, the third most consumed oil after soybean oil at 1.14 million MT and rapeseed oil at 672,000 MT.

During this time of crisis, Mexico will continue to rely on imported palm oil. Palm oil is the most imported vegetable oil in Mexico since its local production is insufficient and can only fulfill around 20% of the total consumption. On the other hand, soybean oil and rapeseed oil which are the most consumed vegetable oil in Mexico, are locally produced at around 88% and 84% of the total consumption. Mexico federal government has identified that the state of Chiapas, located at the southeast of the country, has the most suitable land for oil palm cultivation. The land has the capacity to be planted with over 400 thousand hectares of oil palm trees in the future.

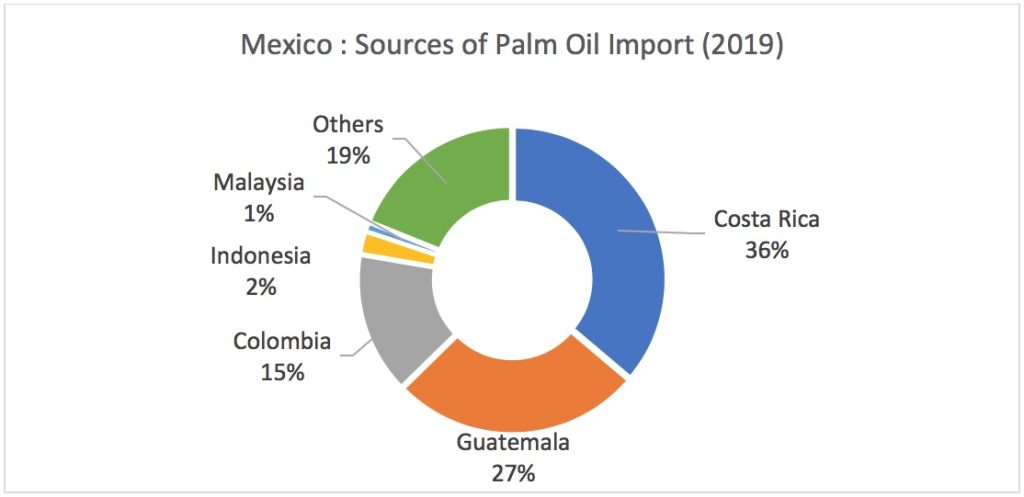

Palm oil has been cultivated in Mexico since the late 1990s. Most of Mexican oil palm plantations were developed on converted cattle lands. The Mexican government saw the crop as a way to alleviate poverty among smallholder farmers at a time when the cattle market had collapsed. However, domestic sufficient is not enough for local consumption. Main sources of imported palm oil are Costa Rica, Guatemala and Colombia. The country also imported from Indonesia and Malaysia but at a very small amount.

Palm Oil Import by Mexico (‘000 MT)

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Costa Rica | 111.3 | 143.4 | 116.5 | 140.8 | 174.0 |

| Guatemala | 134.5 | 160.8 | 235.3 | 210.8 | 127.4 |

| Colombia | 54.1 | 51.1 | 60.9 | 85.6 | 72.2 |

| Indonesia | 46.2 | 26.0 | 21.2 | 13.8 | 11.6 |

| Malaysia | 14.2 | 2.9 | 4.7 | 6.5 | 4.7 |

| Others | 88.9 | 97.6 | 81.7 | 69.0 | 91.0 |

| Total | 449.2 | 481.8 | 520.3 | 526.5 | 480.9 |

Source : Oil World

Sources: Reuters, Wells Fargo, U.S. Energy Information Administration, Washington Post, The Heritage Foundation, Trading Economics, MPOC Washington In-House Analysis, Oil World

Prepared by Zainuddin Hassan and Nur Adibah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.