Introduction

Algeria is a net importer of oil and fats, and it will continue to import for the near future as it produces only around 100,000 MT or 9.6% of its requirements of 1 million MT per annum. The oils produced are mainly olive oil, followed by soybean then sunflower. Local supplies are met primarily by imports of oils and fats mostly of soybean oil, followed by palm oil and sunflower oil.

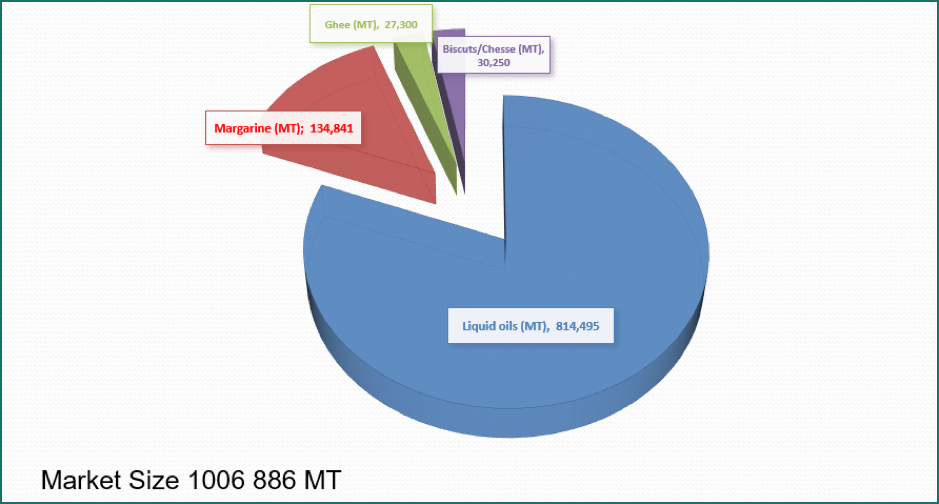

Algeria is mainly a liquid oil market as liquid oil represents more than 80% of the market. Margarine, the second biggest market segment represents around 13% of the total market followed by the fats biscuits & cheese with 3% and the ghee market with 2.7% of the whole oils and fats market in 2017. The same share expected will not change noticeably in 2020. Soybean oil is dominating the imports of the Algerian market with imports reached 864.3 thousand MT, which represents 78.3% of the total imports of the oils & fats in 2019. Palm oil comes in second place after soybean oil, which recorded 158 thousand MT represents 14.3% of the total imports. Palm oil uses mainly for margarine production, biscuits, and other fats-based production. Sunflower oil only captured 3.8% or 42.3 thousand MT of the oils & fats imports in 2019.

Algeria mainly produces olive oil, which covered around 90% of its total production in 2019, and all is only for domestic consumption. Algeria started crushing soybean in 2018, produced small quantities of soybean oil around 1.7 thousand MT, increased significantly in 2019 to reach 8.5 thousand MT, which represents 8.2% of its total oils & fats production.

Changes in MPO exports from January to August 2020

| MPO exports to Algeria 2019 Vs 2020 | ||||

|---|---|---|---|---|

| Product | 2019 | 2020 | Change | Change% |

| PALM OIL | 21,409.31 | 10,505.02 | -10,904.29 | -50.9 |

| PALM KERNEL OIL | 9,569.75 | 11,525.72 | 1,955.97 | 20.4 |

| PALM-BASED OLEO | 5,764.53 | 4,443.99 | -1,320.54 | -22.9 |

| FINISHED PRODUCTS | 15,306.18 | 11,372.62 | -3,933.56 | -25.7 |

| Total | 52,049.77 | 37,847.35 | -14,202.42 | -27.3 |

The total exports of the MPO decreased by 27.2%, and all the MPO exports dropped except the palm kernel oil, which increased by 20%. The palm oil as the leading MPO palm oil product imported in 2019 slumped by 50.9%.

Reasons for the changes:

The main factors that contribute to the drop of palm oil import by Algeria are the Covid-19 pandemic impact on the domestic economy and the expansion of soybean oil local production. During the enforcement of local procedures to flatten the pandemic infection, daily activities in the production and exports of finished products affected the demand for oils and fats, including palm oil. For the period of Oct19-Sept20, imports of soybean oil and palm oil dropped by 154 thousand and 12 thousand MT respectively compared to the corresponding period. HORECA sector and frying industry mostly using palm oil in their production currently affected by the situation and reduced the demand for palm oil.

On the expansion of local soybean production, the government is always to find a way to reduce the dependence on imported products and reduce the price of local products, including the imported soybean meal. Algeria is by far the largest soybean meal import market in Africa and the 15th largest soybean meal importer in the world. Algeria’s poultry feed industry is the primary consumer of soybean meal. Soybean meal is not exempt from VAT. Soybean meal import is on an upward trend since 2016, only dropped in 2017 due to the measures to cut total imports. Soybean meal’s VAT increased from seven to nine per cent in 2017 and remained for 2019. To address local demand for soybean meal, Algeria built its first soybean crushing plant and started its production in 2018. In 2019, the output began to increase and estimated with a crushing capacity of 1 million tonnes per year. Algeria used to import small quantities of soybean seed before 2019. After starting the first crusher of soybean, the amount increased significantly. Currently, to reduce the price of an essential and mostly consumed commodity, the local government is exempting the soybean oil from import duties and encourage local production, which is also expecting the increase of local crushing by the end of 2020.

Expectation

The high consumption of soybean meal influences the high requirement of local crushing and production of soybean oil. With higher local soybean oil crushing, more soybean oil will be made available in the local market, and with a more competitive price compared to palm oil. Palm oil is subjected to 24-49% of import duty and tax (following table), depending on the type of palm oil products and its usage. Palm oil in fats products market most likely will not be affected significantly. Palm oil in the production of margarine and vegetable ghee currently is used as a solution to replace hydrogenated fats. However, the soybean will expand even more for the liquid oil market. The liquid market would be more difficult for palm olein, and sunflower oil to penetrate, especially with the current duties and tax system that are favouring the soybean oil against the other oils.

Import duties & Taxes in Algeria

Algeria:

| Oil Type/ import duties | Crude % | others % | ||||||

|---|---|---|---|---|---|---|---|---|

| Food | Others | Food | Others | |||||

| Import / social Duty | VAT | Import / Social Duty | VAT | Import Duty | VAT | Import Duty | VAT | |

| Soybean oil | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Palm oil | 7 | 19 | 7 | 19 | 5 | 19 | 30 | 19 |

| Sunflower oil | 7 | 19 | 7 | 19 | 30 | 19 | 30 | 19 |

Source: Local authority / Importers

Prepared by Mohd. Suhaili Hambali and Ihab Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.