Background

Since Myanmar opens its door to foreign investment in 2011, the country has transformed from a quiet and isolated nation to a vibrant and fast-moving nation. The country has become a magnet to foreign investment. In 2010-2011 the foreign investment increased 6567% to USD20 billion from USD300 million in 2009-2010. Investors have been drawn in by the size of its internal market, abundant natural resources, fertile land and strategic geographic location between the world’s most populous countries, China and India. Even during the pandemic, Myanmar has attracted over USD5 billion in the first 10 months of the present fiscal year 2019-2020. Singapore, China and Thailand are the top leading investors in Myanmar.

The influx of foreign investments has transformed Myanmar to become one of the economic powerhouses in the ASEAN region. Since 2010 its annual growth rate has been consistently in the region of 5.0 – 8.3 per cent with last year at 6.3 per cent. Even during this challenging year, IMF forecasted Myanmar will experience a positive GDP growth at 1.8% in 2020 when the majority of the countries in the world are experiencing negative growth.

Potential Sectors for Palm Oil

Myanmar’s foreign investments have improved the country’s infrastructure such as their road system and basic necessity. The changes have made the country to become an attractive tourist destination. Myanmar received an increasing number of tourists each year. In 2019, they welcome 4.36 million tourists which were 23% increase from 3.55 million tourists in 2018. Their Deputy Minister of Hotel and Tourism U Tin Latt expected about 2.5 million tourists will be visiting Myanmar in 2020 a 50% fall from the earlier target of 5 million due to Covid-19.

One of the sectors which have a direct effect from the transformation is the HORECA sector. Numbers of International Hoteliers such as Lotte, Pan Pacific, GCD Hospitality, ad AccorHoter decided to join the race to capture the lucrative tourism market in Myanmar. With the existing of these highly-rated hotel brands coupled with high demand from the visitors, USD50 per night hotel rate is long gone in Myanmar. Nowadays, residents in Yangon can afford USD190 per night hotel room.

Increasing disposable income has allowed Burmese to dine out more frequently than before. International and famous fast-food chains such as KFC, Lotteria, Pizza Hut, Burger King, Marry Brown, The Pizza Company etc have set their foot in Myanmar. KFC and Lotteria have become the most popular fast-food chains in Myanmar.

This positive growth in the HORECA sector has enticed the demand of the oils and fats in the country which has made Myanmar as one of the important markets for oils and fats in the ASEAN region.

Palm Oil Scenario

Palm oil dominates oils and fats import to Myanmar with a share of 96 % or 920.6 metric ton. The major bulk of oil imported into Myanmar to cater to the growing demand for oils & fats in the country. The remainder of about 18,300 metric tons of imports is comprised of soybean, palm kernel oil and coconut oil.

Table 1: Myanmar Oils and Fats Imports

| Imports (1000 MT) | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Palm oil | 781.7 | 786.1 | 828.1 | 880.2 | 920.6 |

| Sunflower oil | 3.8 | 8.7 | 6.4 | 15 | 25.1 |

| Soybean oil | 15.2 | 13.8 | 9.5 | 8.8 | 9.7 |

| Others | 4.1 | 4.2 | 4.3 | 3.2 | 3.5 |

| Total | 804.8 | 812.8 | 848.3 | 907.2 | 958.9 |

Source: Oil World

Table 2: Myanmar – Palm Oil Imports

| Palm Oil (1000 MT) | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|

| Indonesia | 404.1 | 564.1 | 552.4 | 691.0 | 745.5 | 798 |

| Malaysia | 207.6 | 205.9 | 197.7 | 134.0 | 90.7 | 76.5 |

| Others | 52.0 | 11.7 | 36.0 | 3.1 | 44.0 | 46.1 |

| Total | 663.7 | 781.7 | 786.1 | 828.1 | 880.2 | 920.6 |

Source: Oil World & MPOB

Even though palm oil is the dominant edible oil in Myanmar, Malaysian palm oil export to Myanmar has deteriorated since 2016. Malaysian used to export palm oil to Myanmar at the region of 200,000 metric tons in 2014 and 2015. Due to strong competition from Indonesia, Malaysian export has reduced significantly in which only 76,500 metric tons were exported to Myanmar against Indonesian export at 798,000 metric tons. The competition from Indonesia mainly because Myanmar’s major palm oil buyers are depending on traders from Singapore which often favours Indonesian palm oil due to its competitive pricing.

Malaysian Palm Oil Opportunities and Conclusion

The expanding growth in the HORECA sector and the increasing number of the middle-income population is the best indicators that palm oil demand will increase in Myanmar. Malaysian palm oil needs to reclaim the market that they lost to our neighbour. Even though they may not have the muscle to offer better pricing than their competitors, there are other areas which they may need to consider implement.

- Reliable Local Partner

Identifying a reliable local partner in Myanmar will give an upper hand for Malaysian palm oil exporters against their competitors. Most of the local palm oil importers have vast and strategic networking. Furthermore, with their local partners’ inputs and advice they can create an effective promotional campaign for their products in the country. Myanmar is a country rich with local cultures and beliefs. Local inputs are vital to creating localize and suitable promotional activities. In short, forging a good relationship with them will give Malaysian exporters a strong command in the Myanmar market.

- Innovative Packaging for Consumer Pack

Consumer pack (cooking oil) is one of the sectors which are important for palm oil. It is the most preferred cooking oil in the country due to its price competitiveness and versatility. Malaysian palm cooking oil has a good reputation in Myanmar, they believe Malaysian palm cooking oil offers the best quality compared to others.

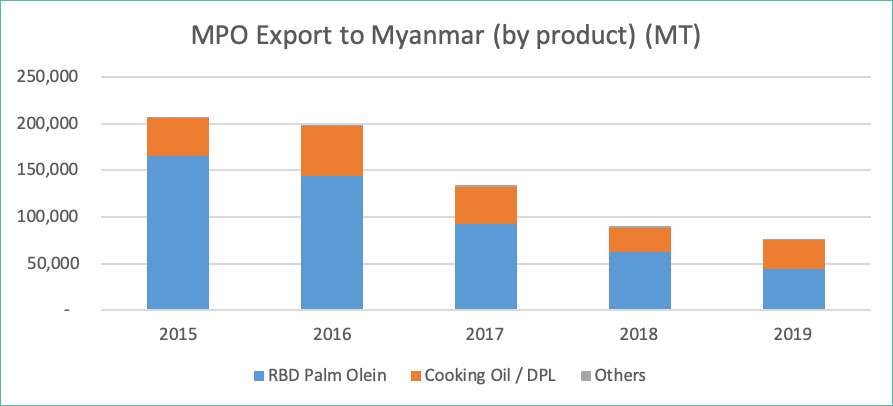

Graph 1: MPO Export to Myanmar (by Product)(MT)

The above graph shows that even though Malaysian export to Myanmar shows a significant decline, cooking oil export maintains around 30,000 and 50,000 metric tons. However, the market has started to be competitive with the presence of brands from our direct competitors and Myanmar local brands. Malaysian cooking oil may be a disadvantage in term of pricing but they may uphold their good quality image by offering to improve and better packaging. Giving a premium look to the cooking oil packaging will have the edge to other competitors. Malaysian exporters should look for potential JV with local oil importers that wanted to produce this premium and improved packing as Malaysia has the technological advantage and know-how to run efficient packing operations.

Furthermore, good packaging may also eradicate the palm oil negative image in Myanmar which is mainly due to contamination from handling of oil from tanks to barrels and later loose packs. Malaysian exporters should look at this challenge as an opportunity rather than obstacles.

Conclusion

Myanmar will continue to be an important market for palm oil. The growth in the HORECA sector and increase in the middle-class consumers will be the driving factors for the palm oil demand in the country. Controlling only 8.3% in the 920,600 metric tons should raise an alarm in Malaysian palm oil camp. Undoubtedly, Indonesian palm oil dominated the market by offering a competitive price. However, Malaysian palm oil could capture some of the market shares by forging a good relationship with the Myanmar buyers, reliable distributors and attractive packaging (consumer pack). Myanmar is true ‘The Land of Gold’ for palm oil but it must be for Malaysian palm oil as well.

Prepared by : Muhammad Kharibi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

Source :

- MPOB

- Oilworld

- Myanmar Insider

- The Independent

- Oxford Business Group

- The Star

- Go Myanmar tour