In the EU Region, rapeseed is the dominant domestic crop which is primarily used as biofuel feedstock, food applications well as non-food applications. By pressing the seeds, a process known as crushing, the oil and cake are separated. The oil produced is used for cooking and food applications while as much as 50% of the oil produced is used in biofuels production. As for the rapeseed cake or meal it is primarily used as protein in animal feed.

The Current Supply and Demand Scenario

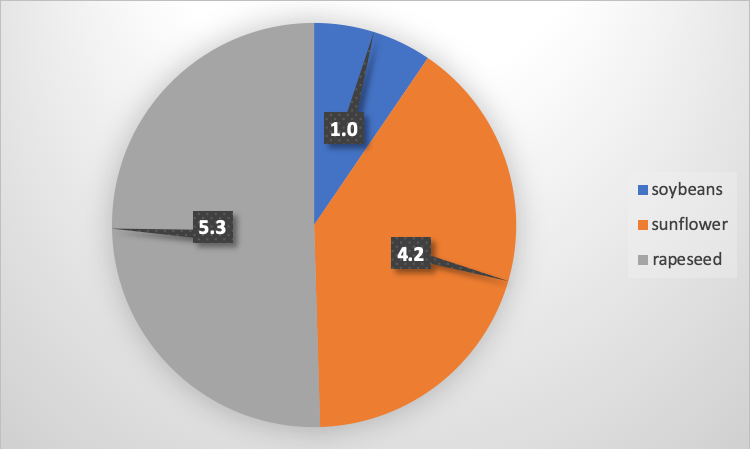

According to the EU Commission, rapeseed account for the largest share of oilseed harvested area. From an estimated total of 10.6 million hectares of oilseed planted area in 2020, rapeseed´s share is 5.3 million hectares. It is expected that by June 2020, about 10.45 M MT will be crushed but this is 800,000 MT lower than the volume reported in the same period of 2019. The main reason for the lower crushing is due to the Covid 19 pandemic which restricted movement which curtailed crushing activities.

EU-27 Share of oilseed crops in 2020 total harvested area of 10.6 mn ha

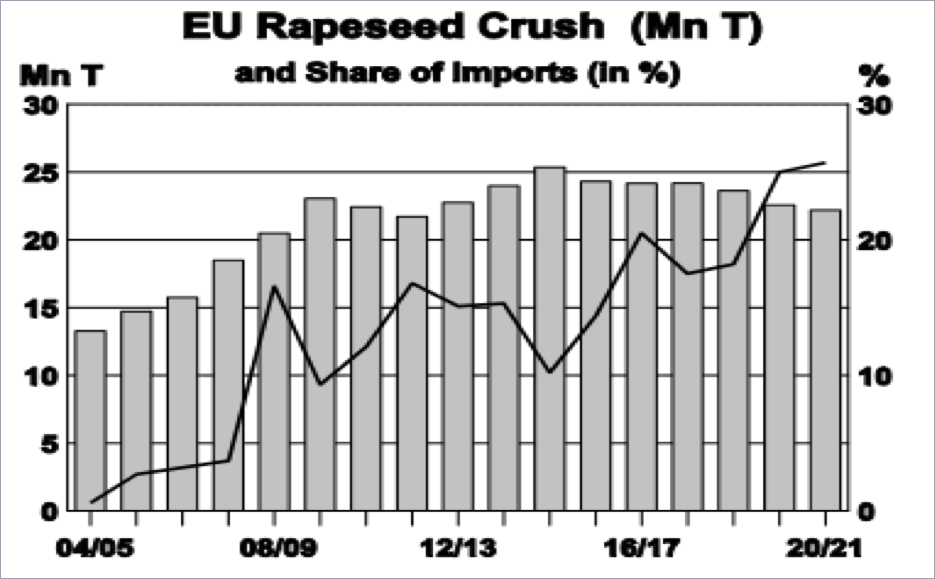

The situation for rapeseed does not look very optimistic due to a combination of unfavourable climate conditions, environmental legislations and slowing demand factors which has put some pressure on the European rapeseed market in 2019. The outlook for rapeseed has aggravated into a crisis due to the Covid 19 pandemic which as a result, as of May 2020, crushings for the 2020/21 season are expected to reach a nine-year low, the third consecutive drop.

In late May 2020, the mood in the European rapeseed market was decidedly somber as problems like decreasing supply and flagging demand, which were already an issue in 2019 were compounded by the outbreak of COVID-19.

Regarding the supply-side, industry analyst Oil World (Oil World Weekly, No. 19, Vol. 63, May 14, 2020, pp. 224 f.) expects EU rapeseed supplies to drop by 0.9 M MT to 18.1 M MT at the start of the 2020/21 season. This would be the lowest level in 14 years. Two severe drought years in some of the key growing areas plus unfavorable weather conditions hampered the sowing of rapeseed in autumn 2019, especially in France, where some areas had to be converted to other uses.

In early 2020 late frost and dryness in the key rapeseed producing countries of Germany, France, Poland as well as some parts of Eastern Europe further reduced yield prospects. Thus, Oil World expects EU rapeseed production to be limited to around 16.7 M MT, the lowest level since 2006.

The likely flip side of that coin would be high demand from EU processors for imported rapeseed. Based on Oil World forecasts, third country imports are likely to reach a record 5.7 million MT. The stark drop of demand for rapeseed oil can primarily be traced to EU biodiesel producers and the implosion of that market as a direct consequence of COVID-19 restrictions.

Unfortunately for producers of rapeseed meal (which is used as protein in animal feed), their market is also likely to be negatively affected. In May 2020 copa*cogeca, the main lobby group of farmers and agri-cooperatives on an European level, warned in an opinion piece that pressure groups like “Animal right movements, but also some scientists and politicians claim (industrial) livestock farming to have a direct link with an increased probability of disease outbreaks impacting on public health.”

Beyond livestock farming, COVID-19 outbreaks in several slaughterhouses in Germany, France, and the Netherlands have many European consumers worried about eating meat. The way the industry operates, there cannot be an effective social distancing among workers especially in meat processing and packing plants where workers need to work close together to achieve maximum efficiency. The lower demand for meat will also see record number of livestock in the pastures which may cause an overpopulation of livestock heads. Furthermore, as more people are forced to curtail outdoor activities, it is not inconceivable that these developments will put a lasting dent into meat consumption and thus the demand for feed.

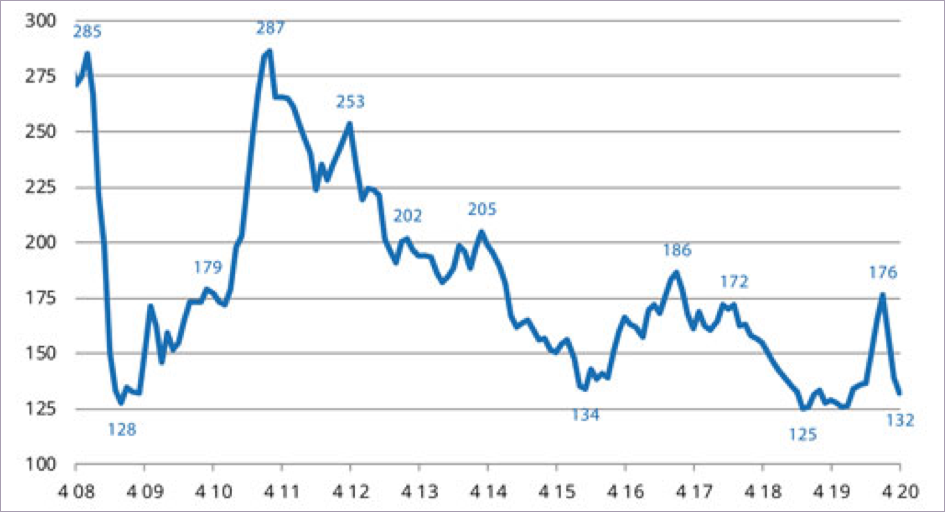

Against this backdrop prices for vegetable oil in the global markets have come under pressure. The UN Food and Agriculture Organization (FAO) price index for vegetable oil, which measures the monthly change in international prices of the commodity, fell in April by 7.2 points or 5.2% to 131.8 points compared to the previous month, its lowest level since August 2019. This is also the third consecutive monthly decline.

FAO Vegetable Oil Price Index, April 2020

The reason for the lower index are the declining prices for palm, soy, and rapeseed oil. By contrast, sunflower oil has become more expensive. Palm oil especially, has fallen sharply due to the drop in diesel and biodiesel consumption caused by the economic slump following measures to contain the corona pandemic. A higher than expected output in Malaysia and Indonesia added to the pressure.

The Repercussions on Trade

Against the rapeseed scenario described above, some critical repercussions affecting international trade and EU politics are likely. Regarding trade, the EU is faced with the need to grow rapeseed imports. However, one of the main suppliers, Ukraine, is experiencing a drop in production itself: Thus, exports to the EU (which amounted to 95% of the harvest last year) are set to decline sharply.

That leaves Australian and Canadian canola, both expecting a good harvest this season. However, in Oil World´s estimate, Australian imports to the EU will remain subdued until late 2020 due to low stocks and the late arrival of the new crop.

Canadian canola imports, in turn, are expected to reach between 1.5 to 1.7 M MT. However, most of that is genetically modified (GMO) and thus cannot be processed in the EU food industry as per relevant regulations.

Conclusion: Impact on Palm Oil Unclear

The question on palm oil producer’s minds is: given the current European rapeseed scenario, will there be replacement effects benefitting palm oil?

The answer is not clear-cut.

Overall, the critical factor appears to be biodiesel demand. And in that regard, the sword of Damocles hanging over the EU is the risk of a second wave of COVID-19 in late summer or fall 2020. If transport restrictions were to return, another collapse in diesel consumption is likely. That would, of course, affect biodiesel.

On the other hand, a different effect might work in favor of palm oil. In late April 2020, copa*cogeca sent a letter to the European Commission, urging it to take rapid action to deal with the growing risk of imbalance in the European protein plant and its biofuel supply chains. The letter warns that saturation of storage capacity for vegetable oils could negatively impact the European crushing industry and thus the supply of protein meals for animal feed.

Also interesting for the palm oil industry might be another lever: Having to rely on Canadian GMO-canola this season, the European food industry may be forced to turn towards palm oil instead. However, in the medium to long term, the dominating sentiment in the EU now seems to be a focus on greater reliance on “regionally”, i.e., domestically produced agricultural commodities and less dependence on imports. This is also in line with the EU´s “Farm-to-Fork” initiative.

Consequently, agricultural lobbyists like the German Association for the Promotion of Oil and Protein Plants (UFOP) are already calling on the Commission to ease restrictions on fertilizer and pesticide use in rapeseed production.

Prepared by Uthaya Kumar and Mohd. Izham

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.