COVID-19 pandemic has spread to over 190 countries and is having a noticeable impact on global economic growth. Based on the Organization for Economic Cooperation and Development (OECD) estimates so far, the virus could trim global economic growth by at least 0.5% to 1.5% but could rise to 2.0% per month if current conditions persist. Global trade could fall by 13% to 32%, depending on the depth and extent of the global economic downturn.

The effect on commodities such as edible oils, oilseeds and oil and gas industry is most telling due to a double blow of low demand and low prices. This is because most countries in the world have imposed movement control orders or lockdowns as a measurement to curb the spread of the pandemic. As a result of the lockdowns and travel restrictions imposed there was also a decline in consumption of petroleum products, which as a consequence resulted to declining prices.

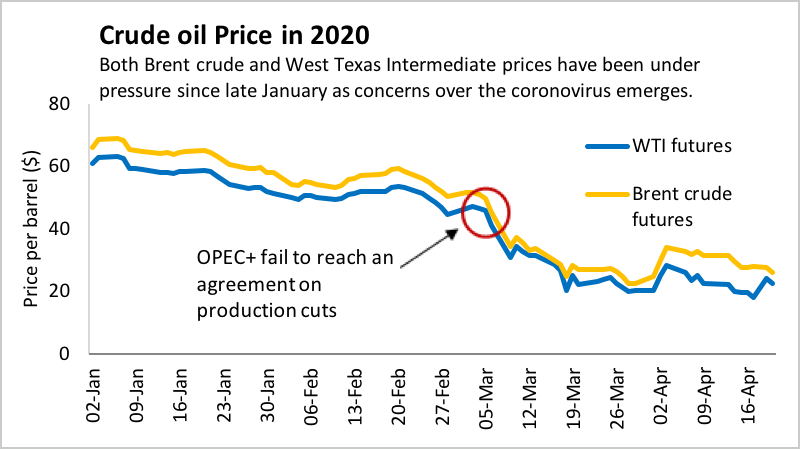

Crude oil prices have fallen more than 60% since the beginning of 2020 amid the coronavirus crisis and a price war led by Riyadh and Moscow. On April 12 2020, OPEC and Russia signed a deal to cut production by 10% but there are concerns that Riyadh and Moscow may not adhere to the accord. This became a realty when the KSA flooded the market with oil in April bring it down the price of crude oil to the low’s of USD20 per barrel. As a consequence of this action, crude oil prices continue to fall as two of the main producers continue to flood the market.

The effect was seen when the price of WTI Crude fell below USD15 a barrel on 20 April 2020. This was followed by the price of crude WTI oil for May delivery crashed on early April 21, 2020 plunging 321 per cent overnight to touch an all-time low of minus USD40.32 per barrel before eventually settling for the day at minus USD37.63. However, the June contract for WTI was trading at USD16.50 per barrel.

Since crude oil price has an influence on prices of major commodities such as palm oil, soybean oil, rapeseed oil and sunflower oils, they were not spared from the aftermath and registered declines following the drop in crude oil price. The main reason for the downward shift is that crude palm oil price has a positive correlation with crude oil price and palm oil is the most used vegetable oil for biodiesel blending. Any movement of crude oil, whether positive or negative will have an impact on palm oil prices.

In 2020, government of Malaysia planned to increase the local biodiesel mandate from B10 to B20 for the national biodiesel program and was launched in February with the support of the automobile industry. The B20 is a blending of 20% palm methyl esters with 80% of petroleum diesel in the transport sector in Malaysia which is proven to be environmental friendly and can reduce greenhouse gas emissions.

The objectives of biodiesel mandate in Malaysia are two pronged; to utilise palm oil in the domestic biodiesel mix which will boost domestic consumption and as a means for the palm oil industry to manage the excess palm oil stock to stabilize the CPO prices. Malaysia implemented the B10 mandate in 2019 which produced about 1.3 million to 1.4 million tonnes of palm biodiesel. The palm oil stocks dropped from 3.2 million tonnes in December 2018 to 2 million tonnes in December 2019 which was partially due to the increased mandate from B7 to B10.

The B20 biodiesel mandate was expected to utilise 1.3 million tonnes of crude palm oil but with the deferment of this program, there will be a higher volume of unutilized CPO. As a result, palm oil stock level is likely to be higher by end of this year and will be further exacerbated by the slow palm oil demand from importing countries.

In view of the current double blow situation of low crude oil price and the COVID-19 pandemic which has adversely affected demand for commodities, the Malaysian government announced on April 15 2020 that the implementation of B20 mandate will be delayed. The current low crude oil price does not make the B20 implementation economical as a widening price discount of crude oil to CPO prices will make it more costly for biodiesel blending. For example, on April 22, the palm oil and gas oil (POGO) spread was at USD246 per metric tonne whereas on March 2 was at USD102.

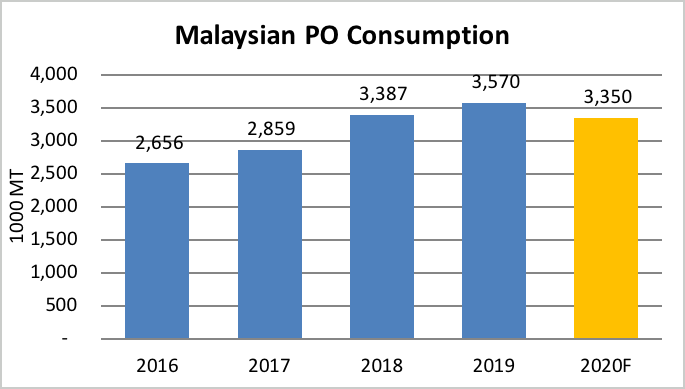

In early 2020, MPOC projected that Malaysian palm oil consumption will be at 3.7 million tonnes which is an increase of 5.9% compared to 3.6 million tonnes in 2019. However, due to the COVID-19 pandemic, which is certain to result in lower overall domestic consumption, it is projected that Malaysian palm oil consumption is revised to 3.35 million tonnes; a drop by 6.1% compared to 2019.

As conclusion, based on the current palm oil-gas oil spread it is unlikely to see discretionary blending activities as palm oil is trading at a steep premium level of USD264 per tonne to gas oil prices. Biodiesel exports this year are expected to be reduced and if the Malaysian government wish to push through the B20 biodiesel blending program, more fund allocation will be need to cover the shortfall. Thus, based on the current situation, the B20 programme may not be economical to proceed this year.

Prepared by: Rina Mariati Gustam & Mohd Izham Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.