COVID 19 is currently developing in Africa with many countries affected in the region. With the spread of the pandemic, many governments in the region have announced lockdowns in the effort to curb the spread of COVID 19. Economic repercussions and uncertainty were felt across the continent as the direct result of the effort. In spite of this, many countries in the region face an uphill battle of maintaining economic stability in this dire time.

One such country is South Africa. According to Channel News Asia, as of 15th April 2020, there are 2,415 confirmed cases of COVID 19 in the country, 27 reported deaths, and 410 recovered cases. COVID 19 pandemic is putting a strain on South Africa’s economy especially as lockdowns are announced in metropolitan areas, with many in the lower-income group who relies heavily on informal economy are unable to work. South African government have initiated a food aid programme to help the lower-income population, but food demand has outweighed the supply. Protests are ongoing in Cape Town due to the inability of access to the food aid as lower-income population are struggling with placing food on the table.

Despite the crisis, manufacturing and trade activities are still ongoing albeit with restricted manpower. Essential food item manufacturing is being pushed to further cater to increasing demand for the government’s food aid programme and ports are still operational with minimum operating berths although land borders are closed to curb the spread of the virus.

Oils and Fats Situation in South Africa

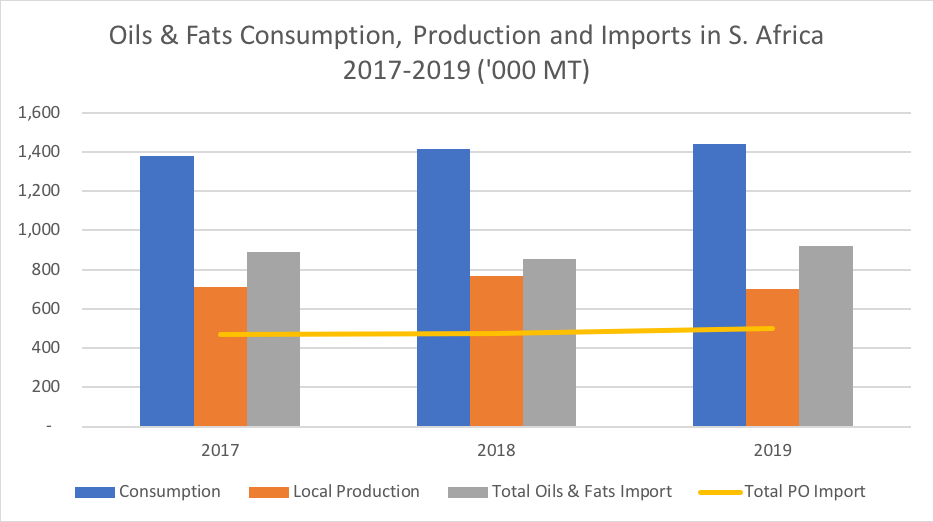

The demand for oils and fats in South Africa has been increasing over the years and recorded 1.4 million MT of consumption in 2019. The country mainly produces sunflower oil with production in 2019 recorded at 256,000 MT. South Africa also produced 222,000 MT of soybean oil in 2019. However, consumption in the region exceeds the production of the oils and fats and the shortfall are met with imports from EU and Argentina.

In addition to sunflower and soybean oil, South Africa also imports palm oil mainly from Malaysia and Indonesia. Palm oil accounted for 54% of the oils and fats import share in 2019. In the same period, Malaysia exported 216,406 MT of palm oil into South Africa, an increase of 2.3% compared to the previous year. It is estimated that Malaysia commanded 43.3% of the palm oil import share in South Africa in 2019.

| MPO Imports (MT) | Jan | Feb | Mar | Jan-Mar |

|---|---|---|---|---|

| 2020 | 11,505 | 15,881 | 21,169 | 48,555 |

| 2019 | 20,859 | 13,726 | 43,455 | 78,040 |

Table 1: Malaysian Palm Oil Exports into South Africa

Source: MPOB

From table 1, the trend shows that palm oil is imported in large number in the month of March. January and February are usually slower months due to overstocking. The market usually picks up in March. However, at the end of March 2020, palm oil imports into the country registered a decline of 44% compared to the same period last year. This decline is due to the weakened Rand which lowered the demand for palm oil in South Africa.

COVID 19 has yet to register any serious implication towards palm oil imports into South Africa other than slower port operations. However, HORECA sector in the country is facing a predicament as lockdowns force schools, hotels, tourism activities to be interrupted. Bulk buying from HORECA sector is expected to be negatively impacted as lockdowns on major metropolitan areas continue. In lieu of this, sources from the local industry mentioned that there is increasing consumption on household and confectionary products as demand for food especially for the lower-income population increases.

Conclusion

Keeping in view that major markets in Sub-Saharan Africa registers declining imports, South Africa has maintained a rather stable demand for palm oil. As food demand increases in the region, it is expected that there will be an increase in demand in household items and confectionary products especially in the lower income population as South African Government aims to boost their food aid programme.

Prepared by Karthigayen Selva Kumar and Fazari Radzi,

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.