China has lifted its strict Covid rules in an apparent attempt to alleviate economic pressures and cool escalating discontent. Among the measures it has scrapped is the use of its primary Covid tracking app, while domestic travel restrictions have been lifted. The government has allowed people with Covid to quarantine at home and stated that from early January 2023, overseas visitors entering the country will no longer have to go into quarantine.

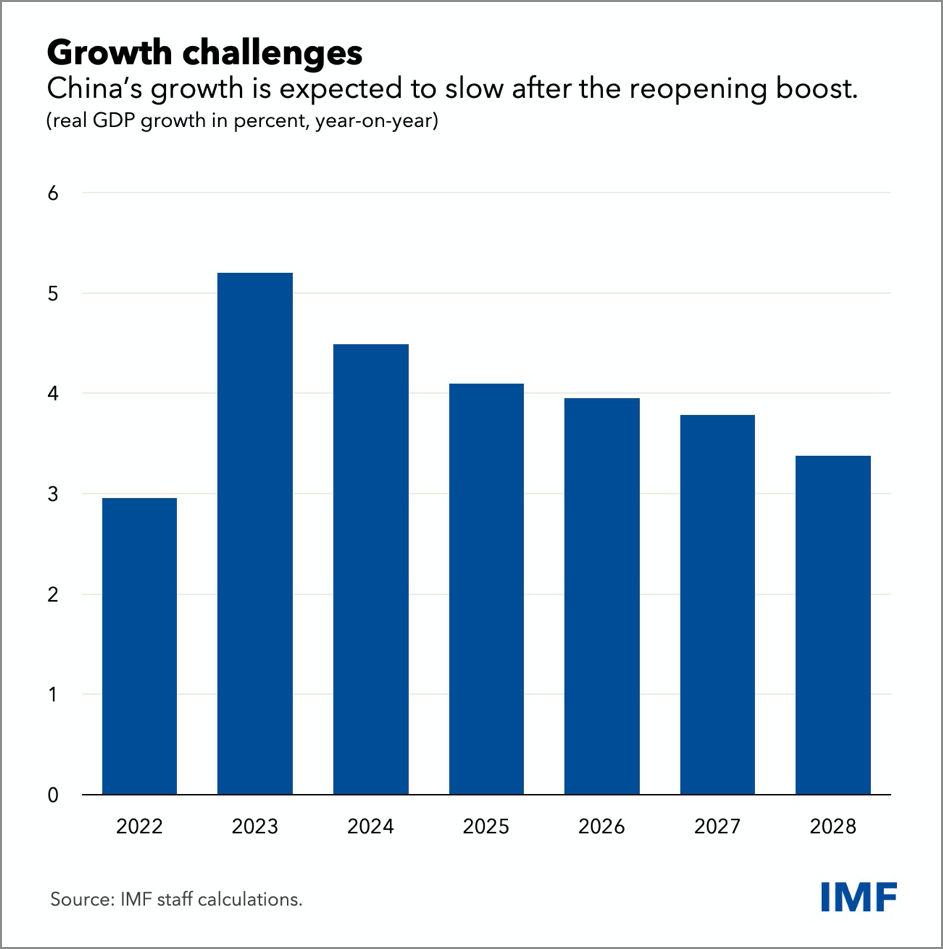

The main reason for the lifting of the Covid rules was that the Chinese economy had one of its worst performances in decades in 2022, as growth was dragged down by numerous Covid lockdowns followed by a deadly outbreak in December. Based on news reports, economic growth for China grew by 3% which, is short of the country’s target of 5.5%. This was the most disappointing record since 1976, when the economy declined by 1.6%.

Palm oil demand in China

In China, demand for palm oil is primarily driven by its use as a cooking oil, as a major ingredient in instant noodles and in the production of cosmetics. Other palm products other than palm oil also have a good share in non-food sectors, such as the oleochemicals sector. This is reflected in the volume of palm-based oleochemicals imported by China in 2022, which was recorded at 500,000 MT.

In consideration of palm oil’s importance in food usage, China has in recent years made forays into going upstream in order to secure its supply of palm oil. For example, Julong Group has developed 50,000 acres of palm plantations in Indonesia. Meanwhile, the Chinese Academy of Tropical Agricultural Sciences is trialling growing oil-producing palm trees in Hainan.

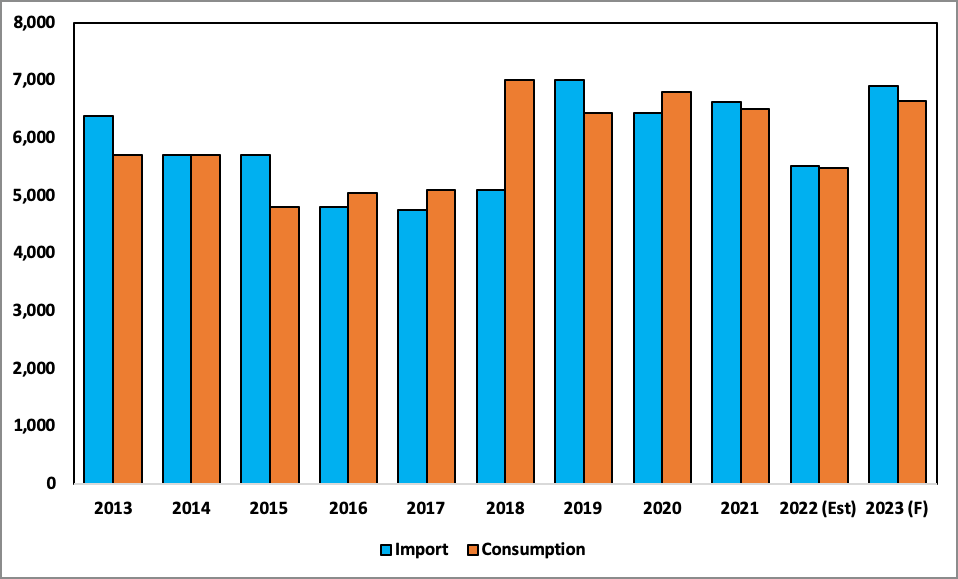

Chart 1: Palm oil import & consumption in China

China is the world’s second largest importer of palm oil with a volume of 5.5 million MT imported in 2022. However, this is a reduction of 1.1 million as compared to the 6.6 million MT imported in 2021. Imports of palm oil declined significantly in the first half of 2022 due to the high price of palm oil as well as tight supply from Indonesia as the country adopted policies to curb domestic palm oil price hikes by limiting exports. The overall import of oils and fats by China also declined from 13 million MT in 2021 to just above 9 million MT in 2022, a drop of close to 4 million MT or by 30.7%. In addition, the port congestion at several ports in China also contributed to the overall lower imports of oils and fats. Another factor is the high prices of vegetable oils in 2022 which also led to higher domestic production, which rose slightly from 29.4 million in 2021 to 29.7 million in 2022.

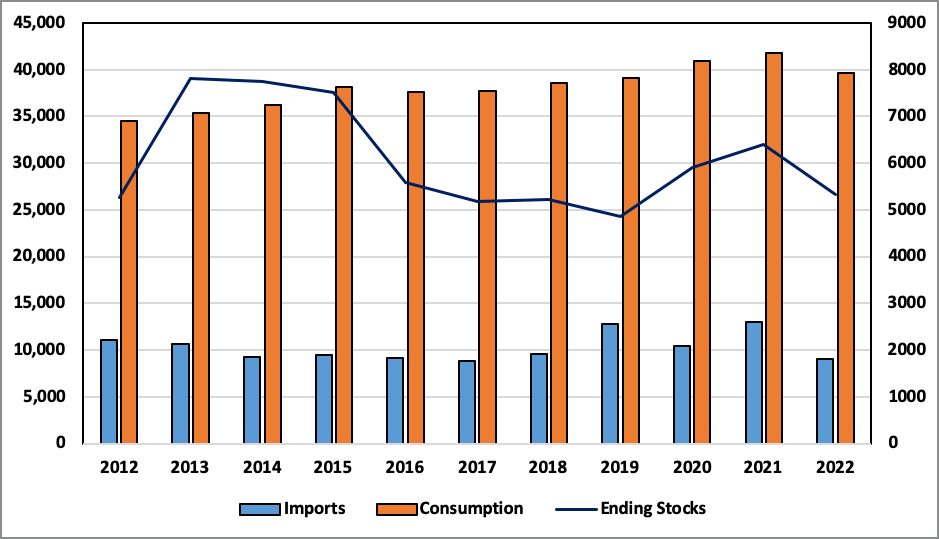

The zero-Covid policy which saw strict lockdowns imposed by the government also curbed demand for palm oil as economic sectors such as the HORECA industry was among the worst affected. There were closures of restaurants and eating houses which usually catered to high volume customers. As a result, the overall oils and fats consumption in China in 2022 declined from 41.7 million MT in 2021 to 39.7 million MT in 2022, a drop of 2 million MT or by 4.8%. Despite this lower consumption, combined with the lower imports, the stock level in China is currently at just above 5.3 million MT, which is slightly below the 10 year average of 6.1 million MT.

Economic Outlook for China

According to the latest IMF Report, the economy in China is set to make a rebound in 2023 due to increased mobility and economic activities picking up subsequent to the lifting of pandemic restrictions. This will provide a much needed boost to the local as well as the global economy. Analysts expect the economy to expand by 5.2% in 2023 as compared to 3% in 2022, which is good news not only for China but also the world as the Chinese economy is expected to contribute a third of global growth.

Chart 2: IMF Growth forecast for China

The reopening of the Chinese economy following several years of strict “zero-Covid” measures has buoyed sentiment among economists that China will be among the leaders in global economic growth. This is because when China’s growth rate rises by 1 percentage point, growth in other countries increases by around 0.3 percentage point, according to recent IMF staff analysis. This would underscore how domestic reforms could boost China’s economy and that of other countries.

Palm oil outlook in China 2023

Among the main drivers for imports in China is the stock level. In 2022, stock levels fell to a 10-year low of 5.3 million MT, which is lower than the 10-year average of 6.12 million MT. The economic recovery would also result in higher domestic consumption of oils and fats and would push demand for palm oil. Since palm oil constitutes 45% of imports and 14% of total consumption, demand for palm oil will invariably recover in 2023.

Chart 3: Oils & fats consumption, import and stocks in China

Demand for palm oil in China will see a recovery since the opening of the market, both domestically and internationally. Demand is not only sensitive to the negative impacts of Covid-19, but is also affected by other risks such as price volatility and domestic production of edible oils. The outlook therefore remains positive for China to increase their palm oil intake.

Prepared by: Mohd. Izham Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.