Maghreb countries such as Morocco, Algeria and Tunisia have a good potential for the palm oil export destination in the region. The uptrend recorded for the last few years shows the high prospect of additional demand in the years ahead and emerged as another attractive market for palm oil in the MENA region. The countries located near the Mediterranean Sea make it more suitable to enter the European market.

The trade agreement between the European and Maghreb countries further supports the trade and expansion of the market for these countries, which require more raw material such as palm oil for local production and export palm oil-based products. Maghreb countries have long enjoyed access to the European market, which dates as far back as 1969 under the Generalised System of Preference, promoting closer market integration between North Africa and the EU.

Palm Oil Market potential

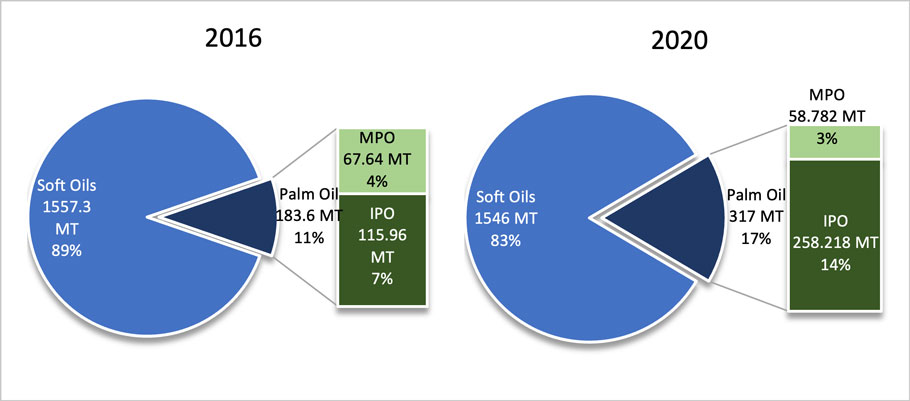

Chart 1: Morocco, Algeria & Tunisia Oils & Fats Imports (‘000 MT)

| ‘000 MT | 2016 | 2020 | Vol. change | % Change |

|---|---|---|---|---|

| Soft Oils & Fats | 1,557.3 | 1,546.0 | -11.3 | -0.7 |

| MPO | 67.6 | 58.8 | -8.9 | -13.1 |

| IPO | 116.0 | 258.2 | 142.3 | 122.7 |

| Total | 1,740.9 | 1,863.0 | 122.1 | 7.0 |

Source: OilWorld / MPOB

The imports of oils & fats into these countries are relatively high, and the demand is in the uptrend. The imports increased by 122,000 MT or 7% for the last five years to 1,863,000 MT in 2020. However, 83% of the market is dominated by soft oil, while palm oil only captured a small portion at 17%. Despite its lower share, palm oil usage increases reliably through higher demand for fat products and non-food applications. From 2016 through 2019, palm oil captured an additional share of 6% at the expense of other vegetable oils (Chart 1).

The demand for palm oil is also increasing in tandem with the population. With a combined population of 91.2 million, Algeria, Morocco and Tunisia have a tremendous potential market for palm oil, which is nearly as big as the population in Egypt (100 Mil), potentially creating a significant requirement for palm oil in local production and consumption.

But palm oil usage in these countries is still low compared to their neighbour Egypt, which has registered 52% of share in the oils & fats sector. Looking at Egypt’s trend, the palm oil import into Maghreb countries could triple the current volume to 970,000 MT per year. However, to achieve the high potential of palm oil demand in the countries, more promotion and awareness programmes need to be activated in the countries, such as palm oil awareness, product introduction, and business interaction. The activities will increase the usage and ease the trade among the palm oil industry players.

Fat Products Market Potentials

While soft oil dominates the market, especially the liquid oil sector, the fat products sector such as margarine looks more encouraging for palm oil. Margarine is very popular in these countries and captured a 19% share of the total oils and fats sales in 2020, more than three times higher than Butter (Table 1). The price affordability is the main reason for the high demand compared to more expensive butter. Morocco registered as the highest sales of Margerine with 18,200 MT, followed by Algeria and morocco at 11,400 MT and 9,800 MMT.

Apart from palm oil’s price competitiveness, palm oil-based margarine, which is trans-fat-free, adds another advantage to palm oil demand. Trans fat is an unsaturated fat produced through the hydrogenation of soft oil, which is mostly soybean oil in these countries. Margarine containing trans fat is not recommended due to its negative health effect, and it is still widely available in the Maghreb countries market. However, supply availability and price stability make producers still prefer soybean oil as the main ingredient in margarine and other fat products’ production.

But with current trends of high health’s awareness and consumers’ consent about trans fat, it would shift the demand to more healthy palm oil-based margarine. Those trends push the big producers to turn to palm oil as the healthy alternative for producing margarine and other fat products.

Table 1: 2020 volume sales

| ‘000 MT | Algeria | Morocco | Tunisia | Total | Share |

|---|---|---|---|---|---|

| Butter | 2.3 | 9.7 | 0.8 | 12.80 | 6% |

| Edible Oils | 34 | 47.4 | 21.4 | 102.80 | 50% |

| Margarine | 11.4 | 18.2 | 9.8 | 39.40 | 19% |

| Other Oils & Fats | 17.7 | 23.2 | 10.8 | 51.70 | 25% |

| Total | 65.4 | 98.5 | 42.8 | 206.70 | 100% |

Source: Statista

Malaysian Palm Oil (MPO) market share

The Maghreb countries is a highly price-sensitive market, especially for the bulk trade. The lower price offered by other producing countries, such as Indonesian palm oil (IPO), is more favourable to the buyers. A lower price of raw material means lower production cost, increase the profit margin, and offering more competitive finished products in the market. IPO doubled its market share from 7% in 2016 to 14% in 2020 (Chart 1), whereby MPO only captured 3% of the market share in the oils & fats sector.

Apart from the price, other factors such as shorter waiting time, flexible and efficient distribution channel are equally important. These will reduce the buyers’ price fluctuation risk, received the products timely and reduce their storage cost. Hence, to increase the MPO market share, Malaysian players need to be more flexible and efficient in delivering the services, including the logistic and supply channels. It is essential to have Malaysian players or their agents present in these countries to support their sales, have their product readily available, and address local requirements.

Table 1: Malaysia palm oil product exports to North Africa (Morocco, Algeria & Tunisia)

| MPO Products (Tonne) | 2016 | 2020 | Vol. Change |

|---|---|---|---|

| BUTTER OIL SUBSTITUTE | 46 | 207 | 161 |

| COCOA BUTTER REPLACER | 8 | 647 | 638 |

| COCOA BUTTER SUBSTITUTE | 88 | 176 | 88 |

| COOKING OIL | 67 | 134 | 67 |

| CRUDE PALM KERNEL OIL | 501 | 1,500 | 998 |

| FAT BLEND | 107 | 5,474 | 5,367 |

| H PALM KERNEL OIL | 1,516 | 2,062 | 546 |

| HRBD PALM KERNEL OIL | 2,957 | 4,064 | 1,107 |

| HRBD PALM KERNEL STEARIN | 618 | 9,317 | 8,699 |

| HRBD PALM OIL | 1,768 | 6,300 | 4,532 |

| HRBD PALM OLEIN | – | 1,072 | 1,072 |

| INTERESTERTIFIED MIXED OIL / VEG. OIL | 40 | 429 | 389 |

| PALM FAT | 378 | 214 | 164 |

| PALM KERNEL DIETHANOLAMIDE | – | 128 | 128 |

| PALM MID-FRACTION / RBD PALM MID-FRACTION / SOFT PALM STEARIN | 7 | 265 | 258 |

| PURIFIED / REFINED / DISTILL GLYCERINE / GRD GLYCERINE | 924 | 1,209 | 285 |

| SOAP CHIPS / SOAP / SOAP FLAKES / SOAP STOCK | 151 | 629 | 478 |

| SOAP NOODLES / STOCK / BLEND | 2,280 | 5,066 | 2,787 |

| VEG. FAT | 2,824 | 6,423 | 3,599 |

| VEG. GHEE / VANASPATI | – | 122 | 122 |

| Total | 14,281 | 45,437 | 31,156 |

Source: MPOB

There are plenty of rooms for Malaysian palm oil players to be more competitive in Maghreb countries. As shown in the table above, fats and non-food palm-based products have good prospect in these countries. The imports recorded an increase from 14,281 MT in 2016 to 45,437 in 2020; significant jumped to 218%. Higher acceptance of margarine supports the rise in palm kernel oil and palm kernel stearin as an essential ingredient in margarine production. While, imports such as soap noodle, soap chip and glycerine made a lot of demand for non-food palm-based products. The Malaysian players could focus on those niche markets to further penetrate Mahgreb and expand into other products in the near future.

Prepared by: Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.