Africa in the past decade has become the choice of many international investors. The continent’s extensive number of natural resources, strong population growth, young and increasingly educated workforce, more stability in terms of governance in recent years, and more prospects for economic growth has led many foreign investors and multinational companies from various countries, particularly from China, USA, and France to invest in African nations. Several African countries like Kenya, Uganda, Nigeria, and South Africa are becoming economic powerhouses attracting foreign investors to explore investing opportunities in their countries. In the past 15 years, there has been extensive developments in infrastructure, especially in the Sub-Saharan Africa region. Taking a closer look at the east African region, noticeable advancement in the infrastructure such as improved road system, revamping of port system and logistical services has eased the movement of goods in recent years. Due to population growth and demand, imports from non-African nations as well as imports within African nations has been growing. According to World Integrated Trade Solution (WITS) by World Bank, Sub-Saharan Africa’s total imports in 2019 reached a value of USD 253 million, and intra-Africa trade reached a value of USD 43 million. Meanwhile, Malaysian palm oil imports to Sub-Saharan Africa were valued at USD 2.8 billion in 2021.

1. Improved Road system

The lack of fair transportation infrastructure in this region has been a factor in hampering the intra-regional trade among the countries in east Africa. After the East African Community (EAC) countries established customs union in 2005, pressure for better road system was building up. EAC joining with private sectors, launched a phased programme of upgrading, reconstruction, and modernization of a series of roads and bridges. The aim was to connect the 2,000 km northern corridor that is anchored at the port of Mombasa in Kenya with the 1,600 km central corridor that originates at the port of Dar es Salaam in Tanzania. In recent years, East Africa has prioritized improving its cross-border and local transport infrastructure. Moreover, the 2020 Africa Construction Trends report by Deloitte says East Africa’s transport sector accounted for US$40 billion, an equivalent of 51.5% of the region’s total construction projects last year.

A mega project called the Tripartite Transport and Transit Facilitation Programme Eastern and Southern Africa (TTTFP) was started back in October 2017 jointly by the EAC, Common Market for Eastern and Southern Africa (COMESA), and South African Development Community (SADC) to facilitate the development of a more competitive, integrated and liberalized regional road transport system in the Eastern and Southern African region which includes harmonized road transport policies, laws, regulations and standards for efficient cross border road transport and transit networks, transport and logistics services, systems and procedures. This multi-year project is said to be completed by 2030 and once completed, the countries in the Eastern and Southern Africa will have a better and harmonized road transport policies, laws, regulations, systems, and standards that affect drivers, loads, vehicles, with improved road infrastructure.

The EAC Secretariat also directly coordinated and completed 6 roads sub-sector projects from 2012 to 2020 that links the east African countries Kenya, Tanzania, Uganda, Rwanda, and Burundi totaling around 1,700 km. Notably the Arusha – Namanga – Athi River Road project has reduced the travel time by road from 5 hours to 3 hours between Kenya and Tanzania. These road projects by EAC were to boost the regional trade, reduce transit times at the borders, and lower the travel time and transportation costs.

China’s Belt and Road Initiative (BRI), a multi-billion-dollar infrastructure investment platform provides infrastructure funding to developing countries in Africa as well as assisting to strengthen trade opportunities between China and Africa. Being Africa’s largest economic partner since the year 2000, China has been able to finance and construct several large infrastructure projects across various African countries namely in Algeria, Burundi, Ethiopia, Djibouti, Kenya, Rwanda, Tanzania, Uganda, and Zambia. Many of China’s infrastructure projects in Africa are into the development of roads, railways, and ports. This huge investment from China also helps to strengthen the trade opportunities between Africa and China. East African roads and highways has improved over the last 5 years with strong financial support from Chinese government and private companies. Well known management consulting firm, McKinsey & Company in 2017 reported that about 90 percent of over 10,000 Chinese-owned firms operating in Africa are privately owned.

2. Improved infrastructure at the ports

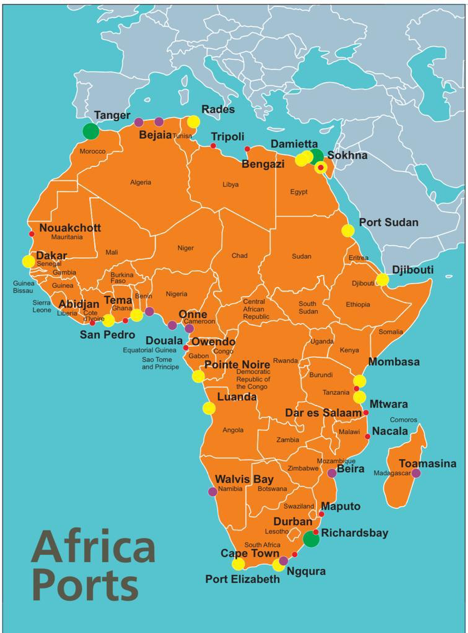

Port of Mombasa, the biggest port in East Africa, has a total capacity of 1.65 million Twenty-Foot Equivalent Units (TEUs) annually. Strategically located in the eastern region of African continent, it serves as the main port for Kenya’s international trade and landlocked countries such as Uganda, South Sudan, Democratic Republic of Congo, Burundi, and Rwanda.

To accommodate the shift in global shipping industry, where large vessels are used for economies of scale, Kenya Port Authority (KPA) completed the first phase of the CT2 construction in September 2017 and will be completing the Phase 2 and 3 by 2025. KPA has authorized Mediterranean Shipping Company (MSC), the second largest shipping line company after Maersk to jointly operate the CT2 through the Kenya National Shipping Line (KSNL), a joint venture of KPA and Mediterranean Shipping Company (MSC) of Switzerland. Once fully operational, the new CT2 will enable the ports to handle post-panamax-plus vessels with container capacity from 1.65 million TEUs to 2.65 million TEUs by 2025, which will give the port an edge over that of Dar es salaam. KPA also developed the surrounding infrastructures along the Northern Corridor that uses the standard gauge railway. This includes the improvement of Inland Container Depot in Nairobi and the Naivasha dry port that are crucial for Kenya. With a cost of KSH 700 million (USD 6 million), KPA refurbished Kisumu Port to revive the trade on Lake Victoria, mainly in the Kenya – Tanzania – Uganda markets. The Kenyan government in 2020 established the Kenya Transport and Logistics Network (KTLN) to manage, coordinate and integrate the operations of public ports, railway, and pipeline services.

3. Improved logistical services

African e-logistic companies play a significant role in improving logistical services as AfCFTA in place and movement of goods and services are increasing due to demand in this region. Through World Bank’s investment in this sector, several companies are being able to expand their services in proving logistics services. Logistical companies now offer a less expensive way to move goods across Africa. African tech-enabled logistics company Kobo360 has an Uber-like app that matches truck owners and drivers looking for work with companies whose cargo needs to be moved. This safe and secure digital platform allows truckers to use to handle every stage of the job, from scheduling to payment. This company’s fleet of 30,000 trucks now operates throughout Burkina Faso, Côte d’Ivoire, Ghana, Kenya, Nigeria, Togo, and Uganda.

A recent International Finance Corporation (IFC) study reports that collaboration between governments and third-party logistics companies has helped the ports, shipping, and trucking services to be designated as essential businesses so that they can be exempted from lockdown measures during COVID-19 pandemic. As of November 2020, IFC had invested over $82 million in e-logistics sector globally, one of which is Kobo360. IFC helps create a market for venture capital (VC) funding in this sector as IFC sees that the rate of innovation growth is particularly slow in developing countries due to the lack of VC funding.

DP World, a multinational logistical company has its footprint worldwide. It has a great focus in African region. In March of 2022 DP world bought over Imperial Logistics, a leading logistics supplier in Africa. Imperial logistics has been a successful and established shipment logistical company with business all over Africa and in Europe as well. Combining DP World’s world-class infrastructure, specifically its investment and expertise in ports on the African continent, with Imperial’s logistics and market access platforms will enable them to offer integrated end-to-end solutions along key trade lanes in and out of Africa.

DP World also operates the Kigali logistics platform which provides end to end logistical services and supply chain management. DP World Kigali is the first inland dry port in East Africa that has the access to port of Mombasa in Kenya and Dar Es Salaam in Tanzania, securing two main trade gateways to the sea with a yearly capacity to handle 350,000 tons of cargo and 50,000 TEUs per year and it connects Rwanda through several road links to neighbouring landlocked countries such as Uganda, Democratic Republic of Congo, and Burundi. DP World Kigali has reduced the cost of logistics services including the long-haul transportation, efficient operations, automation, Inland Container Terminal (ICT), Bonded & Non-Bonded Warehousing and serves as a one stop centre which connects all logistics players in one place since it started its operation in 2018. According to DP World, they have successfully reduced the truck turnaround time to 3 days which used to be an average of 10 to 14 days. Before they started their operations, the cost of transferring a container would be between $5,000 – $7,000, but after starting their operations at Kigali, they have brought the cost down to $2800.

With all these improvements in road, port and logistical services, movement of

goods has eased in this region compared to a decade or two ago. It is also

inevitable to note that despite all these road projects and infrastructure

developments at the ports have been completed and/or are underway in

Sub-Saharan Africa, there is still plenty of room for improvement in these

sectors. It is notable that only one in three rural Africans have access to the

all-season roads. Continuous improvement on infrastructure is needed especially

in the connecting roads between African countries. With more investment

from foreign entities, faster growth and advancement in these sectors can be

achieved.

Prepared by Karthigayen Selva Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.