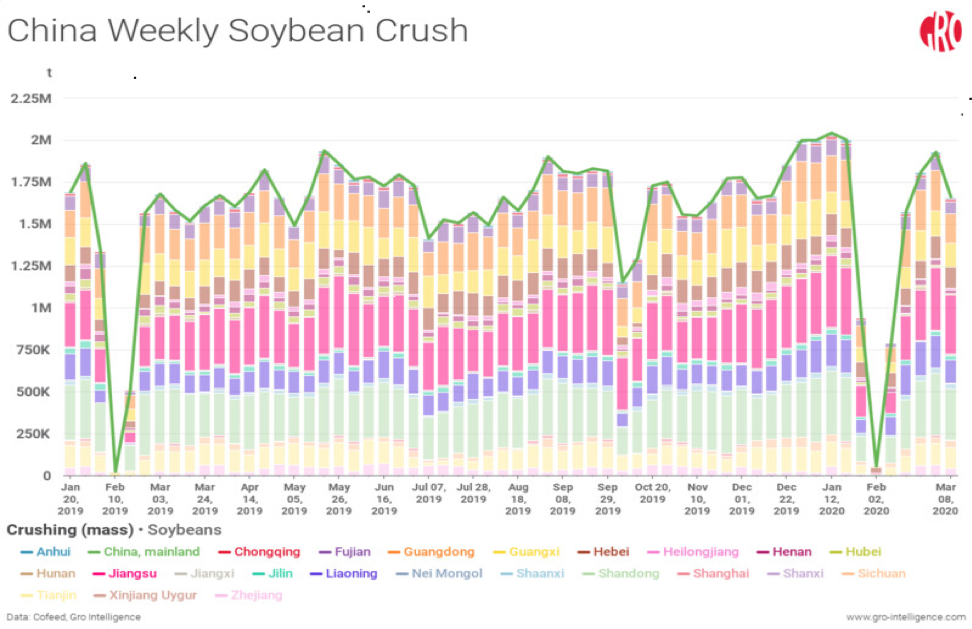

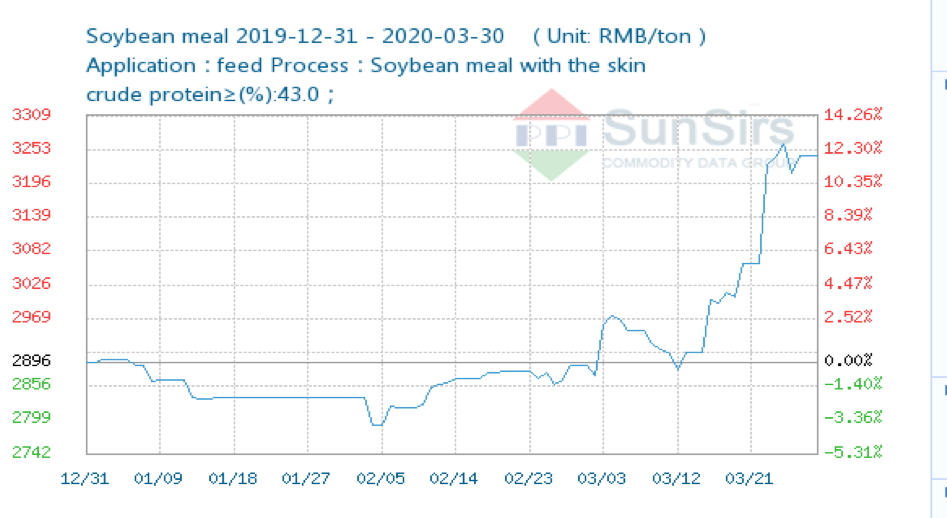

The weekly crushing volume of soybeans in China had surged in mid-February after a sharp fall in the early part of the month. Soymeal price rose from RMB2,896/MT on 31 December 2019 to RMB3,253/MT on 31st March 2020 (April 1, 2020, Sunsirs Commodity Data Group). JC Intelligence Shanghai estimated that crushers in China are currently making a profit between RMB94 to RMB132 per MT on soybean import at a 3% tariff. All imported soybeans from US are exempted from the 30% additional tariff that was imposed earlier.

Forecast made by the Chinese Agricultural Ministry shows a positive outlook for China’s soybean crushing industry. From January to February 2020, compared to the same period last year, China’s import of soybeans grew by 14.2% or 1.6 million MT to 13.5 million MT (MPOC, Shanghai Office). However, this is a far cry compared to the active crushing activities fueled by attractive crushing margin, coupled with the subsequent low arrival of soybeans in March and April., The crushers are forced to depend partly on the existing stock to keep the crushing plants running. According to CNGOIC, China’s soybean import in March and April 2020 is estimated to be only about 4.3 million MT and 6.6 million MT respectively. This has led to a drop in the soybean stock from 3.88 million MT recorded by the end of 2019 to only 2.16 million MT by the end of March 2020.

Nevertheless, soybean shipment orders from Brazil in March were estimated at about 10 million MT. If the 45 days’ voyage for the cargo to arrive in China is taken into consideration, the soybean supplies would surge up to 10 million MT in May. This will inevitably support the crushing industry with enough feedstock to boost up the crushing activity.

The anticipated rise in crushing activities in the forthcoming months is also fuelled by the strengthening of domestic soymeal demand, a favoured feed ingredient for livestock. According to the Chinese agricultural ministry, hog inventories saw an increase of 2.8% in the month of February. This is the fifth consecutive month-on-month increase. The total increase is approximately 10% from September 2019 to February 2020 (Reuters). Rabobank has projected that the hog industry’s recovery from the impact of African Swine Fever (ASF) will continue to push up the soymeal feed production throughout 2020. The hog meat price has also shot up as high as RMB50/kg in February 2020 from RMB20 /kg in January 2019 due to shortage in pork meat production that had declined by almost 50% in 2019. China’s government is reported to have released large quantities of frozen pork from its reserves to stabilize hog meat price since the end of the last year.

In tandem with the rise in crushing activities, soybean oil inventories in China has also increased from 790,800 MT in December 2019 to approximately 1.0 million MT in March 2020. The figures from MPOC’s Shanghai Representative Office shows that the increase in the stocks has partly dented the soybean oil price from USD960.30/MT on 2nd February to USD809.12/MT on 31st March 2020. On top of that, the declining crude mineral oil and a poorer outlook for global oils & fats demand, are also contributing to the lowering price.

Apart from the competition from the rapid increase in soybean oil production and the price factor, palm oil is also taking a beating from demand concerns due to the COVID-19 pandemic. Soybean oil to RBD palm olein spread was fluctuating at a range of between USD64/MT to USD115.59/MT from early February to end of march this year. Moreover, Malaysia is also facing a short term palm oil supply disruption due to temporary suspension of palm oil estate and mill’s operations in Sabah after seven plantation workers were tested positive for COVID-19. UOB Kay Hian foresees that the closure will lead Malaysia’s monthly CPO production to drop by 18-20% or approximately 240,000 MT a month. Short supply will increase the price of palm oil in the short run, thus, raising concerns that the Chinese will favour more soybean oil compared to palm oil, especially when the large soybean arrival is witnessed from May onwards.

Prepared By: Lim Teck Chaii , Theventharan Batumalai & Desmond Ng

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.