COVID 19 pandemic has created chaos all around the world this year. Beginning in March 2020 number of nations have imposed a lockdown to curb the pandemic. The pandemic has also caused an economic disruption in those countries due to the movement control imposed by the respective government. When the situation is looking to be improved in June, the world has been shocked by the second wave of the pandemic. Countries’ economic recovery has been halted due to this situation. Consumers have become prudent about their spending and incline to save more. This spending trend may have an impact on demand for the daily necessities goods which include oils and fats.

Second Wave Scenario

Asia Pacific has the most countries facing the wrath of the COVID-19 second wave, countries that were least affected such as Vietnam, South Korea, Myanmar and Taiwan during the first wave have severely being affected in the second wave. Most of their economic activities have been affected by the pandemic. Countries such as Vietnam and South Korea which tourism is one of the important sectors in their economy has badly affected. The lockdown has made the situation more severe. Even their people have restraint themselves from spending their time at the public eateries especially with their family members. This trend has a direct impact on the oils and fats demand in those countries.

Palm oil is known to have a strong demand in the Asia Pacific region. It is widely used in the food and non-food sectors. Consumer pack such as cooking oil is a popular choice in the ASEAN region due to competitive price, availability and warm climate. Meanwhile, in the temperate climate countries, palm oil is widely used in food manufacturing industries, HORECA and non-food (biomass and biodiesel).

During the earlier period of the lockdown, it has been forecasted that there is no significant reduction in palm oil production and the demand for palm oil in the Asia Pacific region will continue as forecasted with a slight reduction. The forecast was made based on the assumption the COVID-19 pandemic situation will gradually subside in the second half of 2020. However, with the second wave looming and starting to deep its claw in the region economy, we need to revisit the forecast, not on the production but more on the demand side.

Palm Oil Demand in Asia Pacific Region

Malaysian Palm Oil Export Performance (Jan – Jul 2020)

| No | Country | Jan-Jul 2020 | Jan-Jul 2019 | Change (MT) | Change (%) |

|---|---|---|---|---|---|

| 1 | Philippines | 401,660 | 364,464 | 37,196 | 10.21 |

| 2 | Vietnam | 293,065 | 325,079 | (32,014) | (9.85) |

| 3 | Japan | 266,684 | 286,693 | (20,009) | (6.98) |

| 4 | South Korea | 256,665 | 235,129 | 21,536 | 9.16 |

| 5 | Singapore | 212,053 | 221,851 | (9,797) | (4.42) |

| 6 | Taiwan | 120,370 | 125,759 | (5,388) | (4.28) |

| 7 | Australia | 82,698 | 86,228 | (3,530) | (4.09) |

| 8 | Myanmar | 22,694 | 44,508 | (21,814) | (49.01) |

| 9 | Indonesia | 17,501 | 130,126 | (112,624) | (86.55) |

| 10 | New Zealand | 12,469 | 8,639 | 3,830 | 44.33 |

| 11 | Brunei | 5,543 | 5,074 | 469 | 9.25 |

| 12 | Papua N. Guinea | 4,510 | 4,696 | (187) | (3.97) |

| 13 | Fiji | 1,766 | 1,857 | (92) | (4.95) |

| 14 | Cambodia | 1,505 | 830 | 675 | 81.34 |

| 15 | Mongolia | 938 | 782 | 156 | 19.93 |

| 16 | Laos | 184 | 21 | 163 | 781.95 |

| 17 | Solomon Island | 175 | 72 | 103 | 143.88 |

| 18 | Vanuatu | 101 | 105 | (4) | (3.65) |

| 19 | Samoa | 83 | 44 | 39 | 89.08 |

| 20 | Kiribati | 55 | 42 | 14 | 33.03 |

| 21 | Marshall Island | 39 | 0 | 39 | #DIV/0! |

| 22 | New Caledonia | 32 | 49 | (16) | (33.33) |

| 23 | Palau | 21 | 0 | 21 | #DIV/0! |

| 24 | Tonga | 16 | 48 | (32) | (67.29) |

| Total | 1,700,828 | 1,842,096 | (141,268) | (7.67) |

Source: MPOB

From January to July 2020, Malaysian palm oil export to the Asia Pacific region decreased by 141,268 MT or by 7.67% compared to the last year. This was mainly due to the lower imports by Vietnam, Japan, Indonesia and Myanmar.

Philippines’ import of Malaysian palm oil showed an improvement after the drop in 2019. This is mainly due to the high gap in the price spread between palm oil and coconut oil which makes palm oil more attractive for domestic consumption, especially for food applications. For July 2020, the price spread between coconut oil and palm oil was USD238 compared to USD177 in January 2020, increase about USD61 or by 34.5%.

Malaysian palm oil export also shows a decline in Vietnam which is mainly due to an increase in palm oil import from Indonesia and high availability of soybean oil in the market. Vietnam is currently recovering from the 2019 African Swine Fever (ASF) outbreak and as a result, it is anticipated there will be an increase in soybean domestic crushing activities which will translate to slow palm oil imports in Vietnam.

While Myanmar continuously showed a drop in Malaysian palm oil import due to strong competition from the Indonesian palm oil. Myanmar has a bright potential for palm oil but because of the price-sensitive market, Indonesia dominated the palm oil import by 90% of market share. Malaysian palm oil export to Japan and Taiwan also recorded a decline mainly due to the demand disruption because of COVID-19 pandemic outbreak.

Outlook for Palm Oil Imports in Second Half 2020

Food services, food retails and the tourism sectors are Asia Pacific’s most vital industries, offering employment and contributing significant GDP to the countries in the region. In 2019, the tourism sector contributed more than USD 1 trillion to the GDP Asia Pacific region (excluding China). In early 2020, these sectors projected to continue steady growth for the next three or five years which boosted by consumers’ stronger purchasing power, increase middle-class consumers, high urbanization and increasing dining options. However, due to the global pandemic, the food services and tourism sector received a shock. Most of the countries in the region practiced a lockdown, contributed to the sales drop in these sectors. Hotels and restaurants are closed, fewer people dining out and makes people cooking at home.

In the Asia Pacific region, palm oil has mainly been used in the HORECA industry. Important Malaysian palm oil importers in the region such as Vietnam, South Korea, Japan and the Philippines are countries that are facing the second wave of the pandemic. Even though palm oil is being used in the non-food sector in Japan and South Korea which are not affected by the pandemic, the food sector is still the main sector for palm oil in those countries. Hence, it is expected that there will be a reduction in the overall palm oil import into the region.

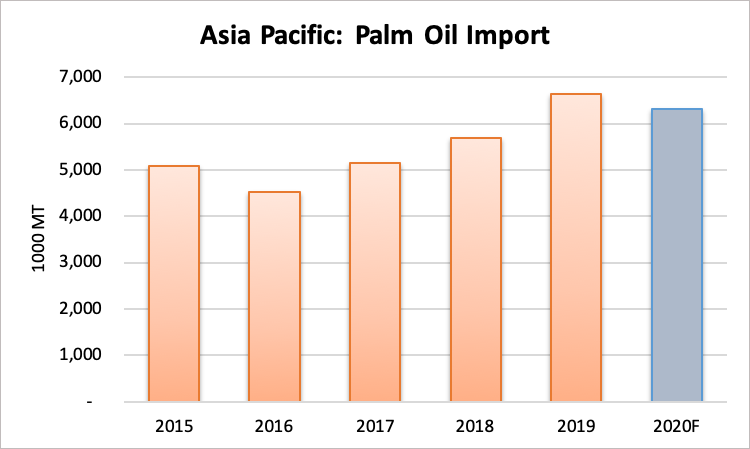

For the year 2020, it is anticipated that total palm oil import in the Asia Pacific region will drop about 5 – 6% due to the second wave of COVID-19 in the major palm oil importer countries in the Asia Pacific region.

Prepared by : Muhammad Kharibi and Rina Mariati

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.