Introduction

Serbia is considered a relatively small oils and fats market, with 8.74 million people in 2020 and consuming 20.6 kg per capita of oils and fats, which is around 10 kg below the world average. But what is interesting to share in this article is how competitive palm oil compares to other oils in this country, which is dominated by soft oil and its potentials.

More interestingly, Serbia is a net exporter of vegetable oils, led by sunflower oil with its local production of 216,000 MT in 2020. In comparison, the total oils and fats consumption stood at only 180,100 MT. However, Serbia still needs to import to satisfy local industries’ requirements and export market. Palm oil, in this case, filled the gap for local oils and fats necessities. Last year, palm oil was the highest imported oil at 29,700 MT, which captured 51% of the total oils and fats imported into the country. The versatility of palm oil, especially for industrial usage and its price advantage, gained good acceptance by local manufacturers. The upward trend of palm oil import by Serbia for the last few years shows favourable outlooks for palm oil.

Oils and Fats consumption and import trends

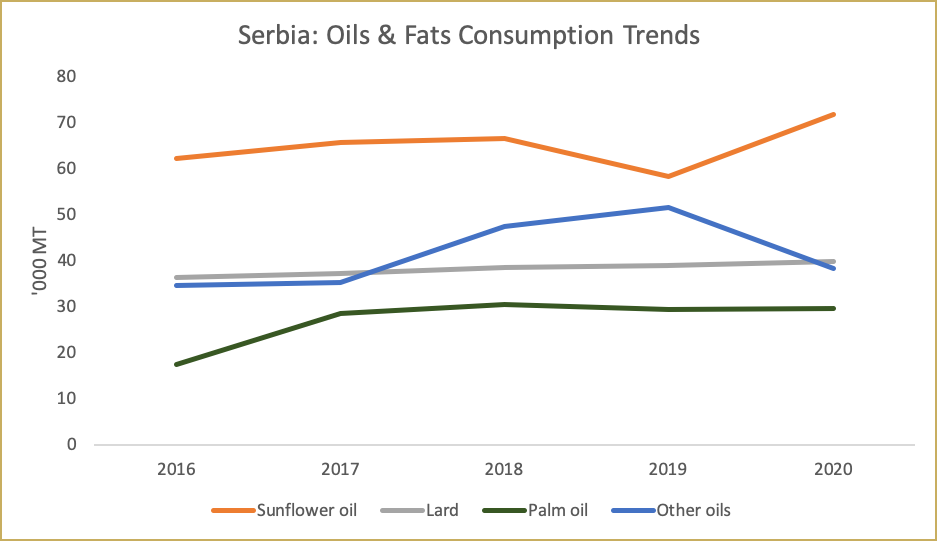

Serbia oils and fats consumption recorded at 180,100 MT in 2020, increased by 1,400 MT compared to 2019 at 178,700. Slower economic activities in 2020 seemed not significantly affect the consumption of oils and fats in the country. Based on the World Bank report, Serbia’s GDP dropped to -0.98 in 2020, much lower than 4.25 in 2019. However, the economy started showing a recovery in January – June 2021, and the GDP growth is projected to move to a positive level at 6 per cent in 2021. With more activities in 2022 and better economic growth, higher consumption of oils and fats is expected, supported by higher export and an increase in HORECA sector activities.

Table 1: Serbia oils & fats consumption (Thousand MT)

| Consumption | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| Sunflower oil | 62.30 | 65.90 | 66.60 | 58.50 | 72.00 |

| Lard | 36.50 | 37.40 | 38.70 | 39.10 | 39.90 |

| Palm oil | 17.60 | 28.70 | 30.60 | 29.40 | 29.70 |

| Other oils | 34.80 | 35.30 | 47.50 | 51.70 | 38.50 |

| Total | 151.20 | 167.30 | 183.40 | 178.70 | 180.10 |

Source: OIL WORLD

Sunflower oil is the biggest consumed in Serbia. Last year, sunflower oil consumption was recorded at 72,000 MT, representing 40% of total oils and fats consumption. Whereby, lard consumption in Serbia is surprisingly high, registered at 39,900 MT or 22% of the total oils and fats consumption. Palm oil consumption ranked third with 29,700 MT or 16% of the share.

Palm Oil consumption growth

Palm oil gained the highest consumption growth for 2016-2020, with a CAGR of 14%. In the early 2000s, palm oil was not popular among Serbian consumers and industry users, where the market was dominated by sunflower oil. However, the increased availability of palm oil in neighbouring countries such as Turkey and the Netherlands had brought palm oil to become a popular alternative oil, especially for industrial usage. This is supported by the increase in awareness about palm oil’s technology and economic advantages. Currently, Palm oil is the third-largest oil consumed in Serbia, started with a very low volume of less than 3,000 MT in 2000, and increased to 29,700 MT in 2020. Mainly, palm oil is used as raw material for confectionery production, frying, bakery and other finished products and HORECA for frying.

Sunflower oil CAGR for the 2016-2020 period was recorded at 3.7%. The increase in consumption of sunflower oil is mainly due to an increase in population as it is used for household, compared to palm oil for industrial usage. In addition, an increase in the production of finished products for exports supports the rise in palm oil consumption in the local market. However, for household usage, especially the liquid market, it is still challenging to penetrate it due to palm cooking oil’s physical appearance, which tends to crystallise during the cold season. Furthermore, sunflower oil is produced locally and readily available. Serbia is big in oilseed production, had around 650,000 MT in 2020 and exported more than 130,000 MT every year.

Malaysian palm oil exports

Malaysian palm oil was the most imported vegetable oil by Serbia in 2020, accounted 13,600 MT, an increase of 116% compared to the previous year. Serbia is a landlocked country, a good logistics with a competitive cost is a crucial purchasing factor for the buyers. Most of the palm oil products that entered Serbia were brought in through Rijeka Port in Croatia and Thessaloniki Port in Greece. Palm oil in 20L jerry-cans is highly demanded by local buyers and traders, which can be easily redistributed the other user in the country.

Table 2: Serbia Palm Oil Imports (Thousand MT)

| Country | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| EU27 | 9.70 | 17.30 | 17.40 | 17.30 | 9.60 |

| Hong Kong | 0.00 | 0.80 | 1.30 | 1.30 | 0.00 |

| Indonesia | 2.70 | 3.90 | 3.50 | 3.60 | 5.70 |

| Malaysia | 5.20 | 6.40 | 7.40 | 6.30 | 13.60 |

| Others | 0.00 | 0.30 | 0.60 | 0.40 | 0.00 |

| Singapore | 0.10 | 0.00 | 0.40 | 0.50 | 0.80 |

| Total | 17.70 | 28.70 | 30.60 | 29.40 | 29.70 |

Source: OIL WORLD

Palm oil demand potentials and outlooks

The tables and chart above clearly showed the good potential of palm oil demand in Serbia. The acceptance of palm oil as part of essential oils for industrial usage gives a better perspective for future development of the palm oil market primarily to support the production of finished goods for export in the European countries. Furthermore, the versatility of palm oil and its competitive price advantage give crucial factors as a choice oils. However, these good attributes need to be explained and promoted among the users to penetrate the market better.

The availability of Malaysian palm oil products in the local market is equally important to support increasing demand from the local buyers. Hence, Malaysian palm oil industry players must have the logistic support through partners or joint ventures with local players and distribute the product more efficiently and increase the availability of Malaysian palm oil products for local industries. As such, local buyers will reduce the waiting time and other related costs such as the storage and price fluctuation risk.

The market outlooks for palm oil in Serbia seem very positive, even though the current volume is small. With Serbia in the centre of Balkan countries and part of EU countries, re-export palm oil-based products from Serbia could be another opportunity for the palm oil market. Furthermore, better economic activities in 2021 and 2022 would bring higher demand for palm oil imports, which could reach 40,000 MT by the end of 2022 or a year later. As the biggest Malaysian palm oil importer in the region, Turkey could potentially be an entry point for the market in Balkan countries and Serbia especially.

Prepared by Mohd Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.