In the middle of the second century BC, the Great Silk Road passed through the territories of modern Uzbekistan. Large trade cities such as Samarkand, Bukhara, and Tashkent appeared and grew along this route. Today, Uzbekistan is the geographic and population centre of Central Asia.

After independence in 1991, the country has greatly diversified its agricultural production, although cotton remains a major part of its economy. The current government of Uzbekistan – a developing country, whose economy is ranked in 162nd place in terms of GDP per capita – is striving for economic stability and predictability to improve its economic performance. In order to achieve this, the government of Uzbekistan has pursued an ambitious initial set of trade and price liberalisation reforms in recent years. And now, despite the fallout from the war in Ukraine, Uzbekistan is expected to have grown by 5.3% in 2022.

As for the vegetable oil business, the country is a net importer of animal and vegetable fats and oils. According to the Customs Service of Uzbekistan, the total worth of import exceeded half a billion USD in 2021. Sunflower oil and margarine are the two most imported items – 72% out of all supplied under HS code 15 (animal and vegetable fats and oils, and their cleavage products). Both products are supplied by Russia – 84% and 80% respectively. To a large extent, the Uzbek market belongs to Russia.

UZBEKISTAN: Balance of Oils and Fats (1,000 MT)[1]

In 2021, the total consumption of oils and fats in Uzbekistan was recorded at 546,000 MT, out of which, 283,600 MT (51%) was produced locally and 228,400 (49%) was imported. The local production predominantly comprised cottonseed oil, whereas the imports comprised sunflower oil and palm oil.

According to the Malaysian Palm Oil Board (MPOB), the top item of export to Uzbekistan in 2022 was RBD Palm Oil – 7,865 MT. In addition, large quantities of hydrogenated fats – HPKO and H RBD PO – were exported there. Overall export volume exceeded 23,500 MT, which was 60% bigger than the previous year’s volume.

TOP 5 EXPORTS OF PALM OIL AND OTHER PALM-BASED PRODUCTS TO UZBEKISTAN[2]

| Product | Volume (MT) |

|---|---|

| RBD PALM OIL | 7 865 |

| HYDROGENATED PALM KERNEL STEARIN | 3 160 |

| SOAP NOODLES/FLAKES/CHIPS/BLEND/STOCK | 2 226 |

| HYDROGENATED RBD PALM OIL | 1 966 |

| HYDROGENATED PALM OIL | 1 554 |

Russian companies supply sunflower oil, specialty fats, coconut oil, palm oil and palm kernel oil. EFKO Group and Rusagro Group – major Russian producers of specialty fats – supplied one third of the vegetable oils imported into Uzbekistan in 2022. While Rusagro is more on sunflower supplies, EFKO is a big supplier of palm oil and specialty fats.

According to the Customs Service of Uzbekistan, out of 387,000 MT of animal fats and vegetable oils imported into Uzbekistan in 2022, 86,000 MT was palm oil, including modified, hydrogenated palm oil. Uzbekistan has not imposed any restrictions on trans fat content as of yet. Malaysian exporters should take note of this. This is why out of the 86,000 tons of palm oil exported to Uzbekistan in 2022, more than 18,000 tons was hydrogenated palm oil, which is supplied mostly by one company – the EFKO Group.

When discussing about the palm oil market of Uzbekistan, it turns out that the dominance of the Russian company EFKO is even more pronounced in recent years, and it has kept growing after 24 February 2022, when the Russian army invaded Ukraine, making Russia the most-sanctioned country in the world. Today EFKO is in a clear lead, supplying more than half of the palm oil volume imported into Uzbekistan.

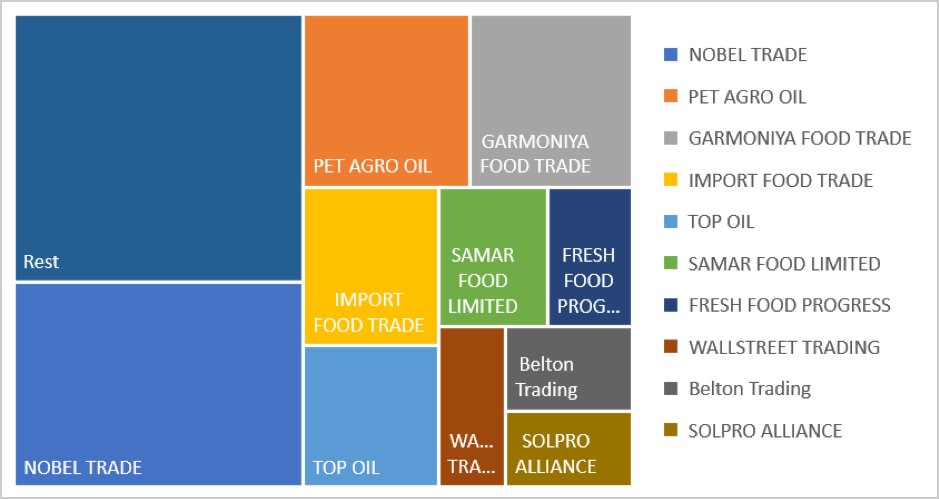

Considering the imports, the diversity of companies that are operating in Uzbekistan should be noted. It is difficult to name a clear leader. Most of them are traders. Among them, several can be distinguished – Nobel Trade and Pet Agro Oil – a JV between Irish and Uzbek companies. Some Uzbek companies trade in imported specialty fats, while others manufacture and sell their own products. Sales of confectionery fats are on the rise. This may indicate progress in the development of the food industry and the HoReCa sector, which the country has made over the last few years.

As mentioned above, one of the biggest market players is Nobel Trade – which imports sunflower oil from Russia and Kazakhstan, and palm oil from Indonesia and Russia.

Most imports of special purpose fats are confectionery fats, milk fat substitutes, and cocoa butter equivalents of lauric type (CBS). In addition to Russian companies, these products are supplied by Indonesian and Malaysian firms. Malaysian palm oil suppliers had long dominated the Uzbek market, but pandemic supply chain disruptions and duty disadvantage to CIS suppliers in 2021, resulted in it being overtaken by the Russian suppliers.

Like many centuries ago, today Uzbekistan continues to be the central point on the route connecting the East and the West. The new Silk Road that China is building is opening up great prospects for Central Asia. We are witnessing the active development of the tourism business and the related HoReCa sector.

Like many centuries ago, today Uzbekistan continues to be the central point on the route connecting the East and the West. The new Silk Road that China is building is opening up great prospects for Central Asia. We are witnessing the active development of the tourism business and the related HoReCa sector.

We at the Malaysian Palm Oil Council (MPOC) are confident that palm oil consumption in this region will grow in the coming years. The Council has been actively involved in the development of the Uzbek market for a long time. We encourage Malaysian companies to join us in promoting Malaysian palm oil to the growing Uzbek market. This year, a major meeting will be organised between business representatives from Uzbekistan and Malaysia, and we invite all interested parties to join it.

Prepared by Aleksey Udovenko , MPOC Russia

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

[1] Source: ISTA Mielke GmbH

[2] Source: MPOB