Overview of oils and fats situation in SSA

Sub-Saharan Africa is a commodity driven economy with agricultural products, minerals, natural gas, including automotive manufacturing, and financial services. With 1.14 billion population and continuous growth, this region is a net importer of oils and fats. In 2020, Sub-Saharan Africa produced 6 million MT of oils and fats and their local consumption was 11.2 million MT. Hence, to fill the gap they imported a total of 7.4 million MT of oils and fats.

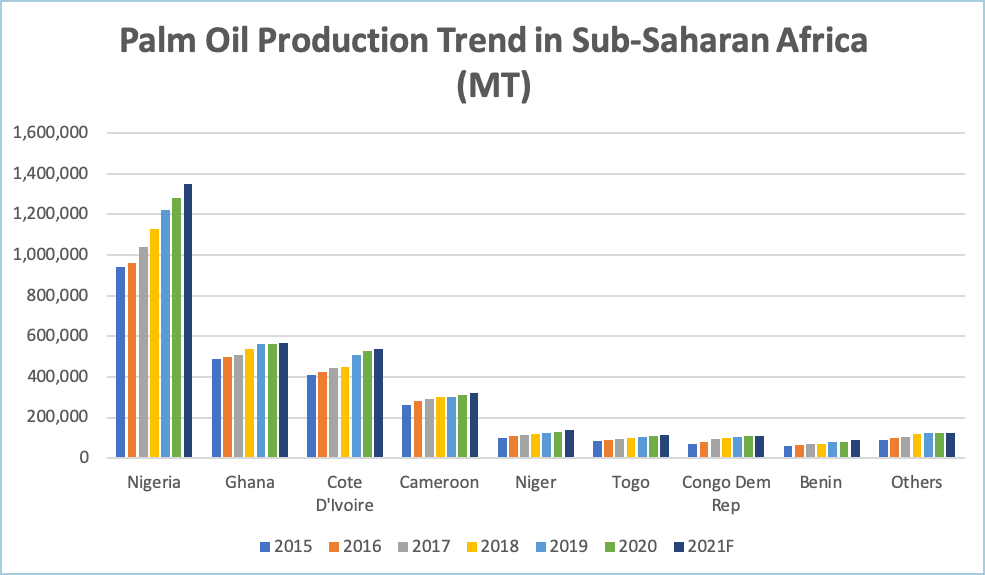

Palm oil production trend in SSA (2015 – 2021F)

Most of the palm oil producing countries are from the western region, and a few are from the central region of Sub-Saharan Africa. Nigeria is the largest producer of palm oil in Sub-Saharan Africa with over 1.2 million MT of production in 2020, which is almost half of the entire palm oil production from Sub-Saharan Africa. The total production of palm oil in Sub-Saharan Africa was 3.3 million MT (F) of palm oil in 2021. All the producing countries are in a growing trend since 2015. As a net importer, Sub-Saharan Africa in the coming years will continue this trend of importing of oils and fats into the region to satisfy the growing population and demand. While about 80% of palm oil coming into this region are from Malaysia and Indonesia, the rest are from Colombia and Thailand. Besides palm oil, groundnut, sunflower, and soybean oil are also produced in this region.

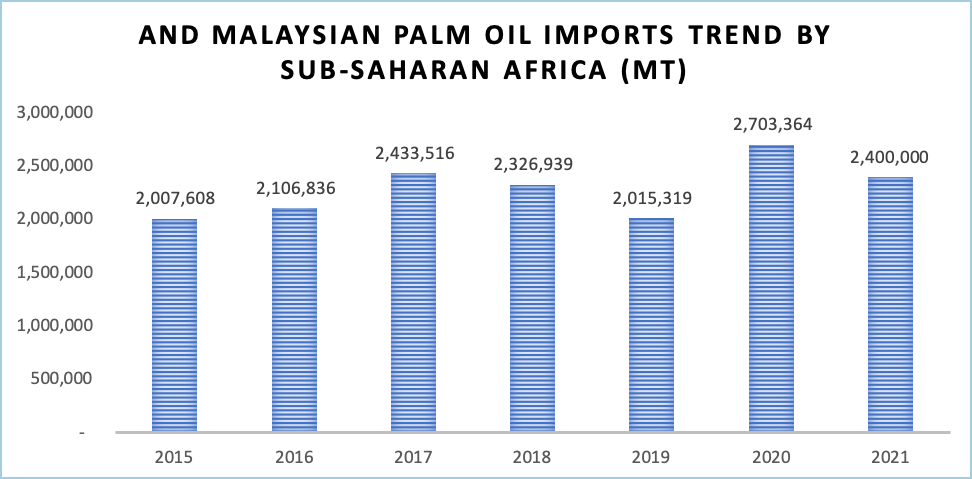

MPO imports trend (2015 – 2021)

In the last 7 years, Sub-Saharan Africa has imported an average of 2.3 million MT of palm oil per year from Malaysia. In 2020, this region recorded the highest ever import volume with a staggering 2.7 million MT of Malaysian palm oil. The main reason for the increase in 2020 was due to the temporary removal of export duty by Malaysian government which helped increase the CPO exports into this region. Moreover, it was coupled with panic buying caused by the pandemic. A spike was seen in imports from Kenya and Mozambique, which are also the re-exporting hubs to the neighboring landlocked countries. Kenya imported 672,715 MT of Malaysian palm oil last year which was the highest ever import volume from this east African nation. Increased imports are seen from Kenya since it lifted the import tariff on crude palm oil in 2020. This has been an important driving force for the uptrend imports from local refineries and from the neighboring countries. Moreover, with better and improved infrastructure (by road) from Kenya to landlocked countries, it is now faster and affordable to transport the goods to Rwanda, Burundi, Uganda, and Democratic Republic of Congo. While various Malaysian palm oil products are being exported into this region, majority of it is in the crude form. Last year, 65% of the total Malaysian palm oil that was exported to Sub-Saharan Africa was in crude form and 24% was in refined form. It is notable that recent developments such as urbanization in large cities in Nigeria, Kenya, and South Africa, have increased the use of FMCG goods in these areas.

Current market situation and exports trend

Market movement in the past couple of years has been largely navigated by the pandemic. The COVID-19 pandemic plunged Sub-Saharan Africa into its first recession in over 25 years. Though the recovery in this region varies, according to World Bank, Sub-Saharan Africa is expected to rebound from recession with a 3.3 percent growth in 2021 with fuel and commodity prices on the rise. Malaysian palm oil imports are affected by the low purchasing power and high inflation in many of the countries in the region. Due to that, countries like Nigeria, Ghana, Benin, Togo, and Niger are facing shortage of local currency.

Many African countries in this region experienced shortage of workers in the agriculture and FMCG sectors as their governments-imposed lockdowns and curfews to curb the spread of the viral pandemic and this affected their productions, including palm oil. Moreover, it also increased the production cost of palm oil whereby the price of locally produced palm oil was less attractive compared to the imported palm oil. The pandemic also resulted in land border closure where movement of goods from one country to another became challenging. Major ports experienced backlog due to low manpower, lack of berths and heightened health safety measures. With all these challenges, the impact on Malaysian palm oil in this region was not severe. The demand for imported palm oil remained high despite the high palm oil price.

These negative impacts didn’t keep investors away from this region. Through large investors, countries from eastern region such as Kenya, Tanzania, and Mozambique are improving their infrastructure and road systems. With these developments, movement of goods through land borders will become less challenging and increase of imported goods including palm oil can be expected from re-exporting hubs like Kenya, Mozambique, and Tanzania. Moreover, there has been higher local investment in palm oil production in countries like Nigeria, Ghana, and Cote D’Ivoire and therefore local production will also be expected to increase in the future.

African Continental Free Trade Area (AfCFTA) the most anticipated, and largest global free trade area came into effect in January 2021. This intra-Africa trade agreement is focused on trade between African nations with elimination of import tariffs on 90% of products, and creating a continental free trade area for goods, people, and services. Connecting 1.3 billion people across 55 countries with combined GDP valued at $3.4 trillion, this agreement aims to reduce trade costs and enable Africa to integrate further into global supply chains. This game changer is expected to reduce poverty, and increase Africa’s exports, including intra-continental export which is expected to increase by 81%. With this trade agreement implemented, impact on Malaysian palm oil imports is expected to be minimal. Though price of locally produced palm oil will be attractive when import tariff is eliminated, the demand for exported palm oil remains high in Sub-Saharan Africa as this region is a net importer and consumption of palm oil is higher than the locally produced palm oil.

Forecast 2022

While pandemic restrictions have been easing lately and recovery in this region is something that is on the table now, expectation for economic recovery is highly anticipated. Imports of palm oil continued as the demand was high. Effects of AfCFTA will not be felt this year as it is still at its infancy stage and many of the details are still being panned out. As a net importer of oils and fats, such as palm oil, growing population drives the demand for palm oil as urbanization in major cities in Sub-Saharan Africa shifts the food trends. The uptrend market for palm oil is expected to continue in 2022 and coming years in the Sub-Saharan Africa region.

Prepared by Karthik Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.