Besides raising revenue for the governments, import duties are often used to give market advantage to domestic production. Tariffs are widely employed as a policy instrument to promote the domestic edible oil sector but the evidence of their impact is mixed. This article will discuss various import duties structure imposed by several countries in the Sub-Saharan Africa region and its impact on palm oil imports and shifting product demands.

Nigeria Palm Oil Tax

The first ban on the importation of vegetable oil was implemented in1986. In 1995, there was a replacement of existing ban with high import duty by the federal government. In the year 2002 – 2008, the Nigerian federal government again imposed a total ban on the import of vegetable oil. The government of Nigeria removed the total import ban on crude palm oil in December 2008 but an import duty of 35% was put in place instead. However, this duty applies to edible oil imported from the Economic Community of West African States (ECOWAS) countries. Packed vegetable oil products imports remain banned.

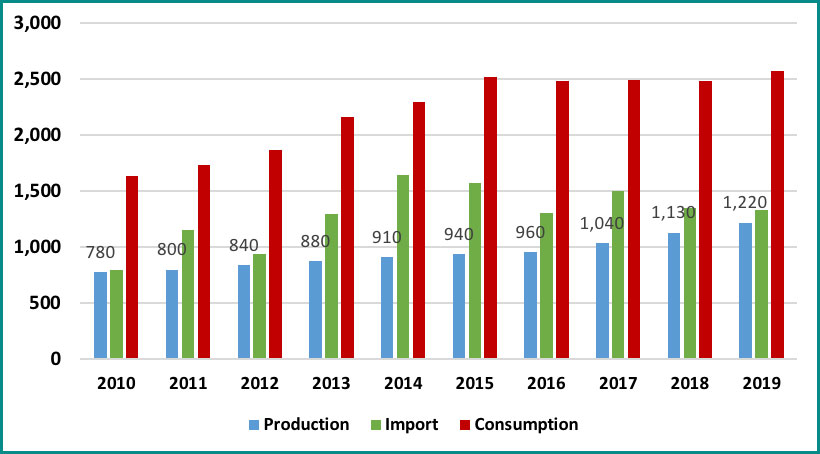

Although the policy has managed to increase the prices of locally produced palm oil, it has not been successful in attracting new investment in large oil palm plantations. In ten year period between 2010-2019 oil palm plantations’ area in Nigeria only increased by 110,000 hectares from 430,000 hectares in 2009 to 540,000 hectares last year. Palm oil production increased from 780,000 MT to 1,220,000 MT during that period, while demand has increased from 1,630,000 MT to 2,570,000 MT. As a result, Nigeria has continued to increase its imports from Malaysia, Indonesia, and other neighbouring West African countries.

Figure 1: Nigeria Palm Oil Production, Import and Consumption (000 MT)

Ghana

Ghana is one of the major consumers of palm oil in West Africa with domestic consumption is estimated at 560,000 MT in 2019. To encourage local investment in an oil palm plantation, Ghana imposed a 20 % import duty on CPO and 35 % for finished products. There is no duty imposed on edible oil originating from ECOWAS member countries.

In October 2002, the Ghanaian Government announced a Presidential Special Initiative (PSI) for the development of the oil palm industry as part of its programme of accelerating economic growth, wealth generation, and employment in the rural area. The long-term objective of the PSI is to develop large oil palm plantations to fill the supply and demand gap in Ghana and neighbouring West African countries. However, this initiative has not been able to attract significant foreign investment into its palm oil sector.

Plantation area cultivated with oil palm only saw minimal increases from 270,000 hectares in 2010 to 370,000 hectares in 2019. Growth in acreage is constrained by the difficulty of acquiring the land for development as ownership is fragmented with many owners having small plots of land. With palm oil yield of less than 2.0 MT per hectare, Ghana just managed to increase its palm oil production to 560,000 MT from 400,000 MT in ten year period, which resulted in imports of 350,000 MT last year.

Shifting Product Demand in East Africa Region

Kenya and Tanzania are two major importers and consumers of palm oil in the East Africa Region. Kenya with very little oilseed production imported 922,000 MT of palm oil last year from Malaysia and Indonesia and imposed a 10% import duty on CPO and 25% duty on refined palm oil.

Tanzania, in its effort to reduce its dependency on edible oil imports, introduced various intervention policies to promote domestic oilseed production. Additional pressure from local oilseed producers has resulted in various transformation in edible oil import tax structure. Before July 2016, there is no import duty on CPO while refined products attracted 10% duty. After July 2016, CPO import duty was raised to 10% and further adjusted to 25% in the 2018/2019 budget and remains at 25% presently.

Table 1: Tanzania Palm Oil Import Duty

| HS Code | Description | Rate(Before Jul 2016) | Rate(Jul 2016-Jun 2018) | Rate(Jul 2018 –Now) |

|---|---|---|---|---|

| 1511.10.00 | Crude Palm Oil | 0% | 10% | 25% |

| 1511.90.10 | Palm Olein, fractions | 10% | 10% | 25% |

| 1511.90.20 | Palm Stearin, fractions | 10% | 10% | 25% |

| 1511.90.30 | RBD Palm Olein | 25% | 25% | 35% |

| 1511.90.40 | RBD Palm Stearin | 10% | 10% | 25% |

| 1511.90.90 | Other | 25% | 25% | 35% |

As a result of the change in import duty structure, Tanzania which used to be one of the major importers of Malaysian CPO has completely changed its palm oil import requirement towards RBD palm olein as illustrated in the table below. This policy shift also resulted in Kenya transforming itself into becoming a major CPO/CPL importer from RBD palm olein.

Table 2: Malaysian Palm Oil Exports to Tanzania (000 MT)

| Products | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Jan-Aug 2020 |

|---|---|---|---|---|---|---|---|

| CPO/CPL | 201,716 | 175,765 | 265,507 | 83,388 | 78,028 | 0 | 1,000 |

| RBD Palm Olein | 70,767 | 54,342 | 93,640 | 140,078 | 106,689 | 182,024 | 93,211 |

Source: MPOB

Table 3: Malaysian Palm Oil Exports to Kenya (000 MT)

| Products | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Jan-Aug 2020 |

|---|---|---|---|---|---|---|---|

| CPO/CPL | 33,846 | 56,510 | 54,979 | 19,712 | 121,737 | 153,172 | 205,063 |

| RBD Palm Olein | 78,649 | 76,255 | 62,740 | 104,935 | 81,420 | 26,551 | 23,922 |

Source: MPOB

Conclusion

Ambitious inspirations by Sub-Saharan African countries to increase local edible oil production must be lauded but there is slow progress in its implementation. Despite introducing intervention measures such as altering import duty structure, the policy has not been able to yield the desired results. The region is still required to increase its palm oil import to satisfy the demand from its growing population and better economic condition. Adjusting duty structure also resulted in shifting product requirements from RBD palm olein to CPO as shown by Tanzania/Kenya Malaysian palm oil import from 2014 to the present. The supply-demand gap will remain in the foreseeable future unless the region undergoes a sudden transformation in policy shift or massive investment in oil palm plantation. In the meantime, imported palm oil from Malaysia continues to play a major role to fulfil that gap.

Prepared by Iskahar Nordin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.