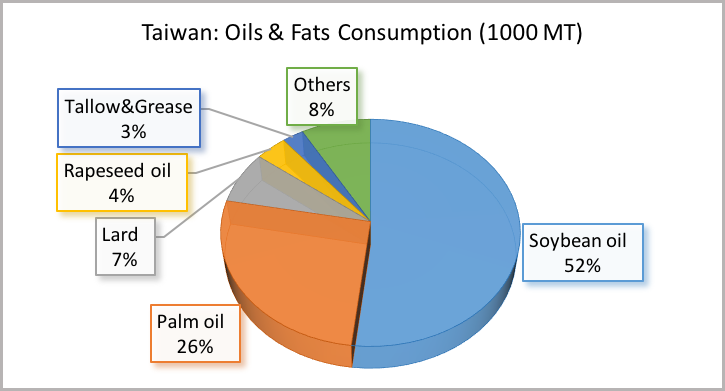

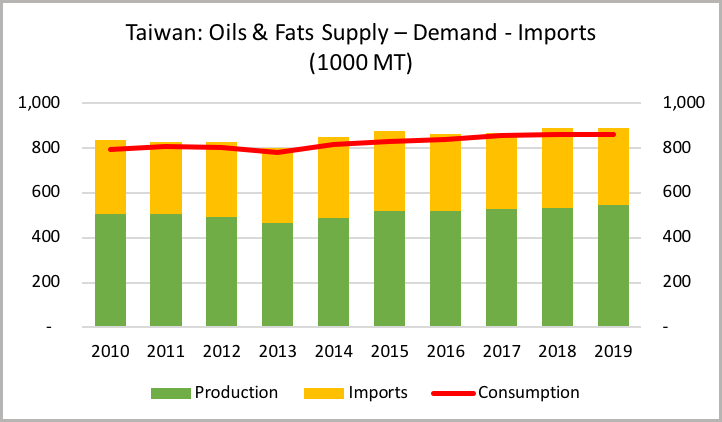

With a population of 23.8 million, Taiwan consumed 860,000 MT of oils and fats in 2019. Soybean oil and palm oil are the main consumed edible oils with a share of 52% and 26% respectively. Soybean oil is the most produced oil in the Taiwan with an average production was 460,000 MT yearly for the last five years. Due to the limited arable land and small agricultural sector, most of the soybean oil production in the Taiwan is crushed from the imported soybeans. Taiwan imported 2.7 million MT of soybean in 2019 which the biggest suppliers are USA (1.8 million MT) and Brazil (773,700 MT) which the total share of these two countries was at 97.4%.

Taiwan is heavily dependent on import. On average for the past five years, 40% of oils and fats consumption in Taiwan was filled by import. Palm oil dominates oils and fats import of the country with share of 65% or 225,000 MT in 2019. Palm oil is mainly used in the HORECA sector and food processing industries. Based on the USDA report, food processing sector in Taiwan produced an estimated USD18 billion per year which accounted for 3.6% of the country’s GDP.

HORECA and foodservice sectors in Taiwan showed a stable growth with a CAGR of 5.35% for the last five years. The stable growth mainly driven by the development in tourism sector. In 2019, Taiwan recorded a high of 11.84 million tourist arrival which representing 7% growth compared to 11.07 million in 2018. Food is one of Taiwan’s top strength in tourism, for example tourists opt for night market snacks or fine dining. The other factors that driven in the HORECA and food services sectors growth are increase in the consumer income, a growing number of working women and growth in the e-commerce sector. The growth of the food industry in these sectors have spurred the demand for palm oil.

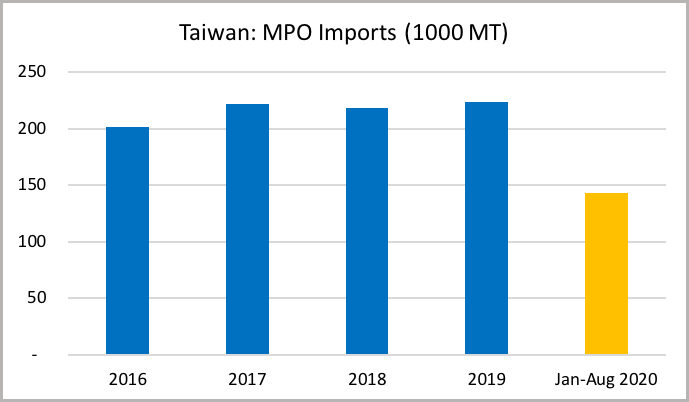

Taiwan is a consistent market for Malaysian palm oil with an average import at 210,000 MT per year from the past five years. MPO holds 97% of the market share in this country. Three-quarter of the palm oil is used in the food processing industry such as instant noodle and cooking oil (blending and industry usage) and HORECA sector. Consumer preference for convenience to eat is one of the factors that develop easy-to-prepare meals which give potential growth in this sector.

Source: MPOB

| Taiwan: MPO Imports by Product (MT) | ||||

|---|---|---|---|---|

| PRODUCT | Jan-Aug 2020 | Jan-Aug 2019 | Change (MT) | Change (%) |

| RBD Palm Olein | 114,380 | 118,128 | (3,747) | (3.17) |

| RBD Palm Oil | 20,366 | 20,656 | (290) | (1.40) |

| RBD Palm Stearin | 5,012 | 6,508 | (1,496) | (22.99) |

| Others | 3,070 | 1,498 | 1,572 | 104.89 |

| Total | 142,829 | 146,790 | (3,961) | (2.70) |

Source: MPOB

For the period of January to August 2020, the import of Malaysian palm oil by Taiwan showed a slight dropped of 3,961 MT or 2.7% compared to the same period in 2019. This drop was mainly due to the demand disruption caused by global pandemic outbreak, COVID-19.

Article from Focus Taiwan reported that, Ministry of Economic Affairs (MOEA) anticipated this year will be a slow growth in Taiwan’s food and beverage sector caused by reduce in people dining out habits due to the COVID-19 pandemic. For the first six month of 2020, this sector revenue fell 9.4% to USD12.7 billion compared to the same period in 2019. Even though the industry may face difficulties this year due to COVID-19 pandemic, other sectors such as food deliveries, supermarkets and hypermarkets show upward trend which creating demand for palm oil in the market.

Malaysian palm oil exporters should continue to pursue and dominate the market. Taiwan promises a strong growth in the food services, food manufacturing and tourism sectors. Furthermore, according to non-OIC (Organization of Islamic Cooperation) countries, Taiwan ranked number 3 in providing a Muslim-friendly travel environment among the world. Thus, palm oil plays a very significant role in these sectors which it will boost Taiwan’s palm oil demand in the coming years. For 2020, it is anticipated that Malaysian palm oil will drop slightly about 1% to 3% due to the global pandemic.

Prepared by: Rina Mariati

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.