The United States (US) is one of the most lucrative beauty and personal care market in the world, along with the EU, UK, and Russian markets. This sector is expected to grow annually by 4.06% based on 2021-2025 CAGR.

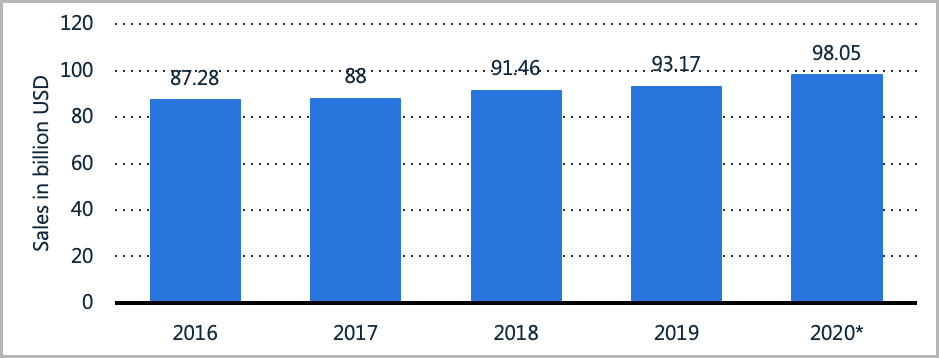

The Beauty & Personal Care market is defined as consumer goods for cosmetics and body care including beauty cosmetics for the face, lips, skincare products, fragrances, and personal care products such as hair care, deodorants, and shaving products. Beauty services such as hairdressers, professional products, and electric personal care products are excluded from this category. In 2020, US beauty and personal care department products generated sales valued at approximately 98.05 billion USD (Refer to Graph 1).

Graph 1 : Retail sales of beauty and personal care products in the United States (in billion USD)

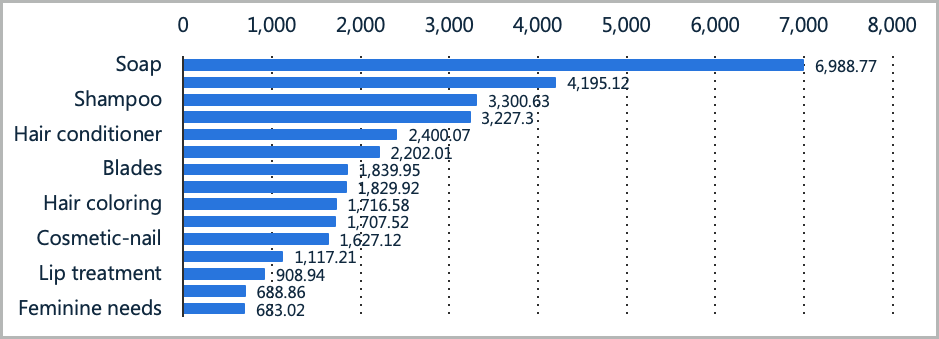

The leading beauty care product category in the US in 2020 based on sales was soap. The sales of soap generated almost seven billion USD. Soap, toothpaste, shampoo, and hair conditioner were among the most commonly purchased products by American consumers that year. These are some of the essentials that may be found in each American household, regardless of age or gender (Refer to Graph 2).

Graph 2 : Leading health and beauty care product categories in the United States in 2020, based on sales (in million USD)

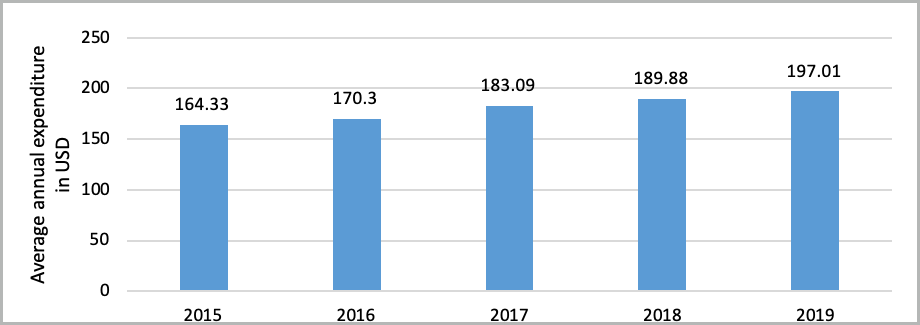

In US, the average yearly expenditure on cosmetics, perfume, and bath preparation items per consumer unit was around 197 USD in 2019 (Refer to Graph 3). When it comes to shopping, Americans frequently go to retail stores like Walmart or Target, as well as pharmaceutical companies like CVS, to purchase their favourite items.

Graph 3 : Average annual expenditure on cosmetics, perfume, and bath preparation products per consumer unit in the United States (USD)

The growing popularity of e-commerce also contributes to the growth in the US beauty and personal care products market. These are some of the fast-moving consumer goods most purchased via online platforms. According to an analysis by P&S Intelligence, the number of internet users in the US is growing. In 2019 alone, there were 312 million internet users in the US. This growth trend is one of the reasons the US beauty and personal care product segments are expected to grow to USD 128.7 billion in 2030. The US Department of Commerce estimates e-commerce to have accounted for 16% of all retail sales in the nation in 2019.

Opportunities for Palm Oil

The US personal care market is thriving and is one of the fastest-growing consumer markets, driven in particular by the cosmetics and skincare segments. Growth is driven by young and aspirational population who want to invest in grooming, looking beautiful, and maintaining their health in the process. Social media, internationality, and eCommerce encourage this shift, which has a long-term impact on beauty product purchasing behaviour. The rise of beauty influences is boosted by social media exposure that acts as a positive word of mouth and effective marketing tool. Trends from across the world are influencing and transforming our everyday beauty and grooming routines.

Natural and organic cosmetic products are gaining high prominence in this region with the increasing awareness and growing preference for luxury personal care brands. Factors, such as consumer knowledge and an increase in awareness of products about the benefits of organics products and services, through digital media and other sources, are adding to the growth in the region. As a result, the demand for these items is increasing.

Increasing preference for natural-based products is likely to become more prominent in the US in the coming years. Manufacturers of personal care and beauty products are looking at the opportunity of expanding the use of vegetable-based products in their formulations and applications. This new production approach is strongly supported by the rising consumer demand towards responsibly produced, natural goods, and sustainable products.

Furthermore, growing concerns over environmental and health associated with the damaging effects associated with petrochemicals are changing the consumers’ perception. This led to the consumers’ preference for eco-friendly, sustainably produced products, shifting away from the usage of harmful products.

The growth in beauty and personal care products in the U.S. could be the driving force in the expansion of palm-based oleochemicals. Malaysia exported a total of 492,193 MT of palm oil and palm products to the U.S.A. for the period of Jan-Sept 2021 where palm-based oleo consisted of 47.8% or 235,529 MT from the total (Refer to Chart 4).

Chart 4 : Malaysian Palm Oil and Palm Products Exported to US

| Product Group | Jan-Sept 2021 (Tonnes) | Jan-Sept 2020 (Tonnes) | Diff (MT) | Diff (%) |

|---|---|---|---|---|

| FINISHED PRODUCTS | 10,958 | 14,085 | (3,127) | (22.2) |

| PALM KERNEL OIL | 27,950 | 61,711 | (33,761) | (54.7) |

| PALM OIL | 217,587 | 433,955 | (216,368) | (49.9) |

| PALM-BASED BIODIESEL | 169 | 15 | 154 | 993.0 |

| PALM-BASED OLEO | 235,529 | 265,547 | (30,018) | (11.3) |

| Grand Total | 492,193 | 775,314 | (283,121) | (36.5) |

Source: MPOB

In the year 2020, Malaysia’s palm-based oleochemical products exported to the US amounted to 321,287 MT with a total value of RM 1.43 billion. The main export product was palmitic acid which accounted for 21.1% of the export volume, followed by refined glycerine at 19.6%. Other top palm-based oleochemical products include lauryl-stearyl alcohol, calcium stearate, stearic acid, and stearyl alcohol.

Oleochemicals Demand Outlook

The beauty and personal care market is primarily driven by the increasing demand for sustainable chemicals across industries. Many companies have started shifting from petrochemicals to oleochemicals in their production process due to the renewable nature of these raw materials. The escalating prices of petrochemicals may also increase the uptake of oleochemicals in the U.S. and across the globe. The enhanced focus on sustainable development is expected to provide an impetus to the growth in the oleochemicals market in the U.S.

The implementation of stringent government rules and regulations associated with the use of petrochemicals in the manufacturing process will stimulate the growth of oleochemicals in the US. The growth trend will also be supported by the increasing demand for sustainable and biodegradable products aimed at reducing the dependence on petrochemicals.

Moreover, the high costs of petrochemical products and shifting preference for eco-friendly products will further boost the demand for oleochemicals in the U.S. over the coming years.

Demand for personal care products is increasing, supported by increasing disposable incomes, product innovation, and high market penetration. Moreover, owing to the focus on sustainable and biodegradable products to reduce reliance on petrochemicals, there is a growing demand for sustainable solutions and bio-degradable products. This will in turn create growth opportunities for palm-based oleochemicals.

Finally, the push for stricter environmental and health regulations and the depletion of non-renewable resources will stimulate the growth of oleochemicals as sustainable alternatives. This demand growth will be supported by the availability of the supply of oleochemicals raw materials and the growing consumer demand for less harmful product alternatives.

Prepared by Zainuddin Hassan and Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.