The blow of the Coronavirus to Italy was fast and furious. The long-term effects on an already fragile economy are feared to be traumatic. The following is a first tentative assessment.

The Italian COVID-19 Scenario

The outbreak of the Coronavirus in Europe began in Italy. Around the middle of February, first cases of infections were reported in the northern regions of Lombardy and Veneto.

The virus spread rapidly. Only one month later, on March 19, 2020, Italy counted more victims than China, a total of 3,405.

The health care system in many northern Italian provinces is so overburdened that patients often cannot be treated adequately. In numerous places, protective masks are not available. That is one of the reasons why much medical staff has become infected with the virus. Several have died.

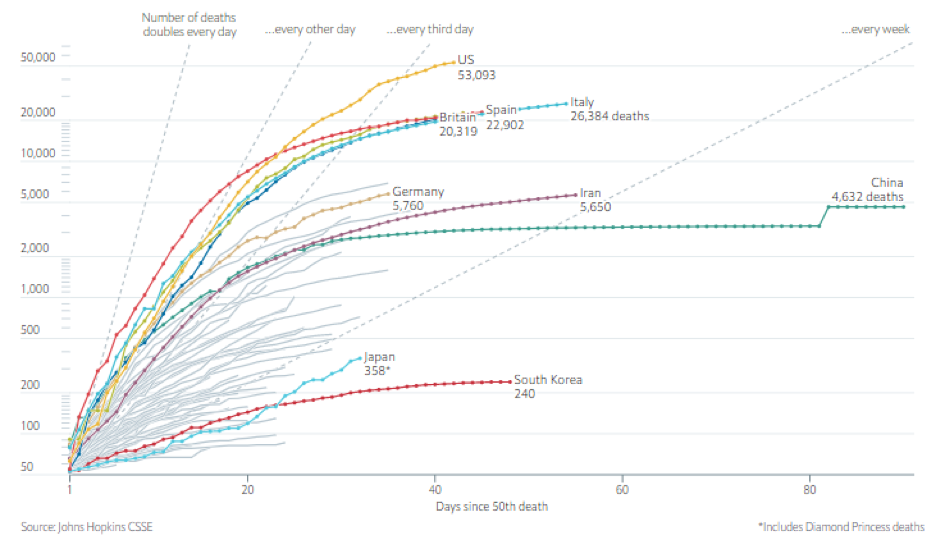

As of April 27 and according to data provided by the Johns Hopkins University, Italy reported close to 198,000 confirmed COVID-19 cases. That is 3rd place worldwide, only after the USA (966,000) and Spain (226,000). In terms of deaths attributed to the virus, Italy ranks second after the US with 26,644 fatalities (see graph).

The trajectory of mortality due to COVID-19 in select countries

In reaction to the spread of the Coronavirus, the Italian government implemented some of the harshest restrictions in all of Europe.

Schools, restaurants, parks, and tourist sites are still closed. Until at least May 4, 2020, leaving one’s own home is only permitted in exceptional cases such as food shopping, a visit to the doctor, or in case of urgent professional needs. Violations are subject to hefty fines.

End of April, there are reports of a cautious easing of the most stringent measures. For example, the textile and fashion industry – crucial to Northern Italy’s economy – are expected to resume operations on May 4, with shops expected to reopen a week later. Bars, restaurants, and hairdressers will be allowed to receive customers again from May 18 onward. Schools, however, will remain closed until September.

Economic Impact

The harm COVID-19 inflicts on the Italian economy is disastrous.

At present, some 2.1 million companies are officially closed down. These typically generate around 40 percent of the country’s value-added. According to a survey by the industry association Confindustria, 43 percent of employees in the manufacturing industry are inactive, and 26 percent are in their home office.

Italy is in emergency mode. What makes the situation worse is the fact that the Italian economy has been in dire straits even before the pandemic. The current crisis exposes and exacerbates the long-standing structural weaknesses of Italy. The British weekly The Economist sees these in three areas:

1) Vulnerable economic sectors.

Two sectors that contribute heavily to the Italian GDP – tourism and agriculture – are both extremely susceptible to disruptions due to COVID-19.

The effect on tourism is obvious given Europe-wide travel bans which, as of now, are expected to last well into the summer. In general, everything that is labor-intensive is under threat in a pandemic.

Take Italian agriculture. This critical export sector is highly dependent on seasonal auxiliary workers – on average, around 370 000 people per season. Most of them come from Eastern European countries and now cannot travel or decide to stay put out of fear to catch the virus.

As a result, there is a severe shortage of staff in this sector. According to estimates by producers’ association Coldiretti, this could lead to a loss of 25 % of the harvest.

2) Corporate Structure

Nearly 50 % of Italians work for firms with fewer than ten employees. In Britain, that number is 20 %, in the USA even less. The problem with that is that smaller companies generally have fewer resources to weather the storm. Also, many of them tend to be left behind in public support programs, which leads to the third weakness of the Italian economy.

3) Fiscal Support

Most of the rich nations in the world have reacted to the COVID-19 crisis by pouring public money on the economy in hopes of putting out the fire.

However, in the European Union, some governments have been burdened with high debt levels for years before Corona. So now they are forced to be thriftier. As a result, the average fiscal boost as a share of GDP in France, Spain, and Italy is about a fourth of that provided in Germany (see table).

Fiscal stimulus in response to COVID-19 as % of GDP (as of April 2020)

These three factors combined lead to a less than bleak outlook for the Italian economy. At the end of March Confindustria published a prediction for 2020 and 2021 that is summarized in the following table.

Italian Economic Outlook – key variables:

| 2020 | 2021 | |

|---|---|---|

| Gross Domestic Product (GDP) | -6,0 | 3,5 |

| Private Consumption | -6,8 | 3,5 |

| Gross Capital Investment | -10,6 | 5,1 |

| Exports | -5,1 | 3,6 |

| Public Debt as % of GDP | 5,0 | 3,2 |

Source: Confindustria

It must be added that at the end of April, these projections already look outdated. Official estimates now put the drop in GDP as well as the level of public debt at 10%.

Palm Oil Outlook

At this point, it is not possible to quantify the effects the Corona crisis may have on Italian trade and consumption of palm oil.

What is clear, however, is that – similar to most European countries – the extensive lockdown measures Italy has taken will hurt the consumption of palm oil as well.

As Italy is one of Europe’s largest producers of biofuels and palm oil is one of the most widely used feedstock, that sector may be used as a proxy to gauge the possible effects.

Data published by the Italian fuel industry association Unione Petrolifera shows a decline in automotive fuel consumption of 43% compared to March 2019. Gasoline fell by 52%. Jet fuel by over 66%.

However, it is essential to note that these numbers do not reflect the expected much stronger slump in April after the lockdown measures were extended from regions to the country as a whole. Thus, Unione Petrolifera, in first estimates for April, expects a drop in petrol and diesel demand for passenger transport of 75% and 50% for freight transport diesel.

In a related development, reports indicate that large cities in northern Italy like Milan plan to restrict transport also after the worst of the COVID-19 crisis is over. The reason are claims that the persistent poor air quality of Italy’s financial capital contributed to the high volume of deaths from COVID-19 respiratory disease.

ENI, the Italian manufacturer of around 1.3 million tons of biofuel at plants near Venice and in Sicily, is already feeling the consequences. The company published its first-quarter results on April 21 and announced the implementation of widespread initiatives to save approximately Euro 600 million of expenses in 2020 in response to COVID-19.

The Malaysian Palm Oil Board (MPOB) reports that Malaysian exports to Italy have dropped by 21 percent in the first quarter of 2020 compared to the same period in 2019 (down to 100,237 MT compared to 126,613 MT).

Again, one must bear in mind that these figures reflect the period before the full impact of the Coronavirus on the Italian economy could be measured.

Prepared by Uthaya Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.