The impact of trade agreements on enhancement of trade flows is undeniable. These agreements or treaties are signed between two trading nations or among regional trading partners to lower trade barriers by reducing or removing tariffs, thus enhancing free flow of trade and giving preference to each other’s items. This provides trading partners with a competitive edge and encourages economic growth.

Commodities like edible oil, oilseed, crude oil and other related items, which are usually traded in very high volumes, tend to show an immediate and positive response to any advantage received through such trade agreements. Malaysia has entered into several trade agreements which are both bilateral and multilateral. These agreements have enabled the Malaysian palm oil industry to take a leading supplier position in those particular markets.

Pakistan is among the countries where Malaysia entered into a preferential trade agreement in 2008. The Comprehensive Free Trade Agreement (FTA) for Closer Economic Partnership between Pakistan and Malaysia was signed in November 2007 and came into effect from January 1, 2008. The bilateral trade between the two countries increased significantly in the following years which was mainly due to the increase in palm oil exports from Malaysia to Pakistan.

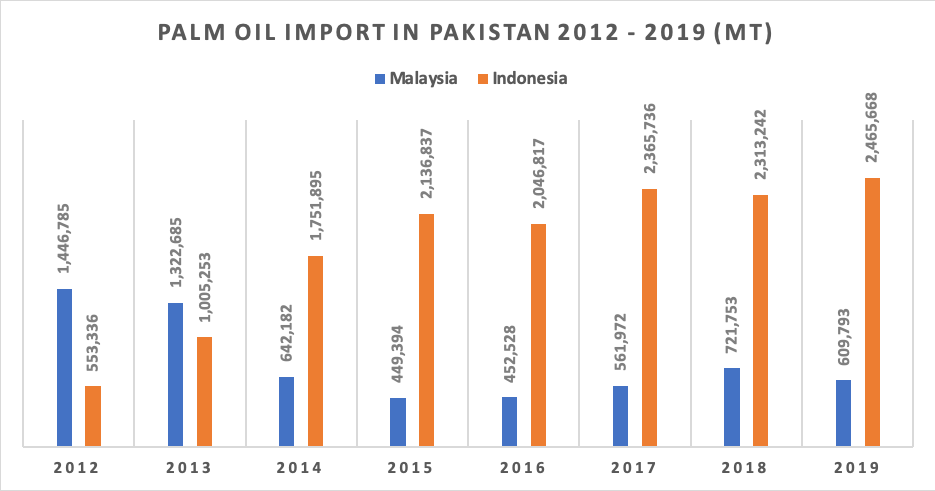

Pakistan is a net importer of edible oil and palm oil constitutes more than 95% of the total imports of oils and fats. Indonesian exporters started tapping into the Pakistani market in early 2000 and by the end of 2006, their market share rose to approximately 50%. The following chart shows the steady increase in the exports of Indonesian palm oil to Pakistan and the shift in the market trend after the Malaysia – Pakistan FTA came into effect:

Source: Shipping Agents’ Vessel Report

The FTA between Malaysian and Pakistan gave a duty advantage of 10% on the imports of palm oil from Malaysia for the first two years and 15% from third year onwards. This duty discount translated to a USD 15 – 18 per MT advantage on importing palm oil form Malaysia as compared to Indonesia. This discount shifted the buying preference in favour of Malaysia and Malaysian share in Pakistan was seen climbing from 61% in 2007 to 74% in 2008; 88% in 2009 and 97% in 2010.

Malaysian suppliers enjoyed preferential duty in Pakistan from January 2008 till September 2013 and during this period palm oil trade was largely dominated by Malaysian suppliers. The market situation changed from 1 September 2013 when the Preferential Trade Agreement (PTA) between Pakistan and Indonesia came into effect. Under this agreement Indonesia granted access to leading export products from Pakistan including textiles, cotton yarn, sports good, leather good and other industrial products and in return Pakistan provided 15% duty advantage on the import of palm oil besides giving access to a wide range of products coming in from Indonesia.

Source: Shipping Agents’ Vessel Report

The PTA between Pakistan and Indonesia came into effect at a time when palm oil trade was under a lot of pressure and suppliers were fighting for volumes. The share of Indonesia in palm oil imports in Pakistan started increasing after the export duty adjustment in Indonesia in the last quarter of 2011, which made the exports of refined palm oil more competitive. This export duty adjustment coupled with a 15% duty discount through the PTA turned the market completely in favour of Indonesia. Consequently, Malaysia’s share in Pakistan declined from 72% in 2012 to 26% in 2014.

It is essential that trade agreements should come under review periodically to ensure that enough opportunities are being provided to goods and services of both countries to access a larger customer base in the trade partners’ respective markets. These review processes also provide an opportunity to negotiate a further reduction of duties on existing and additional tariff lines under the FTA to facilitate business communities of both countries.

Prepared by Faisal Iqbal

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.