PETALING JAYA: Despite the gradual return of foreign workers to the oil palm plantation sector, industry experts remain sceptical of potential growth in terms of crude palm oil (CPO) production this year.

While CPO production is set to improve in 2023, Malaysian Palm Oil Association (MPOA) chief executive Joseph Tek Choon Yee said the growth would be lower versus the past decades.

“There is already a dearth of new mature areas following significant slowdown in most new oil palm plantings in the estates nationwide,” he told StarBiz.

Furthermore, the reduction in fertiliser application over the past consecutive years coupled with erratic weather patterns would further exert negative impacts on the palm oil yields, Tek pointed out.

“Crop recovery will be slow if the labour shortage is still not resolved soon,” he said.

As highlighted by the Malaysian Estate Owners Association recently, the plantation sector would continue to struggle with the shortage of 200,000 foreign workers in 2023.

As of Oct 3, 2022, only 56,282 recruitment applications had been approved for the plantation sector but unfortunately they translated to an actual realised entry of 12,390 foreign workers.Given the serious lack of palm fruit harvesters in the estates, industry experts said the CPO output would likely register another flat growth of around 18.5 million to 19 million tonnes in 2023.

Tek also cautioned that the performance barometer for the palm oil sector would also be affected this year by policies of both producing and consuming countries, including the European Union’s discriminatory ban on palm oil products, biofuel rollouts especially in Indonesia, competing edible oils and other weather uncertainties.

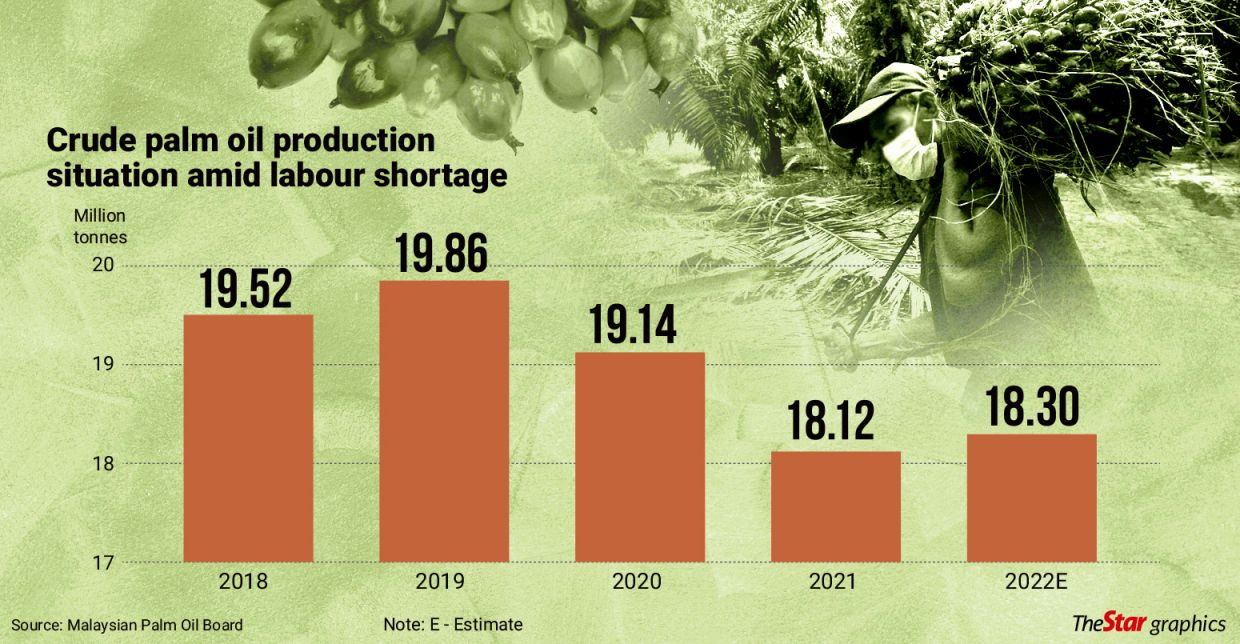

Meanwhile, the Malaysian Palm Oil Board (MPOB) has projected CPO production in 2022 to perform slightly better than in 2021.

The national palm oil custodian expects domestic output to hit 18.30 million tonnes in 2022 from 18.12 million tonnes a year earlier – after two consecutive years of flat growth.

MPOB is expected to release the official full year 2022 palm oil statistics including CPO production, exports, imports and average price at its palm oil economic review and outlook seminar on Thursday.

Prominent speakers at the seminar will also deliberate on the industry’s prospect, CPO price outlook and market developments for 2023 and beyond.

When contacted by StarBiz, MPOB director-general Datuk Dr Ahmad Parveez Ghulam Kadir said: “We are expecting CPO production to perform better in 2023 compared with 2022.

“We will reveal our projections for 2023 at the seminar.”

He opined that the improvement in CPO production would help to ease the tight supply situation that occurred during the first half of 2022 and consequently help to stabilise the CPO price this year.

On the demand side, MPOB is expecting a stronger demand for palm oil in 2023, according to Parveez.

“The continuous concern over the Ukraine-Russia war is expected to further support demand for palm oil in 2023.

“However, this stronger demand is expected to limit the downside risk of the CPO price given the higher production,” explained Parveez.

Industry expert MR Chandran also expects some recovery in the local CPO production in 2023.

This is given that the global CPO production for 2023 is forecast to be 81.4 million tonnes or a production growth of nearly 4% year-on-year (y-o-y).

Oil World, in its latest forecast, has slated global palm oil output to grow by 2.9 million tonnes to 80.2 million tonnes in the October/September 2022/2023 marketing year compared with an increase by 1.2 million tonnes in the 2021/2022 period.

For the period under review, Oil World expects Indonesia to take the lead up by 2.2 million tonnes to 47.7 million tonnes, followed by Malaysia, rising marginally 300,000 tonnes to 18.5 million tonnes, and the rest of world adding 400,000 tonnes to 14 million tonnes.

The stock-to-usage ratio projection for palm oil of 20.0% for 2022/2023 compared with 20.4% in 2021/2022 is well above the five-year historical average of 18.7%.

Maybank Investment Bank (Maybank IB) Research, in its latest report, projected a muted outlook for the plantation sector this year due to the lingering uncertainties and challenges.

“There is still uncertainties in the current normalised supply forecast by the market as the La Nina weather phenomenon is still here.

“This is the third consecutive year although the weather may turn neutral by the end of first quarter of 2023, and it remains unclear if Malaysia-based planters would get sufficient foreign workers this year to boost output,” Maybank IB pointed out.

Source : The Star