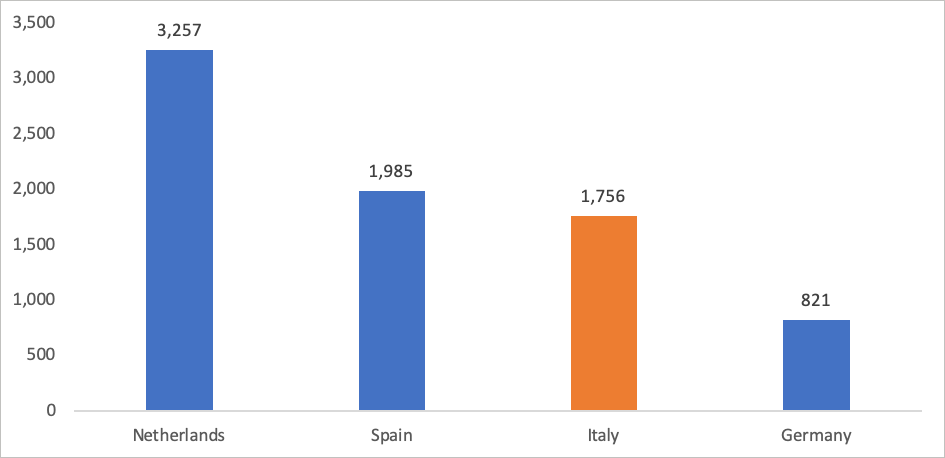

Figure 1: The EU’s four largest palm oil importers 2019 (‘000 MT)

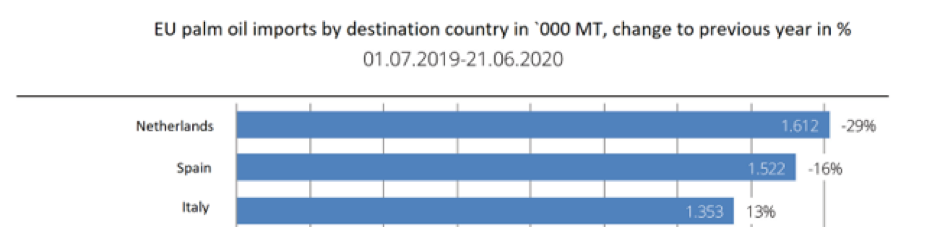

The first wave of Covid-19 in the spring of 2020 hit Europe hard. Italy was the first country affected and its economic heartland, Lombardy, took a severe beating. But while the pandemic-induced woes led in countries like the Netherlands (- 29%) and Spain ( -16%) to a stark drop in palm oil imports, in Italy, they surprisingly grew by 13 % (Figure 2).

Figure 2

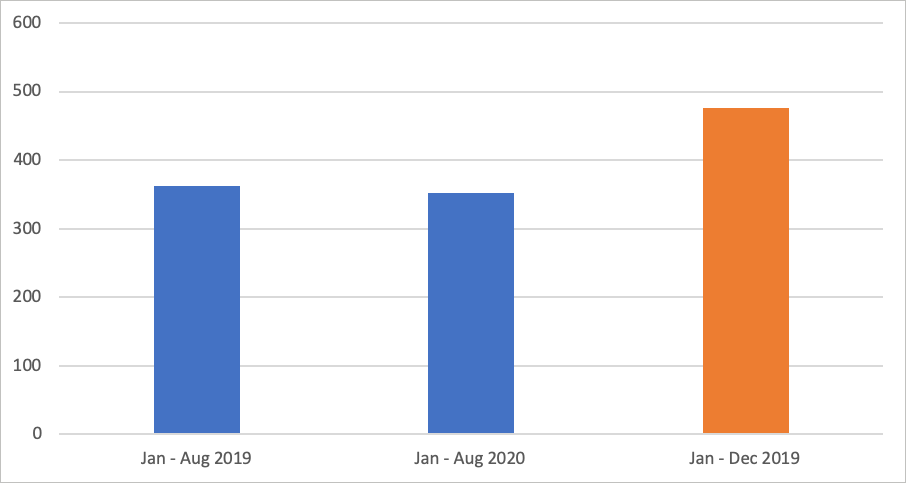

Palm oil exports from Malaysia have by and large been able to weather the Covid-19 storm. For the periods January through August 2019 and 2020, respectively, the Malaysian Palm Oil Board (MPOB) calculated a drop in exports to Italy of a comparatively mild 2.76 %, equivalent to 10 thousand MT.

Figure 3: Malaysian palm oil exports to Italy (MT)

According to the Unione Italiana Olio di Palma Sostenibile around 80 % of the quantities imported go to “industrial technical uses.” Most of that is biodiesel and energy production (Figure 4). And it is there, where the trouble for palm oil starts.

Figure 4:

Eni’s plight may just be the beginning

Eni S.p.A. is an Italian oil and energy group based in Rome. It is one of Europe’s largest and most profitable groups, with a turnover of close to 70 billion Euros in 2019. Eni is also among the leading European biofuel producers.

A 30% stake of the Italian government in Eni did not save the company from getting into trouble with the authorities in early 2020. In January that year, the Italian Competition and Market Authority (AGCM) slapped the energy giant with a EUR 5 million fine for misleading advertising. According to the Wall Street Journal, the amount represents the highest possible penalty.

That ruling attracted quite a bit of attention. It is considered the first against “greenwashing” in Italian history. Greenwashing is a critical term for PR methods that aim to give a company an environmentally friendly and responsible image in the public eye without sufficient evidence.

What had happened? A couple of years ago, Eni had introduced “Diesel+,” a new product made from hydrogenated vegetable oil (HVO) at its refinery in Venice. The raw material used for the HVO is crude palm oil and derivates such as PFAD (palm fatty acid distillate).

In its advertising, Eni marketed Diesel+ as “green diesel” and “renewable.” The AGCM considered that misleading, mainly because of the indirect land-use change (ILUC) associated with palm oil.

The ruling is particularly noteworthy against the background that all feedstock used for biofuels must be certified sustainable in the EU. In this case, the palm oil imported by Italy is approved by the International Sustainability & Carbon Certification (ISCC), according to the Unione Italiana Olio di Palma Sostenibile.

Following the AGCM decision, Eni announced in May 2020 that it would stop using palm oil in biodiesel production by 2023. NGO Transport & Environment complimented that decision with the following image and the caption “Death by palm oil diesel”.

In its Long-Term Strategic Plan to 2050 and Action Plan 2020-2023, Eni states:

“Refining: gradual conversion of Italian sites by focusing on new technologies for the production of decarbonised products from the recycling of waste materials. Increase in bio-refining capacity to 5 million MT per year, palm-oil free from 2023, 7 years ahead of the EU ban.”

What next for palm oil in Italy?

Although a big player, Eni is, of course, not the only biofuels producer in Italy. Still, exporters of the commodity will feel the impact of its decision to stop using palm. According to market reports, in 2019, Eni refined 242,000 MT of palm oil -roughly one-fifth of total imports – and 23,000 MT of POME (palm oil mill effluent) into biofuels.

Given that EU lawmakers in the RED-II, the revised version of the EU’s Renewable Energy Directive, decided to phase out palm oil in biodiesel by 2030, it is clear that the days for that line of business are numbered. However, import levels reached in 2019 define the quota for the period between 2023 and 2030.

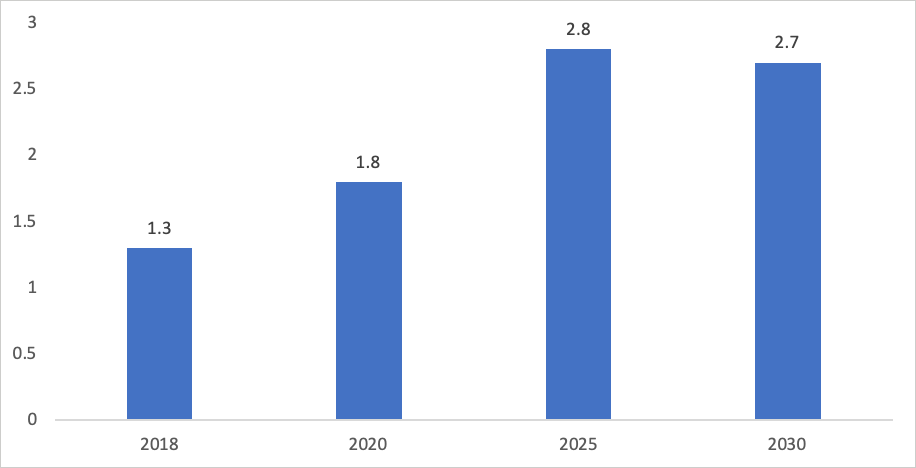

Therefore, the overall increase in Italian palm oil imports in 2019 may point to an attempt to keep options open until 2023. Until 2030 arrives in nine years, there might be a little breathing room for Malaysian palm oil exporters, especially since projections show growth in Italian biofuel production of one million MT between 2020 and 2025 (Figure 5).

Figure 5: Estimated production of biofuel in Italy in selected years (in million MT)

The small portion of palm oil used in non-technical applications (food and cosmetics) in Italy may be more reason for immediate concern.

Conclusion: “It ain´t over till it´s over.”

It is interesting to note that Eni, on its corporate website, mentions castor oil as an alternative for palm oil from 2023 onward. Castor oil, too, is very versatile in its applications. It is suitable for biodiesel, especially when used in colder climes. That is due to its low cloud and pour points.

On the other hand, castor oil is extracted from the Ricinus plant, which, just like the oil palm, only grows in tropical regions. Its yields per hectare are far below those of palm oil, and global supply is limited. According to this source, market volume in 2019 reached 790,000 MT.

Therefore, the strategy pursued by Eni to substitute palm for castor oil does not seem promising. If castor were to gain more traction and production (and thus cultivated are in the tropics) were to expand, it would face the same sustainability challenges as palm oil.

That points to an ugly truth regarding sustainability legislation in European transport. The problem is not palm oil but the 300+ million cars, trucks, and busses on European streets. According to this source, the EU has 610 motor vehicles per 1,000 inhabitants. So everybody can ride in the front seats. But less than 5% of that is powered by an alternative, i.e., non-fossil fuel.

Technologies to increase that portion include battery-power, second-generation biofuels, and hydrogen or ethanol made from straw or algae. But none of those solutions comes without environmental problems on their own.

In this context, it is worth recalling that the RED II includes an exemption provision for feedstock that is considered low-ILUC risk. The conclusion for the Malaysian palm oil industry may be to relentlessly pursue efforts to get its (MSPO-certified) sustainable palm oil recognized as low ILUC-risk in Europe.

The last word in that regard may not yet be spoken. The ever more ambitious emission reduction targets in the EU for greenhouse gases remain in place. They imply a growing demand for biodiesel in the big European markets like France and Germany. And it is still unclear how that demand can be met without palm oil.

Appendix: The Italian Market for Palm Oil in Numbers

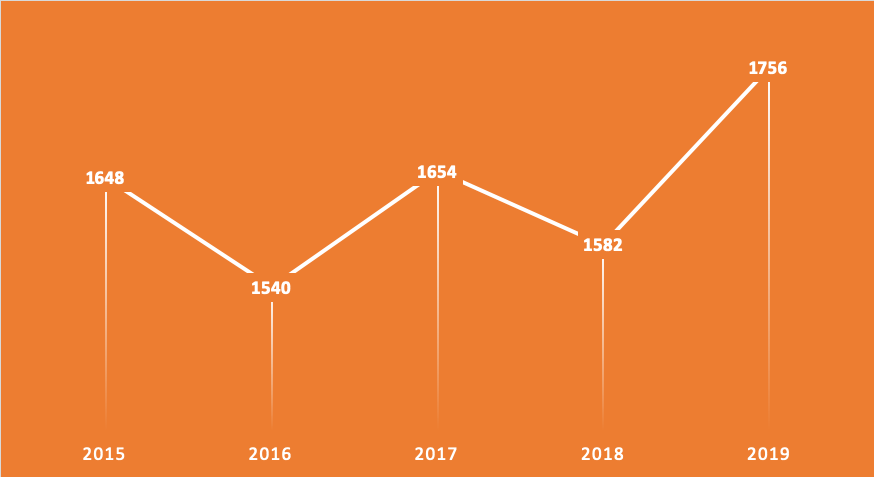

Total palm oil imports into Italy reached a five-year high in 2019.

Figure 6: Italy – total palm oil imports (‘000 MT)

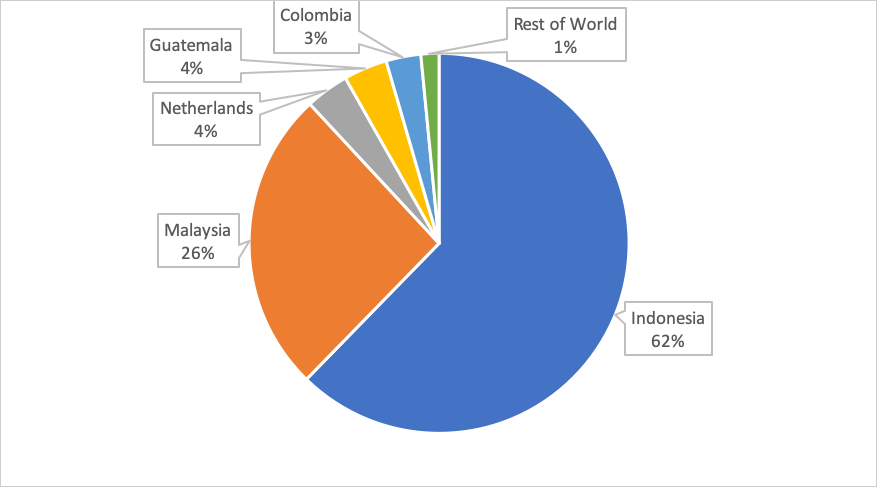

In 2019 as well as in previous years, Indonesia dominated import quantities.

Figure 7: Italy – 2019 total palm oil imports by country of origin (percentage of trade volume)

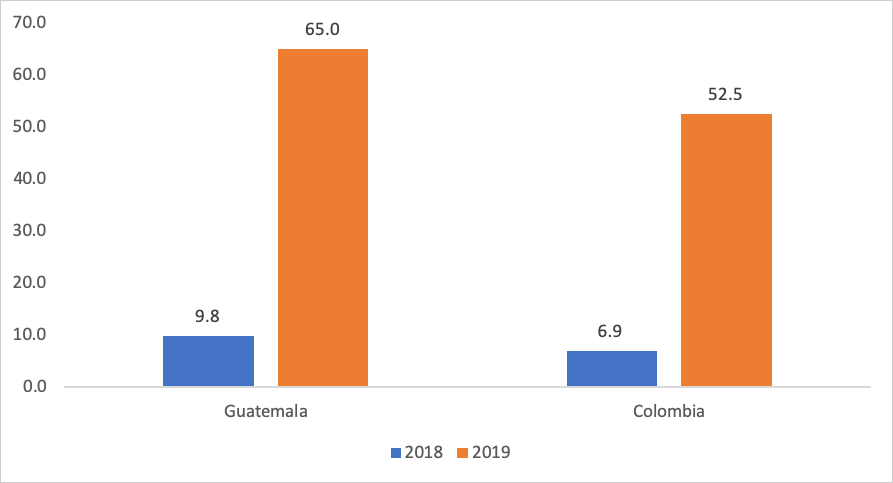

Starting from a low base, Guatemala and Colombia could strongly grow their exports to Italy. Until 2017 both countries did not register any.

Figure 8: Italy – palm oil imports from Guatemala and Colombia (‘000 MT)

Prepared by Uthaya Kumar

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.