For decades the United States remained the largest market for vegetable oils, accounted for approximately 80% of volumetric share in North American vegetable oils market. US dominates the oils and fats regional market, owing to its high consumption and export of oils. Palm oil consumption consumptions have experienced a rapid growth since 2002. Malaysia dominated the US palm oil market for many years before the emergence of Indonesia as the front runner in the export market. Often plagued by unfounded forced labour and environmental issues, Malaysia is currently taking a back seat in the export market to the US.

The recent market research published by Research and Market (R&M) showed that palm oil market in the US is estimated at US$11.9 Billion in the year 2021. The US currently accounts for about 26.9% share in the global market. The US also constitutes the largest regional market for palm kernel oil segment, accounting for 28.8% of the global sales in 2020, which is estimated at US$10.2 Billion.

The R&M also report that the future growth in the market will be driven by growing prominence of certified sustainable palm oil (CSPO) against the backdrop of public concerns over environmental and deforestation issues related to palm oil cultivation.

According to the earliest recorded data published by the research group IndexMundi, palm oil has gained access into the US market since 1965. Import volumes have grown steadily over the years and recorded a huge leap in imports between 2002 and 2008.

Analysis of US Palm Oil Imports

According to the WorldCity analysis of the latest US Census Bureau data, US imports of palm oil increased 20.24 percent from $528.75 million to $635.78 million through the first six months of 2021 when compared to the same period last year.

The latest US Census Bureau import data showed that for January-June 2021, total US palm oil imports amounted to 679,000 tonnes. Palm oil imports from Indonesia constitute 78% of the total imports or about 537,000 tonnes. Malaysia’s market share was 18% or 122,000 tonnes. The top five suppliers were (1) Indonesia, (2) Malaysia, (3) Colombia, (4) Mexico and (5) Ecuador.

In 2020, US imports of palm oil amounted to 1.44 million tonnes. Malaysia’s palm oil import share into the US was 34% or about 495,000 tonnes. Last year, US palm oil consumption constituted about 6% of the total oils and fats consumption. Malaysia’s palm oil exports to the US only made up 3% – or equivalent to 540,349 tonnes of the total global exports from January to December 2020.

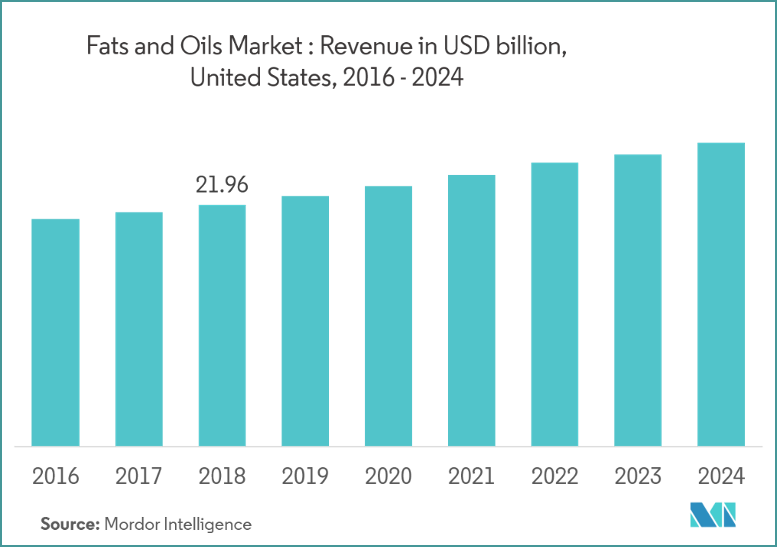

Despite having a large domestic production, the U.S. remained a net importer of oils and fats. In 2020, US total oils and fats imports amounted to 5.34 Mn T. Palm oil imports constitute 28 percent of the total imports.

Malaysia’s Palm Oil Exports to the US

Over the past decades, Malaysian palm oil industry has weathered numerous challenges which has an impact on the marketability of the product worldwide. The palm oil industry has also been subjected to constant public relations attacks which led to negative sentiments and, in some cases, affected the demand for palm oil-based products. These anti palm oil social media campaigns targeted issues related to the industry’s effect on the environment, health (based on a misunderstanding of palm oil products), human rights, and forced labour. Since Malaysia is heavily reliant on palm oil exports, these challenges have some negative impacts on the export markets.

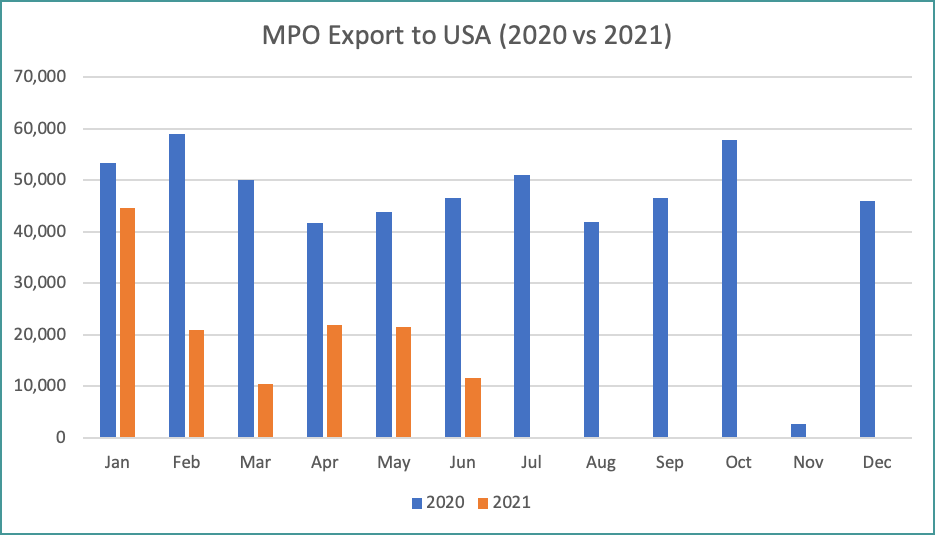

Malaysia’s palm oil exports to the US took a downturn since early this year. This downward trend coincides with the decision by the US Customs and Border Protection (CBP) to issue the Withhold Release Order (WRO) in late last year against two of Malaysia’s biggest producers and exporters of palm oil.

Palm oil exports from Malaysia to the US already showed a significant decrease in Jan-June this year. Total palm oil exports to the US in Jan-June 2021 decreased by 163,345 MT or about 55.5 percent compared to the total export volume of 294,390 MT recorded during the same period last year.

Based on industry feedback, the decline of palm oil imports from Malaysia was partly due to the misunderstanding among US industry players that the WRO was imposed on all palm oil produced in Malaysia instead of it only applicable to the affected companies named in the WRO. US importers are also concerned that the supply chain of palm oil imports and shipments from Malaysia may contain some palm oil supply from the two companies affected by the WRO. Some industry players have decided to totally avoid messing up with the WRO rulings and avoid buying from Malaysia for now, until the WRO issue is fully resolved.

Industry analysts viewed the ban by the US CBP as severe because this is literally a ban by the US government. Due to its position as the world’s largest economy, the US influence is far reaching, and this could have an impact on Malaysia’s palm oil trade with some major export destinations around the globe.

Industry analysts forecast that US palm oil imports from Malaysia will continue a downward trend in the second half of 2021. According to industry experts, it will be a huge challenge for Malaysian companies to regain that lost market share, unless they are willing to sell their products at a huge discount.

Prepared by Zainuddin Hassan and Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.