End of Lockdown

With the lockdown in Wuhan lifted on 8 Apr, China could be considered a country where covid-19 outbreak is official under controlled. At the same time, recognizing the need to bring the economy back on track immediately, the country’s policymakers from central to local governments announced a series of measures and stimulus plans to boost the economy, covering all 3 sectors namely the primary, secondary & tertiary sectors. Among these 3 sectors, tertiary sector plays an important role as it encompasses the domestic consumption, which has been the top engine of growth focused by the Chinese government in recent years. According to China’s National Bureau of Statistic (NBS), domestic consumption continued to perform as the dominant driving force from demand side for six consecutive years in China. According to the data from NBS, the domestic consumption contributed 57.8% of GDP growth in 2019.

In order to boost the recovery in domestic consumption, the measures have been introduced to increase consumer’s spending such as online shopping, fairs with sharp discounts, meal vouchers to lure diners back to the restaurants, and many others. Similar measures worked when deployed during SARS outbreak in 2003 and partly led to fast recovery. But will it work the same way for covid-19, especially when the contribution of domestic consumption is playing more important role in economic growth these days? It would be interesting for us to find out in Q2, after what has been considered a dismal economic performance for Q1 this year which contracted by 6.8% in Q1 2020. But many might be expecting that the attempt to revive the domestic consumption is achievable, given the fact that the containment of covid-19 outbreak took shorter time as compared to SARS outbreak.

Post-SARS – Learnings to Jump Start the Economy

SARS outbreak broke out in January 2003 and being contained by August of the same year. The virus killed 349 people in Mainland China, 300 in Hong Kong, 180 in Taiwan and about hundred more in the rest of the world. Hence, China was the epicenter of this outbreak and it impacted the economy situation due to its inexperience in handling such epidemic at that time. Subsequently, the GDP growth in Q2 of 2003 slowed from 11.1% (recorded in Q1) to 9.1%. Nevertheless, the economic rebounded immediately and achieved 10% growth in Q3 and Q4 respectively, and ended the full year with a strong performance of 10% in 2003.

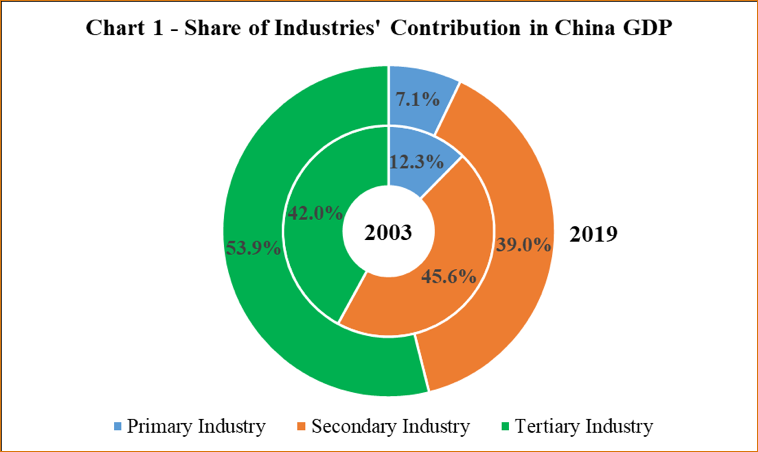

As mentioned earlier, various measures had been taken to boost the economy condition back then but equal attention was given in both tertiary and secondary sectors due to the contribution of both sectors that were equally important at that time. Nevertheless, for China to recover from covid-19, the emphasis given has to be slightly different.

This is in view of the growing importance of tertiary industry contribution to China’s economy currently, which mainly driven by domestic consumer consumption in goods and services. China’s economic structure has become more domestic consumption-led where tertiary industry is the main industry contributed the most to China’s economic growth. The output of China’s tertiary industry accounted for 53.9% of last year’s GDP and contributed 59.4% of national economic growth in the same year, NBS data showed. Back then, this sector only accounted 42.0% of GDP and contributed 39.0% of its growth in the year of SARS outbreak.

Note: Breakdown of primary and secondary industry for 2019 is not available.

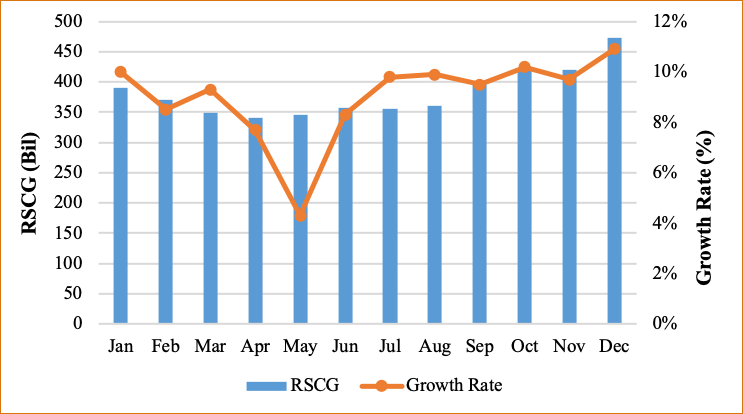

Retail Sales Rebounded Strongly Post-SARS

In 2003, the retail sales of consumer goods (RSCG) slowed down in May (when SARS cases was at its peak and Chinese government decided to close some of the public areas), but rebounded strongly in subsequent months and back to pre-SARS level by July. Similarly, the RSCG growth also slowed in Jan-Feb and improved a bit on M-o-M basis in Mar (-20.5% and -15.8%), but question is whether it could return to 8% pre-covid-19? It seems difficult as the macro environment was rather different between 2003 and now. Why?

Chart 3 – Total Retail Sales of Consumer Goods in 2003

Firstly, China’s economy was in a period of rapid growth since 2002, the year China acceded into WTO. Hence, after the SARS outbreak, China’s economy rebounded rapidly and GDP rose 10% that year in 2003. Subsequently, the country GDP growth maintain double-digit growth for next 4 years. In contrary, China’s economic growth was on a downtrend since 2011 and only managed to record 6.1% in 2019, the lowest after the country opened its door to the world since 90s. Hence, without the strong backing of the macro-environment, it may take longer for China to recover from the impact of Covid-19 this year. Latest data released by the National Bureau of Statistics (NBS) on 17 Apr showed that China’s GDP contracted by 6.8% year-on-year in the first quarter of 2020 amid covid-19 impact, and the International Monetary Fund (IMF) also forecasted that the pandemic would axed China’s GDP growth to only 1.2% in 2020 due to the worldwide spread of covid-19.

Secondly, according to the People’s Bank of China, total household deposit reached RMB87.8 trillion by end March 2020, an increase of RMB6.47 trillion as compared to last year. This is equivalent to RMB63,000 per capita, seems sufficient cash allowing Chinese consumers to go for shopping spree especially after staying at home for so long. However, the wealth in a society is normally being held based on Pareto Principle, where 20% of the people own 80% of total wealth (in this case the household deposit). In other word, it means 28 million Chinese residents among the total population of 1.4 billion have the per capita saving of over RMB 2.5 million and the rest of 1.12 billion Chinese have only approximately RMB 15,600 per person, or RMB46,800 for a family of 3. Nevertheless, the increase of deposit may have another meaning during this current scenario. As some of them are jobless or in anticipation of the arrival of poorer economic condition, most of them are holding back on spendings. Furthermore, the disposable income per capita fell for the first time in China’s history by 3.9% in Q1. As such, it is not difficult to imagine most Chinese would hold on to the cash instead of undertaking an impulsive consumption.

Lastly, the surveyed unemployment rate in urban areas stood at 5.9% in March, 6.2% in Feb and 5.3% in Jan of 2020, while the figures were 5.2%, 5.3% and 5.1% in the same period last year. Although there were a total of 2.29 million new urban jobs created in the first quarter of 2020, but it was down 950,000 over the same period last year, the NBS said.

To rub salt into the wound, China experienced a widespread factories closures with 460,000 Chinese companies closed in Q1 2020, according to Chinese commercial database Tianyancha. It showed that China added more than 3.22 million companies during the first three months, but was down 28.9% year-on-year. Which means, there is increase uncertainty in the job market and most Chinese would be more careful in spending despite the many tempting discount vouchers and great bargain coming to them. Without this impulsive consumption among Chinese on retail goods, the tertiary industry may keep the Chinese economy in trouble water for another quarter before full recovery seen.

In conclusion, the outlook of drastic increase in consumers spending or impulsive consumption to drive one of the economy engines in China may not be arriving soon, at least not in Q2 2020. Rather, we might see consumer’s confidence recovering fully in June and see the consumer spending matches or higher than last year in Q3. Till then, we may only see the demand of cooking oil from catering sector to partially recover and affect the demand of palm oil in Q2 2020.

Prepared By: Desmond Ng

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.