1. Introduction

Algeria is a leading market with a population of over 44 million. Located in Northern Africa, it is positioned at the point of convergence of three worlds: the Mediterranean, Arabia, and Africa, which allows Algeria to hold a strategic geographical position. Led by the oil and gas sector, the Algerian economy expanded by 3.9% year-on-year during the first nine months of 2021, after contracting by 5.5% in 2020. The recovery in hydrocarbon output was driven by surging European gas demand and the easing of OPEC production quotas.

Today, Algeria is the third-largest economy in the Middle East and North Africa (MENA) zone. Food accounts for an average of 42% of Algerian household spending. Among food products, the largest market segment is confectionery and snacks, with a market volume estimated to reach US$15.76m in 2022. Revenue is projected to show an annual growth rate (CAGR 2022-2025) of 22.24%, resulting in a projected market volume of US$28.79m by 2025. In this sector, the number of users is expected to amount to 2.1m users by 2025. User penetration will be 3.6% in 2022 and is expected to hit 4.4% by 2025. The average revenue per user (ARPU) is expected to amount to US$9.69.

2. Oils and Fats Market Situation

Algeria is a liquid oil market, dominated by soybean oil. Several reasons contribute to the huge demand for soybean oil imports, including the competitive price of soybean oil in the local market since soybean oil is exempted from customs duties and VAT, and the government also subsidises cooking oil that is produced from soybean oil.

While soybean is the dominant oil in the liquid oil market, palm oil is in a particularly superb position for the remaining 20% of the market (margarine 13%, biscuits & cheese 3% & vegetable ghee 2.7%). The vegetable ghee market is already dominated by palm oil, almost all the vegetable ghee (around 30,000 MT) produced in Algeria is palm-based. Though it is tough to penetrate the liquid oil market due to the dominance of soybean oil as the preferred oil of the consumers, there is still a window for palm olein to gain a foothold in industrial frying.

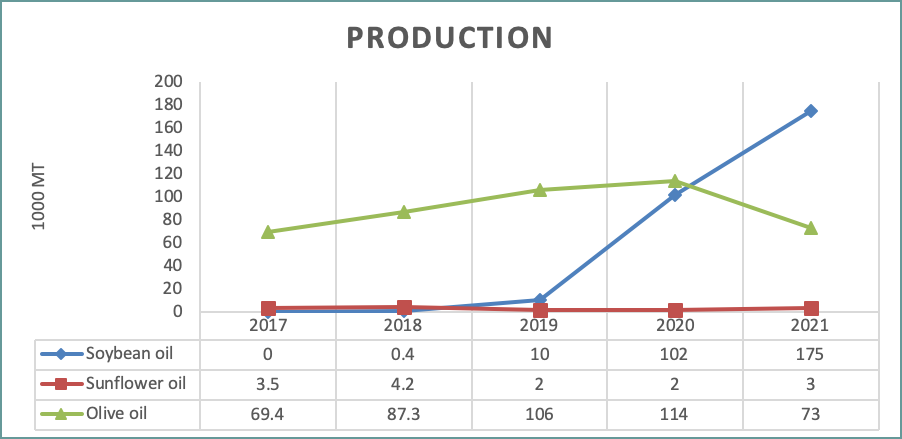

The Algerian oilseed cultivation is not well developed, because of former agricultural policies. Algeria’s production of soybean oil has been growing significantly since 2019, and it tremendously increased in 2020 and 2021 as compared to 2019. Soybean is currently the most produced oil with its share reaching 69%, followed by olive oil at 28.9%.

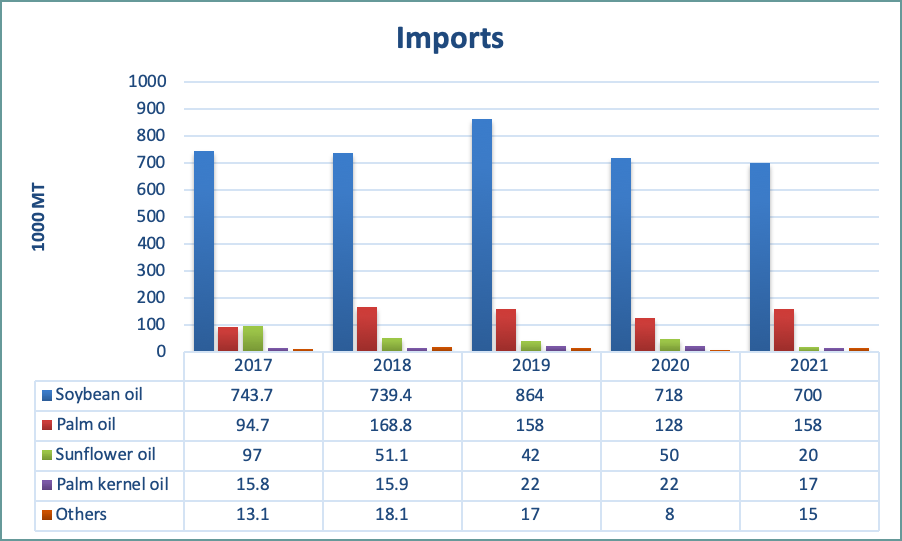

Most of the commercialised oil is produced domestically from imported crude oils and refined locally by two main refineries namely Enterprise National des Corps Gras (ENCG) and Cevital Group. Self-sufficiency is still far away. However, Algeria is expanding the crushing of soybean and has already managed to reduce the import of soybean oil, with this resulting in the reduction of the overall import of oils and fats starting 2020.

In 2021, the total import of oils and fats amounted to 910,000 tonnes; soybean oil as the major oil accounted for 77% of the total imports, followed by palm oil and sunflower oil; at 17.3% and 2.2%, respectively.

In 2021, the total consumption in Algeria stood at 1.06 million MT, with soybean as the major oil consumed at 760,000 tonnes, accounting for 71.2% of the total oil and fat consumption, followed by palm oil at 14.8%, olive oil at 7.8%, and sunflower at 3%. Algeria’s per capita consumption slightly decreased to 23.9 kg per annum in 2021, as compared to 24.4 kg per annum in 2020.

3. Malaysian Palm Oil Performance

The total Malaysian Palm Oil exports to Algeria in 2021, amounted to 65,647 tonnes, representing an increase of 18% as compared to exports in 2020. In 2021, palm oil was the most exported product representing around 39%, among which HRBD palm oil was the biggest figure amounting to 10,868 tonnes, RBD palm oil was recorded at 6,058 tonnes, and 5,359 tonnes for RBD palm stearin, followed by finished products with a share of 31%. Vegetable fat was the highest, recorded at 12,283 tonnes. Palm kernel share stood at 26% and oleochemicals share was at 4%.

| Table 3: Malaysia Export to Algeria by product (Tonnes) | |||||

|---|---|---|---|---|---|

| Product | 2021 | 2020 | 2019 | 2018 | 2017 |

| PALM OIL | 25,657 | 17,016 | 34,661 | 28,903 | 29,976 |

| PALM KERNEL OIL | 17,224 | 15,480 | 17,261 | 10,643 | 14,191 |

| OLEOCHEMICALS | 2,462 | 6,042 | 8,166 | 8,009 | 3,606 |

| FINISHED PRODUCTS | 20,305 | 17,163 | 23,078 | 15,327 | 6,951 |

| Total | 65,647 | 55,701 | 83,166 | 62,882 | 54,725 |

Source: MPOB

4. Import Duties

Algeria has an import duty and VAT system that is favourable towards soybean oil and seeds, with both having been exempted from duties and VAT since 2011 while all other oils are subjected to 19% VAT. Crude sunflower oil import duty for food use has been set at 5%, non-food is 15% whereas refined sunflower oil is subjected to 30%. Palm oil, whether crude or refined is subjected to 5% for food uses while 30% for other than food uses. It is observed that only fats with H.S. 1517 are subjected to low import duties at 5%, whereas others are subjected to 30%.

| Table 8: Import Duties | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Oil type/ import duties | Crude % | others % | ||||||||||||

| Food | Others | Import Duty | VAT | |||||||||||

| Import Duty | VAT | Import Duty | VAT | |||||||||||

| Soybean oil | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||

| Sunflower oil | 5 | 19 | 15 | 19 | 30 | 19 | ||||||||

| Oil Type/ import duties | Crude % | others % | ||||||||||||

| Food | Others | Food | Others | |||||||||||

| Import Duty | VAT | Import Duty | VAT | Import Duty | VAT | Import Duty | VAT | |||||||

| Palm oil | 5 | 19 | 15 | 19 | 5 | 19 | 30 | 19 | ||||||

Source: Local Authority/Importers

5. Margarine Sector

Margarine is very popular in Algeria among consumers and food manufacturers. It has also been leading the sales in its category as compared to butter and cooking fats for the past six years, and it is forecasted to continue to lead and grow until 2025. The main reason is the affordability of the margarine as compared to the expensive butter (tentatively five times the price of margarine), which the price-sensitive Algerian consumers finds attractive. Two types of margarine are widely produced in Algeria; the table margarine which is used in pastry and cooking, and puff pastry margarine that is used in confectionery and snacks. The total margarine production in Algeria stands at around 140,000 tonnes per year, the palm-based margarine constitutes 70 to75% of the market share. Most of the margarine in Algeria is hydrogenated and recently there has been a shift towards non-hydrogenated margarine that is made by producers such as Cevital, La belle, and Mateg. Currently, manufacturers use hydrogenated soybean oil or palm oil in the production of margarine.

| Table 1: Margarine Production | ||

|---|---|---|

| Product | Quantities (MT) | Palm-based |

| Table Margarine | 90,000 | 70% |

| Puff Pastry Margarine | 50,000 | 75% |

| Total | 140,000 | |

Source local manufacturer/trader

| Table 2: Margarine Production | ||

|---|---|---|

| Product | Hydrogenated (MT) | Trans free (MT) |

| Table Margarine | 75,000 | 15,000 |

| Puff Pastry Margarine | 35,000 | 15,000 |

| Total | 110,000 | 30,000 |

Source local manufacturer/trader

6. Conclusion

Food accounts for an average of 42% of Algerian household spending. Among food products, the largest market segment is confectionery and snacks. Palm oil is in a superb position to expand its market share in the country due to the huge and increased demand for palm-based fats for the manufacturing of shortening and margarine, to cater to the developing confectionery market. Apart from that, some other applications of palm oil can be explored, such as cheese production, which has started to emerge in the market.

Prepared by Lamyaa El Enany

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.