The International Monetary Fund (IMF) presents a global economic forecast that, while cautiously tempered, offers a perspective of resilience. Although the expected global growth in 2023 and 2024, at 3% and 2.9% respectively, is below the historical average of 3.8% over the last two decades, it’s important to acknowledge the global economy’s ability to adapt and recover.

Developed economies are anticipated to moderate their growth due to tightening monetary policies. In contrast, emerging market and developing economies are poised for a steady, albeit modest, growth rate of 4% in both 2023 and 2024. This indicates the ongoing dynamism in these regions.

Nonetheless, there are factors of uncertainty, such as the Israel-Hamas conflict, which introduces volatility into global crude oil prices. This, in turn, has a cascading effect on edible oil prices. Nevertheless, economies worldwide have exhibited resilience in navigating such challenges.

In a notable development, the IMF has revised India’s growth forecast upward, from 6.1% to 6.3% for the fiscal year 2023-24. This signals the potential for growth in a dynamic economy with a rapidly evolving landscape.

Furthermore, India has witnessed a positive turn in the inflation rate, with a three-month low of 5% in September 2023, primarily due to moderating food prices. Notably, India’s inflation rate has come within the Central bank’s tolerance limit of 6%. The moderation is prominently driven by decreasing vegetable and cooking gas prices.

Edible oil prices in India remained stable during the same period, with local palm oil prices at around INR 77-78/kg.

In terms of trade, India’s reduced vegetable oil imports in September 2023, down to 1.55 million metric tons from 1.86 million metric tons in August 2023, are partly attributed to abundant port stocks. While post-festive season demand in India is expected to be weaker, it’s important to remember that this fluctuation is a common feature of the trade cycle and does not detract from the country’s overall economic potential.

In summary, the IMF’s forecast provides an opportunity to recognize the resilience and adaptability of the global economy. India’s growth outlook and moderation in inflation rates also showcase the potential for growth and stability. It’s important to remember that economic fluctuations are part of the natural ebb and flow of global economics, and they offer opportunities for innovation and adaptation.

Indian Vegetable Oil Imports Surge, Yet Uncertainty Looms: A Critical Analysis

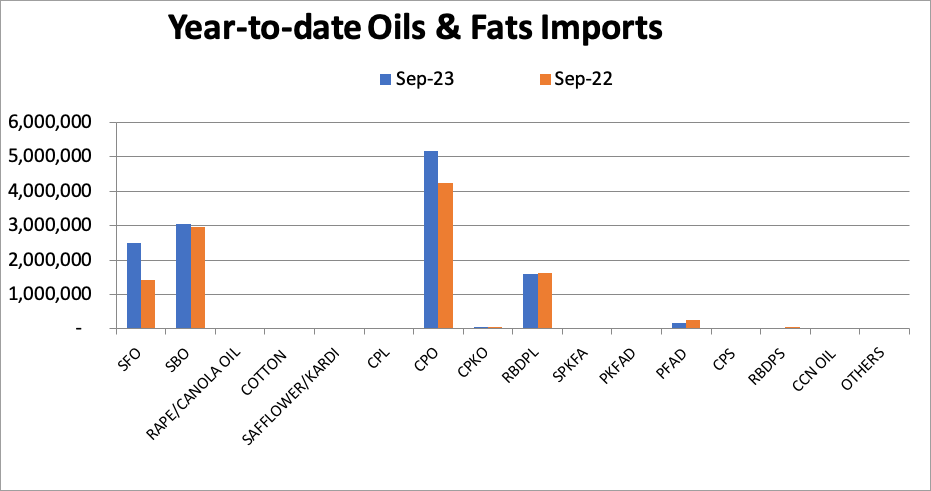

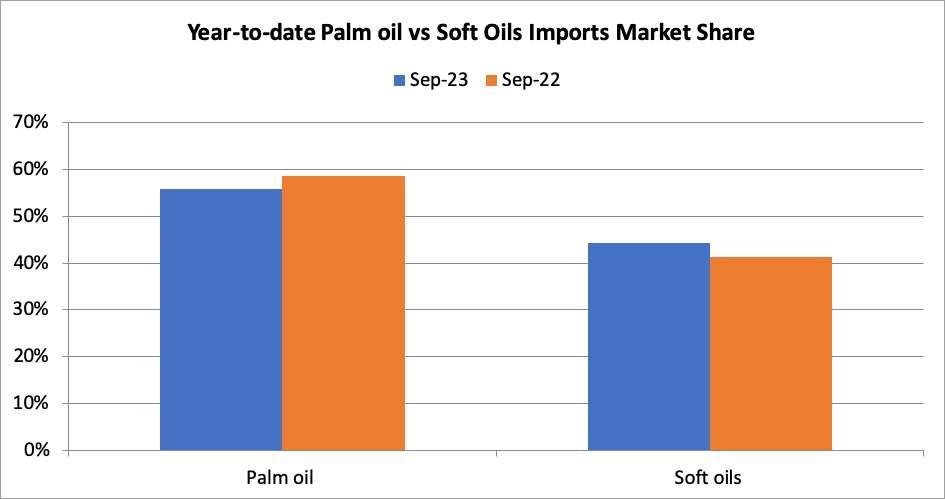

In the realm of economic data, numbers often tell the story with greater precision than words ever could. The latest statistics on Indian vegetable oil imports for the period of January to September 2023 are a case in point, and the implications are profound. While the headline figure reveals an 18% year-on-year increase, bringing imports to a staggering 12.56 million metric tons (MMT), a closer examination of the data reveals nuances that warrant our attention.

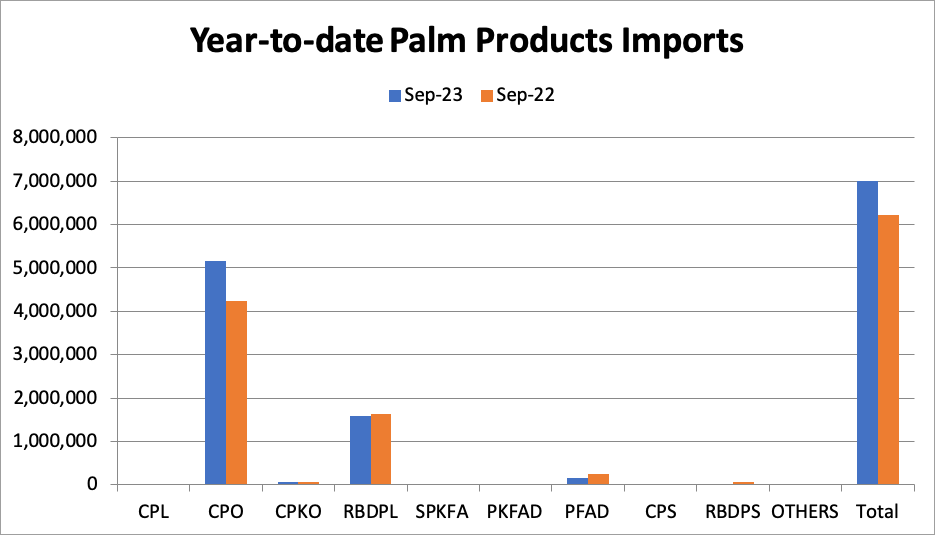

Palm Oil’s Shifting Landscape

Palm oil, a key component of the Indian vegetable oil basket, witnessed a 12.5% YoY increase in imports during the same period, climbing to 7 MMT. However, it is the details that demand our scrutiny. The decline in imports from Malaysia by 22%, to 2.2 MMT, coupled with a 44% YoY surge in imports from Indonesia, reaching 3.93 MMT, is a bellwether for the influence of global dynamics. The price differential between Malaysian and Indonesian palm oil, combined with export policies, has effectively shifted the balance of power in this trade.

This phenomenon reflects the broader currents of global trade. It underscores how trade policy and market conditions in key supplying nations can rapidly alter the dynamics of imports in importing nations. India’s intricate relationship with Southeast Asian palm oil producers underscores the vulnerability to external factors.

Soft Oils and the Power of Price Spreads

While palm oil attracts the spotlight, soft oil imports (comprising Crude Degummed Soybean Oil and Crude Sunflower Oil) surged by 27% YoY to 5.55 MMT. The reasons behind this rise are twofold: a narrow premium or discount of Soft Oils relative to rival oils and the uncertainty surrounding the grain corridor in the Black Sea region. This highlights the significance of price spreads and global geopolitics in driving imports in an economy as vast and varied as India.

Soft oil’s reliance on the Black Sea region is a stark reminder of how disruptions in one part of the world can trigger ripples thousands of miles away. Moreover, it demonstrates that economic decisions, in the form of higher imports, are often made in response to geopolitical tensions, a factor beyond the control of economic actors within India.

Port Stocks and Seasonal Shifts

The decline in palm oil imports in September 2023 by 22% month-on-month, attributed to high port stocks and sluggish dispatches in the preceding months, merits a closer look. These port stocks are symbolic of how economic factors intertwine in a complex dance, significantly affecting the fortunes of the vegetable oil industry. In a similar vein, soft oil imports in September fell by 9% compared to the previous month, with the uncertainty surrounding the Black Sea region grain corridor weighing heavily.

Additionally, the marginal 3% month-on-month decline in edible oil stocks at Indian ports, despite the overall increase in imports, indicates the influence of seasonal shifts. It highlights the intricacies of demand, supply, and logistics that can impact the delicate balance of an economic sector.

Future Outlook and Lessons for Policymakers

As we look ahead to October 2023, forecasts suggest a 20-25% month-on-month decline in edible oil imports, primarily driven by higher port stocks, domestic oilseed arrivals, and weaker post-festive season demand. This impending downturn is a poignant reminder that economic predictions should be based on a holistic understanding of various factors – international, domestic, and seasonal.

Considering the prevailing economic dynamics and insights from the industry, here’s a nuanced forecast for edible oil imports in the coming months.

Palm Oil demand in this OND quarter is expected to be 2.3 MMT and India also expects soft oils to 1.2 MMT ( about 600 K each of Sun and Soya).

Several factors warrant attention when interpreting these figures. Firstly, November and December are marked by the Durga Puja and Diwali festivals, which traditionally boost demand. However, it’s essential to bear in mind that post-festive periods typically witness a decrease in demand, leading to a slowing effect.

Another contributing factor is the ongoing competition between palm and sunflower oil, mainly driven by price sensitivity within the market. Sunflower oil continues to strive to take some market share from palm as well as soya due to its competitive pricing.

Furthermore, the soybean oil market faces a unique set of constraints, including the influence of government support prices for Kharif crops and the presence of significant seed reserves from NAFED. These factors, coupled with sluggish sales, may lead to imports remaining below their full potential.

The forecasts for edible oil imports in the upcoming quarter are shaped by a dynamic interplay of economic, seasonal, and market-specific variables. These projections are designed to offer a comprehensive outlook, considering the multifaceted nature of the industry and its ongoing developments.

In conclusion, the surge in vegetable oil imports in India is more than a mere economic statistic. It is a reflection of the intricate web of global trade, geopolitics, and seasonal shifts that underpin an industry of critical importance.

Prepared by: Bhavna Shah

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.