KUALA LUMPUR (Jan 15): Apex Securities has kept its “neutral” call on the plantation sector as the market is believed to have factored in the recovery of crude palm oil (CPO) prices to around the RM4,000 per tonne projected by the research house.

In a note, Apex Securities said the plantation sector is trading at forward price-to-earnings ratios (PERs) of 23.6 times for 2023 and 17.3 times for 2024 and is currently above its historical three-year average of 14.3 times, implying the sector is overvalued at the moment.

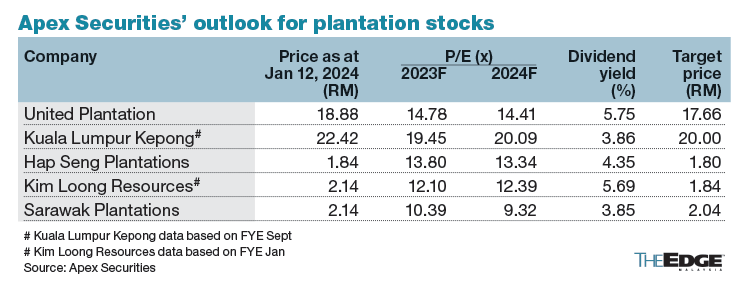

Meanwhile, it retained its “hold” calls for Kuala Lumpur Kepong Bhd (target price [TP]: RM20), Hap Seng Plantations Holdings Bhd (TP: RM1.80), Kim Loong Resources Bhd (TP: RM1.84), United Plantations Bhd (TP: RM17.66) and Sarawak Plantation Bhd (TP: RM2.04), as these counters have breached their respective TPs.

“We advocate investors to hold planters with strong dividend yields such as Kim Loong and United Plantations,” it said.

In the note, Apex Securities cited Malaysia Palm Oil Board director general Datuk Dr Ahmad Parvees, who expects CPO prices to see a strong rebound in the second half of 2024 (2H2024), with a range of between RM3,900 and RM4,200 per tonne.

This is on the back of modest growth in CPO production by 1.1% amid continued labour shortages, while palm oil stocks are expected to decline 14.8% in the same period, falling below the two million-tonne threshold due to higher palm oil exports.

Other supporting factors for price recovery include the mandate of the B35 biodiesel in Indonesia, unfavourable weather conditions, and the expectation of tight soybean products at least until April 2024.

Furthermore, the research house has quoted LMC International Ltd head of Southeast Asia Dr Julian Conway McGill as saying that the supply of palm oil has been stagnant and will remain subdued due to the lack of expansion in Indonesia and Malaysia.

“As vegetable oil consumption continues to rise due to a growing population, soybean oil has been utilised to fill the gap left by palm oil. As meal prices continue to decline, farmers will need to raise soybean oil prices to offset the losses. Consequently, Dr Julian anticipates palm oil prices will recover above RM4,000/tonne in 2H2024, in tandem with the higher soybean oil prices,” it stated.

Furthermore, Apex Securities highlights the potential implication of carbon pricing on the palm oil industry as it could result in higher production costs.

“However, it is still in the early stages, and the government is currently working to strike a balance to achieve emissions reduction without hindering the growth of the sector,” it said.

The government is also exploring ways to integrate both the carbon tax and the Domestic Emissions Trading Scheme (DETS) to avoid “double taxation” while leveraging the strengths of each instrument, it added.

CPO futures touched a one-month high of RM3,856/tonne on Jan 12, before retreating 0.2% to RM3,847/tonne at the time of writing on Monday.

Across Bursa Malaysia, the KL Plantation Index is currently trading at its five-month high of 7,150.66 points. The index, which tracks Malaysian listed plantation counters, has risen by 2.03% since the start of the year.

Source : The Edge Malaysia