ASEAN is one of the vibrant economic regions in the world. The member countries of ASEAN, which include Thailand, Laos, Cambodia, Vietnam, Malaysia, Philippines, Myanmar, Brunei, Indonesia, and Myanmar, have all shown strong GDP growth in the past years. Even during these testing times when the world is facing the wrath of COVID-19, countries such as Myanmar and Vietnam have successfully contained the pandemic and minimized its impact on their economies. It is widely believed that most of the countries in the world are likely to experience negative growth in their GDP in 2020, Indonesia and Myanmar are expected to register positive GDP growth, despite of the ongoing pandemic.

The ASEAN Trade in Goods Agreement (ATIGA) was signed in February 2009 and subsequently entered-into-force on 17 May 2010. The main objective of ATIGA was to establish an integrated market and production base with a free flow of goods between the region. The trade liberalization in the region has created a robust intra-ASEAN trade which allows consumers and manufacturers to source goods from the more efficient producers in ASEAN. Eventually, ASEAN’s manufacturing sectors will become more efficient and competitive in the global market.

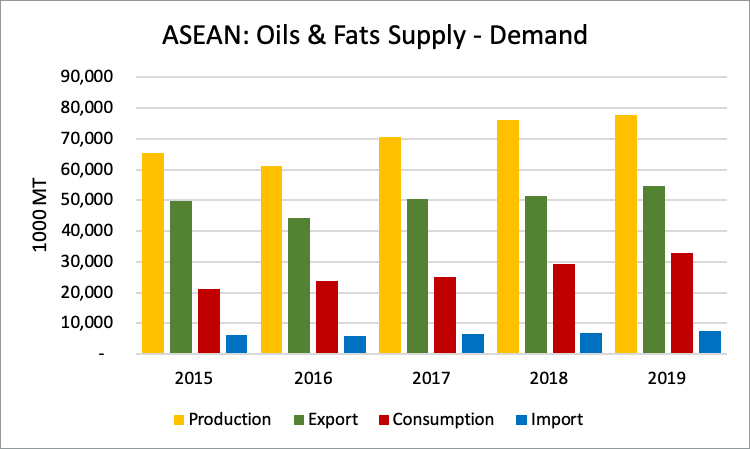

ASEAN is an important market for Malaysian palm oil. In 2019, the region imported 7.4 million MT of oils and fats and palm oil was the main imported oil with a share of 55% which equals to 4.1 million MT. With a population of 661 million people, the consumption of oils and fats was about 32.7 million MT in 2019 and the average caput use was around 15kg to 18kg compared to world average caput use was 30.8kg.

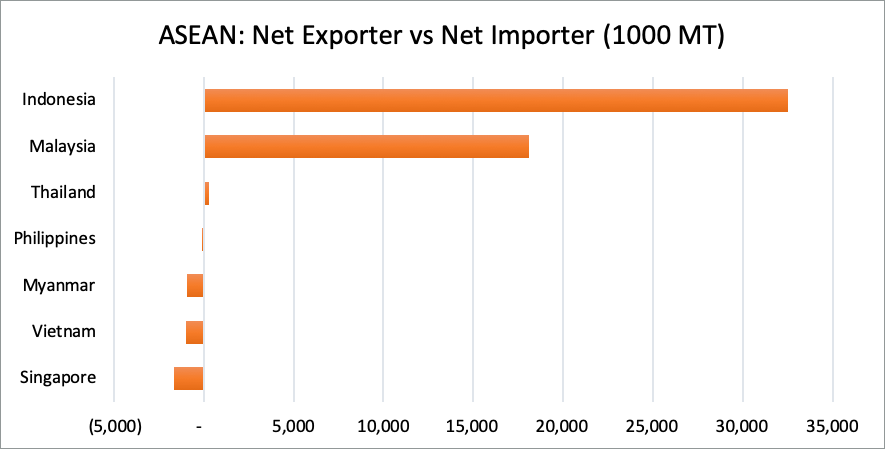

Indonesia, Malaysia and Philippines the leading producers of palm oil and coconut oil in the world which contributed about 94% of oils and fats production in the ASEAN. Palm oil is the main edible oil consumed in the ASEAN region with the share of 45% from 9 million MT of oils and fats consumed in the region. The main palm oil consumers are Malaysia and Indonesia due to high biodiesel mandate in both countries. In the food sector, palm oil is mainly used in the household, HORECA sector and food processing industries.

Malaysia Palm Oil

In 2019, Malaysia exported 2.2 million MT of palm oil and palm products to the ASEAN countries (22% of MPO export) which increased by 233,020 MT or 12% compared to the year of 2018. The top importers of Malaysian palm oil in ASEAN are the Philippines, Vietnam and Singapore which imports about 74% of the total Malaysian palm oil to the region.

| COUNTRY (1000 MT) | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Philippines | 648.4 | 625.0 | 751.7 | 689.3 | 629.1 |

| Vietnam | 584.0 | 556.3 | 633.1 | 461.6 | 595.3 |

| Singapore | 393.2 | 353.0 | 416.2 | 379.2 | 361.9 |

| Indonesia | 4.1 | 2.9 | 2.2 | 1.7 | 195.9 |

| Myanmar | 393.2 | 353.0 | 416.2 | 379.2 | 361.9 |

| Brunei | 6.4 | 6.8 | 10.6 | 8.3 | 8.3 |

| Cambodia | 1.5 | 3.2 | 3.4 | 2.3 | 1.8 |

| Laos | 0.5 | 0.7 | 0.9 | 0 | 0.3 |

| Thailand | 0 | 0 | 0 | 0 | 0 |

| Total | 2,031.2 | 1,900.9 | 2,234.4 | 1,921.5 | 2,154.5 |

Source: MPOB

The import of palm oil in this region is growing driven by the expanding development in the food and beverages sector led by the HORECA industry. In addition, the growth is attributed to the improving GDP, rising per capita income, rapid urbanization and the growing middle-class consumers base in the region.

Due to these factors, the economic activities are expected to prosper in the region. The presence of ATIGA has made trading among the members easier. It allows the trade between ASEAN members with ease of documentations. This is also aided by the removal of duties on certain selected products in the agreements. (See table below)

| ATIGA Rates of Duty (%) | Philippines | Vietnam | Myanmar | Singapore |

|---|---|---|---|---|

| Palm oil | 0% | 0% | 0% | 0% |

| Coconut oil | 0% | 0% | 0% | 0% |

Source: https://asean.org/?static_post=annex-2-tariff-schedules

This duty removal has paved ways for Malaysian palm oil to grow in the ASEAN region.

Palm Oil Trade

The elimination of both intra-regional and non-tariff barriers under ATIGA have been a key reason for the increase of palm oil trade in the region. Elimination of import duty in certain countries enables palm oil to be priced competitively as compared to other imported oils and fats. For instance, in the Philippines, import of palm oil is subjected to a 15% duty import, however, under ATIGA, this duty is eliminated and all products of palm oil enjoy zero duty.

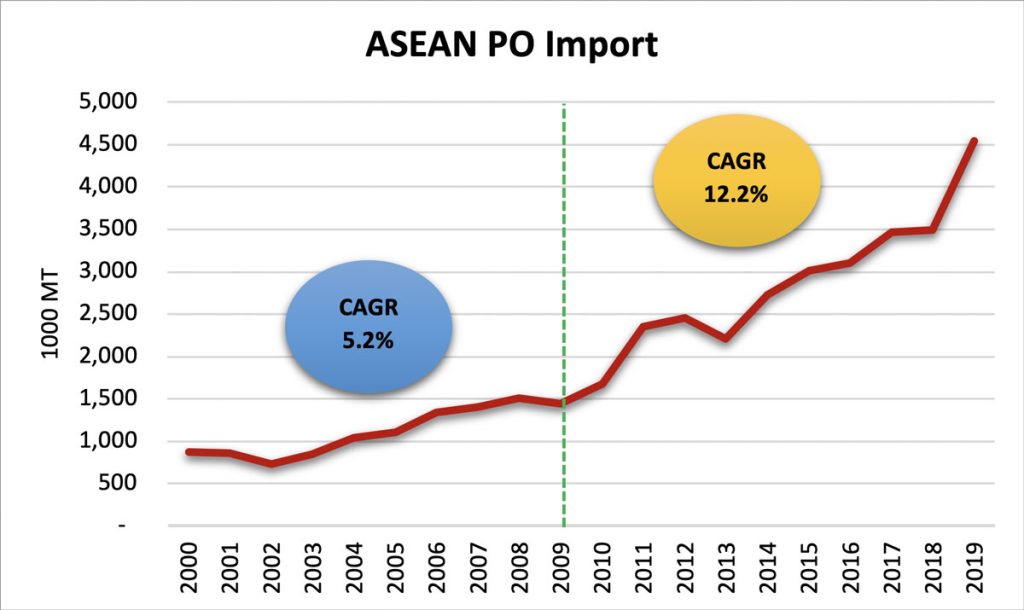

The impact of ATIGA on the import of palm oil in ASEAN region can be clearly witnessed from the import chart of the last 20 years. In the first ten years, when the trade of palm oil was under normal tariffs, the imports of palm oil in ASEAN region registered a CAGR of 5.2%. However, after the commencement of ATIGA, the trade of palm oil started showing significant increase and registered a CAGR of 12.2% in the subsequent 10 years. This clearly shows that the removal of trade barriers and enabling free flow of goods can have a subsequent affect on improving the trade of goods within a region.

Keeping in view the positive outlook of ASEAN economy and the growth in trade, , Malaysian palm oil exporters should continue focusing on this region and increase their penetration into the ASEAN market.

Source:

- MITI Website

- Oil World, Annual 2020

- DTI Philippines

Prepared by: Muhammad Kharibi & Rina Mariati

Appendix

Philippines Import Tariff

| Hdg. No. |

AHTN Code 2017 | DESCRIPTION | Rates of Duty (%) | ASEAN Members States Enjoying Concession | ||||

|---|---|---|---|---|---|---|---|---|

| MFM | ATIGA | |||||||

| Jul – Dec 2017 | 2018 | 2019 | 2020 | |||||

| 15.11 | Palm Oil and its fraction, whether or not refined, but no chemical modified | |||||||

| 1511.10.00 1511.90 1511.90.20 |

|

15 15 |

15 15 |

15 15 |

15 15 |

0 0 |

ALL ALL |

|

| 1511.90.31 |

|

15 | 15 | 15 | 15 | 0 | ALL | |

| 1511.90.32 1511.90.36 |

|

15 15 |

15 15 |

15 15 |

15 15 |

0 0 |

ALL ALL |

|

| 1511.90.37 |

|

15 | 15 | 15 | 15 | 0 | ALL | |

| 1511.90.39 |

|

15 | 15 | 15 | 15 | 0 | ALL | |

| 1511.90.41 |

|

15 | 15 | 15 | 15 | 0 | ALL | |

| 1511.90.42 |

|

15 | 15 | 15 | 15 | 0 | ALL | |

| 1511.90.49 |

|

15 | 15 | 15 | 15 | 0 | ALL | |

Source: DTI Philippines

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.