Introduction

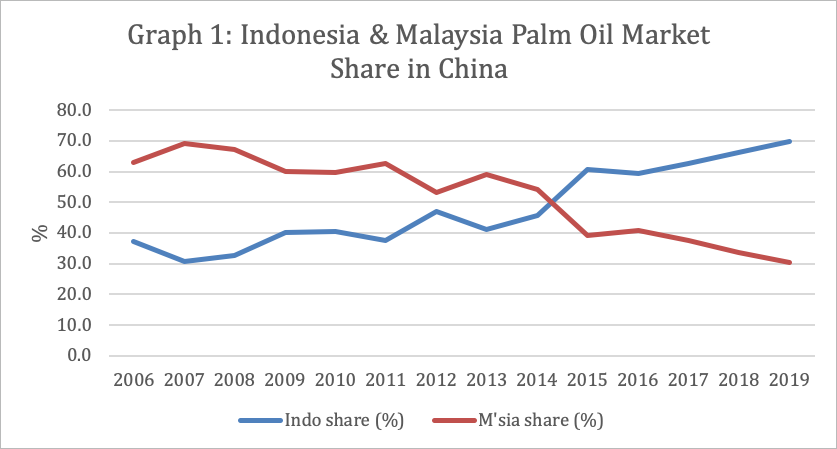

China’s palm oil imports have increased by almost 10 folds from 830,000 MT in 1992 to 7.6 million MT in 2019. During the same period, Malaysia’s exports also have grown 5 fold from 550,830 MT in 1992 to 2.49 million MT in 2019. Despite a significant increase in the volume of Malaysian palm oil exports to China, Malaysia was unable to capitalize on the overall increase in the palm oil imports in this market. Malaysia’s share in China’s palm oil import has dropped from 62.6% in 2011 to 30.3% in 2019. This market is now dominated by Indonesian palm oil suppliers. Higher supply of palm oil in Indonesia, price-sensitive nature of Chinese market and consistent price discounts offered by Indonesian suppliers are some of the main reasons for this shift in Chinese buying preference over the last few years.

MPO’s Performance in 2020

From Jan to May 2020, Malaysian palm oil exports to China have registered a significant increase. Data from Chinese General Administration of Customs show that in Jan-May 2020, China purchased 1.12 Million MT of PO from Malaysia, increased by 24.6% or 221,720 MT, while Indonesia shipped 1.19 Million MT of PO to China, decreased by 37.6% or 713,123 MT as compared to last year. As a result, MPO share in China has increased to 48.5% in the first 5 months of 2020 as compared to 32.2% in the same period of last year.

Regardless of the intense competition to acquire market share, China, in general, is considered to be a mature market where the need for the use of edible oil has been almost constant for years. The consumption of oils and fats was 38.1 MMT in 2015, only increased by 2.6% to 39.1 MMT in 2019. Although most of the consumers’ edible oil consumption has been met by the supply of soybean oil and rapeseed oil, usage of palm oil is predominant in the HORECA sector and increasing demand for palm oil usage in this sector is witnessed from the industry data. To add more value to the palm oil sector in China, there are some areas of development that can be exploited to increase the palm oil import especially to increase the consumer’s market segment.

Pushing Palm Oil in Consumer’s Market

China’s rapid development and changes in the consumer’s behaviour have created opportunities for higher usage of palm oil products over the years. Steady economic growth has led to an increase in per capita income, which in turn leads to higher purchases of all palm products. However, the main issue in the consumer market segment is the sentiment of palm oil, which is seen as not as healthy, as compared to other soft oils alternatives. Addressing this issue is important to increase the usage of palm-based products among Chinese consumers.

Introduction of Malaysian red palm oil can be the beginning of penetrating the more health-conscious consumer segment of the Chinese market. Apart from using red palm oil as an alternative healthy substitute for edible oil, avenues of blending red palm oil with other soft oils and also as an ingredient in bakery products formulation can be explored further. Red palm oil is rich in vitamin A and vitamin E. Blending it into soft oils and using red palm in bakery products formulation will increase the products nutrient content. The blending of red palm oil’s red-orange colour will also make the appearance of products such as margarine, mayonnaise and ice-cream more appealing. Apart from red palm oil, more effective campaigns to promote the general health and beneficial attributes of palm-based products can be conducted effectively regularly to penetrate consumers’ household market.

Besides the food sector, an increasing hygiene consciousness among Chinese especially after COVID-19 pandemic opens rooms for more palm-based oleochemical derivatives import, to be used in the hygiene and sanitization products manufacturing sector. The expectation that a higher amount of cleansing products such as detergents, hand wash will be produced as China recovers from the pandemic is inevitable.

Inner Region Exploitation

In the less developed markets in the inner regions, such as Xinjiang, Qinghai, and Sichuan, the volume of purchase is confined to more packed palm fats like shortening and margarine for confectionery. Lard is generally used as the main frying medium. Hence, there are opportunities for palm oil frying fats to be promoted to replace lard as a healthier frying option. Other than that, popular tourist cities such as Kumming, Chendu and Xián are areas which enjoy higher growth in the HORECA and confectionery sector would provide opportunities for higher palm oil products sales.

Currently, the expansion of palm oil usage is being hindered by hefty logistics costs to transport palm oil products from coastal ports to the inland area. Only conventional railway transportation systems cover most of China’s inner part. Hence, to increase palm oil exports to the less developed inner China region, processing and storage facilities development will be required to ease the problem. Malaysian companies can take initiative to consider positioning an effective logistics, distribution system and manufacturing facilities together with potential Chinese partners in these regions to enhance the availability of palm throughout China.

MPOC’s Action Plans

MPOC’s action plan has been targeted at China’s trade industry group, consumers and the government sectors. Some of the initiatives that MPOC has taken involve; expanding into regions where Malaysian palm oil’s application remains low, intensify the effort to increase the awareness among Chinese consumers and officials on health and functional attributes of palm oil, strengthen the rapport with trade associations and research institutions to make MPOC the referral point when come to issue on palm oil, identify and nurture spokespersons for Malaysian palm oil and encouraging the introduction of palm olein based cooking oil. Some of the major programmes to reach Chinese consumers that had been undertaken such as Malaysian Palm Oil WeChat programme as well as exhibitions and forums. More programs are being developed strategically to strengthen the foundation of the Malaysian market share in China.

Prepared by: Theventharan Batumalai & Lim Teck Chaii

Prepared By: Theventharan Batumalai and Lim Teck Chaii

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.