Introduction

China has undertaken various measures in the past to strengthen its economy. A major expansion of China’s global economic influence happened in 2001 when China took its first initiative to liberalize its traditional economy and become a member of the World Trade Organisation (WTO). With the WTO membership, the most populous nation has opened up the economy to the world market, and GDP per capita of the nation has seen very significant growth.

The membership also has made the country opened its economy and cross border investment opportunities were encouraged. During these years, Malaysia’s palm oil industry players has taken the opportunity to invest in many oleochemicals plant, refinery, shortening plant and bulking installation in the country to better position itself in China’s market.

Palm Oil Trade Liberalisation

China’s WTO membership has enabled the country to penetrate the global oils and fats market and lifted its barrier to unrestricted oils and fats trading activities. Before joining WTO, all decisions to import palm oil was made by the Central Government on the advice of the Provincial Governments according to their needs and palm oil imports were made only by limited state-controlled firms. The import of palm oil was less than 2 Million MT in the year 2000.

After joining the WTO, as part of the membership agreement, China has committed itself to import a specified quantity of palm oil every year. This follows the establishment of the Tariff Rate Quota System (TRQ). This TRQ permits the import of a certain quantity of palm oil at a lower duty rate, while quantities exceeding the quota are subject to a higher duty rate. China has initially allocated 2.4 million MT under the TRQ for palm oil import in 2002. The quota was increased to 3.168 million MT in 2005. Only palm stearin was exempted from the TRQ requirements. (Refer to table 1).

Table 1 : ASEAN-CHINA Free Trade Agreement Tariff Schedule for

Major Palm Oil Products

| Product | Tariff before China join WTO (%) | MFN Rate (TRQ) (%) | FTA Rate (%) |

|---|---|---|---|

| Crude Palm Oil | 19.9 | 9 | 9 |

| RBD Palm Olein | 19.9 | 9 | 9 |

| RBD Palm Stearin | 8 | 8 | 8 |

Source : Ministry of International Trade (MITI) & MPOB

Tariff Rate Quota System (TRQ) vs ASEAN–China Free Trade Area (ACFTA)

In July 2005, China and ASEAN Countries agreed to the sign ASEAN–China Free Trade Area (ACFTA). With the adoption of ACTFA Trade agreement, importation of palm oil was no longer subjected to the Tariff Quota System (TRQ). In other words, the imports of palm oil depend on the market forces with minimal influence from the government. Chinese palm oil importers only require a license under the Administration of Automatic Import License Regulation to import. The new regulation was enforced on 1 January 2006 along with ACTFA and it applies to other edible oils import including rapeseed oil and soybean oil.

Palm Oil Import Performance Post-WTO

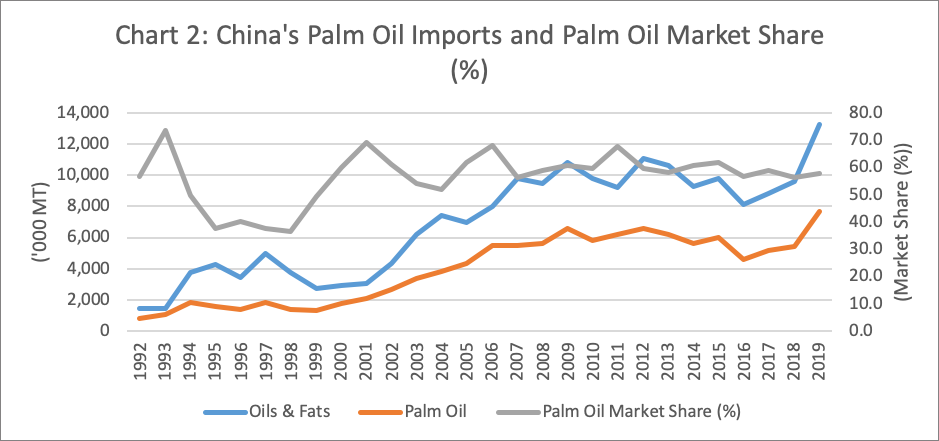

Since China joins the WTO followed by ACFTA, palm oil exporters reap the benefits of China’s higher accessibility to the global oils and fats market. Palm oil import volume grew from 2.1 million MT in 2001 at an average annual growth rate of 21.6% per annum to reach 3.2 million MT in 2005. After the country becomes a member country of the FTA, palm oil imports grew at an average annual rate of 5.4% to reach 7.7 million MT in 2019. Palm oil also has managed to capture a stable market share in China’s overall the oils & fats import. Since 2001, the range of the market share of palm oil in china market is around 52% to 69%.

A globalised economic development in the region and the marketing efforts from various bodies including MPOC, the growth of palm oil in expected to increase further in the future. From the correlation response which can be seen in Chart 2 between the import of total oil and fats and palm oil, and from the market analytics the annual growth (CAGR) of palm oil is projected to be 2.6%. This stability of the palm oil growth will provide the opportunity to promote a broader range of palm-based products such as chocolates, red palm oil etc.

Prepared By: Lim Teck Chaii and Theventharan Batumalai

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.