China is among the largest importers of palm oil in the world and has a major influence on the supply and demand dynamics of this commodity . The official data from Chinese Customs in table 1 illustrates that China has decreased its overall palm oil import from 1,171,500MT to 882,200MT in Jan-Feb 2020. The overall reduction of 289,300 MT or 24.7% compared to last year exhibits a significant decline in the demand for palm oil in this market.

Table 1: Palm Oil Import by Country of Origin in Jan-Feb 2020 (MT)

| Jan-Feb 2020 | Jan-Feb 2019 | Changes (Vol.) | Changes (%) | Jan-Dec 2019 | |

|---|---|---|---|---|---|

| Malaysia | 420,800 | 416,900 | 3,900 | 0.9% | 2,284,500 |

| Indonesia | 455,200 | 754,400 | -299,200 | -39.7% | 5,253,200 |

| Other | 6200 | 200 | 6,000 | 3000.0% | 14300 |

| Total | 882,200 | 1,171,500 | -289,300 | -24.7% | 7,552,000 |

Source: Chinese General Administration of Customs

The lowering demand from China has had a bearist effect on the market in the palm oil industry. Producers, particularly Malaysia and Indonesia, who are already struggling with the restrictions imposed to curb the spread of global pandemic and decreasing prices are struggling to keep their exports and stocks in check.

Graph 1: Malaysian Palm oil export to China from January to March 2020

Graph 1 shows that total Malaysian palm oil export to China from the month of January to March 2020 has slumped from 571,253MT to 481,652MT compared to the same period in 2019. The export quantity has lessened by 89,601MT which is about 15.7% lower. The drop can be caused by several factors including overall demand, price competitiveness, the stock level of palm oil in China, as well as an anticipated higher soybean oil output.

Lowering Price Discount between Soybean and Palm Oil

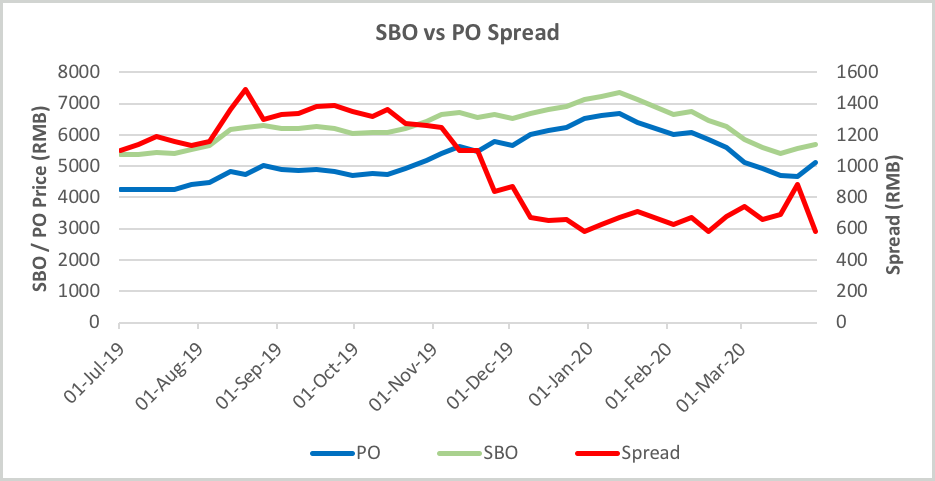

Graph 2: Soybean Oil versus Palm Oil Price Spread

The price spread between soybean oil and palm oil plays a determining role in palm oil usage especially during cold seasons due to its nature of hardening at lower temperature. Technically, in order for the palm olein to be used in the winter season, it has to be fractionated into an olien with a lower melting point (as low as 10°C). The cost of this fractionation process is estimated to be around RMB800. Hence, if the price spread between soybean oil and palm oil is more than RMB800, the price discount will encourage the importers to purchase palm oil over soybean oil. However, in the last quarter of 2019, soybean oil and palm oil price spread dropped below RMB1,000 and reached as low as RMB580 by end of December. This price spread drop made the usage of palm oil unattractive as the narrowing price discount could not compensate the cost of fractionating palm olein. Eventually, this led to the slowdown of palm oil import in the subsequent months.

Higher Palm Oil Stock in Q1, 2020

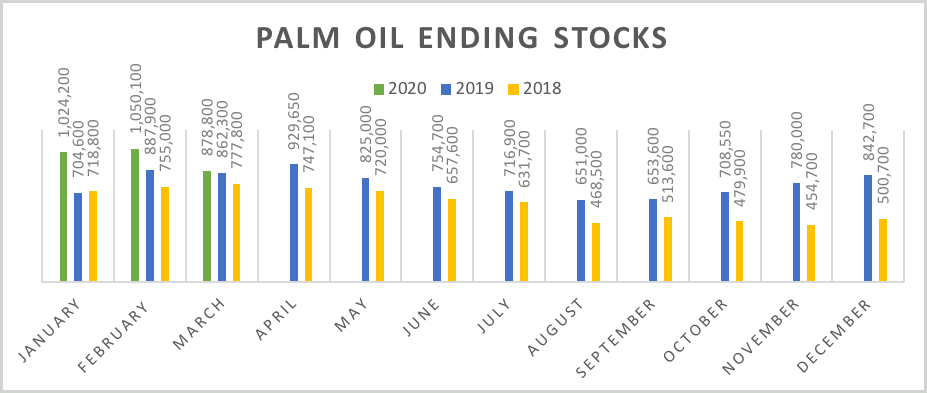

Graph 3: Palm Oil Ending Stocks in China

Graph 3 shows that the palm oil stock in China had built-up towards the end of 2019 compared to the same period in 2018. The rise in stock was primarily attributed to the arrival of large palm oil shipments contracted in Q3 2019, when the import margin was more favourable for the importers. However, the sudden surge of CPO price towards the end of Q4 in 2019 disrupted the trend for palm oil. Consequently, the increase in stock became a stumbling block for some importers from importing more palm oil in early 2020.

Palm Oil Stock Outlook for 2nd Quarter

The positive outlook of trade negotiation progress between the US and China and the exemption of additional tariff of 30% for soybean by China has aided the recovery of soybean import. Furthermore, the steady recovery of swine industry from the African Swine Fever (AFS) outbreak is also poised to increase the crushing of soybean, which will lead to higher soybean oil output in China in coming months. These factors are leading to the slowdown of palm oil import in China.

However, the stock level of palm oil in China is expected to drop , based on the palm oil shipments arrival in Q2 which is about 1.2 million MT and also the anticipated higher consumption of palm oil during the warmer weather in coming months. The drop in the stock is expected to improve the import margin and drive the palm oil import higher in Q3.

Prepared By: Desmond Ng & Theventharan Batumalai

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.