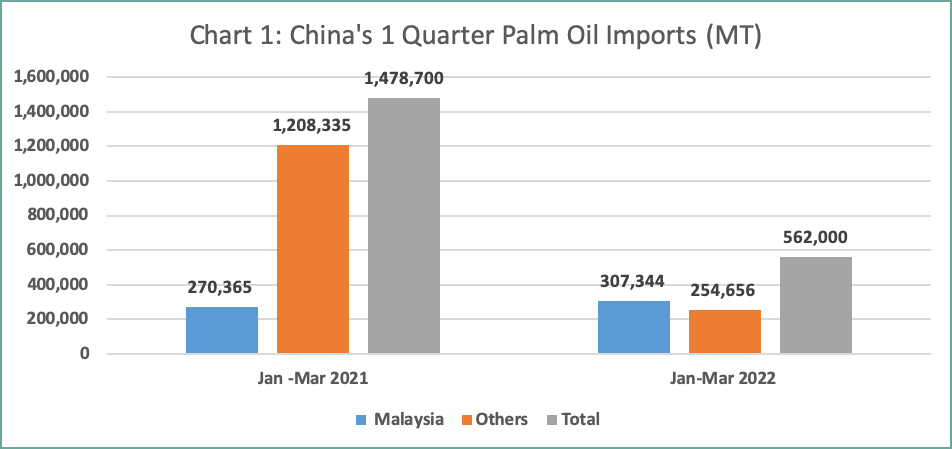

China’s import of palm oil in the first quarter of 2022 fell sharply by 65.7%, or 971,800 MT to 506,900 MT from 1,478,700 MT in the same period last year. Major factors which contributed to the decline in imports included Indonesia’s policies to curb domestic palm oil price hikes and the tight global supply of edible oils. Amidst the volatility of the palm oil market situation, this write-up is undertaken to share with readers China’s palm oil market situation in early 2022 and the outlook for the whole of 2022.

In early 2022, the palm oil market was mainly affected by Indonesia’s measures introduced to control the price of domestic palm oil. This led to changes in the country’s palm oil availability to the world disrupting global palm oil supply and leading to volatility in palm oil prices.

Indonesia’s export policies to curb domestic palm oil price hike introduced at the beginning of 2022

Starting 28 January 2022, Indonesia enacted a Domestic Market Obligation (DMO) policyrequiring exporters of palm oil products to sell 20 percent of their total export volume in the form of CPO or RBD palm olein domestically for 6 months. The ruling announced in January only covered crude palm oil, RBD palm olein, and used cooking oil. From 15th February 2022 onwards, the scope was expanded to include all palm products. On 10th March 2022, the country’s Domestic Market Obligation was raised from 20% to 30%.

Under the Domestic Market Obligation ruling, exporters are required to sell the CPO and RBD palm olein to the local market at a fixed price. For CPO the selling price is Rp. 9,300/kg. For RBD palm olein the ceiling selling price is Rp 11,500/liter for bulk cooking oil, Rp. 13,500/liter for pillow pack and Rp. 14,000/liter for the premium pack. Sales between cooking oil producers or re-packers are set at Rp. 10,300/kg.

On 18th March 2022, Indonesia revoked the Domestic Market Obligation (DMO) policy and replaced it with a higher export levy. Under this new enactment, the export levy for CPO was raised from USD175 /MT to USD375/MT. The levy raises the tax paid by CPO exporters from USD375/MT to USD575/MT when combined with the export duty, which remains at USD200/MT.

With the Domestic Market Obligation (DMO) being replaced by a higher export levy, the availability of the country’s palm oil for export increased. This developmed resulted in easing of prices in the international market and the third month’s BMD contract fell by RM369 from RM5,936 to RM5,567 from 17th March 2022 to 18th March 2022.

On 28th April 2022, Indonesia changed its export policy again. This time the country banned its exports of CPO, RBD palm olein, RBD palm oil, and used cooking oil opening up opportunities for Malaysia to export more of these products to China. This policy replaced the Domestic Market Obligation enacted earlier.

The export ban on Indonesia’s export was again replaced on 23rd May 2022 by requiring exporters to set 10 million MT of cooking oil to be sold in the local market. Lifting the export ban again increases the supply of Indonesia’s palm oil to the international market.

Other factors affecting China’s palm oil market in 2022

Other factors to be kept in view that could affect China’s palm oil market in 2022 are the Ukraine Russia trade conflict which disrupts global sunflower oil supply, the covid-19 pandemic situation which disrupts logistical activities, the labor shortage in Malaysia’s plantation which lowers the country’s palm oil production and lower South America soybean production. These factors contribute to tight global edible oil supply and high edible oil palm oil prices which limits palm oil import.

Ukraine Russian conflict resulted in uncertainty in Ukraine’s edible oil supply and imports. Among the various type of edible oil exported, the impact of Ukraine’s sunflower oil export in the global oils and fats market is the most significant as it accounts for around 46% of global sunflower oil exports.

Malaysia’s palm oil production would be higher if not for the labor shortage problem faced by the industry which affects fresh fruit bunch (FFB) yield. Malaysia’s palm oil industry is heavily dependent on foreign workers to fill the gap in the industry workforce, especially the harvesters. Approximately 80% of the workers in the industry are foreign workers. To ease the labor shortage problem, the government announced that it has approved the hiring of 32,000 foreign workers who are expected to arrive after the Ramadan 2022 Hari Raya.

Due to El Nino which affects the South American soybean crop starting mid-December 2021 till the beginning of 2022, Oil World forecast that global soybean production for the 2021/22 season will fall by 4.1% or 14.86 million MT to 349.51 million MT. Production of South America’s top growers of namely Brazil and Argentine is estimated by Oil World to decline by 13.36 million MT to 125.5 million MT and 2.8 million MT to 41.0 MT respectively for the 2021/22 season.

China’s Palm Oil market 2022 outlook

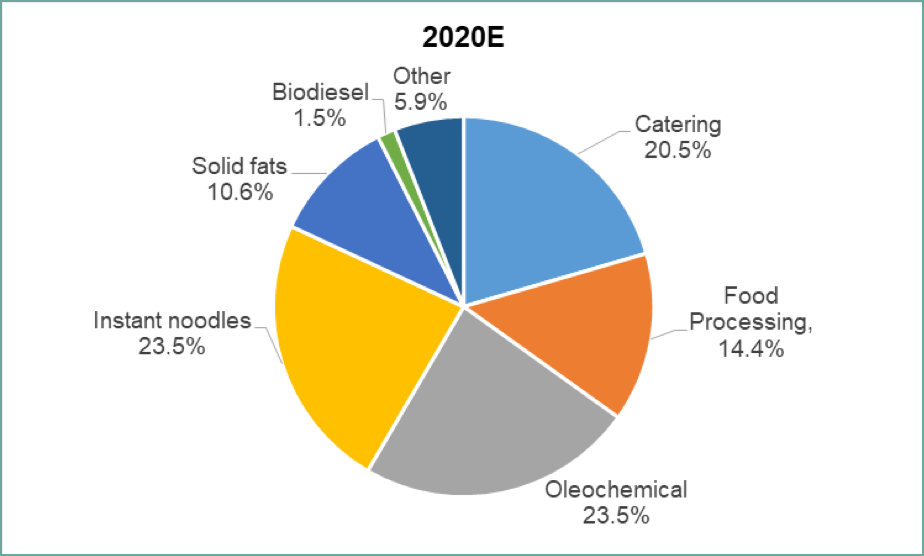

In China, about 75% of total palm oil is consumed in the food sector, including catering, instant noodles, food processing, bakery & confectionery sectors, etc. Palm products other than palm oil, also have a good share in non-food sectors, such as oleochemicals sectors, etc.

From the breakdown of the palm oil application chart in China, it can be deduced that the massive rise in palm oil prices will result in less biodiesel being produced. Snacks and foods processing and solid fats sector will be affected by the drop in tourism and outdoor events. Oleochemical demand is anticipated to drop in usage of those oleochemical products not related to the healthcare sector. Instant noodles, a meal that offers ease of preparing, look more stable in demand under this unfavorable environment.

Chart 2: Palm Oil Application Sector

It appears that the decline in RBD palm olein and RBD palm stearin imports will be most substantial among all the palm fractions imported. This is because RBD palm olein and RBD palm stearin cater to 4 big sectors in China’s palm oil usage. RBD palm olein caters mainly to the catering and food processing sector which collectively accounts for 34.9% of China’s palm oil applications. Meanwhile, RBD palm stearin caters mainly to the oleochemical sector application which accounts for 34.1% of the country’s palm oil application.

Conclusion

The analysis above predicted a pessimistic climate for China’s palm oil imports in 2022. The major factors that are anticipated to result in lower palm oil imports for 2022 are COVID-19 uncertainties, the tight global edible oil supply and high palm oil prices. Already for the first quarter of 2022, China’s palm oil imports have dropped by 65.7% or 971,800 MT to 506,900 MT from 1,478,700 MT.

Palm oil is projected to be affected by declining usage in the catering, food processing, oleochemicals, solid fats, and biodiesel sector in 2022. Instant noodles sector palm oil demand will most probably be stable despite the current unfavorable environment with more people demanding easy to prepared food.

Most of the drop will originate from RBD palm olein and RBD stearin as they account for the bulk of more than 80% of the country’s palm oil import.

Based on the expectation that palm oil usage in the catering and food processing sector usage of palm oil will drop by 50% while oleochemical usage will decline by 20% from the 2021 level to 2022, the estimated palm oil import by China in 2022 will register 4.96 million MT. The volume estimated to be imported is 22.5% lower than 2021 imports of 6.4 million MT.

Prepared by: Lim Teck Chaii

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.