Market Snapshot

South America is one of the key global producers of edible oils. Indeed, a significant number of its exports are integral to the continent’s production, from foodstuffs to raw materials. South American countries, particularly Brazil are major exporters of soybean while Argentina is the top exporter of soybean oil. Colombia leads the palm oil production in the Americas, and is the world’s fourth largest palm oil producer with an average production of 1.6 million metric tonnes (MT) annually. In Guatemala City, a small pilot project to produce biodiesel from recycled cooking oil has shown so much potential that its organisers are hoping to scale it up to help power a whole fleet of city vehicles. Ecuador is the largest palm oil exporter in Latin America, with 60% of its CPO going to export.

The liquid oil segment is projected to be the fastest growing segment as oils are largely consumed for cooking purposes, where the liquid form is preferred over solid. By fat type, the butter and margarine segment commands the largest market share.

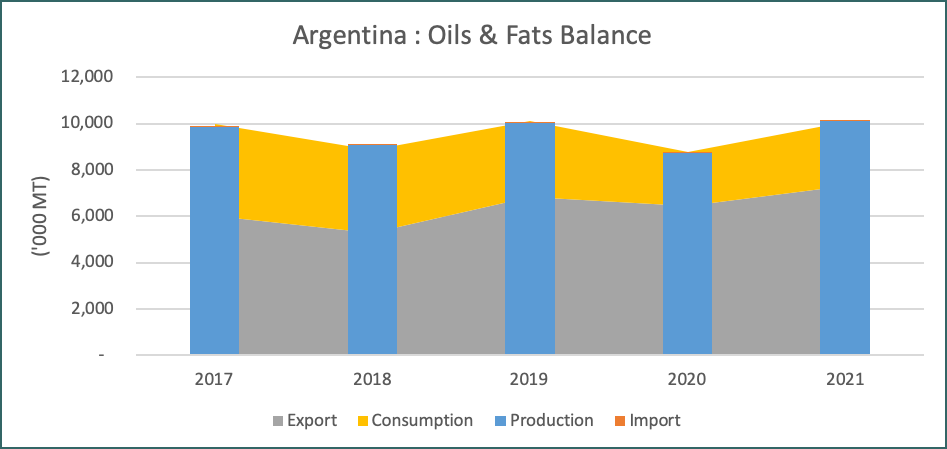

Market Focus: Argentina

Within South America, Argentina is one of the more self-sufficient countries; whereby the country’s domestic oil production exceeds the domestic requirement. Soybean oil is the major oil produced in Argentina with an average amount of 8 million MT annually. Out of this amount, only 24% is consumed domestically while the remainder is for the export market. India remains by far, the most important market for the Argentinian soybean oil. Recently in 2022, there has been an increasing interest in Argentina’s soybean oil from the Middle East and North African countries, which typically import sunflower oil from the Black Sea region.

In March 2022, the government of Argentina raised the export taxes of soybean meal and soybean oil from 31% to 33%. The new tax rate matches the export tax of soybean, which has received negative reactions from farm groups, claiming that it is another tax increase. The government has announced that the additional revenue will be used to subsidise wheat prices for domestic millers, in order to stabilise prices.

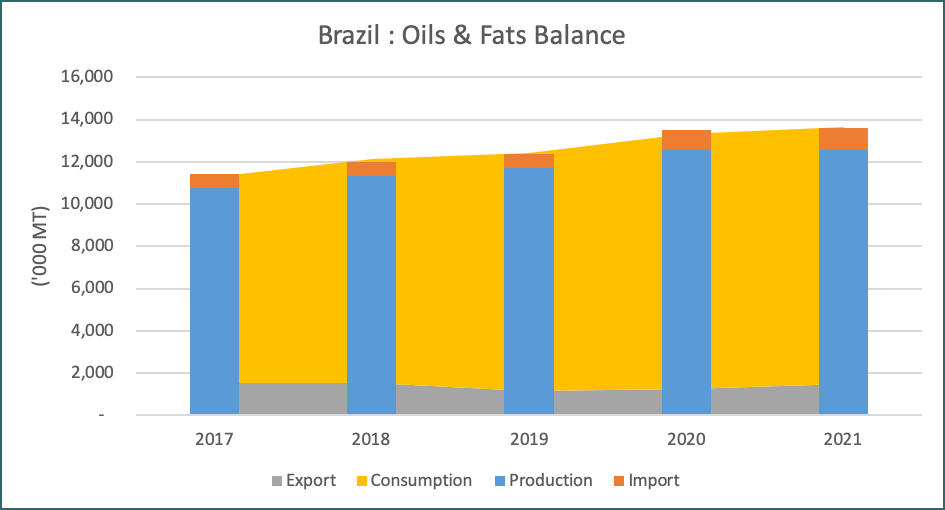

Market Focus: Brazil

Within the past several years, Brazil has surpassed the United States to become the largest soybean-producing nation. China purchases around 70% of the Brazilian soybean and uses it mainly for animal protein consumption. The worldwide market for poultry, pork, and beef has grown significantly in the past decades, which in turn has driven the increase in the demand for animal feed, normally derived from soybean and corn. The top three planting areas in Brazil are Mato Grosso, Parana and Rio Grande do Sul. Key players of the Brazilian vegetable oil market include Bunge Limited and Cargill, Incorporated.

Cooking Oils & Fats Market

The South American cooking oils and fats market size was around USD7.56 billion in 2020, according to Market Data Forecast. Much of the continent’s cooking culture is based on frying. The growing demand for cooking oils and fats is the primary factor that is driving the demand for the market. The rise in the disposable income and the growing busy lifestyle of consumers is the second reason which is driving the demand for processed food worldwide. Additionally, the rising use of high-quality edible oils related to the moderate consumption of oils and fats, is also another key factor that is driving the demand for the market.

Independent small grocers, supermarkets, and hypermarkets remain the biggest distribution channels while e-commerce continues on as a minor distribution channel. Although it recorded a strong growth during the pandemic, e-commerce still only has a very small presence in the retail distribution of edible oils, accounting for only 1% of regional sales in 2021.

The most active companies in the South America vegetable oils market are ADM, Bunge Limited, Wilmar International Limited, as well as Cargill, Incorporated, among others. The active companies in the market have adopted product innovation as a strategy, due to changing consumer preferences in the region. The major focus of the companies is to offer products with a wider application range, aiding all feed, food and beverage and industrial sectors, thereby catering to consumers’ preferences efficiently. Moreover, the companies have adopted continuous expansion as their strategy of obtaining a competitive advantage in the market, and expanding their geographical presence and customer base.

Prepared by Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.