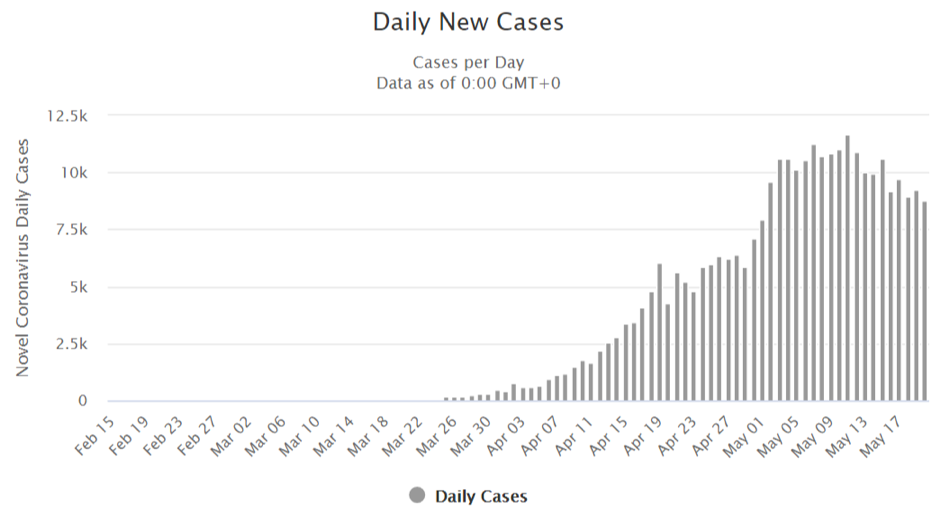

Russia’s consumer rights watchdog Rospotrebnadzor reported the first two cases of COVID-19 on January 31, 2020. Both are Chinese citizens[1]. As of May 20 Russia, confirmed 8764 new cases, signaling a slowdown in spreading of coronavirus. As one of the most affected food industries look forward to re-opening. But the big question is whether to expect the recovery in the near future.

How it all began. The pandemic has prompted the government to introduce restrictive measures that have affected the food industry, resulting in lower demand on raw materials. Lower demand in turn initiated the fall off prices on many items including palm oil.

HoReCa: Sorry we are closed. The subsequent actions taken by the government left the HoReCa sector in an extremely poor condition. Since the end of March, restaurants and cafes have been forced to start selling takeaways. The average bill in cafes and restaurants fell by 35% compared with the beginning of February, sales in monetary terms fell by 70%.

With the restrictions introduced, the food industry has shifted to online deliveries. At the same time, consumer demand fell sharply – self-isolation brought people back to cooking at home.

Lost and found demand. What (consumer demand) was lost in the B2B sector appeared in retail. According to international financial reporting standards (IFRS), leading food retailer in Russia “Magnit” increased its net profit in the first quarter of 2020 by 30.8% compared to the same period last year – to 4.2 billion rubles. The retailer’s revenue for the reporting period increased by 18.5% – up to 376 billion rubles, the company said.

The main competitor of “Magnit” – X5 Retail Group disclosed the results of the first quarter earlier in April. The company’s revenue increased by 15.6%, to 469 billion rubles, net retail revenue – by 15.9%, to 468.5 billion. Comparable sales of X5 increased in the reporting period by 5.7%. The company noted that the peak of sales amid the spread of coronavirus occurred on March 28.

The day after tomorrow. Marketanalysts say thatapproximately 30% of HoReCa establishments will not be able to resume work after the epidemic ended. It can be even worse if the government does not provide support to the sector. If that is case we should expect about 50% of restaurants to close by the end of the year.

But the situation in Russia may go from bad to worse with the seasonal flu. Since we face a seasonal increase of influenza every fall, compounded with the coronavirus it may further complicate Russia’s period of lockdown.

In that case the HoReCa segment recovering expected after the first quarter of 2021. Bigger restaurants that occupy vast areas will come to life only by 2022 due to public distancing recommendations that make this format unprofitable.

Fat industry: Shut down for service. A similar situation observed in the Oil and Fat Industry which is considered the main consumer of palm oil. Some buyers decided to use the lockdown for plants maintenance. The closing for maintenance placed purchases of palm oil temporarily on hold. Volumes allocated for the plants which went on maintenance were not utilized. This has led to a 5-10% increase in palm oil stocks compared to average levels.

A big regional buyer of palm oil reports:

“we had 32 thousand tons stocks in January. Then in May the stocks went up to 40 thousand tons which is slightly above the previous year”

Re-opening recovery. Further development of the situation largely depends on whether the second wave of the epidemic will swept over Russia. Seasonal influenza compounded with the coronavirus may increase pressure on the health system extending the lockdown period in Russia.

Totally exhausted after two month of lockdown, and having the economic situation deteriorating, both consumers and manufacturers are eagerly awaiting the removal of previously imposed restrictions. But according to our forecasts, consumer demand will recover gradually, depending on a strategy applied by the government.

Although movement restrictions removal may help the HoReCa sector, the measure won’t have immediate impact. Borders opening will provide stronger support to the food industry. Removal border crossing restrictions will bring export of food products back to life. A revived food industry will restore demand for palm oil.

But, we must understand the main thing: coronavirus has created serious financial difficulties for both the consumer and the manufacturer. This may be the main factor that will restrain the recovery of consumer demand and, as a consequence, growth in food production and demand for raw materials – palm oil.

Most of my hopes are with the price for palm oil, which is very attractive for the importer these days and should breakthrough all obstacles, once the borders opened.

Prepared by Aleksey Udovenko

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

[1] TASS: First two persons infected with coronavirus identified in Russia