CPO PRICE TREND FOR 2018 - AN UPDATE

2018 Global Palm Oil Market Trends and Opportunities CPO Price Trend – Views from Industry Experts

MPOC’s second POINTERS for the year 2018 was held from 6-12 August, 2018. This effort is timely as fresh factors affecting CPO price fluctuations have surfaced in the second half of 2018. A panel of experts in this POINTERS seminar were engaged to provide updated views of the edible oil market situation and forecast 2018 CPO price trend. Besides CPO price forecasting, their papers cover 2018 global oils and fats supply outlook, Malaysia’s palm oil supply and demand, USA soybean production, China and India’s edible oil market situation.

Views and analysis of the price forecasting experts

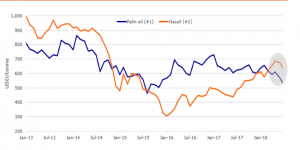

The experts are of the view that CPO price has bottom out in the last Quarter of 2018.The average price is forecast to decline slightly by RM20 to settle at RM2, 350 for the benchmark 3rd month price traded in the Bursa Malaysia Derivative Exchange from 3rd quarter to 4th quarter 2018 by one of the presenter.

Improved demand of vegetable oils in the global energy market is one of the major factor supporting CPO price currently. Indonesia’s expansion of the mandatory blending of B5 for train and B15 for their mining industry from May 2018 will boost Indonesian palm oil usage. According to the Indonesian government, it will increase the usage of biodiesel from 2.54 million kiloliters in 2017 to 2.89 million million kiloliters in the transportation and power plant sectors in 2018. Removal of EU-28’s import tariff on Indonesian biodiesel in March 2018 will result in additional Indonesia’s biodiesel production.

Some independent weather forecaster in India feared that El Nino will be forming in the country around September which may affect India’s kharif crop harvest.

There will definitely be a hike in soybean price subsequently higher soybean oil price towards the end of the year. This is because China imported soybean price will rise due to the additional 25% tariff imposed on USA soybean import following the USA-China trade war. The development augurs well for CPO price and palm oil import into the country.

These scenarios represent a considerable upward potential for the rise in CPO price towards the end of 2018. However, the experts are of the view that this could not happen as the bearish factors of palm oil will lead palm oil price to stabilize around current level.

These scenarios represent a considerable upward potential for the rise in CPO price towards the end of 2018. However, the experts are of the view that this could not happen as the bearish factors of palm oil will lead palm oil price to stabilize around current level.

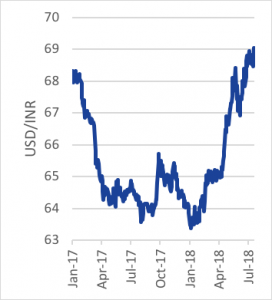

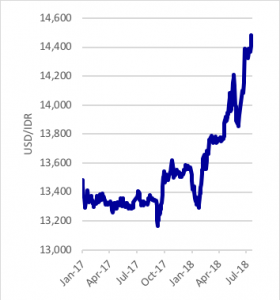

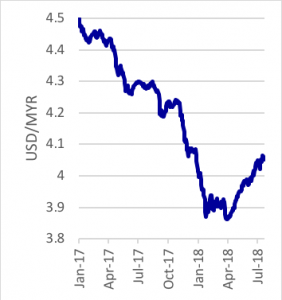

As most of the commodities are traded in US dollar, a comparison between the USD and India’s rupee was taken into consideration to forecast India’s palm oil demand outlook. Based on this analysis of foreign currency impact of palm oil in India, the weak Indian rupee could limit palm oil demand in India. The same analysis was also done on Malaysia ringgit and Indonesian rupiah. It was concluded that the stronger USD will support higher local palm oil prices in Malaysia and Indonesia.

On the demand side, an increase in India’s palm oil import for 2018 could not have happen as the bearish factor on edible oil imports would bring overall edible oil imports down including palm oil due to the country’s tariff hike. One of the panelist forecast that India’s edible oil imports will drop by 14.87 million MT or 10.8% to 138 million MT in 2017/18 from 152.87 million MT in 2016/17.

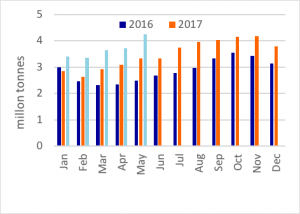

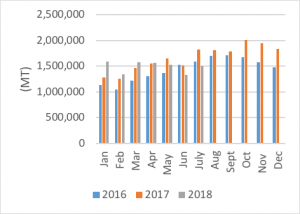

Going by the normal trend of production in Malaysia and Indonesia, palm oil production is expected to peak in September and October. Under the current bearish palm oil demand scenario, it is view that the rising production will give way to an upward trend in palm oil’s stock level. The high production will prolong until the end of the year. If we refer to this pattern of production, the panel of expert feels that palm oil stock will continue to be high in the major producing countries. MPOC forecast that the Malaysia palm oil stock will rise by 100,000 MT from 2.7 million MT in 2017 to 2.8 million MT in 2018.

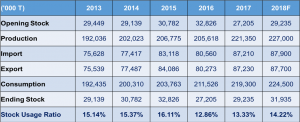

In the global summary, MPOC forecast that global imports of edible oil will climb marginally by 0.79% or 210,000 MT to 87.9 million MT in 2018. The marginally higher imports is expected as the global edible oil price is relatively low. Based on MPOC’s forecast, the total vegetable oil production is forecast to reach 227 million tonnes in 2018 contributed mainly by palm oil. Global palm oil production is projected at 70 million tonnes with Malaysia and Indonesia as leading producers. Malaysian palm oil production is projected to reach 20.3 million tonnes, in 2018 due to better yields. India looks set to retain its position as the largest consumer and importer of palm oil. China will likely increase their palm oil imports in 2018 due to the current attractive price and USA-China trade war. Overall consumption for oils and fats in 2018 is forecast at 224.5 million tonnes while palm oil consumption will reach 67 million tonnes.On soybean front, a huge increase in soybean crop was seen in Argentina for the next planting season in 2018/19. The threat of long drought and heat has affected Argentina soybean production in the last season 2017/18. With better weather, this scenario represent a considerable upward potential for high production for soybean. This led one of the presenter to forecast that Argentina soybean production will rise by 20 million MT from 37 million MT in 2017/18 to 57 million MT in 2018/19.

Table 1: MPOC’s 2018F Global Edible Oil Supply & Demand Scenario

Conclusion

The improvement of the vegetable oil in the global energy market is one of the main factor that is supporting the CPO price currently. Other bullish factors supporting CPO price currently relates to US-China trade war and the possibility of El Nino occurring in September which may affect India’s kharif crop production. After taking into consideration the bearish and bullish factors affecting CPO price, the experts are of the view that CPO price has bottom out in the last Quarter of 2018. One of the speaker forecast that the average price will decline slightly by RM20 to settle at RM2, 350 for the benchmark 3rd month spot price traded in the Bursa Malaysia Derivative Exchange from 3rd quarter to 4th quarter 2018.

(Details of presentation and discussion can be viewed in the POINTERS website: www.pointers.org.my. For further query you may contact the author Lim Teck Chaii at lim@mpoc.org.my)