South America Global Weather Events

Known as the South American agricultural powerhouse, Brazil and Argentina crop production in 2022 is expected to greatly affect the global oils and fats market. Both Brazil and Argentina account for almost 50% of total global soybean supply, with Brazil ranked as the largest exporter of soybean worldwide. Argentina is the world’s top exporter of soybean oil and soymeal as well as a major supplier of corn to world markets. Hit by a second consecutive year of drought, Brazil and Argentina are heading for smaller harvests of major crops, especially soybeans, corn and sugar.

The prolonged drought in Brazil is expected to wipe out up to 90% of the harvest in some fields due to excruciating heat and dryness. Losses in Brazil are concentrated mainly in the southern states, such as Rio Grande do Sul, Paraná and Mato Grosso do Sul, where the La Nina phenomenon caused drought during the summer. La Nina events has caused increased rain across northern Brazil and decreased rain in southern Brazil. Such has been the case in the southern soy growing region where precipitation has been very scarce since November 2021. In Rio Grande do Sul, the nation’s second top soy producer, farmers are worrying over stunted plants and withered leaves.

In Argentina, nearly the entire country has been suffering from a drought since November 2021 as a result of La Nina. This weather pattern which decreased rain levels in Argentina’s central plains are causing dry grassland in the normally lush Pampas and drought soil condition in the provinces of Santa Fe, Cordoba and Entre Rios. According to Rosario grains exchange, Argentina’s 2021/22 soybean yields in the core farm zone could drop beneath the level in 2018 when a major drought hammered production.

Chart 1: Brazil and Argentina Soybean Balance

Impact on Palm Oil Trade

Both soybean oil and palm oil are agricultural products that can be substituted for one another in a variety of situations. The price of palm oil generally rises in tandem with any rise in the price of soybean oil.

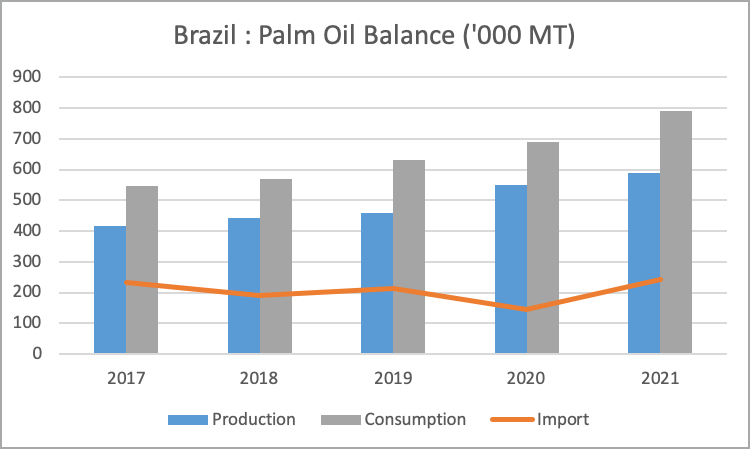

Brazil primarily uses palm oil as an edible oil and for the production of lubricants and greases. Palm kernel oil is used for cosmetics, confectionary fats, and detergents. The Brazilian government is increasingly promoting oil palm cultivation for palm oil-based biodiesel. Agropalma, Brasil BioFuels (BBF, formerly Biopalma), and Palmaplan are among Brazil’s major palm oil producers. Numerous commodity traders and FMCG companies with NDPE policies buy from BBF. They include Bunge, Cargill, General Mills, Mondelez, Nestlé, Upfield, Kellogg’s, and Grupo Bimbo. Brazil’s market share and scale in palm oil production are minimal, producing 590,000 MT of palm oil in 2021 while consumption is at 790,000 MT. For the past five years, palm oil import by Brazil had steadily increased reaching 243,700 MT in 2021 mainly imported from Indonesia and Colombia.

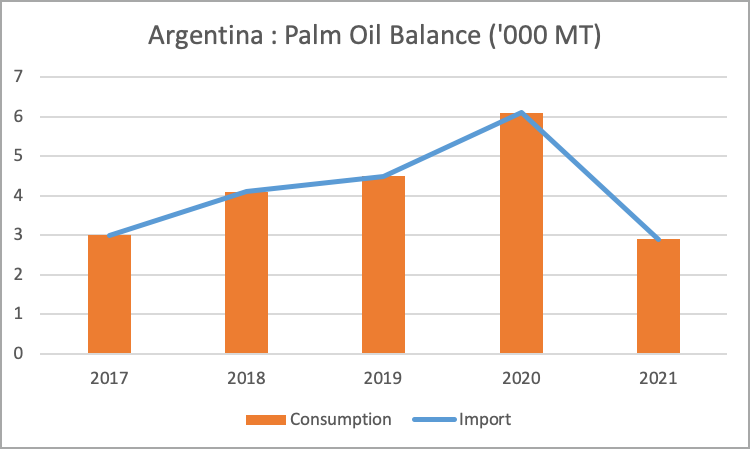

Palm oil import and consumption by Argentina is at 2,900 MT in 2021. This amount is smaller by 52% compared to the previous year of 2020 where the volume was at 6,100 MT, this decline in imports is attributed to the pandemic. In Argentina, soybean oil is the most consumed oil followed by sunflower oil. 74% of the domestically produced soybean oil were exported while the balance is for local consumption. Most of Argentina’s soybean oil is used mainly for export purposes and for the country’s local biodiesel industry. As the top soybean oil producer, Argentina is self-sufficient and only imported a very small amount of oils and fats. Main imports are palm kernel oil and palm oil mainly from Malaysia, Indonesia and Colombia.

With the shortage of soybean production, the prices of soybean, soybean oil and soymeal will be impacted. Eventhough Malaysian palm oil import by Brazil and Argentina has not been so big, the import is crucial to supplement food industries in both countries. Since most of their soybeans and soybean oil are used mainly for export purposes and local biodiesel industry, palm oil import is expected to increase under the current scenario.

Prepared by Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.