Country’s Synopses

Egypt’s unique geographical location at the crossroads between Africa, Europe, and the Middle East makes it an ideal regional business hub. Egypt is a country packed with potential. With around 110 million inhabitants, it is the highly populous country in the Arab world and is growing at 2% yearly. A large consumer base is attracting increasing interest from the global food sector. It is the third most prominent and most robust economy in the Arab region. It was one of the only economies in the world, along with China, that continued growing during the Covid-19 pandemic. The country’s business environment also sets the stage for a flourishing future. Egypt posted economic growth at 4.4% in Q1 of the fiscal year 2022/23.

Egypt developed the Suez Canal Economic Zone (SCZone) with a unique location; located around the leading international maritime route, “The Suez Canal passageway,” that connects Europe, East, and North Africa, with Asia passing through the Arabian Gulf. Thus, serving most of the global trade, where 20% of the international container trade, 10% of the seaborne business, and 18,000 ships pass through each year. As a result, Egypt is a potential hub for commercial activities in the Middle East and Africa. Furthermore, the duty-free structure and shallow VAT of palm oil make Egypt a suitable market for palm oil products for the local market needs and re-exports to neighboring countries.

The recent local currency devaluation made Egypt a more competitive investment destination than before. As a result, it will increase the inflow of foreign currency and Foreign Direct Investment into the market and boost economic activities. There are numerous investment opportunities in various sectors, attracting interest from around the world. Egypt offers massive potential for companies seeking to expand beyond the developed, mature markets of the northern hemisphere. On a more positive note, Egypt’s exports are expected to increase as it can now offer a competitively priced product amidst global competition. Local manufacturers have tremendous potential to seize the opportunity of the current high cost of imports by providing competitive and more affordable locally produced products.

The food manufacturing sector is one of the Egyptian economy’s fundamental pillars in export growth. It accounts for 14% of the total exports and contributes 24.5% of the GDP. The number of companies increased from 4,000 to 17,000, and the sector’s total investments amounted to approximately EGP 500bn. Egypt’s exports of food industries grew by about 0.5 percent, reaching $3.490 billion during the first ten months of 2022, up from $3.473 billion during the same period in 2021. Exports to the Arab markets amounted to $1.748 billion within the first ten months of 2022, representing 50 percent of the total food exports. The European Union came second in the list with $697 million worth of food imports from Egypt; the EU represented 20 percent of Egypt’s total food exports. On the other hand, food exports to the United States rose by 24 percent to hit $232 million, representing 7 percent of Egypt’s total food exports.

Benefits of Trade agreements to Malaysia Palm Oil Industry

Egypt is part of several multilateral trade agreements, including the Greater Arab Free Trade Agreement (GAFTA), the African Continental Free Trade Agreement (AFCFTA), the Agadir Free Trade Agreement, the Common Market for Eastern and Southern Africa (COMESA), and others.

Egypt enjoyed preferential access to several countries through the multiple free trade agreements, which provide access to 1.5 billion consumers, of which 110 million consumers in Egypt. Moreover, connecting investors with other established and emerging markets, with 8% of global trade passing through the Suez Canal. It is also worth mentioning that shipping time and cost are lower from Egypt, seven days less to the USA than from China, and 50% cheaper than the UAE.

The trade agreements have a positive and significant impact in stimulating trade from Malaysia to key markets like Egypt to become the main re-export center to other countries under the established agreements to satisfy the vast demand for oils and fats and to fill the gap of limited local production. The current existing trade agreements create countless opportunities and facilitate the export growth of Malaysian palm oil to new developing markets.

Palm Oil Market Potential

The Egyptian palm oil market is developing at a rapid pace. Palm oil is economically essential and versatile edible oil is a vital component for food and non-food industries. Egypt’s significant growth driver for palm oil usage is its competitive price and technical properties. There is also a higher intake of palm oil in the food processing industry and the growth of the HoReCa (hotel/restaurant/cafe) sector to cater to tourism industry needs.

Most recently, palm oil has principally been approved to be included in the cooking oil blend produced by the Egyptian government for the food subsidy program and comprised 10% palm oil into the program. In addition, the government disclosed its plans to develop and merge some edible oil subsidiaries to enhance the production capacity, reduce total costs, and maximize profits. This step aims to improve the competitiveness of Egyptian products in local and international markets. Furthermore, it plans to establish three new edible oil factories at New Borg Al Arab, Sadat City, and Suhag City to replace the six old factories. The government is willing to establish cooperation and joint ventures with Malaysian parties to conclude the said development plan.

As a result, palm oil is widely used in products ranging from blended cooking oils, vegetable ghee, cheese, sweets, baked goods, margarine, cereals, detergents, and cosmetics. All the above creates opportunities for Malaysian Palm oil expansion in Egypt.

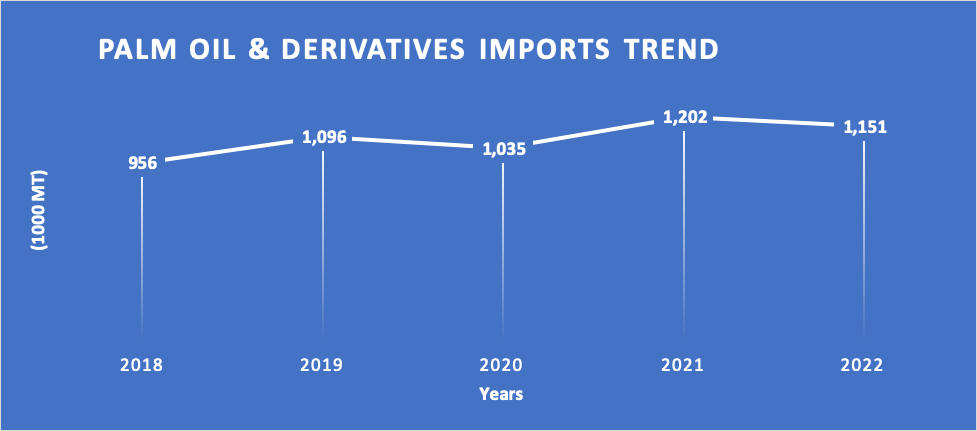

Palm oil imports have been upward for the last five years. In 2022, it amounted to 1.15 Mn tonnes. As a result, palm oil is enjoying a leading market share in Egypt’s oils and fats portfolio; it constitutes 67% of the total oils and fats imports, followed by soybean oil at 16%, sunflower oil at 14%, Palm kernel oil at 2% and others stands at 1%.

Palm Oil Market Key Players

The leading suppliers for bulk palm oil shipments to Egypt are Wilmar and Pacific Interlink, both with a share of 41 %, followed by PT Synergy Oil Nusantara at 9%, AAA Oils and Fats Pte Ltd 5%, Nagamas Group at 2% and both Asianagro Agungiaya & Mewaholeo Industries shares stand at 1%. Most suppliers deliver Indonesian palm oil, which accounts for 77.7% of palm oil imports into Egypt, while Malaysian palm oil represents 22.3%.

Malaysian Palm Oil Growth in Egypt

In 2022, exports of Malaysian palm oil and its derivatives to Egypt witnessed a substantial increase of 37% compared to 2021. Malaysian Palm oil exports to Egypt have been increasing in the last five years; this represents an increase of four folds when compared to the year 2018 to the year 2022.

It is remarkable progress since almost all imports originated from Indonesia for a long time. Malaysia’s exports to Egypt are expected to increase the strong demand for palm oil for various food and non-food applications to fulfill local market needs and satisfy the increasing demand in neighboring countries.

| Malaysian Palm Oil Exports by Products in 2022 versus 2021 (Tonnes) | ||||

|---|---|---|---|---|

| Product Group | 2021 | 2022 | Change (Vol) |

Change (%0 |

| PALM OIL | 219,719 | 350,178 | 130,459 | 59 |

| PALM KERNEL OIL | 36,685 | 23,714 | -12,972 | -35 |

| PALM-BASED OLEO | 34,800 | 31,063 | -3,737 | -11 |

| FINISHED PRODUCTS | 14,861 | 14,328 | -533 | -4 |

| PALM KERNEL CAKE | 408 | 0 | -408 | -100 |

| Total | 306,474 | 419,284 | 112,810 | 37 |

Conclusion

Egypt is a potential market for palm oil usage; it holds a great opportunity for Malaysian Palm oil market expansion through various ways. First, it can be concluded through direct exports benefiting from the favorable palm oil import duties and taxes and the growing need in the food industry sector. Secondly, there is a window to collaborate with Government affiliate companies to develop bulk storage facilities to cater to the local market needs and re-export to neighboring counties, thus cutting the lead time for products. Finally, there is also a need to work closely with the government to put into effect the inclusion of palm olein in the cooking oil blend offered under the food subsidy scheme.

MPOC-Egypt plays a vital role in facilitating Malaysian palm oil exporters and industry members’ links with potential investors and identifying joint ventures and investment opportunities in Egypt. As a result, it may pave to way for the market expansion of Malaysian palm oil products into the Egyptian market.

Prepared by Lamyaa El Enany

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.